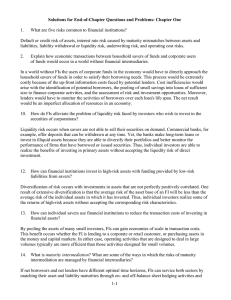

PPT - University of Colorado Boulder

FNCE 4000

Financial Institutions Management

Chapter 1

Why are Financial Institutions Special?

1-1

Without FIs

•Primary difference is direct transacting versus transformation

•Example of direct below:

Equity & Debt

Households

(net savers)

Corporations

(net borrowers)

Cash

1-2

FIs’ Specialness

Without FIs: Low level of fund flows.

– Information costs

Economies of scale reduce costs for FIs to screen and monitor borrowers

– Less liquidity

– Substantial price risk

1-3

With FIs

Households

Cash

Deposits/Insurance

Policies

FI

(Brokers)

FI

(Asset

Transformers)

Corporations

Equity & Debt

Cash

1-4

FIs are Middlemen!

Why should they exist?

– Reduce information costs

– Spread of risk

– Economies of scale

– Maturity intermediation

– Payment services

– <transfer monetary policy>

1-5

Specialness and Regulation

FIs receive special regulatory attention.

Reasons:

– Negative externalities of FI failure

– Special services provided by FIs

– Institution-specific functions such as money supply transmission (banks), credit allocation (thrifts, farm banks), payment services (banks, thrifts), etc.

1-6

Regulation of FIs

Important features of regulatory policy:

– Protect ultimate sources and users of savings

Including prevention of unfair practices such as redlining and other discriminatory actions

– Primary role:

Ensure soundness of the overall system

1-7

Regulation of FIs

Safety + soundness

Monetary policy

Credit allocation

Consumer protection

Investor protection

Entry

Consumer protection

Regulation is not costless

1-8

Regulation

Safety and soundness regulation:

– Regulations to increase diversification

No more than 10 percent of equity to single borrower

– Minimum capital requirements

– Guaranty funds:

Deposit insurance fund (DIF):

Securities Investors Protection Fund (SIPC)

– Monitoring and surveillance.

FDIC monitors and regulates DIF participants.

1-9

Regulation

Consumer protection regulation

– Community Reinvestment Act (CRA)

– Home Mortgage Disclosure Act (HMDA)

Effect on net regulatory burden

– FFIEC processed info on as many as 17 million mortgage transactions in 2009

– Analysts questioning the net benefit

1-10

Consumer Protection Regulation

Potential extensions of regulations

– CRA to other FIs such as insurance companies in light of consolidation and trend toward universal banking

New additions:

– Consumer Financial Protection Agency

(2009)

– Credit card reform bill effective 2010

1-11

Additional Terms

Redlining

Negative externality

Disintermediation

Liquidity

Solvency

Information costs

Payment Services

1-12

Global Trends

US FIs facing increased competition from foreign FIs

Securitization of assets (30 year trend)

Only 2 of the top ten banks are US banks

Foreign bank assets in the US typically more than 10 percent

– As high as 21.9 percent

1-13

Largest Banks

1-14

Financial Crisis

DJIA fell 53.8 percent in less than 1 ½ years as if mid-March 2009

Record home foreclosures

– 1 in 45 in default in late 2008

Goldman Sachs and Morgan Stanley

– Only survivors of the major firms

1-15

Risk and the Financial Crisis

Reactions to FSM Act and other factors:

– Shift from “originate and hold” to

“originate and distribute”

Affects incentives to monitor and control risk.

Shift to off balance sheet risks

Degraded quality and increased risk

Housing market bubble

– Encouraged subprime market and more exotic mortgages

1-16

Financial Crisis

AIG bailout

Citigroup needed government support

Chrysler and GM declared bankruptcy in 2009

Unemployment in excess of 10 percent

1-17

Beginning of the Collapse

Home prices plummeted in 2006-07

– Mortgage delinquencies rose

– Forelosure filings increased 93 percent from July 2006 to July 2007

– Securitized mortgages led to large financial losses

Subprime mortgages

– Countrywide Financial bailed out and eventually taken over by Bank of America

1-18

Significant failures and events

Bear Stearns funds filed for bankruptcy

– Acquired by J.P. Morgan Chase

– Fed moved beyond lending only to

Depository Institutions

Government seizure of Fannie Mae and Freddie Mac

Lehman Brothers failure

Crisis spread worldwide

1-19

Rescue Plan

Federal Reserve and other central banks infused $180 billion

$700 billion Troubled Asset Relief

Program (TARP)

Still struggling in 2009

$827 billion stimulus program

– American Recovery and Reinvestment

Act of 2009

1-20

Types of FIs

Depository institutions

Insurance Companies

Pension Funds

Investment Banks

Mutual Funds

Finance Companies

1-21

Trends in Assets Held by FIs

1-22

Pertinent Websites

The Banker

Federal Reserve

FDIC

FFIEC

Investment Co.

Institute www.thebanker.com

www.federalreserve.gov

www.fdic.gov

www.ffiec.gov

www.ici.com

OCC

SEC

SIPC

Wall Street Journal www.occ.treas.gov

www.sec.gov

www.sipc.org

www.wsj.com

1-23