3. What determines the levels of household

advertisement

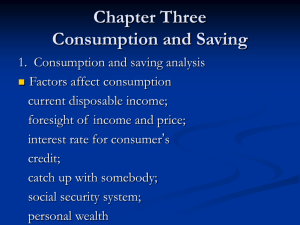

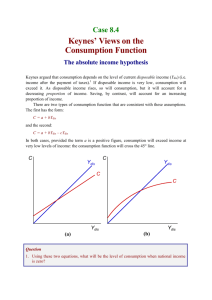

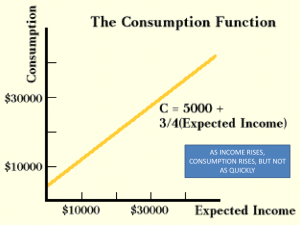

What determines the levels of household consumption and investment? 1. Factors influencing consumption Expectations: If a consumer thinks their income will rise in the near future they will ____________________ consumption now. If they expect prices to rise they will buy goods now. Interest rates and availability of credit: If interest rates are reduced, consumption will_____________ as the cost of borrowing is ________________. Wealth: If consumers’ wealth increases, spending may be high even if income is low. For example, if you were to receive property through the death of a relativeyour wealth has increased (but your income has not) and you may spend more as a result of this wealth ‘feel-good’ factor. Distribution of income: If income is redistributed and taken from high-income groups and given to low income groups, consumption is likely to rise. This is because the low-income groups tend to spend more out of each dollar. (see below) Real disposable income: The true purchasing power of the money in your pocket/wallet/bank after taxes. This is the single most important factor in determining the level of household consumption. The proportion of total income spent is known as the average propensity to consume (apc). APC = total consumption/total disposable income Activity 1 Do the following calculations with apc, disposable income and consumption. 1. What is the apc of a person who spends $350 out of a disposable income of $500. 2. If a man has a disposable income of $600 and an apc of 0.75, how much does he spend? 3. If a woman who spends $400 has an apc of 0.8, what is her disposable income? Note, although the total amount spent usually rises as disposable income rises, the proportion spent- the apc- usually falls. A poor family may have an apc of 1 or even greater (how is this possible?______) because they will have to spend all their income just to buy necessities. As the family becomes richer their apc may fall as they might have to spend only 80% of their total income to buy the same (or a greater) quantity of goods and services. So as income rises people tend to spend a smaller proportion of their income. The proportion of extra income spent is known as the marginal propensity to consume (mpc). mpc = change in consumption/change in disposable income Activity 2 Do the following calculations with mpc 1. If a person’s income rises by $400 and her spending rises by $140, what is her mpc? 2. If a man with an mpc of 0.5 experiences a rise in income of $60 how much extra will he spend? 3. If a woman has an mpc of 0.9 and her income rises by $700 how much will her spending increase by? Activity 3 Disposable income $ 100 200 300 400 500 600 Consumption $ 120 200 270 320 350 360 apc mpc Savings and income Savings is the part of disposable income which people do not spend. It is calculated from disposable income less consumption. As with consumption, the main influence on savings is the level of income. As incomes rise you would expect the average household to _____________ savings. The proportion of income that is saved is called the average propensity to save (aps) APS = total savings/total disposable income APC + APS = ???? The marginal propensity to save is the change in saving resulting from a change in income. mps = change in saving/change in disposable income MPC+MPS = 1 Activity 4 Do the following calculations on saving. 1. A woman saves $60 out of her income of $200. What are her aps and apc? 2. A man’s income rises by $80 and as a result his savings increase by $20. What is his mpc and mps? 3. If a woman has an mpc of 0.9 and her income rises by $300 how much will her savings increase by? Activity 5 Disposable income $ 100 200 300 400 500 600 700 800 Consumption $ 100 190 270 340 400 450 490 520 saving aps apc mps mpc 2. Factors influencing the level of Investment Expenditure The level of investment depends on: availability of finance interest rates the expected rates of return from the investment- what you hope to get back in financial terms from your investment EXPECTATIONS- what will demand be like in the future? Future prices? Economic outlook? Interest Interest is the return on capital AND the cost of borrowing money. The interest paid for borrowing money will depend on: How long the loan is for- generally if you borrow for a longer time you are charged more Risk- the riskier the project the more the lender will usually charge The size of the loan- smaller loans tend to attract higher rates on interest Higher interest rates make the cost of borrowing more expensive for households and firms, e.g. loans, credit cards, overdrafts, mortgages. They also make savings more attractive. Levels of interest rates and investment can be graphically represented on an investment schedule like the one below. Interest rate (r) % With an increase in interest rates, investment is likely to fall. This is because it is more expensive to borrow and there are now fewer projects, which have a higher rate of return than the cost of borrowing. With a lower interest rate, more projects become profitable (as the cost of borrowing has fallen) and investment increases. Investment (I)