New Hire Benefits Orientation - Northshore Technical Community

advertisement

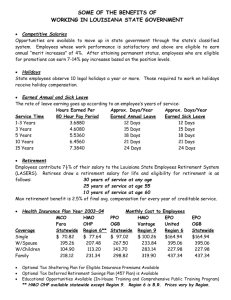

New Hire Benefits Orientation LEAVE Leave policies for classified employees is mandated by the Louisiana Department of State Civil Service. Leave for grant employees are mandated by regulations of the granting authority. For unclassified, non-civil service employees, the College has formally adopted the Louisiana Community and Technical College System (LCTCS) Policy II.3.003 Leave Record Establishment and Regulations for all Unclassified, Non-Civil Service Employees as its official policy. Regulations regarding all forms of leave for unclassified faculty and staff (sick leave, annual leave, faculty leave, sabbatical leave, advanced degree leave, military leave, special/civil/emergency/other leave including bereavement/funeral leave, family medical (FMLA) leave, educational leave, administrative leave, compensatory leave, leave without pay, workmen's compensation leave, leave of absence without pay) as are addressed in LCTCS Policy#II.3.003 Annual Leave for Unclassified Employees on the 12-Month Basis: DAYS OF ANNUAL LEAVE EARNED PER MONTH BY FULL-TIME EMPLOYEES Years of Service Day (hours of Leave Earned Per Month) Less Than 3 1 (8 hrs) 3. But Less Than 5 5, But Less Than 10 1-1/4 (10 hrs) 1-1/2 (12 hrs) 10, But Less Than 15 1-3/4 (14 hrs) 15 and Over 2 (16 hrs) HOURS OF ANNUAL LEAVE EARNED BI-WEEKLY BY FULL-TIME EMPLOYEES Years of Service Hours of Leave Earned Biweekly Less Than 3 3. But Less Than 5 5, But Less Than 10 10, But Less Than 15 15 and Over .0461 hour .0576 hour .0692 hour .0807 hour .0923 hour 3.688 hours 4.608 hours 5.536 hours 6.456 hours 7.384 hours Sick Leave Earnings DAYS OF SICK LEAVE EARNED PER MONTH BY FULL-TIME EMPLOYEES Years of Service Day (hours of Leave Earned Per Month) Less Than 3. But Less 3 Than 5 1 (8 hrs) 1-1/4 (10 hrs) 5, But Less Than 10 1-1/2 (12 hrs) 10, But Less 15 and Over Than 15 1-3/4 (14 hrs) 2 (16 hrs) HOURS OF SICK LEAVE EARNED BI-WEEKLY BY FULL-TIME EMPLOYEES Years of Service Hours of Leave Earned Biweekly Less Than 3 3. But Less Than 5 5, But Less Than 10 10, But Less 15 and Over Than 15 .0461 hour .0576 hour .0692 hour .0807 hour .0923 hour 3.688 hours 4.608 hours 5.536 hours 6.456 hours 7.384 hours Faculty Leave for Employees on Nine (9) Month (Academic Year) Basis Only: 1. Faculty Leave is leave granted to eligible (full-time) faculty members employed for the academic year and who have a regular tour of duty. 2. Faculty leave is paid leave in lieu of annual leave and is comprised of the days between terms and at holiday periods when students are not in classes. 3. Faculty leave shall be granted as specified by the official calendar of the institution served, and shall be taken as it is granted. Holidays Under the R.S 1:55 provision, “Each institution of higher education in the state, through a representative appointed by it, shall designate a maximum of fourteen (14) legal holidays per calendar year to be observed by all of its employees.” 1. Monday, January 17, 2011 -Martin Luther King, Jr. Birthday 2. Monday, March 7,2011 - Mardi Gras 3. Tuesday, March 8, 2011 - Mardi Gras 4. Friday, April 22, 2011 - Good Friday 5. Monday, July 4, 2011 -4th of July 6. Monday, September 5, 2011 - Labor Day 7. Thursday, November 24,2011- Thanksgiving 8. Friday, November 25, 2011- Thanksgiving 9. Friday, December 23, 2011 -ChristmaslWinter Holiday 10. Monday, December 26,2011- ChristmaslWinter Holiday 11. Tuesday, December 27,2011- ChristmaslWinter Holiday 12. Wednesday, December 28,2011- ChristmaslWinter Holiday 13. Thursday, December 29,2011- ChristmaslWinter Holiday 14. Friday, December 30,2011- ChristmaslWinter Holiday Benefits Medical: The Office of Group Benefits (OGB) is responsible for administering life and health benefits for state employees, participating school boards, and certain political subdivisions. A summary of the benefits offered by our health plan is provided on the OGB website (www.groupbenefits.org), as are listings of our health maintenance organizations and our Flexible Benefits Plan. You will also find a listing of our preferred providers, exclusive providers plan documents, and specific information for providers. This site also discusses our flexible benefits plan, contractors for mental health, and prescription drug plan. Current medical benefits plans offered to Northshore Technical College employees are as followed: PPO HMO United Health Care CD-HSA Plan Eligibility Full Time Employees and Dependents Legal Spouse Never married children under 21 that you support Never married children up to 24 who full time students (need proof within 30 days of each semester start) Dependent Verification Required Pre-Existing Conditions If diagnosed or treated within 6 months prior to enrollment date Then that condition is pre-existing and no benefits payable for that condition in first 12 months of coverage. Must complete enrollment form within 30 days for a new dependent otherwise preexisting condition applies. May be exempt from PEC if continuously covered without a 63-day break in coverage. Plan Overview PPO HMO CDHP-HSA Coverage In-Network All regions Nationwide Nationwide Administrator OGB Blue Cross & Blue Shield of LA United Healthcare Unlimited Lifetime Maximum Deductible $500 active $300 retiree 3-person maximum None $1,250 employee $2,500 employee +1 $3,000 family Out-of-Pocket Maximum $1,000 per person ** $1,000 per person $3,000 per family $2,000 per person Hospital In-Network 10% of contracted rate* Pre-cert required $100 per day $300 max per admit Pre-cert required 20% of contracted rate* Pre-cert required Doctor Visits 10% of contracted rate* No referral required Co-pay $15 PCP $25 specialist No referral required 20% of contracted rate* (primary care & specialty care) *Subject to plan year deductible and/or applicable co-insurance **Active employees & retirees without Medicare Key Points New employees who want to enroll in health insurance must complete the Acknowledgement of PreExisting Condition and Statement of Physical Condition form and the Insurance Portability Law (IPL) Application. Life Insurance Office of Group Benefits provides life insurance for employees and their dependents at state group rates. Underwritten by Prudential Insurance Co. of America Group Term Life Plan State pays half the premium for employees and retirees Employee pays premium for dependent life. Reduction of 25% in coverage and appropriate reduction in premiums, July 1st following ages 65 & 70. Choose between Basic Plan and Basic Plus Supplemental Accidental Death & Dismemberment benefits are available to all active & retired employees who are covered under the Basic or Basic Plus plans. Retirees over 70 not eligible for AD&D benefits. Flexible Benefits Why Are Flexible Benefit Plans Important? Increase spendable income Easy Reduce Taxes What Are Flex Plan Options? Flex Plan Options Premium Conversion Option (No Fee) Dependent Care FSA ($3.50/Month) Health Care FSA ($3.50/Month) Put aside your eligible payroll health care premium deductions Eligible premium deductions will automatically continue in the Flex plan from year to year unless you request to drop out during annual enrollment Set aside money from paycheck for dependent care expense MUST RE-ENROLL in this program each year during annual enrollment Set aside $600 - $5000 from paycheck for out-of-pocket medical expenses MUST RE-ENROLL in this program each year during annual enrollment Spending Account Eligibility Requirements Premium Conversion- You are eligible if you are an active, full-time employee of the State of Louisiana whose agency participates in the State of Louisiana Flexible Benefits Plan. Health Care FSA Eligibility - You are eligible to participate if you meet all of the following conditions: are an active full-time employee, be continuously employed by current employer for at least the twelve consecutive months are employed by a state employer that utilizes the State of Louisiana Flexible Benefits Plan, and pay the administrative fee. Dependent Care FSA Eligibility - You are eligible if you are an active, full-time employee of the State of Louisiana whose agency participates in the State of Louisiana Flexible Benefits Plan and pay the administration fee. FAQs When can I change my elections? Once you enroll, your election will remain in effect for the entire plan year unless you have a qualified status change, such as a marriage, divorce, or the birth or adoption of a child. What happens if I have money left in my FS account at the end of the plan year? Due to current IRS regulations, any money left in your Health and Dependent Care FSAs after all claims have been processed for that plan year must be forfeited. Please remember the IRS “USE IT or LOSE IT” rule. You cannot carry your money into the next plan year or be paid in cash, however, a Grace Period has been added. (This modifies the IRS “Use it or Lose it” rule.) This period allow you to incur eligible expenses in this period to be paid with money remaining in your prior year account. The Grace Period timeline is set each plan year. The Run-Off Period is the 45-day time period after the end of the Grace Period, during which participants can submit eligible expenses incurred during the preceding plan year for reimbursement. Key Points Employees have 30 days from hire date to enroll in the Flexible Benefits Plan. The employee must complete both the GB-01 Insurance Enrollment Form and the Flexible Benefits Enrollment form and indicate their enrollment choice OR waiver of coverage. Do not sign in both places. Once enrolled OGB member may only change plans during annual enrollment. Questions? A summary of the benefits offered by our health, life insurance, or flexible plans are provided on the OGB website (www.groupbenefits.org). This site will provide a benefit comparison chart, schedule of rates, and plan documents. Please ask your HR Representative if you have additional questions. Miscellaneous Benefits Other Benefits are offered to State employees via general deduction by various vendors. Below lists some of the benefits offered: Dental Vision Savings Programs PrePaid Legal Services Insurance Plans Life Accidental Cancer Heart Attack Intensive Care Disability Hospital To enroll in these benefits, the employee will need to contact the vendor directly. Please refer to the Miscellaneous Vendor Contact Sheet. TRSL Retirement Plan Retirement benefits and contribution requirements for Northshore Technical College unclassified employees are mandated by the Teachers' Retirement System of Louisiana. All full-time, unclassified personnel are required by state law to enroll in Teacher’s Retirement System of Louisiana members as a condition of employment. Plan members will contribute 8% of their salaries. For more information regarding TRSL, please visit www.trsl.org. The percentage contribution of each employee to his/her retirement plan is matched with a certain percentage by the College. Annually, the percentages for the State Retirement Plan, Teachers' Retirement Plan, and the Optional Retirement Plan (ORP) are set by each plan. Employer Contributions for FY 10-11 20.2% LASERS Retirement benefits and contribution requirements for Northshore Technical College employees are mandated by the Louisiana State Employees' Retirement System (LASERS). All classified personnel are required by state law to enroll in Louisiana State Employees Retirement System (LASERS) as a condition of employment. Employees will contribute 8% if hired after 7/1/06 and 7.5% if hired before 7/1/06. For more information regarding LASERS, please visit www.lasersonline.org. The percentage contribution of each employee to his/her retirement plan is matched with a certain percentage by the College. Annually, the percentages for the State Retirement Plan, Teachers' Retirement Plan, and the Optional Retirement Plan (ORP) are set by each plan. Employer Contributions for FY 10-11 22%