Course Summary - Faculty Directory | Berkeley-Haas

advertisement

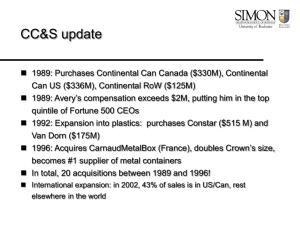

Crown Cork & Seal Take-aways Crown Cork & Seal Update Acquisitions: 1989 — Purchases Continental Can Canada ($330M), Continental Can US ($336M) 1990 — Purchases Continental RoW ($125M) 1992 — Expansion into plastics: Constar purchased ($515 M) and Van Dorn ($175M) 1993 — #2 supplier of metal containers (Pechiney #1) 1996 — Acquired CarnaudMetalBox (France) for $5.2B in stock and cash (largest acquisition of a European firm by an American one at the time) becomes #1 supplier of metal containers Crown Cork & Seal Update International Expansion: 1993 — Builds beverage can and plastic cap production lines in UAE, Jordan, Argentina, and Shanghai 1994 — Expansion into Vietnam via JV with two local companies, plans to produce 400M cans per year 1994 — Announces Beijing JV, its 3rd in China Crown Cork & Seal Update Management: 1989 — William Avery compensation exceeds $2M, putting him in the top quintile of Fortune 500 CEOs Continuing restructuring: more than two dozen plants closed between 1991 and 1995 1992 — Firm re-organized around 4 divisions: North America, International, Machinery, and Plastics 2000 — William Avery steps down CCS Performance is excellent through 1996 … Relative Performance of Crown Cork & Seal vs. S&P 500 (1989 - 1997) 400 Adjusted Closing Price (1/3/1989 = 100) CCS 350 300 250 200 S&P 500 150 100 50 0 1/3/1989 1/3/1990 1/3/1991 1/3/1992 1/3/1993 1/3/1994 1/3/1995 1/3/1996 Week Ending Net sales increase to $8.3B in FY 96 from $1.8B in FY88 growth fueled mainly through acquisitions (financed by debt) Net income increases to $294M in 96 from $93M in 88 … but hit by a “perfect storm” in 1998 & 99 Relative Performance of Crown Cork & Seal vs. S&P 500 (1989-present) Adjusted Closing Price (1/3/1989 = 100) 600 S&P 500 500 CCS + 333% 400 300 200 CCS S&P 500 + 581% 100 Week Ending Overcapacity in Europe (50% of sales) leads to pricing pressure US Soda bottlers raise prices, stemming growth in demand Higher oil prices Major U.S. customer goes Chapter 11 Asbestos litigation Credit Rating dropped to below investment grade 20 04 1/ 3/ 20 03 1/ 3/ 20 02 1/ 3/ 20 01 1/ 3/ 20 00 1/ 3/ 19 99 1/ 3/ 19 98 1/ 3/ 19 97 1/ 3/ 19 96 1/ 3/ 19 95 1/ 3/ 19 94 1/ 3/ 19 93 1/ 3/ 19 92 1/ 3/ 19 91 1/ 3/ 19 90 1/ 3/ 1/ 3/ 19 89 0 Avery out, back to the basics New CEO, John Conway, evokes strategy of Connelly difficult to return to bare-bones corporate culture of the past 2003 SGA/Sales 5.1% Divested Constar International (plastics) Nov 2002 Focus on repairing balance sheet & paying down debt Consolidation in the metal can industry Post 2001, looks like a 3-firm oligopoly, with each firm selectively taking out capacity Overview While industry analysis indicated that the container industry was extremely competitive We saw that CC&S prospered in spite of this. How much does company position matter? Average Economic Profits in the Steel Industry, 1978 - 1996 ROE-Ke Spread 40% Great Northern Iron 30% 20% Worthington Inds Nucor Steel Technologies 10% Oregon Mills Commercial Metals 0% Carpenter British Steel PLC Cleveland-Cliffs Birmingham Quanex Lukens (10%) USX-US Steel ACME Metals Ampco Inland Steel (20%) (30%) $0 $1 $2 $3 $4 Average Invested Equity ($B) $5 $6 $7 $8 $9 $10 Source: Ghemawat, Strategy and the Business Landscape Armco WHX Bethlehem $11 $12 $13 $14 $15 More on Company Position Company position is intimately linked with a company’s strategy While CC&S’s rivals largely adopted diversification strategies… CC&S chose a focused strategy based on appealing to profitable segments of the market