Chapter 5

Banking Services:

Savings Plans and

Payment Accounts

McGraw-Hill/Irwin

Copyright © 2007 by The McGraw-Hill Companies, Inc. All rights reserved.

A Strategy for Managing Cash

• Cash, check, credit card or an ATM are the

most common payment choices.

• Common mistakes in managing cash

include…

Overspending from impulse buying and using

credit cards.

Not having enough liquid assets (cash and

checking account) to pay current bills.

Using savings or borrowing to pay for current

expenses.

Failing to put unneeded funds in an interestearning savings account or investment plan.

5-2

Types of Financial Services

• Savings.

Time deposits in savings, CD’s.

• Payment services.

Checking accounts are

called demand deposits.

Automatic payments.

• Borrowing for the short- or long-term.

• Other financial services.

Insurance, investment, real estate purchases, tax

assistance, and financial planning are additional

services you may use.

5-3

Types of Financial Services

(continued)

• Asset management account.

Also called a cash management account.

Offered by brokers and financial institutions.

Provides a complete financial services

program for a single fee and includes...

•

•

•

•

•

•

A minimum balance.

A checking account and an ATM card.

A credit card

Online banking.

Access to a variety of investments.

www.schwab.com or

www.americanexpress.com.

5-4

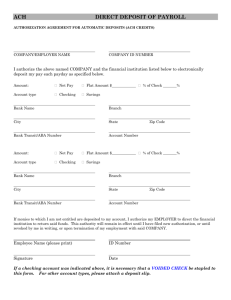

Electronic Banking Services

• Direct deposit of paychecks and other

regular income.

• Automatic payments transfer funds for

savings or to pay bills. Deduct them from

your register.

• ATM access to obtain cash, check account

balances, and transfer funds - check out

the fees.

• A debit card - takes money out of your

account. Lost card liability $50-$500.

5-5

Opportunity Costs

of Financial Services

• Higher rate of return may

be obtained at the cost

of lower liquidity.

• Convenience of a 24-hour ATM

should be considered against service fees.

• The “no fee” checking account with a $500

non-interest-bearing minimum balance

means lost interest of nearly $400 at 6

percent compounded over 10 years.

5-6

Changing Interest Rates and Decisions

Related to Financial Services

The prime rate is what banks charge large

corporations. See www.federalreserve.gov.

When interest rates are rising...

Use long-term loans to benefit from current low

rates.

Select short-term savings instruments to take

advantage of higher rates when they mature.

When interest rates are falling...

Use short-term loans to take advantage of

lower rates when you refinance the loans.

Select long-term savings instruments to

“lock in” earnings at current high rates.

5-7

Types of Financial Institutions

• Deposit type institutions

Commercial banks are corporations that offer a full

range of services including checking, savings,

lending and other services.

Savings and loan associations have checking

accounts, specialized savings plans, loans

including mortgages, and other financial planning

services.

Mutual savings banks specialize in savings

accounts and mortgage loans. They are owned by

their depositors.

Credit unions are user-owned, nonprofit and

provide comprehensive financial services.

5-8

Types of Financial Institutions

(continued)

• Non-deposit type institutions.

Life insurance companies offer insurance

plus savings and investment features.

Some offer financial planning and

investing services.

Investment companies offer a money

market fund on which you can write a

limited number of checks.

Finance companies make short and

medium term loans to consumers, but at

higher rates.

5-9

Types of Financial Institutions

(continued)

• Non-deposit type institutions

Mortgage companies provide loans to

customers so they can purchase homes.

Pawnshops make loans on possessions but

charge higher fees than other financial

institutions. Used for quick cash.

Check-cashing outlets charge 1-20% of the

face value of a check. 2-3% is average.

5-10

Comparing Financial Institutions

• Basic concerns of a financial services

customer.

Where can I get the best

return on my savings?

How can I minimize the

cost of checking and

payment services?

Will I be able to borrow

money when I need it?

5-11

Choosing a Financial Institution

• Consider

Services offered.

Interest rates.

Fees and charges.

Financial advice.

Safety (deposit insurance).

Convenience.

Locations.

Online services.

Special programs.

5-12

Types of Savings Plans

• Regular savings accounts.

• Certificates of deposit.

• Require you to leave your money on deposit

for a set time period, otherwise you incur

penalties.

Several types to chose from.

Consider all the earnings and all the costs.

• Interest earning checking accounts.

• Money market accounts and funds.

Money market accounts are covered by the FDIC,

but money market funds are not.

5-13

Types of Savings Plans

(continued)

• U.S. savings bonds.

Series EE sold at half of face value, with

potential tax advantages if used to pay tuition

and fees.

Series HH pays interest every six months.

I Bonds combine fixed rated and inflation rate.

See www.savingsbonds.gov for rates.

• Advantages

Exempt from state and local income taxes.

You don’t have to pay federal income tax on

interest until redemption.

5-14

Evaluating Savings Plans

• Rate of return or yield.

Percentage increase in value due to interest.

Frequent compounding means more interest

earning interest

• Inflation - compare your APY with inflation

rate.

• Taxes – after-tax rate of return

• Liquidity – early withdrawal penalties?

• Safety - FDIC and NCUA.

FDIC insures up to $100,000 per person per

financial institution (see www.fdic.gov).

5-15

After Tax Rate of Return

• (1 - tax rate) x yield on savings

• (1 - .28) x .06

• .72 x .06

• 4.32%

• A person earns 6% on savings, but

has a 28% marginal tax rate. The

after tax rate of return is 4.32%.

5-16

What is “Truth in Savings?”

• Requires Disclosure of...

Fees on deposit account.

The interest rate.

The annual percentage yield.

Other terms and conditions.

• Sets formulas for computing the APY.

• Requires disclosure of fees and APY on

customer statements.

• Establishes rules for advertising accounts.

• Restricts method of calculating the balance

on which interest is paid.

5-17

Payment Methods

• Checks

• Debit Cards

• Online Payments –most credit cards

now offer this service

• Stored-value cards

• Smart Cards

5-18

Checking Accounts

• A major portion of business transactions are

conducted by check, making a checking

account a necessity for most people.

• Types of checking accounts include...

Regular – many have minimum balances.

Activity account-fees on checks & deposits.

5-19

Checking Accounts

(continued)

• Types of checking accounts

include…(continued)

Interest-earning or NOW accounts which

usually require a minimum balance.

Share draft accounts are interest earning

checking accounts at credit unions.

• Evaluating checking accounts.

Restrictions, such as a minimum balance.

Fees, and charges.

Interest rate and computation method.

Special services, such as overdraft protection.

5-20

Other Payment Methods

• Certified check.

Personal check with guaranteed payment.

• Cashier’s check.

Check of a financial institution you get by paying

the face amount plus a fee.

• Money order.

Purchase at financial institution, post office, store.

• Traveler’s check.

Sign each check twice.

Electronic traveler’s checks - prepaid travel card.

5-21

Reconciliation

• Change the bank statement balance to

reflect deposits in transit and

outstanding checks.

• Change the check register balance to

reflect interest, bank fees, direct

deposits, automatic payments, etc.

5-22

Types of Endorsements

• Blank – Just sign your name; the check

is now bearer paper

• Restrictive – For deposit only

• Special – Endorse the check to

someone else

5-23

Online Activity

• Go to www.bankrate.com and explore

money market account rates.

• Also look at rates for one year and five

year CD’s. If you had money to invest

right now, which maturity of CD’s would

you choose?

5-24