FHA Fills the Credit Void During

advertisement

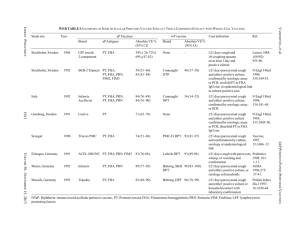

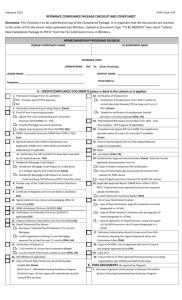

FHA Business - Current Considerations MIDWEST LENDERS CONFERENCE June 18th 2013 Future FHA Business Prospects ED TELLINGS RED Mortgage Capital MBA Update Eileen Gray Mortgage Bankers Association Capital Markets Update Karen Cady Credit Suisse 1 Future FHA Business Prospects 2 From The Girl Next Door to Belle of the Ball: the emergence of FHA / HUD as a force in Multifamily Finance FHA Fills the Credit Void Why HUD/FHA Multifamily Loan Programs are Likely to Thrive in the Future 5 Reasons for Optimism Some Challenges to Consider 3 $9,739 Endorsements $12,000 $11,000 Averave Loan Balance $10,000 $12,000 $10,000 $9,000 $8,000 $8,000 $6,000 $7,000 $6,000 $4,000 Thousands $14,000 Average Loan Size Total Initial Endorsements Millions FHA FILLS THE CREDIT VOID DURING FINANCIAL CRISIS $5,000 $13,051 $12,505 $11,289 $5,437 $3,733 $4,191 $5,127 $5,550 $7,540 $7,359 $6,481 $4,791 $0 $4,190 $2,000 $4,000 $3,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 FISCAL YEAR Form 2007 to 2011, loans endorsed expanded more than 300% and average loan size increased 111%. Source: HUD.gov HUB initial endorsement data base. Excludes OAHP 223a7s and OHP health care loans 4 MULTIFAMILY CREDIT MARKET SHARE 2007 - 2012 ORIGINATION VOLUME IN BILLIONS / MARKET SHARE AS % 2007 EST. OTHER, $85.3, 54% FHA, $4.8, 3% EST. OTHER, $25.4, 24% FHA, $13.1, 13% 2012 FANNIE, $45.3, 29% FREDDIE, $21.6, 14% FREDDIE, $30.9, 30% FANNIE, $33.8, 33% Sources: HUD, MBA , FRB and RED CAPITAL Research. 5 WILL IT LAST, OR EVEN GROW FIVE REASONS FOR OPTIMISM Programmatic Advantages Competitor Challenges Rental Housing Demand Need for Affordable Housing Recent FHA Converts 6 REASONS FOR OPTIMISM #1: PROGRAMMATIC ADVANTAGES Long-term, Fixed-rate Assumable Financing Competitive LTV and DSCR Levels Fixed-rate, Non-recourse Construction Credit Competitive, Fixed Interest Rates Residential Healthcare Financing 7 PROGRAMMATIC ADVANTAGES: TERM FHA Loans offer long, fully-amortizing terms. Competing lenders, with limited exceptions, offer only balloon structures. In a low interest rate environment, borrowers seek to lock-in attractive rates. Lender FHA 223f Refi / Purchase Fannie / Freddie Fixed-rate Balloon Term (months) 420 60 – 120 (360) Bank & Thrift 60 – 180 Life Company 60 – 240 CMBS 60 – 120 8 PROGRAMMATIC ADVANTAGES: DSCR Low Debt-service Coverage Ratio: FHA loans generally bear a Debt-service to NOI Coverage Ratio of 1.20%. Competing products apply 1.25X ratios on even the highest quality loans, and higher ratios on lesser credits. Lender FHA 223f Refi / Purchase MIN DSCR 1.20X Fannie / Freddie Fixed-rate Balloon 1.25X + Bank & Thrift 1.25X + Life Company 1.30X + CMBS 1.25X + 9 PROGRAMMATIC ADVANTAGES: LTV Loan-to-Value Ratio Advantages: FHA loans may be funded up to 80% of value, and in some cases slightly more. Competing lenders are generally less aggressive except with respect to the highest quality credits generating exceptional cash flows. Lender MAX LTV FHA 223f Refi / Purchase 80% / 83% Fannie / Freddie Fixed-rate Balloon 65% - 80% Bank & Thrift 55% - 75% Life Company 55% - 70% CMBS 55% - 75% 10 PROGRAMMATIC ADVANTAGES: CONSTRUCTION FINANCING HUD offer the most attractive construction financing in the market: fixed-rate, nonrecourse financing with structured permanent mortgage take-out. Construction financing available in the private market consists of Libor-based floaters with full or partial recourse to the sponsor characterized by greater lease-up, revenue and permanent take-out risks. Lender FHA 221(d)(4) New Construction / Perm Fannie / Freddie MAX LTV 80% - 83% of cost Not Available Bank & Thrift 65% - 70% of cost Life Company Not Available CMBS Not Available 11 PROGRAMMATIC ADVANTAGE: PRICING Basis point pricing advantage of standard FHA 223f to private lender options Lender Spread to FHA 223f Norms GSE (Tier Plus) LTV <65% + 140 bps LTV>65% + 120 bps Bank & Thrift + 150 bps and up Life Company + 130 bps and up CMBS LTV <65% + 135 bps and up LTV>65% + 150 bps and up Generic Ten-year Mortgage Pricing Spreads, June 2013. FHA 223f all-in at approximately 2.95% - 3.20% or 10-year UST + 65 – 100 bps. 12 PROGRAMMATIC ADVANTAGE: CONSTRUCTION LOAN PRICING AND CONVERSION TO PERMANENT FINANCING UPON COMPLETION AND COST CERTIFICATION FHA 221(d)(4) Spreads to Bank Floating Rates Applicable to Construction Loans FHA Construction – Perm -20 bps -70 bps Generic Pricing Spreads, June 2013. FHA 221(d)(4) 480 month construction to perm all-in at approximately 3.5%. Bank standard 24-month construction loan at Libor + 300 – 350 bps, swappable to 2-year Treasury + 340 bps – 390 bps or approximately 3.70% - 4.20%. 13 REASONS FOR OPTIMISM #2: COMPETITORS’ CHALLENGES Government Sponsored Agencies CMBS Conduits Commercial Banks & Thrifts Life Insurance Companies 14 MARKET OUTLOOK: FANNIE MAE / FREDDIE MAC • During conservatorship period (3 – 7 years) • Conservator seeks to limit taxpayer risk and prepare GSE to operate without government credit subsidy • MFH underwriting standards will tighten further • Mortgage insurance premiums will continue to rise, diluting GSE pricing advantage relative to CMBS/Banks • Reform • Uncertain outcome dictated by Congress • GSE MFH Lines of Business may emerge as fully-private or evolve into fully-public entities • Implementation to last a decade or longer • FY2013 restricted goals 15 MARKET OUTLOOK: CMBS CONDUITS • Conduits will continue to struggle to generate sufficient deal volume to support high fixed operating costs and overhead • Conduits will recover market share only gradually as investor confidence in loan underwriting improves and bond spreads tighten • Unlikely to be broadly competitive for class-A/B multifamily product for the foreseeable future • Dodd-Frank risk retention requirements problematic, making securitization highly capital intensive and will make achieving ROEs thresholds challenging. 16 MARKET OUTLOOK: BANKS & THRIFTS • Local and regional banks becoming more competitive for multifamily construction and permanent debt business • Construction loans among their most profitable LOBs • Underwriting terms strict, Libor spreads wide • Personal guarantee and recourse provisions still typical • Aggressively pursing LIHTC business for CRA purposes • Money center and super-regional banks will be hampered by Increased capital requirements pursuant to Basel III, less likely to pursue large construction loan opportunities • Local and regional banks will be less affected by Basel III and are likely to increase as a competitive threat for smaller credits 17 MARKET OUTLOOK: LIFE COMPANIES • Actively seeking CRE lending opportunities, especially in class-A multifamily sector • Highly competitive for the right deals, but remain selective. Prefer urban infill mid-rise and high-rise properties in the major coastal markets. Unlikely to compete actively in Heartland for garden apartments • Appetite for MFH debt stabilizing as absolute rate levels bounce from early-year lows, although returns remain below Life Co. yield hurdles. • Likely to become a larger factor in the market when rates return to levels typical of economic expansions. 18 REASONS FOR OPTIMISM #3: DEMAND FOR RENTAL HOUSING Demographic Growth Decreasing Homeownership Rates Construction Volumes Remain Inadequate 19 NEED FOR CONSTRUCTION FINANCING ACUTE Demand for rental housing is growing as the rate of homeownership falls. If Americans continue to form new households at a 1.1% annual rate over the next 10 years and the rate of homeownership falls 0.25% per year, the U.S. will need to add nearly 700,000 rental units annually to meet demand, fueling prospective construction loan demand. Renter Households in America Rental Households (000) Sources: Census Bureau and RED Research 48,000 45,000 42,000 Increase of 7 million households over 10 years 46,315 39,583 39,000 36,000 33,000 30,000 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 Homeownership in America declined from a historic high of 69.2% in 2004 to 65.2% in 1Q13, representing an average decrease of about 0.48% per year. Assuming homeownership continues to decline at a rate of about 0.25% per year for the next 10 years the number of household living in all types of rental structures (1-4, 5+, MH) will increase by about 700,000 per year. 20 DECREASE IN HOMEOWNERSHIP The rate of homeownership in America has declined steadily since 2006, particularly among households headed by persons under the age of 35, the group that traditionally exhibits the highest propensity to rent. Until conventional mortgage financing with relatively low LTVs becomes readily available again, these trends are likely to continue. Rate of U.S. Homeownership U.S. HOUSEHOLDS Census Bureau and RED ResearchAGED ALL U.S. HOUSEHOLDS Sources: 34 OR YOUNGER 44% 68% 42% 66% 40% 64% 38% 62% 36% 60% 34% Title 70% 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Source: U.S. Census Bureau 21 FORECAST CHANGE IN RENTER COHORT (AGES 16 – 29 YEARS) HOMEOWNERSHIP RATE Rate of U.S. Homeownership Renter Cohort Homeownership Rate Sources: Census Bureau and RED Research Forecast Renter Cohort Homeownership Rate 35% 34% 33% 32% 31% 30% 29% 28% 27% 2001 2003 2005 2007 2009 2011 2013 2015 2017 22 5+ STARTS REMAIN BELOW TREND While American Households will demand as many 400,000 new multifamily rental units per year over the next decade, construction starts have only recently approached the levels observed prior to the Great Recession Units Thousands Annual 5+ Construction Starts Source: U.S. Census Bureau 350 311 280 300 250 234 200 150 100 50 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 SAAR *About one of every three renter households lives in a multifamily dwelling of 20 or more units, producing annual natural net demand for about 240,000 units. In addition, hazard and functional obsolescence removes roughly 0.2% of units in structures of 20 or more units from total stock, producing a net need of roughly 160,000 units annual37, for a total of 400,000 units. 23 REASONS FOR OPTIMISM #4: AFFORDABLE HOUSING Need for Affordable Housing Growing 24 CORE MISSION BUSINESS IS AS VITAL AS EVER: AFFORDABLE HOUSING Affordable Units Financed Made up More than 33% of all Units Financed during the Past 10 Years SECT. 8 / 202 10% Tax Exempt Bonds 19% SECTION 8 46% Affordable 33% Market Rate 67% LIHTC 25% Affordable housing activity by business line. Source: RMC Portfolio as a Proxy 25 Severely Cost Burdened Households (Millions) NEED FOR AFFORDABLE HOUSING CONTINUED TO GROW Households Paying More than 50% of Pre-tax Income for Housing 22 20 9.5 18 9.0 16 14 12 7.0 6.5 10 10.5 8 6 9.0 9.0 2004 2007 7.5 4 2001 Source: Joint Center for Housing Studies, Harvard University 2010 26 REASONS FOR OPTIMISM #5: RECENT FHA CONVERTS Dozens of New Adopters Introduced to FHA Positive Experience / Repeat Business 27 NEW ADOPTERS LIKELY TO REMAIN ACTIVE CUSTOMERS • Many experienced developers utilized Sect. 221(d)(4) construction financing for the first time • RED’s clients were universally satisfied • All will consider future 221(d)(4) financings • Some have reconfigured business models to conform to the timing and underwriting requirements of the HUD program • Quality market-rate developers have become believers and will not discontinue use of the program when conventional construction lenders return to the market 28 PROPERTIES DEVELOPED BY NEW ADOPTERS Properties in the Columbus HUB region developed by new adopters using FHA construction-to-perm credit products Hilliard Grand, Dublin, OH Arlington Park, Hilliard, OH Hilliard Grand, Dublin, OH Prescott Place, Columbus, OH Prescott Place, Columbus, OH Arlington Park, Hilliard, OH 29 SOME CHALLENGES TO CONSIDER Overall HUD Morale Programmatic Changes/Enforcement Cost of Funds 30 OVERALL HUD MORALE • Sequestration • Furloughs • Reorganization • Revised Business Model • Lack of Resources 31 PROGRAMMATIC CHANGES/ENFORCEMENT • LTV, DSCR, Sponsor Requirements • Secondary Debt Limits • Loss of Section 202 Refinancing Flexibilities • Strengthened IOI Requirements • Availability of Commitment Authority • Davis-Bacon Wage Determination 32