What are EmpowerPoints??

advertisement

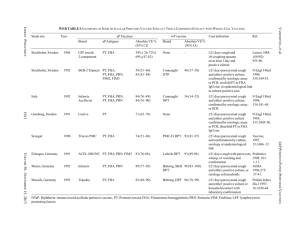

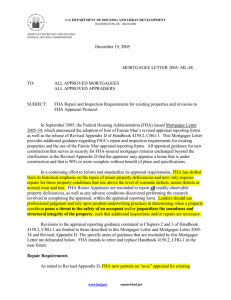

Sales Meeting in a Box September 2015 Our VISION Enriching Lives through a dedicated commitment to home ownership What are EmpowerPoints?? EmpowerPoints is a way to reward your teammates when they provide excellent customer service. When you see a co-worker living the Vision, Mission or Primary Principles, log into EmpowerPoints and award them with EmpowerPoints. How do I Get Started?? >> Visit: www.empowerpoints.com >Create an Account >Start awarding and redeeming points What can I do with my EmpowerPoints?? EmpowerPoints can be used to purchase Eagle branded items available on the EmpowerPoints site. Did you know?? You can earn 5 EmpowerPoints for your Best Ideas! All you have to do is submit your Best idea to: bestidea@eaglehomemortgage.com We look forward to hearing from you!! Best Idea Quarterly Focus In addition to all your best ideas, we are going to focus on How do you want to receive information? Communication & Marketing Let us know how you feel we can improve as a company! How do you market during the 4th quarter? What are your marketing ideas? Did you know? Refer an employee to work here and you could earn up to $1000 Branch Volume Branch Units Top LO’s Top Processors Top Funders Top UWs Top 5 Branch Volume Puyallup $23,400,901 Eagle $15,400,426 Tigard $15,370,600 Reno $14,500,274 Bellevue $11,670,749 Top 5 Branch Units Puyallup – 97 Eagle – 88 Tigard – 60 Reno – 57 Bellevue - 35 Top 5 Loan Officer Volume Julee Felsman $8,427,656 Ted Buchanan $6,585,339 Bryan Laflamme $4,554,864 Dave Skow $4,250,765 Rick Dennis $3,376,246 Top 5 Loan Officer Units Julee Felsman – 32 Ted Buchanan – 19 Bryan Laflamme – 18 Don Mackay – 14 Jenny Lack - 13 Top 5 7 Processors Marcia Guerin 30 Tara Hanson 26 Stacy Nolan 25 Mary Koole 25 Ashlie Smith 25 Kim Stec 25 Laurie Kindel 25 Top 5 Funders Tim Sampson 80 Debra D’Allegro 76 Sandra Moriarty 75 Roni Fisher 66 Lyn Shahan 61 Top 5 Underwriters Debbie Hart 159 Helen Cripe 140 Pam Hamel 130 Shelly Sorensen 117 Lynda Lough 106 Branch Numbers & Awards Conversion of principal residence to investment or second home • Follow new Fannie guidelines as announced in Fannie bulletin 2015-07 • Appraisal is no longer required to document 30% equity • Reference Mortgagee Letter 2015-07 Chase non-conforming guidelines Programs fixed 6303 ARMs 6301, 6337, 6338 I/O ARMs 6302, 6339, 6340: Substantial changes to Chase guidelines including: • Enhanced and simplified LTV table • DTI ratio maximums are more detailed • Additional option for minimum credit requirements • Additional option for rental income reserve requirements Freddie Mac Conventional Conforming Loans Program 2160 Revolving credit accounts that are paid off to zero, in order to qualify, no longer must be closed Continuing Education How is your CE coming along??? You will have from June 15th through September 30th to complete your required hours. The race is on… QC Audit Results – April 2015 The types of loans reviewed in the audit included 10% of Conventional, FHA and VA Loans. A sampling of the loans are Cancelled/Denied, Brokered, Pre-Funding, Discretionary or Random Helpful Hints As a company, we are required to address any area that has an error rate over 2% along with submitting an action plan of how to prevent future occurrences Please focus on all exceptions over 2% and help eliminate these from reoccurring in the future!!! From Operations Underwriting Updates The 5/8/15 buzz content bulleted below has been amended by FHA • See actual new excerpt from 4000.1 on the following page • Family members can still remain on contract and not be a borrower • Only borrowers can sign the purchase agreement (means NPS or other parties not on the loan cannot hold title to the property) FHA Single Family 4000.1: FHA Single Family Housing Policy Handbook II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT A. TITLE II INSURED HOUSING PROGRAMS FORWARD MORTGAGES (09/14/15) 1. Origination/Processing (09/14/15) a. Applications and Disclosures (09/14/15) E) Sales Contract and Supporting Documentation (1) Sales Contract (a) Standard The Mortgagee must not originate an insured Mortgage for the purchase of a Property if any provision of the sales contract violates FHA requirements. The Mortgagee must ensure that (1) all purchasers listed on the sales contract are Borrowers, and (2) only Borrowers sign the sales contract. An addendum or modification may be used to remove or correct any provisions of the sales contract that do not conform to these requirements. The Family Member of a purchaser, who is not a borrower, may be listed on the sales contract without modification or removal Featured Velma Email Also available to co-brand Don’t forget to check out the TRID Toolkit! The components of the TRID Toolkit include: Landing Page/Microsite (http://home.eaglehomemortgage.com/TRID) 3-Minute Video HTML Email Invitation to Lunch ‘N Learn PowerPoint Presentation Training Sign up for September Calendar Training Classes Today Training Calendar Visit the training calendar today: >UAMC Portal >Training Resources >Training Calendar If you see a need for a class that isn’t listed – reach out to Amy Lind Branch Update Sharing of Best Practices - Success Stories