Luxemburg Stock Exchange

advertisement

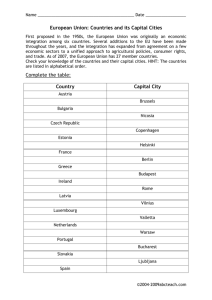

13th XBRL International Conference May 16-19, 2006, Madrid Luxembourg Stock Exchange Building an efficient gateway for international securities 13th XBRL International Conference, May 16-19, 2006, Madrid Agenda The Luxembourg Stock Exchange: Gateway to the financial world The New European Financial Reporting Framework Building a new reporting framework : “e-file” Leveraging from standard-based reporting within a Luxembourg perspective 2 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid The Luxembourg Stock Exchange : Gateway to the financial world • Founded in 1928 as a for-profit organization and still an independent exchange • Market for Luxembourg shares • A partnership agreement with Euronext (cross membership) • World leader in listing of international bonds and UCITS • A network of domestic and international banks, law firms, issuers, etc 3 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid First Eurobond listed on the Luxembourg Stock Exchange on 17 July 1963 4 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid The Luxembourg Stock Exchange : Gateway to the financial world Listings on the Luxembourg Stock Exchange Dec’ 2005 Dec’ 2004 Dec’ 2003 Dec’ 2002 26,782 24,292 21,285 18,883 14,768 7,661 4,353 12,458 7,726 4,108 9,781 7,282 4,222 7,613 6,804 4,466 279 261 268 268 Foreign 44 235 47 214 50 218 55 213 UCIs 6,172 6,055 5,754 5,798 Luxembourg Foreign 5,981 191 5,876 179 5,568 186 5,601 197 Warrants Total 2,821 36,054 Bonds EUR USD Other Shares Domestic 5 2,414 33,022 1,795 29,102 1,537 26,486 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid The Luxembourg Stock Exchange : Gateway to the financial world 4,200 issuers (100 countries, 13 supranationals) LUXEMBOURG . 6 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid The Luxembourg Stock Exchange : Gateway to the financial world Given the number of issuers and the wide variety of listed securities, requirements in terms of information to be conveyed between all stakeholders are colossal. 7 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid CCLux (Centrale de Communications Luxembourg) was launched in 1995 by the Luxembourg Stock Exchange and the Association of Investment Funds Create a single communication channel between the industry and the supervisory authority and rationalize the communication flows Provide the fund industry with the most up-to date, comprehensive and reliable data on Luxembourg-domiciled funds Promote the Luxembourg fund industry through enhanced visibility and transparency. In May 2002 CCLux became a 100 percent subsidiary of the Luxembourg Stock Exchange 8 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid CCLux Collects net asset values, financial data, legal reports ... Manages production of structured data products Provides electronically data to financial data vendors, financial press, rating agencies, supervisory bodies ... Information available on CCLux web site www.cclux.lu 9 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid CCLux today: Before 1998 • Unique communication channel for the legal reporting (from fund administration to local authorities) • Database with all the Luxembourg-domiciled funds • 99% of the Luxembourg funds use CCLux for the dissemination of their NAVs • Communication network for the key players of the fund industry • Full subsidiary of the Luxembourg Stock Exchange – strategic vehicle 10 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid CCLux 14,500 NAVs collected every day, ie 95% of the NAVs of Luxembourg investment funds, more than 20,000 prospectuses and financial statements are on line, consultation portal is accessible worldwide with 1,500 registered users, partners : 81 fund administrations; 18 data flow subscribers (data vendors and media), data is disseminated worldwide through data terminals and data vendors’ networks. 11 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid New European Financial Reporting Framework • Financial Services Action Plan (FSAP) includes a list of directives redesigning the landscape of the European Financial industry and Capital Markets; • European Directives i.e. prospectus, transparency for listed company, MiFID,,…ensure the development of a single securities market for new issues and trading of securities; • The efficiency of the financial reporting value chain, the access and the transparency of the information are increasingly becoming key factors in the management of financial institutions. 12 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid New European Financial Reporting Framework Financial Services Action Plan / securities-related EU directives • • • • • • • 13 Prospectus Market abuse Transparency MiFID IFRS Takeover Some aspects concern also the UCITS Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid Building a new reporting framework : e-file e-file was developed to facilitate the connectivity of financial institutions in the transmission of financial documents and data Lawyers Local FSA CCLux Fund administration Transfert agents Listing agents 14 Luxembourg Stock Exchange Numbering Agency Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid Building a new reporting framework : e-file Principles Filing entity CSSF File File Approval of a new instrument Prospectus draft 1 Approval of a new instrument Prospectus reading Comments are sent Prospectus draft 2 Final prospectus 15 Update of file progress Close + publication of prospectus Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid Building a new reporting framework : e-file More e-file Critical to collection data electronically on a timely and secure way to ensure the success of listing procedures Collect non-structured and structured data linked to the business processes Transparency & efficiency of the listing process Access to information : Consultation portal gives access to a complete database of listed securities 16 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid Securities and corporate event filing Structured reporting with validation on external databases Standardised reports XBRL reports, … Annual reports, … Filing of document based reports Listing & approval for new securities, … Filing of documents Building a new reporting framework : e-file Business process overview Electronic form management & validation Referential layer Issuers … Basic e-file functionalities : Electronic Filing • Alerts • Messaging • Types of filing procedures • Encryption, Authentification • Workflows • Automation (STP) 17 Structured communication Securities Non structured communication Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid Leveraging from standard based reporting : XBRL Added values of XBRL for Capital Markets : Facilitate the collection and dissemination of structured data from listed companies Harmonize and improve the exchange of financial information and structured data of the listed companies between stock exchanges (companies with multiple listing market place) Enhance the access and comparison of the financial information of listed company via web consultation portal Fit particularly well in the framework of the new directive about the harmonisation of the transparency obligations of listed companies: • increase frequency of reporting • harmonise financial content • set up electronic centralised data consultation platform 18 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid Leveraging from standard-based reporting : XBRL Stock Exchange Promoters / Fund administration Periodic reporting CSSF Statec Facilitate the compliance exercise Financial Reporting IFRS (per sector / industry) Insurance cies All Luxembourg registered companies Centrale des bilans Allow different tools : from structured forms to system to system Collection Banks Diffusion Exchange (data & doc.) Consultation Comparison and analysis Tools Analysts Distributors Data vendors 19 Improve analysis decisionmaking process Investors Audit Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid …within a local perspective at Luxembourg • Building of a Luxembourg jurisdiction is on-going at Luxembourg • XBRL will support the future regulatory banking reporting (COREP / FINREP) by 2008; • Opportunity for financial institutions to leverage around the new reporting • reduced regulatory burden • enhance data quality 20 Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange 13th XBRL International Conference, May 16-19, 2006, Madrid For further information... www.bourse.lu 11, avenue de la Porte-Neuve B.P. 165 L-2011 Luxembourg Tel. : (+352) 47 79 36-1 Fax : (+352) 47 32 98 info@bourse.lu 21 www.cclux.lu 11, avenue de la Porte-Neuve B.P. 165 L-2015 Luxembourg Tel. : (+352) 47 79 36-581 Fax : (+352) 47 79 36-204 info@cclux.lu Reproduction is forbidden unless duly authorized by the Luxembourg Stock Exchange