"MEKOM" AD

advertisement

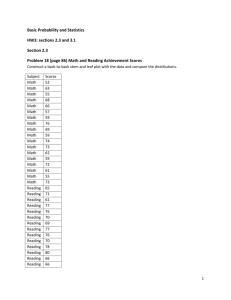

"MEKOM" AD: Investment Presentation January 2008 Table of contents I. Executive Summary 3 II. "Mekom" AD’s Products and Markets 5 III. "Mekom" AD’s History and Performance 20 IV. Development Plan and Financial Projections 28 V. Investment Case 33 VI. Public Offering Details 37 VII. Contacts 39 I. Executive Summary Executive Summary "Mekom" AD is the biggest and most modern meat producer in Bulgaria On the domestic market, "Mekom" AD is a market leader in the upper meat product segments – boiled-smoked and raw-dried sausages The company is fully integrated – from breeding of its own products to slaughtering and meat processing "Mekom" AD is known for its innovative products, such as products from ostrich, buffalo, or rabbit meat The company recently consolidated ownership in 12 daughter companies in order to simplify organizational structure and eliminate inter-company dealing "Mekom" AD has the ambition and the potential to become a regional leader – the proceeds from the IPO will support its regional expansion plans and continued development of the Bulgarian market "Mekom" AD aims to raise a minimum of BGN 22 million through its IPO in order to support its investment program The expected free-float of the company after the IPO is 16.67% "Mekom" AD is the only Bulgarian company with all feasible certificates for exports to the EU. "Mekom" AD is the biggest Bulgarian meat exporter and sells its products in 11 European countries 4 II. "Mekom" AD’s Products and Markets "Mekom" AD is a leading meat producing and meat processing company in Bulgaria and one of the biggest and most modern on the Balkans "Mekom" AD was established in 1906 in the town of Silistra, north-east Bulgaria "Mekom" AD is the largest integrated meat processing company in Bulgaria The company is the only Bulgarian meat producer certified in category "A" for export to EU countries and has some of the largest and most modern production facilities on the Balkans The company has a closed production cycle – from supply of live animals, to own breeding farms, slaughter houses, and processed meat production lines The company has experienced management and specialists and employs more than 500 people "Mekom" AD’s main plant in Silistra 6 "Mekom" AD is the only Bulgarian company with certificate type "A" for export to the EU "Mekom" AD is the first meat company in Bulgaria to introduce the HACCP system for quality control The company has introduced a system for full traceability of products – any product on the shelves can be traced back to the original live animal source "Mekom" AD is the only Bulgarian producer with type "A" export license – for all kinds of meat (except pigs), durable boiled-smoked sausages, raw-dried sausages, and delicatessen in 2002 The only exception is pigs due to EU ban on pig export from the region "Mekom" AD’s main licenses Approval No: BG1901021 BG 1901021 Company City Mecom Ltd. Silistra Mecom Ltd Silistra Activities Type of animals Comments CP, CS, SH B, C, O, P, R, E, rba Durable boiled-smoked sausage Raw-dried sausage 1, 3, T delicatessen Source: "Mekom" AD, EU Legend: CP: Cutting plant; CS: Cold store; SH: Slaughterhouse; B: Bovine meat; C: Caprine meat; O: Ovine meat; P: Pig meat; R: Ratites; E: Equidae; Rba: Rabbit 7 "Mekom" AD has a well-diversified product portfolio "Mekom" AD has a diversified product portfolio in three basic lines of products – processed meat products, meat carcasses, and live animals "Mekom" AD produces an entire range of processed meat products: Short-lived products – sausages, frankfurters, minced meats, etc. ("Kamchia", "Hamburgski") Durable boiled-smoked sausages – various kinds of salami ("Durostorum", "Bourgas", "Bai Ganyo") Raw-dried sausages – different kinds of loukanka and sudzuk ("Karlovska", "Srebarna", "Trapezitsa") Hams, delicatessen, others Chilled/Frozen meat and meat carcasses Lamb, pork, buffalo, beef, cow, rabbit, ostrich Live animals The company breeds and sells its patented breed of pigs called "Silistra Hybrid" "Mekom" AD is also exclusive distributor for Bulgaria for the products of Italian company "Montana" for proscuitto and other specialized raw-dried products, which the company does not produce itself 8 "Mekom" AD is the biggest Bulgarian exporter of meat and meat products "Mekom" AD is Bulgaria’s largest exporter of meat and meat products. The company has the following export market shares for Bulgaria: More than 55% of the total sheep and goat export More than 85% of the total beef and buffalo export More than 90% of the total rabbit meat export More than 60% of sub-products and delicatessen 100% of ostrich meat "Mekom" AD’s European markets Sweden Finland Norway Estonia Latvia Lithuania Denmark R.S.F.S.R. Ireland Netherlands Belarus U.K. Germany Poland Belgium The company exports its products to 11 European countries Slovakia Moldova Austria Romania Croatia Monaco Spain Hungary Slovenia Switzerland Corsica As of mid 2007, "Mekom" AD is the only Bulgarian meat company licensed to export cold-cuts, ostrich, rabbit and beef meat to EU countries Czech France Portugal Ukraine Luxembourg Bosnia Serbia Bulgaria Italy Macedonia Montenegro Turkey Sardinia Albania Malta Greece Cyprus "Mekom" AD’s processed meat products are sold in supermarkets in Germany, Spain, Switzerland, Romania, and the U.K. 9 In Bulgaria, "Mekom" AD is positioned in the upper segments for processed meat products "Mekom" AD has a market share of more than 14% in the most expensive segment of durable raw-dried products (lukanka, sudzhuk) The company has a market share of more than 10% in the segment of boiled-smoked sausages "Mekom" AD has an approximate market share of 4% in the segment of short-lived sausages products "Mekom" AD is a leading supplier of chilled and frozen meat and carcass meat for the Bulgarian market The company is an absolute leader in the segment for chilled/frozen lamb meat "Mekom" AD is also the key producer for Billa’s range of "Clever" meat products Relative price index of processed meat products in Bulgaria BGN/kg Short-lived products Durable boiled-smoked sausages Raw-dried sausages 15 8 4 Source: "Mekom" AD; Bulgarian Association of Meat producers 10 "Mekom" AD has invested in world-class production capacity "Mekom" AD has world-class slaughter lines with below capacities: Lamb – 500 lambs/hour Pigs – 150 pigs/hour Calves – 40 calves/hour Buffaloes – 40 buffalos/hour Rabbits – 600-1,000 rabbits/hour Ostrich – 35-45 ostriches/hour "Mekom" AD has a full equipment line for the production of all types of sausages with daily capacity of 150 tons The company has freezers with total capacity of 3,200 tons "Mekom" AD also has its own electricity supply units, as well as a new waste disposal and management unit "Mekom" AD’s slaughter-lines and processed meat facilities 11 "Mekom" AD has developed a patented breed of pigs called "Silistra Hybrid" "Mekom" AD has developed a patented unique breed of pigs, called "Silistra Hybrid" The synthetic line is created under the method of the complex, reproducing, politype cross-breeding. This type of breeding combines the positive qualities of four breeds, with the maximum participation of Pietrain breed The breed has the following characteristics: High fertility – 12-15 pigs per delivery Relatively large size at birth – 1.4-1.5 kg/pig at birth Low level of fat – 8% Large amount of red meat – 75-80% of body mass Quick growth – age of reaching 100 kg is 5.5 months The breed "Silistra Hybrid" has won several gold medals at various national and international fairs and competitions The patent for "Silistra Hybrid" 12 "Mekom" AD breeds its own animals and has well-established relationships with suppliers, which minimizes raw-materials risk Pigs – "Mekom" AD has its own complex with 35,000 pigs capacity and 2,000 sows "Silistra Hybrid". Currently, "Mekom" AD imports pig meat from the EU and has a developed network in Bulgaria Sheep/lamb – "Mekom" AD breeds on average 35,000-45,000 animals and has a developed sourcing network in Bulgaria, Romania and Macedonia Calves and buffaloes – "Mekom" AD breeds approximately 2,000 buffaloes and 3,000-4,000 calves Rabbits – "Mekom" AD buys rabbits from private local producers in Bulgaria and Romania Ostriches – "Mekom" AD buys ostriches from private local producers in Bulgaria and Romania Buffaloes bred in "Mekom" AD’s buffalo complex 13 "Mekom" AD has an extensive distribution network in Bulgaria and abroad "Mekom" AD owns 85 specialized freezer trucks and 24 trucks for the transportation of live animals Distribution channel Retail Chains Distributors Own stores Direct sales to customers Online store "Mekom" AD’s advantages "Mekom" AD has long-term contracts with the biggest retail chains in Bulgaria – Billa, Kaufland, Picadilly, Hit, etc. On the Romanian market, "Mekom" AD works with Metro, Billa, Real, G Market. Recently, "Mekom" AD was selected to supply the entire OMV petrol retail network in Romania with meat products In Bulgaria, "Mekom" AD has distributors in all major Bulgarian cities who deliver to smaller stores, restaurants, hotels, others "Mekom" AD also works with distributors in Spain, Germany, Switzerland, France, England, and other countries "Mekom" AD has exclusive own stores in Silistra and Sofia and rents stores in Blagoevgrad and Plovdiv "Mekom" AD sells directly to certain large customers in Bulgaria and abroad The company is in the process of developing an online store that will serve customers in Bulgaria and abroad 14 "Mekom" AD has an experienced management team Stefan Raichev is the President of the company and the major shareholder. He has worked in the company since 1980, starting as a production engineer and rising to a CEO position. Mr. Raichev privatized the company in 1998. In 2005, he was chosen for the Businessman of the Year in Bulgaria Margarita Stoyanova is a member of the Board of Directors and an executive director. She has extensive financial and accounting experience and is in charge of the overall financial and strategic management of the company Ivelin Nikolov is a member of the Board of Directors and in charge of marketing and trade activities. Mr. Nikolov has prior experience with multinational FMCG companies in Bulgaria Daniel Krumov is a member of the Board of Directors with prior experience in banking. Mr. Krumov is responsible for capital budgeting and financial management Dragomir Dimitrov is a member of the Board of Directors and an executive director. He has good knowledge in the field of national and international business 15 The Bulgarian meat market has a significant growth potential The Bulgarian meat market grew by ~14% in the last few years… …and is expected to continue to grow due to low starting base of meat consumption Meat product sales in Bulgaria Thousands of tons Per capita meat consumption In kg per person (2005) +14% 59,854 85 75 64,766 65 46 50,729 Short-lived products 44,244 Durable boiled- 28,554 Smoked products Durable boiledSmoked and Smoked products 33,486 40,783 46,757 Pork Beef 8,027 8,001 9,350 8,005 7,663 9,242 9,721 10,004 2002 2003 2004 2005 Source: Bulgarian Association of Meat Producers 44 32 Lamb Poultry 24 10 4 2 8 Bulgaria 2 9 11 6 15 22 22 4 12 Romania Czech Republic Serbia Source: CEEC Agri Policy Report; USDA Foreign Agri Service Consumption of meat products in Bulgaria will continue to grow on the basis of increasing purchasing power of the population and shift to processed meat products 16 The number of meat processing companies on the Bulgarian market is decreasing Recently, a lot of meat processing companies in Bulgaria have been closed due to their inability to meet EU production requirements Since 2004, the number of meat producing and meat processing companies has decreased almost two-fold "Mekom" AD is well-positioned to capitalize on the trend of meat factories closure in Bulgaria Number of meat processing companies in Bulgaria Company Meat producing companies for red meat Meat producing companies for white meat Meat processing Minced meat Total Dec-04 195 60 213 144 612 Dec-05 178 59 213 144 594 Apr-07 81 42 163 63 349 Source: Bulgarian Association of Meat Producers 17 The Romanian meat market holds significant growth potential Meat producing and processing has increased on average by 4.2% per year from 2000 to 2005 and reached 1.5 million tons – 40.1% is pork, 26.6% is poultry, 25.3% is beef, and 7.5% is lamb The Romanian market is relatively consolidated as the five biggest producers form 40% of the sales In 2005, per capita meat consumption was 64.6 kg (10% more than in 2004) Consumption of pork is the biggest – 32 kg/person, followed by poultry with 21.2 kg/person, lamb with 1.8 kg/person. Consumption of meat products is 8-9 kg/person In 2007, there is an increased demand for more expensive products of better quality It is expected that the Romanian meat market will continue to grow with the general increase of purchasing power in the country "Mekom" AD is well positioned to grow its sales on the Romanian market: The company already sells in Metro, Real, Billa, and other chains "Mekom" AD recently signed an agreement to supply all OMV petrol stations in Romania with meat products "Mekom" AD has strong positions in the upper segments of meat products, where there is less competition from local and international producers "Mekom" AD’s geographic position in Silistra provides it with a logistical advantage 18 "Mekom" AD is well positioned to exploit the trends in the EU lamb market The EU is a net importer of lamb with average imports of 260,000 tons per year Consumption is unlikely to see high increases, but the demand in Southern European countries (Italy, Greece, Spain, Croatia) cannot be met with local production Lamb production in countries, such as France, Ireland and England has decreased in recent years Southern countries do not import lamb from producers like the UK and France, because of the method of lambs slaughtering Local production is insufficient to meet demand "Mekom" AD is the largest exporter of lamb in the region and will continue to hold strong positions Lamb Consumption Forecast for EU - 25, 2007 – 2012 Kg/person Production (net) EU 15 EU-N10* Import Export Consumption Per capita consumption EU 15 EU-N10* 2007 1,041 1,027 14 263 4 2008 1,040 1,026 14 263 4 2009 1,038 1,024 14 263 4 2010 1,034 1,020 14 264 4 2011 1,030 1,016 14 265 4 2012 1,025 1,014 11 266 4 1,299 2.8 3.3 0.2 1,299 2.8 3.3 0.2 1,298 2.8 3.3 0.2 1,294 2.8 3.3 0.2 1,291 2.8 3.3 0.2 1,288 2.8 3.2 0.2 *EU-N10 10 New Member states; Source: Directorate General for Agriculture and Rural Development 19 III. "Mekom" AD’s History and Performance "Mekom" AD completed consolidation of 12 related companies to become a fully integrated meat producer Previously, the operations of the company were spread among 12 different companies for administrative reasons. Still, "Mekom" AD was the holder of all patents and trademarks With the legal restructuring, the daughter companies will be a part of the "Mekom" AD, so that the company operates as a whole and inter-company dealings are eliminated Galina Raicheva Stefan Raichev 99% 0.5% Margarita Stoyanova 0.5% Mekom AD Agrospektar Invest AD Kremonini AD Silistra Hybrid OOD Rusgal OOD Ronex 2000 OOD OMV OOD DrustarBV OOD SVI OOD Select OOD 99% 98% 97.32% 99% 80% 98% Interfoods AD Mekom OOD DMK 2003 OOD 80% 99.33% 99% 99% 88% 96% 21 "Mekom" AD’s sales have doubled in the past three years ~70% of "Mekom" AD’s sales are from exports… Sales and Exports* BGN ‘000 Total Sales Exports +44% 53,476 17,377 Sales portfolio, end 2006 % Processed products Live animals (export) (export) Processed products 5% 1% 36,270 35,444 26,727 The company hashas managed to diversify sales …The company a diversified salesitsportfolio 23,726 20% (BG) Chilled/frozen 9% meat (BG) 4% 2004 2005 Source: "Mekom" AD 2006 Chilled/ frozen meat (export) 62% Live animals (BG) Source: "Mekom" AD "Mekom" AD has well-diversified product portfolio across products and geographic markets The established products and markets base provides for further diversified growth * All results are on pro-forma, consolidated basis 22 "Mekom" AD has grown significantly in the past few years "Mekom" AD’s pro-forma consolidated Income Statement Indicator (in BGN '000) Revenues Cost of goods sold Gross margin Operating expenses EBITDA Depreciation and amortization EBIT Financial revenues/expenses, net Earnings before taxes Tax expenses Net Profit 2004 26 727 (17 968) 8 759 (3 175) 5 584 (2 640) 2 944 (1 747) 1 197 (230) 967 2005 35 444 (23 493) 11 951 (4 452) 7 499 (3 087) 4 412 (2 249) 2 163 (307) 1 856 2006 53 476 (39 272) 14 204 (5 449) 8 755 (3 461) 5 294 (2 475) 2 819 (368) 2 451 30 June 07 30 830 (23 916) 6 914 (2 524) 4 390 (1 663) 2 727 (931) 1 796 1 796 30 Sept. 07 54 142 (41 575) 12 567 (5 221) 7 346 (2 495) 4 852 (1 397) 3 455 3 455 "Mekom" AD’s revenues have almost doubled in the past three years Net profit has increased more than 2.5x by end of 2006 Results for the 9 months of 2007 are with more than 10% better than forecasted for the period 23 "Mekom" AD’s balance sheet "Mekom" AD’s pro-forma consolidated Balance Sheet Category (in BGN 000) 2004 2005 2006 30 June 07 30 Sept. 07 ASSETS Long-term assets Fixed tangible assets Biological assets (main herd) Expense for acquiring long-term intangible assets Long-term receivables Intangible assets Total long-term assets 30 885 1 112 38 201 1 619 33 653 1 881 32 670 2 064 427 9 32 433 290 5 40 115 184 4 35 722 166 5 34 905 30 878 2 232 1 184 29 5 34 328 68 656 Short-term assets Inventory Trade receivables Cash and equivalents Total short-term assets 8 893 1 805 1 098 11 796 13 086 3 370 1 095 17 551 18 573 5 939 2 774 27 286 19 213 4 483 1 198 24 894 20 933 3 649 2 386 26 968 TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Stockholders' equity Shareholder capital Reserves Retained earnings Current year profit/loss Total shareholders' equity 44 229 57 666 63 008 59 799 61 296 2 500 1 820 510 967 5 797 2 500 2 259 1 023 1 856 7 638 2 500 2 793 2 150 2 451 9 894 2 500 3 138 4 596 1 796 12 030 3 231 3 081 4 596 3 455 14 363 Long-term liabilities Loans Deferred liabilities Financial leasing Financing Other long-term liabilities 23 631 16 866 28 197 18 057 208 35 885 19 672 262 6 695 70 9 486 446 24 142 12 614 261 740 10 527 10 035 5 916 27 314 16 355 301 559 9 814 285 Total Current liabilities Loans payable 14 801 4 205 21 831 4 786 28 972 10 367 11 884 3 732 19 619 184 LIABILITIES AND STOCKHOLDERS' EQUITY 44 229 57 666 63 008 59 799 61 296 24 Description of companies controlled by "Mekom" AD Company Brief Description Interfoods AD Mekom OOD DMK 2003 OOD Ronex 2000 OOD The company buys and slaughters cattle, horses and ostriches. It produces short-lived products, raw-dried and durable smoked-boiled products, as well as fresh and frozen meat The company was founded in 1998. It realized BGN 372,000 net profit in 2006 The company’s main activities are sheep and goat slaughtering, and lamb export The company was founded in 2001. It realized BGN 94,000 net profit in 2006 The company’s main activity is transport. It owns 99 distribution trucks, 85 of which are specially equipped to transport frozen meat products. The company also has 24 vehicles for transporting live animals The company was founded in 1999. It realized BGN 470,000 net profit in 2006 The company breeds and fattens sheep. It imports lamb from Romania and exports to the EU The company was founded in 1999. It realized BGN 70,000 net profit in 2006 25 Description of companies controlled by "Mekom" AD Company Brief Description Rusgal OOD Drustar BV OOD Kremonini AD Agrospektar Invest AD The company breeds and fattens sheep and calves. It also breeds buffaloes for milk The company was founded in 2002. It realized BGN 78,000 net profit in 2006 The breeds and fattens sheep. It buys and slaughters sheep, and sells lamb meat The company was founded in 2004. It realized BGN 8,000 net profit in 2006 The company’s main activity is pig breeding The company was founded in 1992. It realized BGN 177,000 net profit in 2006 The company’s main activity is pig breeding The company was founded in 2000. It realized BGN 256,000 net profit in 2006 26 Description of companies controlled by "Mekom" AD Company Silistra Hybrid OOD Brief Description The company breeds its special brand of pigs called "Silistra Hybrid" The company was founded in 2001. It realized BGN 89,000 net profit in 2006 The main activity of the company is pig breeding. Currently, it is also SVI OOD Select OOD OMV OOD investing in a facility for breeding milk buffaloes The company was founded in 2002. It realized BGN 10,000 net profit in 2006 The company’s main activity is sheep and goat breeding. It exports lamb meat to the EU The company was founded in 2003. It realized BGN 341,000 net profit in 2006 The company buys, fattens and sells lamb The company was founded in 2003. It realized BGN 55,000 net profit in 2006 27 IV. Development Plan In Bulgaria, "Mekom" AD will invest in marketing, distribution, and internal improvements The company’s investments in Bulgaria will be in three main directions: Additional investment in sausage production facilities (processing, drying facilities) Increased investment in marketing and trade Investment in distribution to enable better reach of furthest parts of Bulgaria Internal operations improvements (ERP system, process improvements, personnel training, organizational changes) 29 "Mekom" AD is well-positioned to enter the Romanian market "Mekom" AD is located within 200 km of 10 million Romanian consumers (Brasov, Bucharest, Constanta, Brailla, other) The company has established relationships with retail chains in Romania, which will ease the distribution of its products on the Romanian market Most Romanian meat producers have difficulties meeting EU requirements, which creates a market niche that "Mekom" AD can take an advantage of. Recently, "Mekom" AD has been selected to supply all OMV stations in Romania "Mekom" AD has an established brand name in the coldcuts segment in Romania, where it has been present for 2 years already The company will invest in additional marketing and distribution to establish a stronger presence on the Romanian market "Mekom" AD’s geographic positioning relative to the Romanian market Brasov Braila 200 km Bucharest Constanta Silistra 30 "Mekom" AD has the opportunity to acquire a smaller meat producer in the Western Balkans "Mekom" AD sells its products in Croatia and has an established supplies network in Macedonia An acquisition in Macedonia or Serbia will allow the company to: "Mekom" AD’s presence and potential markets in South East Europe Acquire local brands and expands its sales presence Find additional placement for some of its existing processed meat products and "Silistra Hybrid" pigs Expand its supply network for lamb Avoid duties for sales to Croatia and other Western Balkan countries Markets, where "Mekom" AD is present Target priority market Potential market 31 "Mekom" AD’s base investment plan Investment Area Amount (leva) Details/Timing Modernization and expansion of meat processing facilities 4,000,000 Investi in additional capacity for meat processing 2008 Marketing, distribution – Bulgaria 2,000,000 Invest in marketing and merchandising. Additional investments in distribution - 2008/9 Romanian market entry 5,000,000 Expansion of the "Silistra Hybrid" facilities 3,000,000 Invest in marketing research, advertising and trade spend. Build own distrubution center and/or contract out local distributors - 2008/9 Invest in additional buildings and renovation for better breeding of animals - 2008 Purchase of a meat company on the Western Balkans 7,000,000 Acquire a target meat processing company in the Western Balkans - 2008 Investments in organizational improvements (IT, process improvements, training) 1,000,000 Investing in processes and personnel (ERP systems, processes, training, recruitment) Total 22,000,000 "Mekom" AD investment plan will enable it to strengthen its position on the Bulgarian market, as well as establish itself as a regional leader 32 V. Investment Case "Mekom" AD foresees strong income and balance sheet growth on the basis of regional expansion (1/2) "Mekom" AD forecast Income Statement Category (BGN '000) Sales Cost of goods sold Gross profit Gross profit margin Marketing and distribution expenses Administrative expenses Other expenses EBITDA EBITDA margin Depreciation and amortization EBIT EBIT margin Interest income/expense PBT Tax expense Net Profit Net profit margin 2007 2008 2009 2010 2011 2012 64,410 84,896 116,093 147,669 181,420 212,400 (46,819) 17,592 27% (3,902) (3,016) (1,158) 9,516 15% (3,714) 5,803 9% (1,073) 4,730 (473) 4,257 7% (61,114) 23,782 28% (7,143) (3,975) (1,526) 11,138 13% (4,704) 6,434 8% (563) 5,871 (587) 5,284 6% (83,019) 33,073 28% (9,033) (5,436) (2,087) 16,518 14% (4,812) 11,706 10% (568) 11,138 (1,114) 10,025 9% (104,720) 42,949 29% (9,945) (6,915) (2,655) 23,434 16% (4,889) 18,545 13% (4) 18,540 (1,854) 16,686 11% (127,756) 53,665 30% (12,990) (8,495) (3,261) 28,918 16% (4,967) 23,951 13% 548 24,499 (2,450) 22,049 12% (148,308) 64,092 30% (14,867) (9,946) (3,818) 35,461 17% (5,044) 30,417 14% 1,689 32,106 (3,211) 28,895 14% "Mekom" AD is on track to beat its 2007 forecasts 34 "Mekom" AD foresees strong income and balance sheet growth on the basis of regional expansion (2/2) "Mekom" AD forecast Balance Sheet Category (BGN '000) ASSETS Long-term assets Land Buildings Machinery and equipment Transportation vehicles Animals Others Short-term assets Inventory Trade receivables Cash and equivalents TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Equity capital Long-term liabilities Long-term bank debt Other long-term liabilities Revenue receivable Short-term assets Short-term bank debt Trade paybles Other short-term liabilities LIABILITIES AND STOCKHOLDERS' EQUITY 2007 2008 2009 2010 2011 2012 774 41,780 21,336 3,980 3,198 2,500 774 40,828 27,313 3,624 3,198 2,275 774 39,847 27,100 3,481 3,198 2,050 774 38,116 26,848 3,301 3,198 1,825 774 36,385 26,555 3,083 3,198 1,600 774 34,654 26,222 2,827 3,198 1,375 19,404 5,758 2,973 101,702 25,329 7,589 21,180 132,110 34,407 10,378 35,781 157,017 43,401 13,201 55,347 186,010 52,949 16,218 81,601 222,362 61,467 18,988 119,634 269,138 57,671 73,637 83,662 100,348 122,398 151,293 8,307 700 7,266 6,000 1,500 11,783 11,500 2,000 12,533 14,500 2,500 13,283 19,000 2,500 14,533 28,000 2,500 15,783 10,376 16,034 1,348 101,702 16,500 20,929 1,760 132,110 16,500 28,431 2,391 157,017 16,500 35,863 3,016 186,010 16,500 43,752 3,679 222,362 16,500 50,790 4,271 269,138 35 Key assumptions for the forecast financial statements Bulgarian market Export markets The Bulgarian meat market is expected to continue to grow at 10-15% per year in the next 3 years and to slow down to the level of GDP growth thereafter "Mekom" AD’s market share in the short-lived products segment is expected to stay constant i.e. the company will target to grow with the market at a minimum Romania "Mekom" AD’s sales are expected to grow relatively fast on the basis of investment in marketing and distribution. Overall sales are expected to reach ~50% of Bulgarian levels by the year 2012 "Mekom" AD’s market shares in the boiled-smoked and raw-dried segments are expected to rise by 3% per year for the next few years on the basis of: Increased marketing and trade Introduction of new products Further penetration of the retail chains in Bulgaria (where "Mekom" AD is traditionally strong) Improved distribution and allowances for main distributors Decrease of the number of meat processing factories, due to EU requirements Sales of live "Silistra Hybrid" pigs are expected to grow by 20% annually for the next 4 years, based on additional investments and possibility to export to EU countries Other Exports Lamb exports are expected to continue to grow strongly by 20-30% for the next 2-3 years and then subside to growth levels of 5 10%. The growth will be on the basis of increased supply of own and purchased lambs Exports of meat products are expected to rise by 100-200% (starting from low levels) as the company continues to invest in trade spend in Western Europe Western Balkans The revenue forecast assumes the acquisition of a meat producer in the Western Balkans 36 VI. Public Offering Details Public offering details The number of shares offered for sale – 10,682,800 shares with BGN 1 nominal value; all of the shares are ordinary, dematerialized, freely transferable, registered in the Central Depositary Each ordinary share gives its holder the right to 1 (one) vote in the General Meeting of Shareholders, as well as right to dividend upon profit distribution and right to liquidation quota Minimum issue value per share – BGN 2.20 The final offering price per share will be determined by the "book building" method The period, when purchase orders could be submitted – January 21, January 22, January 23, 2008 from 9.00h t0 16.00h The purchase orders are to be sent in sealed envelope to UBB on the following address: 5 Sveta Sofia Str and in Microsoft Excel format to the following e-mail: stambolieva_a@ubb.bg Announcement date of the final offering price and allocation – January 24, 2008, till the end of the day Date of payment– January 29, 2008 38 VII. Contacts Contact Details United Bulgarian Bank AD 5 Sveta Nedelya Street 1040 Sofia Contact person: Ms. Svetlana Koeva Telephone: +359 2 8113756 Fax: +359 2 8113759 E-mail: koeva_s@ubb.bg Allianz Bulgaria AD 79 Mariya Louiza Boulevard 1202 Sofia Contact person: Mr. Georgi Kisov Telephone: +359 2 9215405, 481 Fax: +359 2 9818564 E-mail: g.kissov@bank.allianz.bg 40