Long Term Financial Plan

advertisement

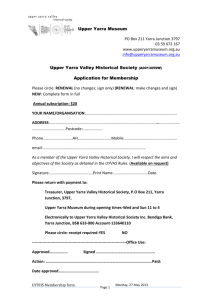

Yarra Ranges Council Long Term Financial Plan June 2014 Long Term Financial Plan 2014/15 – 2023/24 _______________________________________________________________________ Contents 1. Executive summary 1.1 Financial management obligations .............................................................................................................. 1 1.2 Long Term Financial Plan objectives............................................................................................................. 1 2. Yarra Ranges background 2.1 Background................................................................................................................................................... 2 2.2 Key factors influencing the financial position .............................................................................................. 2 2.3 Rates...................................................................................................................................................... 3 3. Financial sustainability 3.1 3.2 3.3 3.4 3.5 3.6 3.7 3.8 Underlying result...........................................................................................................................................6 Liquidity.........................................................................................................................................................7 Indebtedness.................................................................................................................................................7 Self Financing................................................................................................................................................ 8 Capital Replacement..................................................................................................................................... 9 Renewal Gap..................................................................................................................................................9 Average Rate increase...................................................................................................................................11 Overall financial sustainability risk assessment............................................................................................11 4. Relationship to sustainability framework.............................................................................................12 5. Current Financial position 5.1 5.2 5.3 5.4 5.5 Source of funds .............................................................................................................................................. 13 Expenditure.................................................................................................................................................... 13 Debt position................................................................................................................................................. 14 Capital expenditure....................................................................................................................................... 15 Cash position................................................................................................................................................. 15 6. Key Challenges 6.1 Infrastructure................................................................................................................................................ 16 6.2 Environment.................................................................................................................................................. 17 6.3 Risk management requirements................................................................................................................... 17 6.4 Service delivery and growing community expectations.................................................................................17 6.5 Government funding......................................................................................................................................18 6.6 Municipal Emergency Planning and Preparation...........................................................................................18 6.7 Accessibility....................................................................................................................................................18 7. Addressing the challenges – our strategy 7.1 7.2 7.3 7.4 7.6 7.7 7.8 Rates.............................................................................................................................................................. 19 Government funding...................................................................................................................................... 20 Fees and charges........................................................................................................................................... 21 Loan Borrowings............................................................................................................................................ 23 Recurrent operating expenditure.................................................................................................................. 23 New initiatives, one-off expenditure cost pressures...................................................................................... 24 Capital works expenditure............................................................................................................................. 24 Appendices Forecast Comprehensive Income Statement........................................................................................................ 27 Forecast Balance Sheet........................................................................................................................................ 28 Forecast Cash Flow statement............................................................................................................................. 29 Forecast Capital Works Program.......................................................................................................................... 30 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 1. EXECUTIVE SUMMARY The Long Term Financial Plan (LTFP) is the key financial planning document of Council which is governed by a series of financial strategies and accompanying performance indicators that Council considers and adopts. It establishes the financial framework upon which sound financial decisions are made. 1.1 Financial management obligations Council has a legislative requirement to comply with the principles of sound financial management as detailed in section 136 of the Local Government Act 1989, these are: Prudently manage financial risks having regard to economic circumstances. These risks include:o The level of council debt; o The management, maintenance and renewal of infrastructure assets; o The management of current and future liabilities; o Sustainable revenue streams; o Changes in the structure of rates and charges base; o The commercial or entrepreneurial activities of Council. Rating policies that are consistent and with a reasonable degree of stability in the level of the rates burden. Ensure that decisions made and actions taken have regard to their financial effects on future generations. Ensure full, accurate and timely disclosure of financial information relating to the council. A key component of sound financial management is the preparation of longer term financial strategies, plans and budgets. Council has prepared forward budgets for the ten years 2014/15 to 2023/24 which includes a detailed ten year capital expenditure program. The Long Term Financial Plan, including the Financial Strategies do not have to be re-created each year, but rather they should be reviewed annually and modified as Council’s priorities change 1.2 Long term financial plan objectives The 2014/15-2023/24 LTFP is intended to achieve the following objectives in the ten year time frame: Maintain the existing range and level of service provision while developing the capacity to grow and add new services if required; Maintain a strong cash position, ensuring Council remains financially sustainable in the long term; Achieve operating statement surpluses after adjustments for one-off (non-recurring) adjustments; Reduce debt levels; 1 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ Maintain long term financial sustainability indicators at the low-medium risk levels as defined by the Victorian Auditor General’s Office (VAGO) sustainability indicators; Maintenance of existing assets and replacement at a rate consistent with their consumption & condition; Addressing the funding gap for asset renewal; Address unexpected expenditure such as defined benefits superannuation unfunded liabilities (when surplus funds are available); No new EFT staff (unless funded from existing budget or additional revenue generation); Maintain a rate and fees structure which addresses the various objectives with consideration to the level of rate burden; and Once off reduction in the rate rise (net of any costs) should the carbon price legislation be repealed and no substitute legislation is introduced, and this would be applicable in future budget years. 2. YARRA RANGES - BACKGROUND 2.1 Background Council is in a very sound financial position and intends to use this strength to continue the delivery of an exciting range of capital projects and service enhancements without compromising the long term financial health of the organisation. In recent years Council has made a set of decisions that significantly impacts the services and infrastructure provided to our community and dealing with the longer term issues of asset maintenance and financial sustainability. This updated Long Term Financial Plan consolidates and builds on this strategic direction. The additional investment made in this strategy will work towards Council's vision of creating a better future for Yarra Ranges, supported by a high performing organisation providing great service to its communities. 2.2 Key factors influencing the financial position There are a number of notable characteristics of Yarra Ranges that heavily influence the current and future financial position. These factors include: The sheer size of Yarra Ranges in geographical terms compared with other metropolitan municipalities, and the consequential increase in unit cost for the delivery of many services and renewal of assets. The different demands and expectations of the urban and rural areas of the municipality place additional pressure on funding to meet issues such as protecting the environment and the identity of diverse townships. The relatively static and ageing population of the municipality compared with many other outer-metro Councils where high growth and development is being experienced. A growing expectation from the community and other levels of Government that Council will provide an increasing range of services at an increasing standard or quality. Ageing infrastructure that requires significant maintenance and re-investment. An ongoing emphasis by Council on providing environmental leadership to the Yarra Ranges municipality by reducing or offsetting emissions and promoting environmental education programs. 2 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ Increasing legislative obligations imposed by the State Government and the continued erosion of the real value of specific purpose grants that do not keep pace with providing services. Capping of many user fees and charges by the Victorian Government leaves Councils unable to recover the true cost of delivering services such as libraries, planning, and building. An ageing population, placing increasing demand on direct care service provision. Challenge of delivering services in an environment of growing costs of delivery – particularly costs of fuel and utilities and renewal of assets. These factors set the scene for Yarra Ranges operating within an inherently restricted financial context and with increasing demand for services and capital expenditure in a number of areas. 2.3 Rates Council continues to keep rate increases stable, and is working hard to keep rates down and drive cost efficiencies and reduction in expenditure. The above factors however contribute to the following picture of Yarra Ranges’ average rates compared with the interface councils for the 2013/14 financial year (source MAV July 2013, draft budget data for 8 interface councils): Yarra Ranges ($) Average total rates Rates per head Interface Councils ($) Difference (%) 1,766 1,727 2% 740 707 5% The data above shows that Yarra Ranges is only 2% higher than the average of interface councils on rates per assessment. An ongoing problem for Yarra Ranges is that our urban residents have a direct comparison of rating levels with the adjoining municipalities of Knox and Maroondah where rates for similar properties are lower. Yarra Ranges’ location on Melbourne’s eastern fringe at the urban/rural interface presents a distinct contrast to our urban neighbours. This is highlighted by our unique combination of conspiring factors including fire and emergency management, complex land use planning, vegetation management, vast open space/bushland reserve management responsibilities, extensive and dispersed rural infrastructure base and low growth as a source of funding. Rates per head of population is an increasingly more useful measure of local government rates as the services provided by Yarra Ranges expands from property-based to human-based services. In terms of the MAV data and rates per head of population, Yarra Ranges is ranked 55 th lowest out of the 73 Councils reported on. The average rates per head of population across the sector was $791 and this is higher than Yarra Ranges’ result of $740. The data provided by MAV reported on 73 councils across the state (out of 79 Victorian councils) and ranked (from highest to lowest) Yarra Ranges rates per assessment at 21st, an improvement from 15th position. The average total rates across 73 councils was $1,662 and ranged from Loddon Shire at $1,135 to Melbourne at $2,360 followed by Nillumbik at $2,319. Average rates lifted by 3 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 4.8% across all councils and Yarra Ranges is on par with this increase. However it is anticipated that as Council holds its average rate increase to 4.8%, it will continue to drop lower in rates per assessment compared to the rest of the sector. Rate increases are, however, inevitable. The Local Government Cost Index calculated by the MAV (using a combination of construction, materials and wages indices to measure the sector’s expenditure profile) has consistently shown that costs continue to rise faster than CPI. Council has to meet higher expenses just to maintain its current position. The rising cost of delivering a large number of council services is not reflected in the Consumer Price Index (which calculates price movements for a series of common household goods and services such as food, petrol and utility costs) due to the majority of council spending being driven by labour, material and construction costs. Additional rate increases are needed to fund capital works programs and to overcome declining grants from other levels of government. Adding to Council’s cost pressures, the State and Commonwealth continue to link indexation of many grants to CPI or less, despite this being a largely irrelevant benchmarking tool for real cost movements. This means that pressure always falls on rate revenue to continue to fund service delivery, capital expenditure and renewal of assets, in addition to defined benefits superannuation funding shortfalls. In distributing rates across the municipality, Council distinguishes between the different purposes for which properties are used – commercial/industrial properties are rated at 150% of the residential value, whereas farming properties are at 70% of the residential value. Since Yarra Ranges has a higher than average proportion of farm assessments, and a lower than average proportion of residential assessments, residential properties have received a relatively higher share of the rate burden than the outer metro council average. The higher than average cost per unit of service delivery due to the various physical attributes of the municipality also exacerbates this. However, to shift the share of rates from residential properties to farming properties would have a minimal impact on residential but a significant impact on the smaller proportion of farming properties. 4 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 2. FINANCIAL SUSTAINABILITY An annual assessment of Council’s financial sustainability is an outcome of the year end audit process and its scope covers a review of the key financial ratios. This analysis provides a sustainability risk rating for the past three financial years to 30 June 2013, based on key indicators that VAGO commenced reporting in 2003-04. These ratios provide a set of interrelated indicators for local governments to use as a guide to assess their financial performance and position. The indicators used reflect short and long term sustainability, and are measured to determine whether councils: • generate enough revenue to cover operating costs (including the cost of replacing assets reflected in the depreciation expense)—underlying result • have sufficient working capital to meet short-term commitments—liquidity • are not overly reliant on debt to fund capital programs—indebtedness • generate sufficient operating cash flows to invest in asset renewal and repay any debt it may have incurred in the past—self-financing • have been replacing assets at a rate consistent with their consumption—capital replacement • have been maintaining existing assets at a consistent rate—renewal gap. It is important to consider the trend when assessing these indicators. VAGO Risk assessment criteria for financial sustainability indicators Risk High Medium Low Underlying result Negative 10% or less Capital replacement Equal to or less than 1.0 Liquidity Equal to or less than 1.0 Indebtedness More than 60% Self-financing Less than 10% Renewal gap Equal to or less than 0.5 Insufficient revenue is being generated to fund operations and asset renewal. Insufficient current assets to cover liabilities. Potentially longterm concern over ability to repay debt levels from own-source revenue. Insufficient cash from operations to fund new assets and asset renewal. Spending on capital works has not kept pace with consumption of assets. Spending on existing assets has not kept pace with consumption of these assets. Negative 10% to zero 1.0–1.5 40–60% 10–20% 1.0–1.5 0.5–1.0 A risk of long-term run down to cash reserves and inability to fund asset renewals. Need for caution with cash flow, as issues could arise with meeting obligations as they fall due. Some concern over the ability to repay debt from own-source revenue. May not be generating sufficient cash from operations to fund new assets. May indicate spending on asset renewal is insufficient. May indicate insufficient spending on renewal of existing assets. More than zero Generating surpluses consistently. More than 1.5 No immediate issues with repaying shortterm liabilities as they fall due. 40% or less No concern over the ability to repay debt from own-source revenue. 20% or more Generating enough cash from operations to fund assets. More than 1.5 Low risk of insufficient spending on asset renewal. More than 1.0 Low risk of insufficient spending on asset base. 5 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ There are a new suite of indicators released as part of the Local Government (Planning and Reporting) Act and Regulations legislated in April 2014. Council remains committed to the VAGO Financial Sustainability indicators as there is currently no expectation that VAGO will discontinue reporting these indicators to Parliament. The VAGO indicators are also more conservative from a financial sustainability point of view. Council will explore the potential to incorporate the new financial and sustainability indicators as included in the Budget, into the Long Term Financial Plan in the future. 3.1 Underlying result (adjusted operating surplus) Underlying Results (excludes capital grants & non monetary contributions) 20.00% 15.00% 10.00% 5.00% 0.00% -5.00% -10.00% 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B Operating surplus/(deficit) – is total operating income less total operating expenses. It is an indicator of a Council’s ability to meet its operating expenses from operating revenue. The operating result has a direct impact on the equity or net worth of Council. A surplus result contributes to the net worth, whilst a deficit reduces the net worth of Council. The underlying result (%) is assessed following the removal of one-off (non-recurrent) items of income and expenditure. These one off items include non-recurrent capital grants, gifted assets, asset revaluations, write offs and impact of asset sales. Capital income is deducted on the grounds that it represents “unmatched’ income (expenditure is not included) and it is a non-recurring source of income. It should be noted that VAGO’s previously documented results (2009/10 -2011/12) did not exclude non-recurrent capital grants as this data was not available through the annual accounts (applies to all councils). Moving forward this data is to be included in annual accounts for all councils and will be used to calculate the indicator. Trend in underlying result The long term financial strategy reflects a significant change in Council’s risk relating to the underlying surplus moving from VAGO’s medium risk category (2011/12 & 2013/14) to low risk (2014/15-2023/24). The medium risk years were a result of funding a number of major projects (utilising cash reserves) for which significant non-recurrent capital grant funding was received. The trend moving forwards reflects less reliance on non-recurrent funding. 6 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 3.2 Liquidity Liquidity 2.50 2.00 1.50 1.00 0.50 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B Liquidity (current assets divided by current liabilities) is a measure of Council’s ability to pay existing liabilities in the following 12 months. A ratio of between 1 and 1.5 is seen as the preferred position with VAGO rating below 1.5 as medium and below 1 as high risk. Trend in liquidity The strategy in the long term financial plan is to maintain a level of between 1 and 1.5, as Council utilises its cash reserves when possible. The change from low risk to medium risk is as a result of having high cash reserves due to capital carry forwards in 2011/12 and 2012/13. 3.3 Indebtedness Indebtedness 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B 7 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ Indebtedness (%) is expressed as non-current liabilities (liabilities beyond the next 12 months) divided by own-sourced revenue. Own sourced revenue (as defined by VAGO) excludes such items as contributions and all grants. The higher the % the less able to cover non-current liabilities from the revenues Council generates itself. The target for the long term financial plan is to maintain an indebtedness % in the low risk range (below 40%). Trend in indebtedness Indebtedness peaks at 35% in 2015/16, a reduction from 40.6% in last year’s LTFP, and Council maintains a low risk level of indebtedness per VAGO’s risk assessment model with debt reducing further over the life of the LTFP. Total borrowings for the 10 year period are $60million with the outstanding debt at 2023/24 at $12.7million. The peak outstanding debt is $51.3million in 2015/16, and with no new borrowings from 2020. There is a strong argument that own-sourced revenue should include recurrent grants such as the Victorian Grants Commission funding and Department of Human Services funding (Aged Care and Children’s Services). If these were to be included in these calculations the indicator would reduce further. 3.4 Self Financing Self Financing 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B Self-financing (%) is expressed as net cash flow from operating activities divided by underlying revenue (excludes non recurrent grants and contributions). This ratio measures the ability to replace assets using cash generated by Council. The higher the % the more effectively this can be done. Council’s long term strategy is to maintain a level of self financing in the low risk range of VAGO’s assessment (above 20%). Trend in self financing Council’s 2012/13 actual is in the high risk area due to the payment of the defined benefits super unfunded liability. For the 2013/14 forecast, Council’s self financing ratio is in VAGO’s high risk area but it then stays consistently in the low range (above 20%) for the balance of the 10 years. The 2013/14 year reflects reduced Grants Commission income of $7.3m (recurrent grant) due to the first instalment being made in 2012/13 and consequently reducing cash flow from operating activities. 8 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 3.5 Capital Replacement Capital Replacement 2.50 2.00 1.50 1.00 0.50 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B Capital expenditure is expressed as a ratio of Capital expenditure against depreciation. It is a comparison of the rate of spending on infrastructure against the depreciation of capital. Ratios higher than 1:1 indicate that spending is faster than the depreciation rate. This is a long term indicator as capital expenditure may vary from year to year based on a number of factors and so should be viewed as an average over a period. Trend in Capital Replacement In all years in the assessment period Council maintains a ratio in VAGO’s low to medium risk area. The long term financial strategy for this indicator is to maintain a ratio average over 10 years in the low risk area (above 1:1.5). The average achieved for the next 10 years for Council has achieved this with an average of 1:1.8. 3.6 Renewal Gap Renewal gap 2.25 2.00 1.75 1.50 1.25 1.00 0.75 0.50 0.25 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B 9 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ The renewal gap is expressed as a ratio of capital renewal & upgrade expenditure against depreciation. It is a comparison of the rate of spending on existing assets through renewing, restoring and replacing existing assets with depreciation. Ratios higher than 1:1 indicate that spending on existing assets is greater than the depreciation rate. Similar to the capital replacement, this is a long-term indicator, as capital expenditure can vary from year to year. This indicator needs to be considered in relation to the assessment of the existing condition of infrastructure assets to determine whether future funding is capable of maintaining these assets at an appropriate level. Throughout the local government sector, indications are that assets are not being adequately maintained highlighting a significant existing renewal gap which is expanding (i.e the assets have not been maintained at an appropriate level and future funding is insufficient to ensure their useful life is maximised). To achieve a balanced assessment of renewal gap there is a need to invest year on year funding at a level between 1 and 1.5 per VAGO’s indicator but also to assess the existing gap and close that gap to ensure that our asset infrastructure achieves its maximum useful life. Yarra Ranges Council has commenced reviewing its current asset data, and is changing processes in order to capture new data, in order to inform Council’s asset management plans, which will in turn inform Council’s asset renewal needs. Modelling based on current data, shows that whilst the cumulative renewal gap peaks in 2016-17, the gap begins to reduce favourably with Council’s significant renewal funds investment after this time. Movement in renewal gap - 10 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 3.7 Average rate increase The following graph represents the average rate increases projected over the term of the long term financial plan. For the period of this long term financial plan it is proposed to hold averages rates increases steady at 4.8%, recognising the significant rate burden and economic conditions that exist for the community. While maintaining a low average rate increase Yarra Ranges has still been able to satisfy the objectives of maintaining and improving service levels in addition to investing heavily in Council’s infrastructure assets, reduce debt, and fund reserves for potential defined benefits superannuation shortfalls. Rates increase 7% 6% 5% 4% 3% 2% 1% 0% 11/12A 12/13A 13/14F 14/15B 15/16B 16/17B 17/18B 18/19B 19/20B 20/21B 21/22B 22/23B 23/24B 3.8 Overall financial sustainability risk assessment VAGO determines the overall financial sustainability risk assessment using the ratings determined by the 6 indicators presented 2.1 – 2.6. The following table classifies the overall result. High risk of short-term and immediate sustainability concerns indicated by either: • red underlying result indicator or • red liquidity indicator. Medium risk of longer-term sustainability concerns indicated by either: • red self-financing indicator or • red indebtedness indicator or • red capital replacement indicator or • red renewal gap indicator. Low risk of financial sustainability concerns—there are no high-risk indicators. Yarra Ranges overall financial sustainability risk assessment The overall financial sustainability risk assessment per VAGO’s ratings indicate that Yarra Ranges Council is at the low risk level. 11 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 4. RELATIONSHIP TO THE SUSTAINABILITY FRAMEWORK Supporting the achievement of the Vision 2020 Community Plan (“Vision 2020”) is the explicit focus of all Council activities. Vision 2020 is the shared vision of the Yarra Ranges community and is a statement about the kind of community, economy and environment our community wishes to have in the future. The Council Plan 2013-2017 was updated in May 2013. Five strategic objectives lead to the sustainability of our community and our organisation. The achievement of these objectives will be supported by a combination of organisational values which guide our behaviour and sustainability principles, which guide our decision-making in achieving these goals. It is through this framework, that we strive to deliver high quality services to our community. All organisational policies and strategies, including this Long Term Financial Plan, are developed within this framework and are guided by the values and sustainability principles. The updated strategic objectives are presented below: Quality community infrastructure has been identified by Council as one of its strategic objectives that contributes to Council being a sustainable community. This is underpinned by long term financial management which is a key action for the high performing organisation strategic objective that contributes to Council being a sustainable organisation. Council’s financial strategies are set out in broad terms in its Strategic Resource Plan, which will form part of the Council Plan 2014 to 2018. This Long Term Financial Plan sets out in further detail the financial strategies to be employed which support the achievement of the Council Plan. The Long Term Financial Plan is reviewed and updated each year to take into account changes in circumstances and to ensure it continues to address the dynamic environment in which Council operates. The Plan is then formally adopted by Council. 12 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 5. CURRENT FINANCIAL POSITION 5.1 Source of Funds The following table sets out the major sources of Council’s 2014/15 budgeted revenue and provides an indication of how much control we have over each source: $’000 % of Total 120,416 73.35% High 28,213 17.18% Low Fees and Charges 9,904 6.03% Low/medium Contributions 1,667 1.01% Low Interest 2,053 1.25% Low Other 1,945 1.18% Low Total 164,198 Source of Funds Rates and Garbage Grants Control As demonstrated in the table above, Yarra Ranges has a very high reliance on property rates and charges and this is the one source of funds that Council has a high degree of control over. Council is limited in its ability to control income from the majority of other sources. Loan borrowings is another source of funds available to Council, however debt must be repaid with interest which reduces the funds available for future years. In this sense borrowings allow Council to do more now but reduces the capacity for future expenditure until the debt is repaid. 5.2 Expenditure On the expenditure side, there are three major components of expenditure: 1. Recurrent service delivery and asset maintenance costs 2. Discretionary funds for new services or service enhancements 3. Capital Works and renewal Recurrent service costs relate to about 150 services provided by Council and the ongoing costs of maintaining assets such as roads, drainage and buildings. Increases in these costs are largely driven by labour costs, contract price increases and other inputs such as fuel. Labour costs in particular generally increase at a level greater than that of standard CPI increases, hence Council is required to ensure that sources of income are matched to at least increases in the costs of providing these services. 13 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ Recurrent costs can be contained or reduced by limiting the range or quantity of services provided or through achieving efficiencies in delivery methods. A small amount of discretionary funds is built into the financial model to allow for one off and recurrent service initiatives and cost pressures. This provides Council with some flexibility each year to deal with the myriad of new and expanding expectations in the community and emerging cost pressures. Capital Works and renewal expenditure is funded by a mix of Council funds, Government grants, community contributions to specific facilities and borrowings if required. Funding is required to maintain and renew existing infrastructure as well as provide for new facilities to meet emerging demands. Like most Councils in Victoria, Yarra Ranges and its predecessors have not put sufficient resources to renewing existing infrastructure. This has created a backlog known as the ‘renewal gap’. Demands for new infrastructure continue to grow and far outweigh Council’s funding ability. The allocation of capital funds requires careful consideration to ensure that maximum value is achieved. Loan borrowings can fund a short term boost in capital funding however, the repayments of interest increase the recurrent expenditure profile and decrease cash through principal repayments. 5.3 Debt position Council has worked hard to reduce its debt, and continues to keep its debt levels as low as possible. Council has a low level of indebtedness with the projected principal outstanding as at 30 June 2014 being $11.43 million. The borrowing of this amount was to pay for the Defined Benefits unfunded superannuation shortfall. Council would be debt free if not for the requirement to fund this liability. This position has provided significant flexibility for future borrowings and is the one of the funding sources to address Council’s ageing infrastructure in the earlier years of the plan. Council proposes some further borrowings in future years to assist in funding infrastructure upgrades and to address the asset renewal gap. The increase in debt in future financial years relates primarily to an extended capital works program which includes a further injection in the updated 10-year capital works program of $138 million to address the asset renewal gap. The 10-year capital works program will deliver new purpose-built community, cultural and sporting facilities and along the way will stimulate construction in the region and help support local jobs. Borrowings can be accommodated within the financial model without compromising the overall financial sustainability of the organisation. In terms of the VAGO Sustainability Model, this is projected to see our indebtedness peak near the high end of low risk profile before dropping back to a very low risk rating. 14 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 5.4 Capital Expenditure Council’s infrastructure challenges are significant and have been a key focus now for several years. Funding from increased rates and previous debt repayments have been redirected into the 10-year capital works program budget. This has enabled Council to significantly increase the funding it contributes to the capital program in recent years and into the future program. Council’s capital works program includes both capital expenditure (forming assets) and major maintenance and renewal of assets. Under the National Consistency Framework, Council is obliged to prepare and endorse an Asset Management Strategy and Asset Management Plans. This work is being undertaken in conjunction with the development of service plans for the organization. An update of the strategy and plans were endorsed by Council 2010 and are currently being reviewed.. The asset management process has a significant impact on shaping the composition of Council’s 10-year Capital Works Program, the Long term Financial Plan and the flow-on funding needs arising from this program. 5.5 Cash Position Council’s cash position in recent years has been very strong and this cash has been utilised and dedicated to retiring debt, funding additional capital works as part of dealing with the infrastructure renewal facing Council, new capital works and other initiatives. Council’s cash and short term investment balances are projected to be $15.3 million as at 30 June 2014. Some of these cash reserves are required to meet obligations such as developer contributions to specific works. Throughout the year the cash balance fluctuates significantly with a low point in January followed by large cash receipts in February from payments of rates in full. This cyclical nature of cash flows limits the amount of cash that can be made available to fund works and services. The cash position at the end of the 10 year plan is required to cash back the defined benefits superannuation unfunded liability. 15 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 6. KEY CHALLENGES This section provides an overview of the key challenges Council is facing with a likely financial impact. 6.1 Infrastructure Throughout the local government sector, there has been a significant focus on the level of spending on infrastructure, and particularly the level of funding available to renew existing infrastructure as distinct from creating new assets. Measuring the actual gap, that is, the difference between the allocated funds to replace existing assets at the end of their useful life and the actual funding that is required to achieve this, is inherently subjective. What is clear is the fact that protection and renewal of existing infrastructure is a key long-term issue for local government and that Council’s Capital Expenditure Program should be structured accordingly. The Capital Works budget has increased over the last few years and has helped to address immediate issues, however the existing standard and extent of assets within the municipality remains a significant issue. The tension between allocating funds to new asset development versus renewal and protection of existing assets remains. Many of Council’s buildings were built 40 to 50 years ago as single purpose buildings with little integration to other Council activities. This ageing infrastructure requires significant investment if it is to meet the rising expectations of the community, and become multi-use facilities that ensure value for money for the community. Ensuring that the networks of roads, footpaths, bridges and drainage are maintained and renewed into the future is also a key challenge for a municipality such as Yarra Ranges due to the geographic spread and topography of the area. A long term project is underway to systematically improve asset management practices and will help Council identify service requirements and establish plans to maintain infrastructure that meets our community’s service needs. This work is aligned to the National Consistency Framework for asset management which is designed to facilitate the implementation of quality asset management practices in local governments. With a focus on reducing the current projected growth in the asset renewal gap, the Capital Expenditure Program is reviewed annually to ensure the current base program capital of works is in-line with existing asset management plans and expected service delivery. This recommended base program can be delivered within funding available in the Long Term Financial Model and is in line with the proposed strategies outlined in this Long Term Financial Plan. Also, other strategies are outlined to support the reduction of the asset renewal gap. It is important to continue to close the gap to ensure assets are well maintained for current and future service needs and ensure the organisation’s long term financial sustainability. It should be noted that the renewal model data is based on a number of assumptions about the useful life of assets that are currently being reviewed and the accuracy of the current data requires 16 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ refinement and validation. There is no doubt that a gap does exist and further asset management modelling is required to build a picture of the renewal issue. Based on more informed asset data and condition data there could be some change to asset renewal values in the future. 6.2 Environment Yarra Ranges is one of Victoria’s largest, most varied and scenic municipalities. It balances a mixture of urban and rural communities. One of the most defining features of the Yarra Ranges is its natural environment. Boasting remarkable mountain ranges, rich valley floors, extensive waterway networks and vast tracts of high rainfall temperate forest, the municipality contains areas of high environmental importance and scenic value. The municipality is also home to a considerable diversity of plant and animal species and ecosystems. Some of the environmental issues faced within the Yarra Ranges municipality and surrounds include energy supply, declining river health, land degradation and erosion, loss of native vegetation and faunal habitat, spread of environmental and noxious weeds and feral pests. Council currently has a number of programs in place to tackle some of these environmental issues, both from a physical works and education perspective, however the expectation to consistently ‘do more’ is unwavering. In addition, the increased frequency and severity of extreme weather events, such as storms, floods, drought and fire, also pose a significant risk to operational budgets. All of the issues mentioned above have significant implications for Council’s Long Term Financial Plan. The cost of service provision for on-ground works (e.g. maintenance, response etc.) and community education continues to rise. In addition, the expectations of the community for Council to take a lead role in tackling local, regional, national and global issues is ever increasing. The legislative landscape around environmental issues (particularly climate change) is largely uncertain, which creates both challenges and opportunities for Council. Other agencies also place great expectations on local government to deliver national strategies and programs. 6.3 Risk management requirements On the back of natural disasters world wide there have been substantial increases in property insurance and public liability insurance. 2012-13 saw a 14% increase in insurance premium costs with a further 15% increase in the 2013-14 financial year. Other costs include a focus on managing and reducing risk and occupational health and safety matters, and costs passed on by contractors in their meeting of similar obligations. Increased financial pressure on risk management is likely to continue to increase into future years. However, these costs should be offset by improvement in the reduction of claims and subsequent management. 6.4 Service delivery and growing community expectations The community demands and expectations on Council services are increasing. There are high levels of socio economic disadvantage across various areas in the municipality, and access to and the provision of services in the outer areas of the municipality create additional costs for service delivery. The priorities of existing and potential new services needs to be continually reviewed, particularly in light of funding trends in future years and changes in community and demographics. 17 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 6.5 Government funding The largest source of government funding to Council is through the annual Victorian Grants Commission allocation. The projected annual grant for 2014-15 is $14.8 million and it is assumed that this grant will be escalated by 2.5% pa for future years. The level of State and Federal government funding toward recurring services has remained relatively flat resulting in a further reliance on rates revenue to meet service delivery expectations. There is no doubt that local government has, over a number of years, been impacted by decisions of Government to shift costs as seen by the 2010 increase in landfill levies announced by the State Government which continue to rise. Yarra Ranges continues to argue that the difficulties of providing services to a dispersed community on the urban/rural fringe are not fully reflected in the Grants Commission methodology. 6.6 Municipal emergency planning and preparedness Council's budget addresses the significant costs of emergency planning and preparedness, including bushfire preparation works. The increased frequency and severity of extreme weather events also continues to have a significant impact on Council's financial resources. Financial pressure in this area will continue as Council continues to respond to the recommendations of the Bushfires Royal Commission, Floods Enquiry and the State Government’s Emergency Management White Paper. State and Federal grant funding opportunities have also been utilised to offset new programs and further test and advance community safety initiatives across the municipality. 6.7 Accessibility It is our plan to make Yarra Ranges a place where residents can continue to engage in the community as they grow older, where their contribution to the day-to-day life of the community is valued, their experience and wisdom are respected, their advice sought and active participation in community life is ongoing. Across Yarra Ranges, the number of people aged over 65 years continues to grow, due to increasing life expectancy and the effect of the `baby boomer' generation moving into the older age groups. According to the ABS, the Yarra Ranges population aged 65 and over is projected to rise from 18,236 in 2010 to 19,368 in 2019 and to 31,325 in 2031. This is an increase overall of 58 per cent between 2011 and 2031. By 2031 one in every five Yarra Ranges resident will be over the age of 65. With a growing older population there are increasing pressures on a number of our services. There are currently funding challenges arising from both an increase in demand for services coupled with government policy changes around service delivery. Without commensurate additional investment from the State and Federal Governments, access to services for those who are most vulnerable will be compromised. 18 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 7. Addressing the challenges – our strategy Overview Council’s financial strategy aims to support the achievement of Council Plan objectives balanced with a sustainable financial framework. The overriding financial challenge facing Council is the allocation of resources between recurrent services, new capital works and renewal / rehabilitation of existing assets, in addition to debt reduction and reserve funds for unfunded defined benefits superannuation liabilities. This challenge is highlighted through factors such as growing customer expectations and a stronger focus on Council’s role in community and township development. The decisions on service delivery and capital funding help drive, and in turn are influenced by, the financial framework within which Council operates. The recommended strategy surrounding this framework is outlined below, expressed in terms of the major income and expenditure items forming the financial equation. Income items The major sources of funds available to Council are rates, government funding, fees and charges, borrowings and existing cash balances. Each of these is addressed in turn. 7.1 Rates Rates revenue is Council’s largest income stream and the one it most directly controls. Rate increases over recent years have been consistently above inflation primarily for the following reasons: to address existing infrastructure issues; to compensate for the cost shifting imposed by other levels of government; to cover wage increases which have generally exceeded the inflation rate; to cover significant externally imposed costs such as the superannuation liability from the defined benefits scheme, occupational heath & safety increases, waste costs; to fund new initiatives with a recurrent budget impact and other one-off costs. Rates must be struck at a fair and reasonable level sufficient to provide funding for required service levels and capital work activities. The Local Government Act requires that Council pursue a rating policy that is consistent with a reasonable level of stability in the level of the rates burden. In setting rates, Council makes a distinction within the property value component of rates based on the purpose for which the property is used, that is, whether the property is used for residential, commercial/industrial, or farming purposes. This distinction is based on the concept that commercial/industrial businesses should pay a fair and equitable contribution to rates taking into account the benefits those businesses derive from the Council services provided in that area. Farm land is rated at a lower amount to encourage the continuation of farming pursuits on rural land. 19 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ A separate rating component based on the principle of ‘user pays’ is determined specifically for the provision of waste management services. Within Yarra Ranges a number of properties are held by their owners in prime locations and are currently undeveloped and are being land banked for a future development opportunity or sale. Council has adopted land use strategies through master plans and the Yarra Ranges Planning Scheme to facilitate appropriate development, however this is dependant upon the owner and their willingness / ability to act. Strategy: 7.1.1 Over the longer term, Council will increase the average General Rate to address cost movements, including movements in both labour and non-labour costs as sufficient to cover required service levels, asset renewal, the Capital Works Program, debt reduction, and unfunded defined benefits superannuation liabilities. 7.1.2 Whilst average rates will increase, Council will be conscious of the need to continue to monitor expenditure, and will maintain an ongoing focus on operating efficiencies and cost savings. 7.1.3 The waste management service charge (a separate rate component) will be structured to reflect the cost of providing waste services to the community. 7.1.4 Differential rates will be applied to ensure appropriate allocation of rates considering the use of land and will include; general land, vacant sub standard land, farm land, commercial land and industrial land. 7.1.5 There will be no Municipal Charge. 7.1.6 Council will maintain a rate structure that addresses the various long term objectives and maintain a reasonable degree of stability in the level of the rates burden. 7.2 Government funding General funding through specific Government funding for services provided by Council has been generally declining in real terms. This necessitates a greater reliance on other revenue sources (notably rates) or an unavoidable reduction in level of service provided. Strategy: 7.2.1 Council will continue to strongly advocate for a more equitable distribution of Federal and State Government funding, particularly for funding currently only available to rural designated Councils. 20 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 7.3 Fees and charges Council’s fees and charges comprise 6.0% of total income in the 2014-15 budget ($9.9 million). While many of the fees and charges are set through legislation, Council does have discretion over the amounts charged for a large number of services. As such, it is important that fees are set at appropriate levels. Strategy: 7.3.1 Fees and charges will be reviewed annually for appropriateness as part of Council’s budget process. This review should involve consideration of the cost of the service, the price charged by comparable service-providers (where applicable), and the extent to which Council is prepared to provide the service at less than full-cost recovery to reflect community and social benefits. Where appropriate, these reviews will be done every 2-3 years rather than annually. 7.4 Loan borrowings The issue of borrowings is complex and the decision to borrow will depend on a number of important factors. Reducing debt had been a key financial strategy over the last decade. This has enabled former loan repayments to be injected into the capital works program on an ongoing basis. Reducing debt also increased Council’s flexibility to respond to unforeseen events and provided the capacity to fund large capital projects required in the future. Benefits and costs of borrowing The main advantage of borrowing to fund asset purchases is to enable the community to enjoy the benefit of an asset now, with the cost being repaid over a period of time. Borrowing in government has different consequences from borrowing in the private sector. In the private sector, the planned rate of return on assets purchased might exceed the cost of borrowing, and so the private entity may ultimately benefit financially as a result. In local government, some assets may bring a specific financial return to Council but the majority will provide non-financial benefits to the community (e.g. social, environmental). The cost of borrowing today is the future repayment of principal and interest, which reduces the total funds available for other purposes in future years. The extent of this cost, and any future financial pay-back to Council, needs to be clearly understood when considering any borrowing decision. 21 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ Borrowing may be appropriate to assist in funding very large capital work items, where the magnitude of a given project simply prohibits its funding from ongoing income sources. In assessing any such projects, consideration needs to be given to factors including: The impact of the borrowing on recurring expenditure in future years; Any additional income projected from the asset being financed; The community’s willingness to pay for the asset through either reduced recurring expenditure or increases in rates; The total level of outstanding borrowings and interest burden which Council is prepared to bear the impact of; The ongoing whole of life costs of the asset. Council’s current level of indebtedness is very small for an organisation of this size and there is capacity to undertake borrowings at financially sustainable levels of debt in coming years. Resident Schemes Bank borrowings have in the past been utilised successfully in funding Resident Special Charge Schemes where the property owners contribute to the loan repayments. In such cases there is no net cost to Council through taking out the borrowing. Strategy: 7.4.1 Borrowings will be considered as an option to fund the acquisition of assets where a detailed business case analysis factoring in actual and opportunity costs indicates that borrowing is the most economical funding method and that recurrent operating and maintenance costs can be met in the operating budget. 7.4.2 That the cost of capital works under Resident Schemes will be funded through borrowings (if required) to the extent that property owners are responsible for the cost of repayment. 7.4.3 That borrowing will not be utilised as an option to fund ongoing operational expenditure. 7.4.4 That borrowing be undertaken to support funding of capital items identified as part of the approved extended 10-year capital works program that could not otherwise be funded from ongoing income sources. 7.4.5 That overall borrowing limit will be set at a financially sustainable level. VAGO’s risk assessment measure for low risk indebtedness to self-sourced funding ratio of 40% will be applied as the maximum target measure. 22 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 7.5 Cash Council’s cash position is discussed in section 5.5. The cash flow pattern is subject to fluctuation during the year resulting from key revenue and expenditure payment dates. Strategy: 7.5.1 Cash flow will be managed bearing in mind the known fluctuations across the financial year and that cash surplus to immediate requirements will continue to be invested appropriately in order to generate interest returns to Council. 7.5.2 Surplus cash will be used to assist in funding the extended capital works program to the extent possible without compromising Council’s cash position. Expenditure items Council’s expenditure can be split into recurrent operating items, new initiatives / additional cost pressures, renewal/rehabilitation of existing assets and spending on new capital works. Each of these elements is addressed in turn. 7.6 Recurrent operating expenditure Providing ongoing services and activities efficiently and to a high quality standard is the key to achieving Council’s Vision. Strategy: 7.6.1 Funding available for recurrent operating expenditure will be increased annually in line with general cost movements. This will generally include a cost escalation component for non-labour costs (which will be actively minimised), and known or expected Enterprise Agreement increases for labour costs. 7.6.2 Services provided by Council will continue to be reviewed in light of community expectations and shifting demand for services. 7.6.3 Areas of ‘discretionary’ cost will be reviewed and separately targeted in terms of efficiency gains and cost reduction each year as part of the annual budget process. 7.6.4 Service delivery issues identified within this Plan will be specifically considered during business planning and budgeting processes in terms of their priority and required funding in order that both short and long term financial forecasts can accurately reflect the funding requirements and internal reallocations required above normal growth factors. 7.6.5 Collaborative service provision in the form of shared services will be further explored to seek further efficiencies in service expenditure. 23 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 7.7 New initiatives and cost pressures While ongoing activities will form the key part of Council’s services, it is important that Council is able to respond to needs for one-off funding, new initiatives and additional cost pressures (i.e. over and above cost escalation provided) Strategy: 7.7.1 A small allocation of additional funding will be available annually to specifically fund one-off projects, new recurrent initiatives and additional recurrent cost pressures. This will be allocated during the budget process based on assessed strategic priorities. The consequences in future years of accepting recurrent new initiatives and cost pressures should be clearly documented and factored into future budget scenarios. 7.8 Capital works expenditure A basic principle of a well balanced and sustainable capital works program should be the protection of the existing asset base as the first priority, with new works funded from remaining resources. A significant amount of work has been conducted to identify the required level of asset maintenance / protection spending on different asset classes based on various modelling scenarios. A major thrust of the financial strategy is to address the problems relating to ageing infrastructure through the extended capital works program which is targeted at purpose built community infrastructure in various strategic locations around the municipality. Currently a project is underway with the objective of upgrading the Corporate Asset System, to ensure more accurate asset data is maintained to support robust long term financial planning. On going education and increased awareness has been initiated as part of the National Consistency Framework to understand service level requirements and formulate asset strategies and asset management plans that address the service requirements. Strategy: 7.8.1 Sufficient resources will be dedicated to renewing the existing asset base in the long term as the first priority in the Capital Works Program. 7.8.2 Remaining funds available for capital works will be allocated to spending on new assets, if required. 7.8.3 Asset realisation, rationalisation and de-commissioning will be considered as a method of funding required new assets, particularly relating to community facilities. 24 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ 7.8.4 The impact of new assets on the ongoing operating budget will be clearly identified and considered when assessing proposals for funding new assets. 7.8.5 Application for external funding for both new and renewal projects will be undertaken for all capital projects where available. 7.8.6 Service level requirements will be established to achieve a closer alignment to asset requirements. 7.8.7 A targeted capital injection will be made to address the asset renewal gap. (Based on current modelling, an additional $138 million will be made available over and above the current set program for allocation to asset renewal over next 10 years). 25 Long Term Financial Plan 2014-15 to 2023-24 Appendix 1 – Financial Projections The following pages contain Council’s projected financial information following the completion of the draft 10-year Capital Works Program, 4year Strategic Resource Plan and 10-year Financial Model. Forecast Comprehensive Statement Income Statement This statement shows what is expected to happen in terms of revenue and expenses over the 10-year period. The bottom line result essentially represents the change in the net worth of Council’s assets during each financial year. Forecast Balance Sheet The Statement of Financial Position presents Council’s balance sheet across the 10-year period, showing the expected movement in assets and liabilities by major category. Forecast Cash Flow Statement The Cash Flow Statement shows the expected cash inflows and outflows across the 10-year period and is split into three main categories of cash flow: Operating activities the normal service delivery functions of Council; Investing activities the enhancement/creation of infrastructure and other assets; and Financing activities the financing of Council’s functions. 26 Long Term Financial Plan 2014-15 to 2023-24 Strategic Resource Plan Future estimates 30-Jun-15 30-Jun-16 30-Jun-17 30-Jun-18 30-Jun-19 30-Jun-20 30-Jun-21 30-Jun-22 $ $ $ $ $ $ $ $ REVENUES 4.80% Rates - general (119,816,392) Rates - special rates & charges (600,000) Grants-recurrent (25,910,487) Grants-Non recurrent (2,302,857) Contributions - cash (1,667,064) Statutory fees and fines (2,232,000) User fees (7,671,734) Reimbursements (333,626) Interest (2,123,000) ERL contribution (120,000) Other revenue (1,421,400) TOTAL REVENUES (164,198,560) EXPENSES Employee Costs Materials & services Bad and doubtful debts Depreciation & amortisation Finance costs Other expenses TOTAL EXPENSES (126,991,901) (134,716,671) (3,702,125) 0 (26,767,162) (27,656,487) (4,575,232) (1,913,009) (1,450,317) (1,462,187) (2,271,050) (2,611,076) (7,843,470) (8,031,934) (303,702) (309,469) (2,176,000) (2,230,325) (124,000) (127,000) (1,497,262) (1,523,765) (177,702,221) (180,581,923) 4.80% 4.80% 30-Jun-23 4.80% 30-Jun-24 4.80% 4.80% (142,852,548) (151,112,692) (159,804,404) (168,949,276) (178,569,958) (188,690,211) (199,334,958) 0 0 0 0 0 0 0 (28,577,154) (29,458,344) (30,367,400) (31,305,223) (32,272,744) (33,270,925) (34,300,758) (1,913,088) (1,725,000) (125,000) (125,000) (125,000) (125,000) (125,000) (1,741,099) (1,767,215) (1,793,724) (1,820,630) (1,847,939) (1,875,658) (1,903,793) (2,452,103) (2,525,666) (2,601,436) (2,679,479) (2,759,864) (2,842,659) (2,927,939) (8,229,737) (8,476,629) (8,730,928) (8,992,856) (9,262,641) (9,540,521) (9,826,736) (315,381) (324,842) (334,588) (344,625) (354,964) (365,613) (376,581) (2,286,008) (2,577,606) (2,677,682) (2,980,488) (3,238,103) (3,499,128) (3,763,623) (131,000) (134,275) (137,632) (141,073) (144,599) (148,214) (151,920) (1,550,920) (1,597,448) (1,645,371) (1,694,732) (1,745,574) (1,797,941) (1,851,880) (190,049,038) (199,699,718) (208,218,165) (219,033,382) (230,321,387) (242,155,871) (254,563,188) 62,827,673 58,567,745 17,500 22,256,000 2,649,089 6,429,419 152,747,426 64,832,894 60,550,395 17,650 22,620,000 2,797,166 6,531,782 157,349,887 67,344,300 62,764,275 17,802 23,226,000 3,095,830 6,639,506 163,087,713 69,987,036 64,276,206 17,959 23,466,000 3,088,443 6,783,816 167,619,460 73,590,270 66,652,945 17,960 23,854,975 2,615,509 6,987,330 173,718,989 77,715,434 68,943,783 17,961 23,714,857 2,349,402 7,196,950 179,938,387 82,292,037 71,390,317 17,962 23,617,907 1,995,463 7,412,859 186,726,545 87,421,364 73,622,305 17,963 23,967,408 1,619,708 7,635,245 194,283,994 93,139,808 75,830,974 17,964 24,402,249 1,220,790 7,864,302 202,476,087 99,486,027 78,105,903 17,965 24,779,610 797,281 8,100,231 211,287,016 300,000 310,000 320,000 330,000 0 0 0 0 0 0 Net (Surplus) /Deficit Other comprehensive income Net asset reval increment (11,151,134) (20,042,334) (17,174,210) (22,099,578) (25,980,729) (28,279,778) (32,306,837) (36,037,393) (39,679,784) (43,276,171) (26,499,475) (27,240,082) (27,839,838) (28,411,878) (29,230,959) (29,456,716) (30,062,592) (30,624,918) (31,169,619) (32,169,429) Comprehensive result (37,650,609) (47,282,417) (45,014,048) (50,511,456) (55,211,688) (57,736,494) (62,369,429) (66,662,311) (70,849,402) (75,445,601) Net (gain)/loss on disposal of Property,Plant & equip, Infrastructure 27 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ BUDGETED STANDARD STATEMENT OF FINANCIAL POSITION 10 Yr LTFP 14/15-23/24 BALANCE SHEET Forecast 2013-14 $'000 Budget 2014-15 $'000 Budget 2015-16 $'000 Budget 2016-17 $'000 Budget 2017-18 $'000 Budget 2018-19 $'000 Budget 2019-20 $'000 Budget 2020-21 $'000 Budget 2021-22 $'000 Budget 2022-23 $'000 Budget 2023-24 $'000 Current Assets Cash and cash equivalents Trade and other receivables Inventories Non Current assets classified as held for sale Other Assets 15,250 18,289 20 0 3,100 28,118 19,523 18 0 2,885 29,037 21,453 18 0 2,951 30,972 22,902 16 0 3,068 33,038 24,220 16 0 3,236 35,480 25,495 16 0 3,281 37,209 27,602 12 0 3,378 41,450 29,087 12 0 3,480 53,728 31,599 12 0 3,638 63,762 33,377 12 0 3,748 73,468 35,103 12 0 3,864 Total Current Assets 36,659 50,544 53,459 56,958 60,510 64,272 68,201 74,029 88,977 100,899 112,447 Non-Current Assets Trade and other receivables Investments in associates accounted for using the equity method Property, plant and equipment ,infrastructure Intangible assets 3,271 4,000 870,819 3,143 4,120 926,152 6,141 4,244 980,088 5,093 4,371 1,024,346 4,093 4,502 1,073,496 3,128 4,636 1,123,630 2,377 4,774 1,175,022 1,624 4,915 1,228,939 1,021 5,060 1,277,773 478 5,208 1,333,545 0 5,360 1,393,997 Total Non-Current Assets 878,090 933,415 990,473 1,033,810 1,082,091 1,131,394 1,182,173 1,235,478 1,283,854 1,339,231 1,399,357 Total Assets 914,749 983,959 1,043,932 1,090,768 1,142,601 1,195,666 1,250,374 1,309,507 1,372,831 1,440,130 1,511,804 Trade and other payables Trust funds and deposits Provisions Interest bearing loans and borrow ings 12,546 1,283 13,860 1,094 12,903 1,336 14,424 3,876 13,298 1,393 16,133 5,195 13,708 1,441 17,794 5,889 14,130 1,491 19,597 6,619 14,564 1535 21,513 5,746 15,015 1581 23,507 6,100 15,414 1629 25,652 6,476 15,908 1678 27,928 6,875 16,402 1728 30,350 7,298 16,912 1780 32,917 3,109 Total Current Liabilities 28,783 32,539 36,019 38,832 41,837 43,358 46,203 49,171 52,389 55,778 54,718 Provisions Interest bearing loans and borrow ings 3,526 10,335 3,774 37,891 4,701 46,175 4,785 45,101 4,903 43,301 5,054 39,482 5,280 33,382 5,552 26,906 5,872 20,031 6,231 12,733 6,629 9,624 Total Non-Current Liabilities 13,861 41,665 50,876 49,886 48,204 44,536 38,662 32,458 25,903 18,964 16,253 Total Liabilities 42,644 74,204 86,895 88,718 90,041 87,894 84,865 81,629 78,292 74,742 70,971 Net Assets 872,105 909,755 957,037 1,002,050 1,052,560 1,107,772 1,165,509 1,227,878 1,294,539 1,365,388 1,440,833 Equity Accumulated surplus Reserves 411,243 460,862 421,458 488,297 440,345 516,692 456,330 545,720 477,204 575,356 503,185 604,587 531,465 634,044 558,772 669,106 589,809 704,730 624,489 740,899 662,765 778,068 Total Equity 872,105 909,755 957,037 1,002,050 1,052,560 1,107,772 1,165,509 1,227,878 1,294,539 1,365,388 1,440,833 Current Liabilities Non-Current Liabilities 28 Long Term Financial Plan 2014-15 to 2023-24 BUDGETED STANDARD STATEMENT OF CASHFLOWS 10 Yr LTFP 14/15-23/24 Forecast 2013-14 $'000 Budget 2014-15 $'000 Budget 2015-16 $'000 Budget 2016-17 $'000 Budget 2017-18 $'000 Budget 2018-19 $'000 Budget 2019-20 $'000 Budget 2020-21 $'000 Budget 2021-22 $'000 Budget 2022-23 $'000 Budget 2023-24 $'000 Cash Flow s from operating activities Receipts Rates Statutory Fees & Fines User Fees and other Fines Grants Operating Grants Capital Contributions Reimbursements Interest Other Receipts Net GST refund/payment Paym ents Payments to suppliers Payments to employees (including redundancies) Other Payments Net cash provided by (used in) operating activities 113,547 1,924 7,206 18,140 4,246 1,817 82 1,957 2,273 10,251 119,459 2,232 7,848 26,022 2,405 1,700 356 2,053 1,765 10,895 125,919 2,271 8,022 26,882 4,779 1,479 324 2,126 1,534 10,816 134,472 2,611 8,215 27,775 1,998 1,491 330 2,180 1,518 10,182 142,695 2,452 8,415 28,700 1,998 1,775 337 2,186 1,560 10,782 150,930 2,526 8,667 29,585 1,802 1,802 347 2,627 1,591 11,051 158,629 2,601 8,914 30,498 131 1,829 357 2,678 1,638 11,438 168,308 2,679 9,195 31,440 131 1,856 368 2,980 1,686 11,864 176,790 2,760 9,466 32,411 131 1,884 379 3,188 1,732 11,558 187,586 2,843 9,753 33,414 131 1,912 390 3,499 1,784 12,461 198,225 2,928 10,042 34,448 131 1,941 402 3,763 1,835 13,094 161,443 174,735 184,152 190,772 200,900 210,928 218,713 230,507 240,299 253,773 266,809 (77,115) (60,844) (7,732) (69,042) (60,996) (8,124) (70,993) (62,905) (6,509) (72,457) (65,305) (7,629) (74,577) (67,827) (7,733) (77,214) (71,299) (7,903) (79,794) (75,282) (8,159) (82,717) (79,714) (8,263) (84,543) (84,687) (8,515) (87,649) (90,244) (8,741) (90,535) (96,417) (8,990) (145,691) (138,162) (140,407) (145,391) (150,137) (156,416) (163,235) (170,694) (177,745) (186,634) (195,942) 15,752 36,573 43,745 45,381 50,763 54,512 55,478 59,813 62,554 67,139 70,867 (33,450) 597 (32,853) (51,737) 347 (51,390) (49,903) 277 (49,626) (40,309) 344 (39,965) (45,027) 493 (44,534) (45,257) 500 (44,757) (46,149) 500 (45,649) (47,972) 500 (47,472) (42,676) 500 (42,176) (49,504) 500 (49,004) (53,561) 500 (53,061) (651) 0 (1,428) (2,079) (2,653) 34,000 (3,662) 27,685 (2,803) 14,000 (4,397) 6,800 (3,101) 5,000 (5,380) (3,481) (3,093) 5,000 (6,070) (4,163) (2,621) 2,000 (6,692) (7,313) (2,354) 0 (5,746) (8,100) (2,000) 0 (6,100) (8,100) (1,624) 0 (6,476) (8,100) (1,226) 0 (6,875) (8,101) (802) 0 (7,298) (8,100) (19,180) 34,430 12,868 15,250 919 28,118 1,935 29,037 2,066 30,972 2,442 33,038 1,729 35,480 4,241 37,209 12,278 41,450 10,034 53,728 9,706 63,762 15,250 28,118 29,037 30,972 33,038 35,480 37,209 41,450 53,728 63,762 73,468 Cash Flow s from investing activities Payments for property,plant and equipment,infrastructure Proceeds from sale of property,plant and equipment,infrastructure Net cash provided by (used in) investing activities Cash Flow s from financing activities Finance Costs Proceeds from interest bearing loans and borrow ings Repayment of interest bearing loans and borrow ings Net cash provided by (used in) financing activities Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of financial year Cash and cash equivalents at end of financial year 29 Long Term Financial Plan 2014-15 to 2023-24 _______________________________________________________________________ Standard Capital Works Statement Forecast 30-Jun-14 Budget 2014-15 Budget 2015-16 Budget 2016-17 Budget 2017-18 Budget 2018-19 Budget 2019-20 Budget 2020-21 Budget 2021-22 Budget 2022-23 Budget 2023-24 Capital expenditure by Spend Category Infrastructure Bridges Drainage Footpaths and cycleways Off street car parks Parks, open space and streetscapes Recreational, leisure and community facilities Roads Waste management Plant and equipment Computers and telecommunications Fixtures, fittings and furniture Plant, machinery and equipment Property Building Improvements Buildings Land Land Improvements Total 581 2,309 3,056 1,458 4,197 823 10,630 175 365 1,764 3,808 358 2,790 1,025 8,334 963 947 1,802 3,394 1,108 2,749 274 11,807 0 642 1,746 2,469 681 3,031 280 8,962 0 395 2,161 2,845 581 2,241 455 8,305 0 443 2,185 2,585 425 2,067 467 9,053 0 456 2,181 2,652 436 2,199 478 7,952 0 471 2,236 2,722 447 1,941 489 7,633 0 483 2,292 2,762 458 2,213 500 8,416 0 482 2,349 2,830 470 2,268 512 8,623 0 494 2,408 2,902 481 2,319 524 8,839 0 731 52 2,799 408 105 1,404 916 107 1,396 429 111 1,564 439 113 2,331 450 116 2,961 462 119 1,902 1,037 121 1,949 1,063 125 1,998 1,089 128 2,048 1,116 131 2,099 2,681 5,949 1,711 9,548 2,835 21,718 2,212 18,182 2,430 22,732 3,496 21,010 2,887 24,426 2,808 26,120 2,750 19,617 2,817 25,889 2,889 29,361 708 36,150 730 33,313 0 49,052 0 40,309 0 45,028 0 45,258 0 46,150 0 47,973 0 42,677 0 49,505 0 53,563 Types of capital works Capital renewal Capital upgrade Capital expansion Capital new Total capital 14,943 12,269 6,259 2,679 36,150 14,188 15,971 9,124 16,541 4,420 5,639 5,581 10,900 33,313 49,052 24,254 9,409 4,511 2,136 40,309 30,473 8,319 3,987 2,248 45,028 31,698 8,265 3,498 1,798 45,258 34,100 6,474 3,708 1,868 46,150 35,425 6,878 3,747 1,922 47,973 35,555 3,753 1,943 1,426 42,677 42,204 3,847 1,993 1,462 49,505 46,078 3,944 2,042 1,499 53,563 Total expenditure funded by -Council -Proceeds from sale of plant -External Total funding 31,756 598 3,796 36,150 30,333 347 2,633 33,313 38,257 344 1,708 40,309 42,584 493 1,951 45,028 42,528 1,105 1,625 45,258 46,125 0 25 46,150 47,948 0 25 47,973 42,652 0 25 42,677 49,480 0 25 49,505 53,538 0 25 53,563 Carry Forward from 2013/14 19,961 40,690 277 8,085 49,052 30