save

advertisement

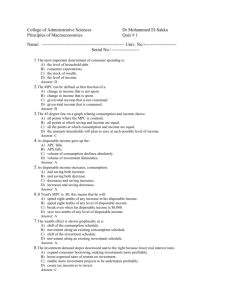

CHAPTER 9 Building the Aggregate Expenditures Model In this chapter, we only consider two aggregates: consumers and businesses. So we are dealing with consumption and investment expenditures. The basic premise of the aggregate expenditures model is that the amount of goods and services produced and therefore the level of employment depend on the level of aggregate expenditures. Consumption is the largest component of aggregate expenditures. People do not spend all there money, they save some of it. So disposable income equals consumption plus savings. The relationship between consumption and income is illustrated in consumption function diagram. In this diagram a 45 degree line represents consumption equaling income. If consumption does not take up all income, then savings will occur and this is shown as a separation of the consumption function from the 45 degree line. CONSUMPTION AND SAVING Consumption SAVING C Consumption schedule C DISSAVING o 45 MPC = Slope of C o MPC + MPS = 1 Saving Disposable Income DISSAVING Saving schedule MPS = Slope of S S SAVING o S Disposable Income The consumption schedule or function specifies the relationship between consumption expenditures and disposable income. We can calculate the average and marginal propensities to consume or save. The APC is the total level of consumption divided by income. The MPC is the change in consumption for a change in income. The APS is saving divided by income. The MPS is the change is saving for a change in income. APC + APS=1 MPC + MPS=1 The marginal propensity to consume is the slope of the consumption function. There are non-income determinants of consumption and saving: wealth, expectations, taxation, the interest rate, and household debt. These factors shift the consumption function up or down. If people have more wealth, they are more willing to spend out of current income. If people have positive expectations, they will spend. Lowering taxes means more spending. Less debt means more money to spend currently. Lower interest means people can borrow more cheaply. TERMINOLOGY, SHIFTS, & STABILITY Consumption C1 C0 Increases in Consumption Means… o 45 o Saving Disposable Income A Decrease S0 S1 In Saving o Disposable Income Consumption TERMINOLOGY, SHIFTS, & STABILITY C0 C2 Decreases in Consumption Means… o 45 o Saving Disposable Income S2 An Increase S0 In Saving o Disposable Income Investment consists of expenditures on new plants, capital equipment, machinery, inventories, and so on. Investments are more likely to occur if the expected rate of return on an investment is higher, and if the real interest rate is lower. The real interest rate is the nominal rate less inflation. We can combine all investments decisions in an economy into an investment demand curve with the expected rate of return and the real interest rate on the vertical axis and investment on the horizontal axis. The higher the expected rate of return the lower the interest rate so they are placed on the vertical axis. This curve can shift for the following reasons: operating costs, business taxes, technological change, stock of capital goods on hand, and expectations. Investment is unstable and thought be a cause of the business cycle. Interest Rate – Investment Relationship and interest rate, i (percents) Expected rate of return, r, 16 14 INVESTMENT DEMAND CURVE 12 10 8 6 4 2 ID 0 5 10 15 20 25 30 35 40 Investment (billions of dollars) We can combine the consumption and investment schedules to explain the equilibrium levels of output, income, and employment. We can identify the equilibrium level of output and income graphically buy placing the added investment and consumption functions on the 45 degree line. The C + I function then crosses the 45 degree line at one point, and this is the equilibrium level. Any level above or below this point represents dis-equilibrium. No level but the equilibrium level can be sustained. At levels of GDP below equilibrium, the economy wants to spend at higher levels than the current level of production, so production will increase. At levels of GPD above equilibrium, the economy is overproducing relative to spending, so the economy will cut back on production. At equilibrium, GDP=C + Ig Private spending, C + I g (billions of dollars) EQUILIBRIUM GDP (C + I g = GDP) $530 C + Ig Equilibrium 510 C 490 470 Ig = $20 Billion 450 430 410 C =$450 Billion 390 370 45 o o 370 390 410 430 450 470 490 510 530 550 Real domestic product, GDP (billions of dollars) The Multiplier • More spending results in higher GDP. Less spending results in less GDP. • But a change in spending results in changing output and income by more than the original amount of spending. • The multiplier determines how much larger that change will be. The multiplier is: m=change in GDP initial change in spending The Multiplier Continued • It follows that an initial change in spending will set off a chain of spending throughout the economy • You spend $100. Some one gets the $100 and he spends part of it and saves the rest. If he spends 80%, he spends $80. Then the next person who gets the $80 will spend 80% of that which is $64. Then the next person who gets the $64 will spend 80% of that. • In general, if we know the multiplier, we multiply the multiplier by the initial spending to get the full amount of spending in the economy. • Another way to define the multiplier is: • m=1/1-mpc or 1/mps where the mpc is the marginal propensity to consume and mps is the marginal propensity to save. THE MULTIPLIER EFFECT (2) (3) Change in Change in (1) Saving Change in Consumption Income (MPC = .75) (MPS = .25) Increase in Investment of $5 $ 5.00 $ 3.75 $ 1.25 Second Round 3.75 2.81 .94 Third Round 2.81 2.11 .70 Fourth Round 2.11 1.58 .53 Fifth Round 1.58 1.19 .39 All Other Rounds 4.75 3.56 1.19 $20.00 $15.00 $ 5.00 Total The Multiplier • The bigger the mpc, the smaller the mps and the bigger the multiplier. • So as people spend more out of their income, the larger will be the impact on the economy. • The multiplier works in reverse too. If people save more and spend less, the lower the multiplier and subsequent impact on the economy. THE MULTIPLIER EFFECT MPC and the Multiplier MPC Multiplier .9 10 .8 5 .75 4 .67 .5 3 2