Analysis of Financial Statements

advertisement

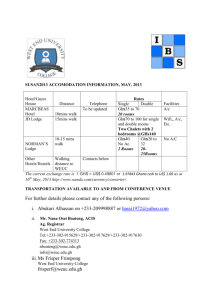

Analysis of Financial Statements Financial statements and reports Ratio analysis The Annual Report Provides A verbal description of the firms operating results during the past year Discussion of new developments Financial statements Key Financial Statements Balance sheet Income statement Statement of cash flows Example of Balance Sheets: Assets Cash Short-term inv. Acct Receivable Inventories Total Current Asset Gross Fixed Asset Less: Depreciation Net Fixed Asset Total assets 2011 9,000 48,600 351,200 715,200 1,124,000 491,000 146,200 344,800 1,468,800 Example of Balance Sheets: Liabilities and Equity Accts payable Notes payable Accruals Total Current Liability Long-term debt Common stock Retained earnings Total equity Total liability and equity 2011 145,600 200,000 136,000 481,600 323,432 460,000 203,768 663,768 1,468,800 Example of Income Statement Sales COGS Other expenses Deprecication Tot. operating. costs EBIT Interest expenses EBT Taxes (30%) Net income 2011 3,432,000 2,864,000 340,000 18,900 3,222,900 209,100 62,500 146,600 43,980 102,620 Good to Know!! EBITDA (Earnings before interest, taxes, depreciation and amortization To measure cash earnings without accrual accounting, cancelling tax jurisdiction effects, and cancelling the effects of different capital structures. Statement of Cash Flows The Statement of Cash Flows reports: • Operating activities • Investing activities • Financing activities To determine whether a change in a balance sheet account by using these rules Sources of Cash Uses of Cash Increase in a liabilities or equity account - Borrowing funds or selling stock provides the firm with cash Decrease in a liabilities or equity account - Paying off a loan or buying back stock uses cash Increase in an asset account Decrease in an asset account - Selling inventory or collecting receivables provides cash - Buying fixed assets or buying more inventory uses cash. 2011 Statement of Cash Flows Cash flow from operating activities: Net income Additions (sources of cash): Depreciation Incr. in accruals Incr. in accounts payable Subtractions (uses of cash): Incr. in receivables Incr. in inventories NCF from operations $ 44,220 20,000 4,000 29,600 (50,800) ( 120,800) ($ 73,780) Cash flow from investing activities: Investment in fixed assets ($ 36,000) Cash flow from financing activities: Increase in notes payable Increase in L-T debt Common dividends NCF from financing $ 25,000 101,180 ( 22,000) $104,180 Net increase (decr.) in cash Cash at beginning of year Cash at end of year ($ 5,600) 57,600 $ 52,000 Management Reports Daily Revenue Report Daily Payroll Cost Report Rooms Revenue Forecast Food and Beverage Menu Abstract Accounts Receivable Aging Schedule Daily Revenue Report ALL SPORTS RESORT As of Friday, 11/10/2008 Today Actual KEY METRICS Budget Last Year Period-to-Date Actual Budget Last Year 70.3% 90.4% 91.8% TOTAL OCCUPANCY % 70.4% 80.0% 72.2% 76.8% 91.2% 92.5% AVAILABLE OCCUPANCY % 76.7% 80.6% 73.4% 391 391 391 TOTAL ROOMS 10,948 10,948 10,948 275 353 359 ROOMS SOLD 7,706 8,753 7,900 279 357 362 OCCUPIED ROOMS 7,818 8,835 7,971 4 3 4 COMPLIMENTARY ROOMS 112 82 74 112 34 28 VACANT ROOMS 3,130 2,113 2,974 358 388 388 AVAILABLE ROOMS 10,052 10,866 10,758 46.40 77.83 65.42 REVPAR 65.97 73.29 67.78 248 N/A 267 ARRIVALS 4,382 N/A 4,382 122 N/A 218 DEPARTURES 4,149 N/A 4,087 522 N/A 636 GUESTS 9,482 N/A 9,734 46 78 136 ROOMS SOLD-Transient 3,243 4,297 4,212 172 220 183 ROOMS SOLD-Group 3,131 2,870 2,365 57 59 39 ROOMS SOLD-Contract 1,332 1,586 1,335 85.61 111.06 81.29 AVERAGE RATE- Transient 117.97 111.06 113.44 66.14 85.41 72.09 AVERAGE RATE- Group 87.04 85.40 89.72 49.23 49.34 47.18 AVERAGE RATE- Contract 48.57 49.34 49.00 Daily Payroll Cost Report Daily Payroll Report Florencia Hotel and Conference Center Date: 6/5/2008 Daily Rooms Regular Overtime Front Desk 38.10 0.00 38.10 $565.79 Reservations 13.03 0.00 13.03 Guest Services 22.03 0.00 Housekeeping 85.70 Management Total Rooms Total Month-to-Date Payroll $ % Regular Overtime 2.10% 671.98 1.67 673.65 $9,930.64 3.99% 3.49% $206.70 0.77% 269.27 14.66 283.93 $4,131.34 1.66% 1.74% 22.03 $252.39 0.94% 338.09 15.84 353.93 $4,412.27 1.77% 1.98% 0.00 85.70 $905.15 3.35% 1,685.39 125.35 1,810.74 $19,480.01 7.82% 9.50% 0.00 0.00 0.00 $0.00 0.00% 0.00 0.00 0.00 $0.00 0.00% 0.30% 158.86 0.00 158.86 $1,930.03 7.15% 2,964.73 157.52 3,122.25 $37,954.26 15.24% 16.70% Daily Rooms Regular Overtime Front Desk 38.10 0.00 Reservations 13.03 Guest Services Payroll $ Payroll % Month-to-Date Hours Budgeted % Budget Payroll $ Cost/Room Regular Overtime 38.10 $565.79 $3.93 671.98 1.67 673.65 $9,930.64 $6.23 $5.29 0.00 13.03 $206.70 $1.44 269.27 14.66 283.93 $4,131.34 $2.59 $2.64 22.03 0.00 22.03 $252.39 $1.75 338.09 15.84 353.93 $4,412.27 $2.77 $3.00 Housekeeping 85.70 0.00 85.70 $905.15 $6.29 1,685.39 125.35 1,810.74 $19,480.01 $12.23 $14.43 Management 0.00 0.00 0.00 $0.00 $0.00 0.00 0.00 0.00 $0.00 $0.00 $0.45 158.86 0.00 158.86 $1,930.03 $13.40 2,964.73 157.52 3,122.25 $37,954.26 $23.83 $25.36 Total Rooms Total Hours Payroll $ Cost/Room Cost/Room Rooms Revenue Forecast FORECAST: as of 11/30/08 City: Los Angeles Property: Huntington - Airport # Rooms: 86 Division: Rooms Huntington Los Angeles Airport 12/1/08 12/2/08 12/3/08 12/4/08 12/5/08 12/6/08 12/7/08 12/8/08 12/9/08 12/10/00 8 12/11/08 12/12/08 Avail Rooms 86 86 86 86 86 86 86 86 86 86 86 86 Forecast # 55 53 26 25 36 48 46 53 53 65 23 23 63.95% 61.63% 30.23% 29.07% 41.86% 55.81% 53.49% 61.63% 61.63% 75.58% 26.74% 26.74% 6215 5313 2653 2724 4050 5272 4741 5313 5157 6153 2300 2473 $113.00 $ 100.25 $ 102.04 $ 108.96 $ 112.50 $ 109.83 $ 103.07 $ 100.25 $ 97.30 $ 94.66 $ 100.00 $ 107.52 12-Day Forecast Report Forecast Occupancy % Net Rooms Revenues Average Rate Food and Beverage Menu Abstract Food Menu Abstract Date: Restaurant: Menu Item Name Mexicana Cantina Meal Period: January-March, 2008 Lunch Number Menu Item Item Item Menu Menu Menu Sold Mix Food Selling CM Costs Revenues CM (MM) % Cost Price (E - D) (D * B) (E * B) (F * B) Bean, Cheese and Jalapeno Nachos 170 1.21% $2.44 $7.25 $4.81 $414.80 $1,232.50 $817.70 Beef, Bean, Cheese and Jalapeno Nachos 180 1.29% $2.78 $8.50 $5.72 $500.40 $1,530.00 $1,029.60 Chicken Fajita, Bean, Cheese and Jalapeno Nachos 222 1.59% $2.83 $9.95 $7.12 $628.26 $2,208.90 $1,580.64 Beef Fajita, Bean, Cheese and Jalapeno Nachos 253 1.81% $3.28 $9.95 $6.67 $829.84 $2,517.35 $1,687.51 Cheese Quesadillas 195 1.39% $1.64 $7.75 $6.11 $319.80 $1,511.25 $1,191.45 Chicken Fajita Quesadillas 286 2.04% $2.02 $8.95 $6.93 $577.72 $2,559.70 $1,981.98 Beef Fajita Quesadillas 259 1.85% $2.48 $8.95 $6.47 $642.32 $2,318.05 $1,675.73 Shrimp and Scallop Quesadillas 158 1.13% $3.82 $11.50 $7.68 $603.56 $1,817.00 $1,213.44 Shrimp Quesadillas 176 1.26% $3.44 $11.50 $8.06 $605.44 $2,024.00 $1,418.56 Spinach Quesadillas 125 0.89% $1.83 $8.50 $6.67 $228.75 $1,062.50 $833.75 Mixed Vegetable Quesadillas 91 0.65% $1.75 $8.50 $6.75 $159.25 $773.50 $614.25 Mixed Vegetable Queso Flameado 37 0.26% $1.24 $7.50 $6.26 $45.88 $277.50 $231.62 Accounts Receivable Aging Schedule Aging Schedule for Hanover Country Club Members Total Number of Days Past Due 1-30 31-60 61-90 Over 90 C. DeCarlo $200 T. Vangard $450 J. Samuel $100 $100 F. Engel $320 $320 M. Pratel $335 M. Morgan $600 Others Total $450 $335 $600 $26,875 $14,000 $10,000 $1,000 $200 1,675 $28,880 $14,200 $10,450 $1,600 $535 $2,095 1.5% 2.0% 10% 20% 40% $213 $209 $160 $107 $838 Estimated uncollectible Total Bad Debts $200 $1,527 Ratio Analysis Categories Liquidity Asset management Debt management Profitability Market value Liquidity = the ability of a firm to meet its short-term obligations as they come due. Liquidity analysis requires use of a forecasted cash budget but ratio analysis provides some quick measures of liquidity. Measures of Liquidity Current ratio = CA CL . To indicate the extent to which the claims of S-T creditors are covered by assets that will soon be converted to cash Quick ratio = CA - Inv. . CL To measure how quick the firm can pay off S-T debt without liquidating inventories Current ratio = Quick ratio = Current Quick CA . CL CA - Inv. . CL 2010 2011 2.3x 0.8x 2.4x 0.8x A little weaker than average. Industry 2.7x 1.0x Asset Management Ratios Inventory turnover ratio Days sales outstanding (accounts receivable) Fixed assets turnover Total assets turnover Inventory turnover = Sales Inventory . (To indicate whether a firm carries too many inventories and whether it manages inventories effectively.) 2010 4.8x 2011 4.6x Industry 7.0x Low inventory turnover--excess inventory for current level of sales. Problems with Inventory Turnover Measurement Sales prices include markups but inventories carried at cost. Sales occur throughout the year, but inventory is at a particular point in time. Differences in accounting methods may make comparisons difficult (e.g. LIFO vs. FIFO). Days Sales Outstanding (DSO) is the average number of days the firm must wait after making a sale before it receives cash. Receivables . DSO = Sales/day $402,000 2011 DSO = $3,850,000/360 = 37.59 days. DSO 2010 2011 Industry 36.8 37.6 32.0 High DSO--firm is collecting too slowly or has overly liberal credit terms. Fixed assets turnover = Sales . Fixed assets [ To show how effective the firms utilizes its fixed assets to generate sales.] Sales Total assets turnover = . TA [To indicate the extent to which a firm uses its total resources to generate sales.] FATO TATO 2010 2011 Industry 10.0 2.3 10.7 2.3 10.7 2.6 Fixed assets turnover OK, but total assets turnover is low--indicates problem with current assets (inventory and receivables). Debt Management Ratios Debt ratio (balance sheet) Debt/equity ratio (balance sheet) Times interest earned (income statement) Fixed charge coverage (income statement) Debt Management Ratios D Debt ratio = A D = . D+E [It measures the proportion of a firm’s total assets that is financed with creditors’ funds.] D Debt/equity = E . [It is similar to debt ratio and relates the amount of a firm’s debt financing to the amount of equity financing.] and Equity multiplier = A/E = 1/(1 - D/A). Times interest earned (TIE) EBIT Interest = . charges [It tells the extent to which the firm’s current earnings are able to meet current interest payments.] DR TIE 2010 2011 Industry 54.8% 3.3 58.4% 2.0 50.0% 2.5 Debt ratio high, TIE low and falling. Debt is risky; would have high kd. Profitability Ratios Profit margin (PM) Basic earning power (BEP) Return on assets (ROA) Return on equity (ROE) Return on investors capital (ROC) NI PM = . Sales [ It gives the profit per dollar of sales.] 2010 2.6% 2011 1.1% Industry 3.5% Indicates: Sales prices are low and/or costs are high. EBIT BEP = . TA [It shows the raw earning power of the firm’s assets, before influence of taxes and leverage. ] 2010 14.2% 2011 9.1% Industry 19.1% Indicates: Firm is doing a poor job of generating earnings from its assets. NI ROA = . TA [It measures a firm’s net income in relation to the total asset investment.] NI ROE = . Common equity [It measures the rate of return that the firm earns on stockholders’ equity.] Profitability Ratios Summary ROA ROE 2010 2011 Industry 6.0% 13.3% 2.7% 6.4% 9.1% 18.2% All profitability measures are low and falling. High inventory, A/R levels lead to low profits. Market Value Ratios Price/Share P/E = . Earnings/Share [The price the market places on $1 of a firm’s earnings.] Common equity Book value/Share = . # Shares Price/Share Market/Book = . Book value/Share [The higher the rate of return a firm is earning on its common equity relative to the return required by investors (the cost of common equity), the higher will be the M/B.] 2010 P/E M/B 2011 9.7% 13.6% 1.3 0.9 Industry 14.2% 1.4 P/E ratios can rise if a decline in EPS is not expected to be permanent. M/B ratio is low. “Normalized” P/E probably low too. Use the Du Pont Equation to get an overview of the firm’s financial position Profit Total asset Equity ROE = x x margin turnover multiplier NI = E NI S x S TA x . TA E Du Pont Equation Provides an Overview Profitability measured by ROE Expense control measured by PM Asset utilization measured by TATO Financial leverage measured by EM (debt utilization) The interaction between the determinants of ROE ROE = PM x TATO x EM 2010 13.30% 2.60 2.3 2.2 2011 6.40% 1.15 2.3 2.4 IND. 18.20% 3.50 2.6 2.0 What is common size analysis? Converting income statement and balance sheet values into % to facilitate comparison between firms of different sizes and firms over time. Income statement: Divide by sales. Balance sheet: Divide by total assets. Used to supplement ratio analysis. Readers of Financial Analysis Owners Track and evaluate management’s performance Lenders Determine the risk of the business defaulting on its loan Managers Compare actual and budgeted results Government Ensure that taxes have been paid Readers of Financial Analysis cont. Suppliers Evaluate the company’s ability to pay its obligations Investment Analysts Evaluate the company’s performance Mergers and Acquisitions Highlight financial strengths, upside potential, and future value Types of Analysis Vertical Analysis Used to analyze variable expenses All accounts are sized using either: Total revenue or Departmental revenue Variable expenses should increase or decrease with the level of sales Management Decision Making Employee Scheduling Based on: Accurate revenue forecasts Productivity goals Customer service goals Management Decision Making Food and Beverage Pricing Track sales of each menu item Calculate each items gross profitability Set menu prices Remove unprofitable items from the menu Management Decision Making Revenue Management Goal is to maximize RevPAR RevPar= Rooms Revenue/Rooms Available Rooms revenue = the revenue generated by room sales Rooms Available= the number of rooms available for in the time period sale Management Decision Making Revenue Management Strategies Close lower levels of pricing during high demand Open all pricing levels during times of low demand Management Decision Making Profit Flexing Utilized when revenues fall behind budget Adjust pricing and reduce expenses Without impacting customer service Maximize remaining revenue opportunities Management Decision Making Cost-volume-profit Modeling Also known as Breakeven Analysis Target the amount of revenue required to reach the owner’s goal Cost-volume-profit Equations Breakeven Volume of Sales = Desired Occupancy % = Desired Volume = Fixed costs (sale price – variable cost) Rooms sold Rooms available for sale Fixed Costs + Desired Profits Sale Price – Variable Cost Breakeven Volume Example Sale price = $250 a night Fixed costs = $40,000 per month Variable cost = $35 per room Breakeven Volume of Sales = = = = Fixed costs (sale price – variable cost) 40,000 (250 - 35) 40,000 215 186 rooms