Savings and Payment Services

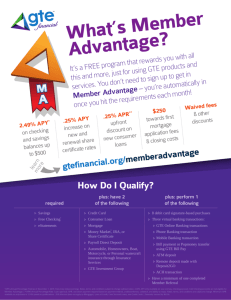

advertisement

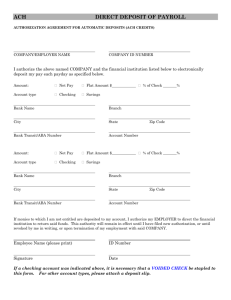

Dr. Steve Hays Personal Finance Bishop Kearney High School Spring 2015 Objectives 1. 2. 3. 4. Identify commonly used financial services Compare the different types of financial institutions Assess various types of savings plans Evaluate different types of payment methods What Financial Services Do You Need? Banks, savings and loans associations, credit unions, and other financial institutions provide, payment, savings and credit services. Meeting Daily Money Needs Common mistakes made when managing current cash needs include Overspending Insufficient liquid asset Using savings to pay for current expenses Failing to put extra funds in an interest bearing or investment account There are times when you need more cash than you have available You have two basic choices Liquidate savings Borrow Using savings and increased use of borrowed funds may reduce net worth and your potential to achieve long-term stability Savings. Payment services. Time deposits in savings and in certificates of deposit. Checking accounts monies are commonly called demand deposits. Automatic payments. Borrowing for the short- or long-term. Other financial services. Insurance, investment, real estate purchases, tax assistance, and financial planning are additional services you may use. Asset management account. (continued) Also called a cash management account. Offered by brokers and financial institutions. Provides a complete financial services program for a single fee and includes... A minimum balance. A checking account and an ATM card. A credit card Online banking. A line of credit for quick cash loans. Access to a variety of investments. www.schwab.com or www.americanexpress.com. For successful financial planning be aware of the following: The prime rate is what banks charge large corporations. See www.federalreserve.gov. When interest rates are rising... Use long-term loans to take advantage of current low rates. Select short-term savings instruments to take advantage of higher rates when they mature. When interest rates are falling... Use short-term loans to take advantage of lower rates when you refinance the loans. Select long-term savings instruments to “lock in” earnings at current high rates. Most banks are offering online services, however the Web-only banks have started to expand over the years e.g. E*Trade Bank. These electronic branches and banks provide the following services: Direct deposit of paychecks and other regular income. Automatic payments transfer funds such as for utilities. Remember to deduct them from your register. ATM access to obtain cash, check account balances, and transfer funds - check out the fees. A debit card - takes money out of your account. Lost card liability $50-$500. Selecting a Financial Institution Higher rate of return may be obtained at the cost of lower liquidity. Convenience of a 24-hour ATM should be considered against service fees. The “no fee” checking account that requires a $500 non-interest-bearing minimum balance means lost interest of nearly $400 at 6 percent compounded over 10 years. Deposit type institutions Commercial banks are corporations that offer a full range of services including checking, savings, lending and other services. Savings and loan associations have checking accounts, specialized savings plans, loans and financial planning and investment services. Mutual savings banks specialize in savings accounts and mortgage loans. They are owned by their depositors, with profits going back to depositors by paying a higher rate on savings. Credit unions are user-owned, nonprofit and provide comprehensive financial services. (continued) Non-deposit type institutions. Life insurance companies offer insurance plus savings and investment features, with some offering financial planning and investing services. Investment companies offer a money market fund on which you can write a limited number of checks. Finance companies make short and medium term loans to consumers, but at higher rates. (continued) Non-deposit type institutions (continued). Mortgage companies provide loans to customers so they can purchase homes. Problematic Financial Businesses Pawnshops make loans on possessions but charge higher fees than other financial institutions. Used for quick cash. Check-cashing outlets charge 1-20% of the face value of a check. 2-3% is average. Title and payday loan companies - high interest. Rent-to –Own Centers leasing merchandise at high interest rates to low-income customers Consider Services offered. Interest rates. Fees and charges. Financial advice. Safety (deposit insurance). Convenience. Locations. Online services. Special programs. Types of Savings Plans Regular savings accounts. Certificates of deposit. Require you to leave your money on deposit for a set time period, otherwise you incur penalties. Several types to chose from. Consider all the earnings and all the costs. Interest earning checking accounts. Money market accounts and funds. Money market accounts are covered by the FDIC, but money market funds are not. (continued) U.S. savings bonds. Series EE sold at half of face value, with potential tax advantages if used to pay tuition and fees. Series HH pays interest every six months. See www.savingsbonds.gov for rates. Advantages Exempt from state and local income taxes. You don’t have to pay federal income tax on earnings until you redeem the bonds. Rate of return or yield. Percentage increase in value due to interest. Compounding. Interest on previous interest earned. Inflation - compare the rate of return on your savings with the inflation rate. Tax considerations for interest earned Liquidity. Safety via FDIC and NCUA. FDIC insures up to $250,000 per person per financial institution (see www.fdic.gov). Restrictions and fees (1 - tax rate) x yield on savings (1 - .28) x .06 .72 x .06 4.32% This means that a person who is earning 6% on their savings, but has a 28% marginal tax rate, is actually earning 4.32% rate of return after they pay income taxes on the interest. Requires Disclosure of... Fees on deposit account. The interest rate. The annual percentage yield. Other terms and conditions. Sets formulas for computing the APY. Requires disclosure of fees and APY on customer statements. Establishes rules for advertising accounts. Restricts the method of calculating the balance on which interest is paid. Comparing Payment Methods While check writing is the most common form of consumer transactions, there is a considerable amount of electronic payment used for retail transaction Electronic Payments • • • • Debit Card Transactions Online Payments Stored-value Cards Smart Cards Checking Accounts Types of checking accounts include... Regular Checking Accounts Usually have a monthly service charge. Activity account. Charge a fee for each check written, and sometimes for deposits. Types of checking accounts include…(continued) Interest-earning or NOW accounts which usually require a minimum balance. Share draft accounts are interest earning checking accounts kept in a credit union. Evaluating checking accounts. Restrictions, such as a minimum balance. Fees, which are increasing, and charges. Interest rate and computation method. Special services, such as overdraft protection. Certified check. Cashier’s check. Check of a financial institution you get by paying the face amount plus a fee. Money order. Personal check with guaranteed payment. Purchase at financial institution, post office, store. Traveler’s check. Sign each check twice. Electronic traveler’s checks - prepaid travel card with ability to get local currency at an ATM. Obtaining and using a checking account involves several activities 1. 2. 3. Opening a Checking Account: • Individual vs. joint account • 3 types of endorsements Making Deposits – Blank endorsement – Restrictive endorsement – Special endorsement Writing Checks • Steps for proper check writing – Record the date – Write the name of the person/organization receiving the check – Record the amount of the check in figures – Write the amount of check in words – Note the reason for the payment (continued) 4. Reconciling your checking account • Steps involved in reconciling bank statements – – – – Compare the written checks with those reported paid. Subtract the total of all checks written but not yet reported as cleared Determine deposits not on the statement. Add the amount to the statement balance Subtract fees or charges and ATM withdrawals from the checkbook balance Add any interest to your checkbook balance