Personnel Activity Reports

advertisement

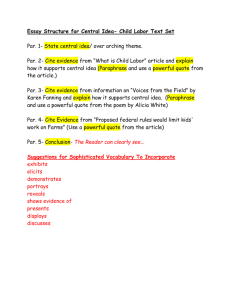

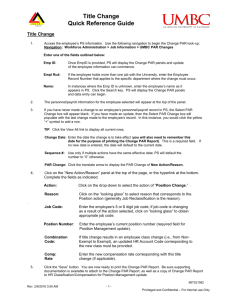

Personnel Activity Reports The why, who, where and how of PARs. Why do we have to complete PARs? The University is reimbursed, by the Federal Government, for indirect costs associated with Federal grants, contracts and other agreements. The University is subject to Federal guidelines relating to these reimbursements, specifically the Office of Management and Budget (OMB) Circular A-21 – Cost Principles for Educational Institutions. Why do we have to complete PARs? OMB Circular A-21 (Section J.10) contains requirements for procedures and documentation to support the distribution of salaries and wages charged directly to an award or through Facilities and Administrative (indirect) activities. The employee’s salary must follow consistently applied institutional policies regarding compensation and be allocated through an official payroll system that ties with the financial records of the institution. Why do we have to complete PARs? The payroll distribution must reasonably reflect the activity for which the employee is compensated. The method must recognize the principle of after-the-fact confirmation so that costs distributed represent actual costs. The main objective of A-21 is verification that compensation charged is appropriate to the activity performed. Why do we have to complete PARs? Our verification method is in the form of Personnel Activity Reports (PARs). PARs are used to confirm that the distribution of activity represents a reasonable estimate of the work performed by the employee during the period. Why do we have to complete PARs? University wide, only 5% of PARs require adjustments. For the majority of employees, the review and certification of a PAR is not a burdensome task. Violation of effort certification requirements or committed cost share tracking requirements have resulted in million dollar fines. (NYU $5 M, Johns Hopkins $2.6 M, FIU $11.5 M, Univ. of Alabama/Birmingham $3.4 M) Who receives a PAR? The Personnel Activity Reports and Effort Reporting Policy lists criteria for University employees subject to personnel activity reporting. Who receives a PAR? In the following situations an employee will receive a PAR: 1. Employees who have a portion of their salaries charged directly to a contract, grant, or sponsored agreement (restricted accounts, “R”) or cost share account “C”. Who receives a PAR? In the following situations an employee will receive a PAR: 2. Any employee who has a portion of their salary charged to a major function and a non-major function (indirect cost activity). * Major Expenditure Functions (Instruction, Research, Public Service) * Indirect Cost Activity – Sponsored Proj. Admin., Dept. Admin., Academic Support, etc. Who receives a PAR? In the following situations an employee will receive a PAR: 3. Any employee who has any portion of his/her time charged to more than one indirect cost activity. (non-major function) 4. Any employee who has 100% of his/her salary charged to departmental administration. (GJ accounts) Where does the information come from that is listed on the PAR? The distribution of salary is obtained from the Payroll Voucher System. When the monthly & academic payrolls are run, the salary distributions are imported into the time and effort (PAR) database. The time and effort (PAR) database accumulates the total amount paid that employee and calculates the percent of total salary that has been charged to individual accounts on the basis of one monthly PAR for each covered employee. Each PAR accounts for 100% of the activity of that employee for the payroll period. It is important to note that effort reporting is in terms of percent not hours. Where does the information come from that is listed on the PAR? Extra compensation is not considered a part of an employee’s regular salary and is not included in determining 100% of effort. (Foundation salary supplements which do not have an associated EFT are not included in determining 100% of effort.) The amount of extra compensation will be displayed as “not reportable” and is for informational purposes ONLY. How do I verify and submit a PAR? A PAR will be generated for each pay period for which an employee is paid. To confirm that the distribution of activity represents a reasonable estimate of the work performed by the employee during the period, each PAR must be reviewed for accuracy and approved by the employee or by a responsible official having first-hand knowledge of the work performed. How do I verify and submit a PAR? When PARs are generated, an email notification will be sent to employee’s registered email address and to their home departmental administrator. The electronic PAR system can be accessed at https://webapps.ais.uga.edu/PCTE/ You will log on to the electronic PAR system using your MyID and password. If the PAR reflects accurately the time expended on a project tracked by a University account number, you will check the “Check here to return this PAR without any changes” check box. Next, you will click the “Save and Submit” button to transmit the approved document to the Accounting Department. How do I verify and submit a PAR? In those situations where the “Current Distribution” does not reflect the time actually expended on a project for the period covered by the PAR, the employee should print their PAR, make changes, sign, and give it to the departmental administrator. Only departmental administrators will be allowed to make changes online. Departmental Administrators should click on the “Departmental User Menu” button. The departmental administrators page will allow you to display PARs for departments you administer. You can view PARs by entering the department number and clicking the “Get Employees” button or by selecting the department from the drop down list. After choosing the department, click on the drop down box titled “Select an Employee and Click Here” to see a listing of employees within that department. The listing of employees will be displayed. Choose the employee and click the “List PARs” button. Both outstanding and previously returned PARs will be displayed for that employee. If you only wish to see the outstanding PARs for an employee, you can choose the employee from the drop down listing under the section “Employees in selected department with outstanding PARs”. Departmental administrators may also view an employees PAR by entering their social security number and clicking the “List PARs” button. In those situations where the “Current Distribution” does not reflect the time actually expended on a project for the period covered by the PAR, you should enter the actual percent distribution of activity in the “new distribution” column. The percentages in the “New Distribution” column must total 100% regardless of the employee’s budgeted appointment (EFT). When you have entered the new distribution percentages, click the “Recalculate” button to see the new computed amounts based on the revised percentages. Next, you will click the “Save and Submit” button to transmit the approved document to the Accounting Department. If you need to add an account to the PAR, click on the “Add Account” button. After clicking the “Add Account” button, a drop down menu will display. Click on the arrow next to “Select a position/account number to add to this PAR”. You will be allowed to choose the available projects (accounts). How do I verify and submit a PAR? The list of available positions/accounts will be only those established in the Budget Amendment system. Each account administrator is responsible to ensure that budgetary action is initiated when necessary to reflect anticipated long term changes in effort of personnel. Detailed budget amendment instructions are published annually by the Budget Department of the Finance and Administration Office. After choosing the position/account you wish to add, enter the new percentages and click the “Recalculate” button to see the new computed amounts. Once all changes have been made, click the “Save & Submit” button to transmit the approved document to the Accounting Department. How do I verify and submit a PAR? If an employee expends time on a project (account number) that is not in the drop down account list on the PAR: 1) the approver must print out the PAR; 2) enter the applicable account number; 3) write the percent in the “new distribution” column; 4)sign and forward printed PAR to the Accounting Department. NOTE: You will still need to submit a personnel and budget amendment. The Accounting Department will hold the PAR and enter the changes once the budget documents have been entered in the Budget system. How do I verify and submit a PAR? The Cost Transfer Policy applies to any changes made on a previously certified PAR. A “Comments” box will be displayed to allow for the appropriate written justification. How do I verify and submit a PAR? For bi-weekly paid employees, the time sheet is their PAR. The certification statement is below the employee’s signature. The employee is signifying the hours reported on the time sheet were the hours of effort on the account. How do I verify and submit a PAR? PARs should be verified and submitted by the published PAR cutoff date of the month following the pay period for which the PAR is applicable. After the PAR cut off date, the e-PAR system will be available in read only mode until the Monday following month-end cutoff. How do I verify and submit a PAR? A balancing, editing and posting process takes place each month after the PAR cutoff date. A special journal entry generated by the system will adjust the original accounts charged to the proper accounts based on the percentages shown on the adjusted PAR. How do I verify and submit a PAR? Entries made as a result of changes in the percent distribution of activity shown on the executed PAR will use a unique object code for both the debit and the credit. In other words, any change in the distribution of activity resulting from information shown on the PAR will be identified in the accounting system by a unique object code. How do I verify and submit a PAR? The unique object codes used for the PAR adjustment JVs are: * Monthly: 51110 (regular payroll) = 51111 (Monthly Time/Effort Payroll) * Academic: 51112 (regular payroll) = 51113 (Academic Time/Effort Payroll) To get the total monthly or academic payroll charges on an account, net the 2 object codes together. How do I verify and submit a PAR? The Account Status report will have a reference of T/Emmdd (T/E0922 for Sept. 22) for the adjustment JV. Staff benefit charges will be transferred to/from accounts as the salary distribution was changed. No PAR changes = No JV PAR Reports Departmental Administrators will continue to receive printed copies of the Variance Reconciliation Report monthly. This report reflects the PAR adjustments made for the month. The variance amounts should tie to the adjustment amounts on the status report. Departmental Administrators will also be able to print a variance reconciliation report and a detail change history report from the Departmental Administrators page. Automatic PAR Adjustments If adjustments are made in payroll, to a pay period with an existing certified (returned) PAR, a system generated time and effort JV adjustment will be made to reflect the percentage distribution on the PAR. In addition, a new PAR will be generated for that pay period. Automatic PAR Adjustments For example, a PAR has been certified for the PPE 7/31/05. This PAR reflects 100% effort on a restricted account. In September, the employee receives back pay for the 7/31/05 pay period and it is charged to a state account. The PAR system will automatically generate a time and effort adjustment to move the additional pay off of the state account and place those earnings on the restricted account to be in line with the PAR percentages. (100% on the restricted account.) A new PAR will be generated for the 7/31/05 pay period which will reflect the new total paid amount. PAR Adjustments & Budgets Under the following conditions, budget amendments for adjustments between 102xGRdddppp to 1021CRdddppp will be done automatically: – – – – – Has to be between same department number Can have multiple CR accounts Only one 102xGR account No other adjustments on the PAR No adjustment made if 102xGR account will go negative PARs and Committed Cost Share Example of committed cost sharing and how it should be tracked: PI stated in proposal narrative that they would spend 10% of their time on project. PI’s monthly academic salary is $7,000. Type of Account Cost Share Not Tracked Cost Share Tracked (PAR not issued) (PAR required) Percent Effort Salary Percent Effort Salary Instruction (1011GH) - state 25% 1,750 25% 1,750 Dept. research (1025GR) - state 75% 5,250 65% 4,550 10% 700 100% 7,000 Cost Share (1021CR) - state 100% 7,000 PARs and Committed Cost Share Alternative: PI stated in proposal narrative that they would spend 10% of their time on project and asks sponsor to fund this effort. PI’s monthly academic salary is $7,000. PAR not issued Type of Account Percent Effort PAR required Salary Percent Effort Salary Instruction (1011GH) - state 25% 1,750 25% 1,750 Dept. research (1025GR) - state 75% 5,250 65% 4,550 10% 700 100% 7,000 Sponsored research (1021RR) - grant 100% 7,000 PAR Questions??