Access to Records

advertisement

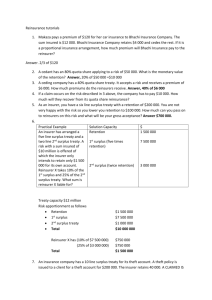

ARIAS•U.S. 2015 FALL CONFERENCE Breakout 4 Recent Changes in Contract Wording: Not Your Grandfather’s Clauses Anymore Panel: Elaine A. Caprio, Myra E. Lobel, John Phillips, Joseph L. Pulvirenti Moderator: Larry P. Schiffer #1081505066 November 12, 2015 DISCLAIMER The material contained in this presentation has been prepared solely for informational purposes and does not necessarily represent the views of, nor shall it be attributed in any way to, the participants or their employers or their affiliates. The content of this presentation is intended to provide a general guide to/on the subject matter. Specialist advice should be sought about your specific circumstances. 1 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 FACT PATTERN 2 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 FACT PATTERN 3 • Cedent is a well-regarded insurance company based in Illinois that is licensed to write property and casualty insurance business in all US jurisdictions. Over the past several years, Cedent has investigated whether to enter into the cyber-risk insurance market to match its competitors’ insurance offerings to commercial insureds in the retail, financial services and health segments of the economy. • Before offering a stand-alone cyber-risk policy to its insureds in 2015, Cedent offered traditional comprehensive general liability and property policies to its insureds, including major health insurance providers and healthcare and hospital systems. To protect itself from excess exposure to property risks, Cedent purchased a Property Catastrophe Excess-of-Loss Treaty. The Treaty was placed through Cedent’s traditional reinsurance intermediary, Broker, and included an Access to Records clause, a Special Termination clause, an Arbitration clause and an Occurrence clause. The clauses are set out below. • In November 2013, Broker approached Reinsurer about participating on Cedent’s Property Catastrophe Treaty for the 2014 policy year. Reinsurer was a mid-sized reinsurer based in Massachusetts and typically participated on reinsurance programs as part of the following market. Broker provided reinsurer with a detailed placement memorandum and business plan. Reinsurer agreed to participate as a 20% participant on Property Catastrophe Treaty. ARIAS•U.S. 2015 Fall Conference / November 12, 2015 FACT PATTERN 4 • In February 2014, Reinsurer was approached by International Reinsurer about its business. International Reinsurer did not have a presence in the US and wanted to obtain a foothold in the US reinsurance market. After intense negotiations, Reinsurer agreed to be acquired by International Reinsurer effective June 2014. International Reinsurer typically led reinsurance programs and often was the sole reinsurer on a reinsurance contract. International Reinsurer did not participate on any of Cedent’s reinsurance contracts. International Reinsurer approached property catastrophe more conservatively than Reinsurer and made all efforts to limit its exposure to cyber-related risks. • In May 2014, one of Cedent’s insureds, Health System, began to suffer a major cyber breach. Over a three-month period, seven of Health System’s facilities were attacked and the computer-controlled sprinkler system in each of the facilities was disabled and damaged. The attacks came at the beginning of each month for a period of several hours and then stopped until the beginning of the next month. Health System did not realize its computerized sprinkler systems had been compromised and damaged until the third attack in the third month (July 2014) when a fire started at its largest facility and the entire facility was destroyed. Previously, in June 2014, a smaller facility had a fire that caused minor smoke damage to its kitchen. Health System did not realize that the June 2014 fire was related to the hacking of its computerized sprinkler system. ARIAS•U.S. 2015 Fall Conference / November 12, 2015 FACT PATTERN • • • 5 Once Health System realized the breaches related to the fires, it immediately notified Cedent. Cedent had been notified about the first fire, but because the smoke damage was minor, the loss was well within Health System’s self-insured retention. Cedent immediately began addressing the property loss issues concerning the second fire, the damage to the computerized sprinkler systems in all facilities, and also crisis management issues concerning the hacking. Cedent also notified Broker of the Health System claim and asked Broker to notify all reinsurers on the Treaty, which Broker did. Cedent ultimately entered into a settlement agreement with Health System under the underlying property coverage for $50 million covering the damage to the computerized sprinkler system in all facilities and the total loss of the main facility. Health System’s policy had an aggregate limit of $50 million. The Property Catastrophe Treaty attached at $25 million. Cedent billed the reinsurers for the Health System loss as one occurrence and ceded the loss to the Property Catastrophe Treaty. Reinsurer, now merged with International Reinsurer, requested an inspection of Cedent’s files after receiving the settlement billing. Reinsurer asked for all underwriting information concerning Health System and all coverage opinions or analysis concerning the claim whether internal or external and whether prepared by in-house or outside counsel. ARIAS•U.S. 2015 Fall Conference / November 12, 2015 “Access to Records” or “Inspection of Records” 6 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Language prior to 2000 “The Reinsurer or its authorized representative may inspect at all reasonable times at the office of the Cedent the books, records and papers pertaining to business reinsured under this Agreement.” This language provided the Reinsurer broad access to all relevant records 7 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Language prior to 2000 – Variations “The Reinsurer or its authorized representative may inspect at all reasonable times at the office of the Cedent the books, records and papers pertaining to business reinsured under this Agreement including files concerning claims, losses, or legal proceedings which involve or are likely to involve the Reinsurer.” Some versions defined records in more detail, or restricted access to certain types of records using language such as “premium and loss transactions” 8 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Language prior to 2000 – Variations “The Reinsurer or its authorized representative may inspect at all reasonable times at the office of the Cedent the books, records and papers pertaining to business reinsured under this Agreement. The Reinsurer's right of inspection shall continue after the termination of this Agreement.” Many agreements now clarify that the right of inspection continues after termination. Alternative formulations include: “This Article shall survive the termination of this Agreement.” Some agreements add a time limitation on access to closed reinsurance claim files: “With respect to closed reinsurance claims, the Reinsurer’s right to inspect claim files, underwriting files, or premium records pertaining to such closed reinsurance claims, will terminate one year after the closing date of the claim; 9 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Current Language “1) The Reinsurer or its authorized representative shall have the right to visit the offices of the Company to inspect, examine, audit, verify and copy any of the Policies or files other than Privileged files of the Company relating to business reinsured under this Contract during regular business hours. For the purposes of this Article, "Privileged" shall mean attorney/client privileged and privileged attorney work product as defined under applicable law. This right shall survive the termination of this Agreement. 2) Notwithstanding the provisions of 1) above, the Company shall allow access to Privileged files in connection with any claim reinsured hereunder following final settlement or final adjudication of such claim with prejudice against all claimants and all parties thereto. The Company may defer release of Privileged files if there are subrogation or other actions with respect to such claim, and in the view of the Company, release is likely to jeopardize the privileges or protections attached to such files. Should the Company seek to defer release of Privileged files, together with the Reinsurer it shall take reasonable steps to provide the Reinsurer with information the Reinsurer requires without causing loss of such privileges or protections. The Reinsurer shall not have access to Privileged files relating to disputes between the Company and the Reinsurer. 3) Within thirty (30) calendar days immediately following completion of an inspection, the Reinsurer shall provide the Company with a written report detailing all its findings, questions or issues arising out of such inspection. This requirement shall survive the termination of this Agreement. 4) Notwithstanding the above, the Reinsurer shall not have any right of access to the Records of the Company if it is not current in all undisputed payments due the Company. 5) The Reinsurer shall keep confidential all information and reports derived from the Records of the Company to which it has received access and shall not publish or communicate that information without the Company's express prior written consent, except when required by retrocessionaires, auditors, legal counsel and/or arbitrators involved in arbitration procedures under this Contract. You’ve probably noticed, it is longer and more complicated! Paragraph 1) establishes the right of inspection, but permits the Company to withhold privileged records. Paragraph 2) addresses sharing privileged records after a claim is closed. Paragraph 3) requires a written report by the Reinsurer conducting the inspection; Paragraph 4) addresses Reinsurers who are not current in payments, and finally Paragraph 5) addresses confidentiality. 10 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Current Language – ( Paragraphs 1 and 2 - Privileged Records) Some cedents are concerned that sharing information with reinsurers will be deemed to break privilege and allow claimants access to the cedent’s claim records. Concerns about privileged records have increased as a result of court decisions (Regence v. TIG, 2010 Ninth Circuit) and certain subsequent decisions: “1) The Reinsurer or its authorized representative shall have the right to visit the offices of the Company to inspect, examine, audit, verify and copy any of the Policies or files other than Privileged files of the Company relating to business reinsured under this Contract during regular business hours. For the purposes of this Article, "Privileged" shall mean attorney/client privileged and privileged attorney work product as defined under applicable law. This right shall survive the termination of this Agreement “ Some variations provide methods for cedent and reinsurer to share information without breaking privilege, either during the settlement process: “If the Company seeks to defer release of such Privileged documents, it shall, in consultation with the Reinsurer, take other steps as reasonably necessary to provide the Reinsurer with the information it reasonably requires to indemnify the Company without causing a loss of such privileges or protections.” Or after all litigation is complete: “However, the Company shall permit and not object to the Reinsurer’s access to Privileged documents in connection with the underlying claim reinsured hereunder following final settlement or final adjudication of the case or cases involving such claim.” ( A longer formulation is in Paragraph 2 of the sample language) 11 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Current Language – ( Paragraph 3 –Report) Requirement to provide a written report of findings: 3) Within thirty (30) calendar days immediately following completion of an inspection, the Reinsurer shall provide the Company with a written report detailing all its findings, questions or issues arising out of such inspection. This requirement shall survive the termination of this Agreement. “ 12 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 ACCESS TO RECORDS Sample Current Language – (Paragraphs 4 & 5 - Undisputed Payments / Confidentiality) 4) Notwithstanding the above, the Reinsurer shall not have any right of access to the Records of the Company if it is not current in all undisputed payments due the Company. 5) The Reinsurer shall keep confidential all information and reports derived from the Records of the Company to which it has received access and shall not publish or communicate that information without the Company's express prior written consent, except when required by retrocessionaires, auditors, legal counsel and/or arbitrators involved in arbitration procedures under this Contract. “ Limitations on access when reinsurers are not current in payments are quite common. Some variations go further by requiring that disputes on payments be documented in writing. The final paragraph imposes a confidentiality obligation. This provision is often in a separate confidentiality article. 13 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 SPECIAL TERMINATION 14 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 SAMPLE LANGUAGE PRIOR TO 2000 • “If at any time either party has a decrease in surplus of 50% or more, or a 2 level drop in A.M. Best’s rating; or a change in ownership, this Contract may be cancelled subject to 30 days notice and subject to the cancellation provisions outlined in Paragraph D(1) (“cut-off”) and D(2) (“run-off”) of the Term Article.” – Bilateral application; – 30 days advance notice; – 50% surplus threshold; – Lack of trigger details; – Company options limited. 15 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 CURRENT LANGUAGE ASPECTS • Company’s Unilateral Election • Immediate Termination • Numerous Expanded Triggers – Participating Reinsurer Expansion • Rescission, Commutation and Special Funding Impacts 16 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Sample Current Language • Special Termination – Notwithstanding the provisions of paragraph A of the Term Article, the Company may terminate a Subscribing Reinsurer's percentage share in this Contract at any time by giving written notice to the Subscribing Reinsurer in the event any of the following circumstances occur: • The Subscribing Reinsurer has ceased assuming new or renewal property or casualty reinsurance; or • A state insurance department or other legal authority has ordered the Subscribing Reinsurer to cease writing business, or the Subscribing Reinsurer is placed under regulatory supervision; or • The Subscribing Reinsurer has become insolvent or has been placed into liquidation, receivership, supervision, administration, winding-up or under a scheme of arrangement, or similar proceedings (whether voluntary or involuntary) or proceedings have been instituted against the Subscribing Reinsurer for the appointment of a receiver, liquidator, rehabilitator, supervisor, administrator, conservator or trustee in bankruptcy, or other agent known by whatever name, to take possession of its assets or control of its operations; or • Either the Subscribing Reinsurer's or the Subscribing Reinsurer's group or holding company's policyholders' surplus (or its equivalent under the Subscribing Reinsurer's or the Subscribing Reinsurer's group or holding company's accounting system), at the inception of this Contract has been reduced by 20.0% or more of the amount of surplus (or the applicable equivalent) 12 months prior to that date; or 17 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Sample Current Language – Triggers – Either the Subscribing Reinsurer's or the Subscribing Reinsurer's group or holding company's policyholders' surplus (or its equivalent under the Subscribing Reinsurer's or the Subscribing Reinsurer's group or holding company's accounting system), at any time during the term of this Contract has been reduced by 20.0% or more of the amount of surplus (or the applicable equivalent) at the date of the Subscribing Reinsurer's or the Subscribing Reinsurer's group or holding company's most recent financial statement filed with regulatory authorities and available to the public as of the inception of this Contract; or – The Subscribing Reinsurer has become, or has announced its intention to become, merged with, acquired by or controlled by any company, corporation, or individual(s) not controlling the Subscribing Reinsurer's operations previously; or – The Subscribing Reinsurer has reinsured its entire liability under this Contract without the Company's prior written consent, except for retrocessions to members of the Subscribing Reinsurer's holding company group; or – The Subscribing Reinsurer has been assigned an A.M. Best's rating of less than "A" and/or an S&P rating of less than "BBB+." However, as respects Underwriting Members of Lloyd's, London, a Lloyd's Market rating of less than "A-" Stable Outlook by A.M. Best and/or less than "BBB+" by S&P will apply; or 18 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Sample Current Language Rescission, Commutation and Special Funding Options – There has been a severance or obstruction of free and unfettered communication and/or normal commercial and/or financial intercourse between the country in which the Company is incorporated and the country in which the Subscribing Reinsurer is incorporated or has its principal office as a result of war, currency regulations, or any circumstances arising out of political, financial, or economic emergency; or – There has been a failure or delay in performing any of the Subscribing Reinsurer's obligations under this Contract, if such failure or delay is caused by Force Majeure; provided, however, that any failure or delay exceeds 15 days from the date such performance would have been due but for such circumstance or event. "Force Majeure" will mean any act of God, strike, lockout, act of public enemy, any accident, explosion, fire, storm, earthquake, flood, drought, peril of sea, riot, embargo, war or foreign, federal, state or municipal order or directive issued by a court or other authorized official, seizure, requisition or allocation, any failure or delay of transportation, shortage of or inability to obtain supplies, equipment fuel or labor or any other circumstance or event beyond the reasonable control of the Subscribing Reinsurer. 19 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Sample Current Language Rescission, Commutation and Special Funding Options • Rescission – In the event of the occurrence of a special termination event within 60 days after the inception of this Contract, the Company may require the Reinsurer to return all premium paid under this Contract, less paid losses and loss adjustment expense, and both parties will be released completely from any and all liability under this Contract. 20 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Sample Current Language Rescission, Commutation and Special Funding Options • Commutation: – Additionally, if a Subscribing Reinsurer's participation is terminated pursuant to subparagraphs 1 through 10 of paragraph A above, the Company, at its sole discretion, may elect to commute the Subscribing Reinsurer's liability for losses, including loss adjustment expense, whether known or unknown, on policies covered under this Contract. In the event the Company and the Subscribing Reinsurer cannot agree upon the capitalized value of the Subscribing Reinsurer's liability on such policies, the two parties will mutually appoint an actuary within 30 days to resolve the matter of valuation and will share equally in any expense associated with such appointment in a manner agreed upon at the time of appointment. The appointed actuary will not be under the control of either party and will be a Fellow of the Casualty Actuarial Society. The value determined by said actuary will be set forth in a sworn statement expressing the actuary's professional opinion that said value is fair for the complete release of all liabilities being commuted. Payment by the Subscribing Reinsurer of the amount of liability ascertained will constitute a complete and final release of the Subscribing Reinsurer with respect to its liability for all losses, including loss adjustment expense, whether known or unknown, on policies covered under this Contract. 21 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Sample Current Language Rescission, Commutation and Special Funding Options • Special Funding: – Alternatively, in the event of any of the circumstances listed above, the Company may, at its option, require the Subscribing Reinsurer to immediately provide funding of its share of the Reinsurer's liabilities hereunder in the manner set forth in the Reserves and Funding Article. This paragraph will not require any Subscribing Reinsurer to provide duplicate funding of any liabilities that the Subscribing Reinsurer has already funded under the Reserves and Funding Article. 22 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Commutation and Funding Survive Treaty Termination The Company's option to require commutation or funding as provided above will survive the termination or expiration of this Contract. 23 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Other Wording Implications • Separate Company Treatment? – Allocations • “Each party agrees that, with respect to the parties named herein as the “Company,” it shall honor the terms set forth herein as if this contract were a separate contract between each Subscribing Reinsurer and each named reinsured company…” • Impact with Other Clauses: – – – – Run-Off Reinsurer Reserves Funding Aggregate Limit Minimum Premium, etc. • Survival Clauses – “All articles of this Contract shall survive the termination of this Contract until all obligations between the parties have been finally settled.” 24 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 THE EVOLUTION OF ARBITRATION CLAUSES 25 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 The “Prehistoric” Era Birth of the Grandfather Clause 26 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Early Arbitration Clause As a precedent to any right of action hereunder, if any differences shall arise between the contracting parties with reference to the interpretation of this Contract or their rights with respect to any transaction involved, whether arising before or after termination of this Contract, such differences shall be submitted to arbitration upon the written request of one of the contracting parties. Each party shall appoint an arbitrator within thirty (30) days of being requested to do so, and the two named shall select a third arbitrator before entering upon the arbitration. If either party refuses or neglects to appoint an arbitrator within the time specified, the other party may appoint the second arbitrator. If the two arbitrators fail to agree on a third arbitrator within thirty (30) days of their appointment, each of them shall name three individuals, of whom the other shall decline two, and the choice shall be made by drawing lots. All arbitrators shall be active or retired disinterested officers of insurance or reinsurance companies or Underwriters at Lloyd's London, not under the control of either party to this Contract. Each party shall submit its case to its arbitrator within thirty (30) days of the appointment of the third arbitrator or within such period as may be agreed by the arbitrators. All arbitrators shall interpret this Contract as an honorable engagement rather than as merely a legal obligation. They are relieved of all judicial formalities and may abstain from following the strict rules of law. They shall make their award with a view to effecting the general purpose of this Contract in a reasonable manner rather than in accordance with a literal interpretation of the language. The decision in writing of any two arbitrators, when filed with the contracting parties, shall be final and binding on both parties. Judgment upon the award rendered may be entered in any court having jurisdiction thereof. Each party shall bear the expense of its own arbitrator and shall jointly and equally bear with the other party the expense of the third arbitrator and of the arbitration. In the event that two arbitrators are chosen by one party as above provided, the expense of the arbitrators and the arbitration shall be equally divided between the two parties. Any arbitration shall take place in the city in which the Company's Head 27 Office is located unless some other place is mutually agreed upon by the contracting parties. Features Early Arbitration Clauses 28 Composition of Panel -Traditional: Two party appointed and one neutral Qualifications of Panel -Active or retired disinterested officials of insurance or reinsurance companies, or Underwriters at Lloyd’s, London, not under the control of either party Timing: Umpire Selection -60 days Umpire Selection Process -Each shall name three, the other shall decline two; choice made by drawing lots Length of Time: Umpire Selection to Hearing -30 days Discovery -No mention of discovery Evidence -Honorable Engagement; may abstain from following strict rules of law Decision & Awards -In writing, by at least two arbitrators Attorney’s Fees -American Rule Mediation -No mention of mediation ARIAS•U.S. 2015 Fall Conference / November 12, 2015 The Renaissance Era Innovations in Arbitration Clauses 29 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Rules, Tools & Reasoned Awards Use of Arbitration Rules: Any and all disputes or differences arising out of this Contract, including its formation and validity, shall be submitted to binding arbitration. Any arbitration shall be based upon the Procedures for the Resolution of U.S. Insurance and Reinsurance Disputes dated September 2009, Regular Panel Version (the “Procedures”), as supplemented by the paragraphs below… Use of Umpire Selection tools: Where the two Party-appointed arbitrators have failed to reach agreement on an umpire within the time specified in paragraph B., each Party shall propose to the other in writing, within seven days thereafter, eight umpire candidates from the ARIAS·U.S. Certified Arbitrators List in effect at the time of the commencement of the arbitration. The umpire will then be selected in accordance with ¶ 6.7(b)-(c) of the Procedures. (Unless the Parties agree otherwise, the ARIAS·U.S. Umpire Questionnaire Form in effect at the time of the commencement of the arbitration shall be used.) Reasoned Awards: The decision of the panel shall be determined by a majority vote of the panel. Any interim order or final award of the panel shall be in writing and shall be a reasoned order/award setting form the rationale of the majority of the panel and any dissenting opinion if appropriate. 30 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Awards Baseball Arbitration: Within 30 days following the appointment date of the arbiter, the parties shall exchange their claims files, underwriting files and any other information deemed relevant by the arbiter relating to this Contract. Within 60 days following the appointment date of the arbiter, each party shall present its case by submitting, in writing, a brief of up to 50 pages setting forth its position (in the case of disputes for less than $1,000,000 the brief shall be limited to 25 pages) and a settlement offer to the arbiter which includes the terms that the party is willing to accept in final settlement of the dispute (the “Settlement Offer”). If one party fails to submit a Settlement Offer within 60 days following the appointment date of the arbiter, the arbiter shall be limited to awarding the Settlement Offer submitted by the other party and no arbitration hearing shall occur. Following the submission of briefs the parties shall have 14 days to submit reply briefs of up to 25 pages (in the case of disputes for less than $1,000,000 the brief shall be limited to 15 pages) setting forth their response to the brief filed by the opposing party. Provided the default award due to non-response by one party as discussed in paragraph H of this Article has not occurred, the arbiter shall be limited to awarding one of the two Settlement Offers submitted; in no event shall the arbiter have the option of declining to make an award of one of the two Settlement Offers submitted. 31 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 The Progressive Era Arbitration 2020 32 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Streamlined Rules For Small Claims Disputes “Smaller” Disputes: For all disputes involving amounts at issue less than USD $1,000,000, the arbitration shall be conducted in accordance with then applicable ARIAS•U.S. Streamlined Rules for the Resolution of U.S. Insurance and Reinsurance Disputes (The Streamlined Rules). 33 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Neutral Panel Arbitration with Time Limits For all disputes involving amounts at issue of USD $1,000,000 or greater, the arbitration shall be conducted in accordance with the then applicable ARIAS-US Neutral Panel Rules for the Resolution of U.S. Insurance and Reinsurance Disputes (The Neutral Rules), subject to the following amendments: 1. Section 13.3 of the ARIAS•U.S. Neutral Panel Rules for the Resolution of U.S. Insurance and Reinsurance Disputes shall provide: The Panel shall interpret this contract as an honorable engagement, and shall not be obligated to follow the strict rules of law or evidence. In making their Decision, the Panel shall apply the custom and practice of the insurance and reinsurance industry, with a view to effecting the general purpose of this Contract. 2. For disputes involving amounts at issue less than USD $10,000,000, the date for the hearing shall be set no later than three hundred and sixty (360) days from the date of the Organizational Meeting. 34 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Streamlined Proceedings Consolidation: If the Company and more than one Reinsurer are involved in the same dispute(s) or difference(s) arising out of this Contract, and the Company requests consolidated arbitration with those Reinsurers in an initial Notice of Arbitration or Response, then those Reinsurers shall constitute and act as one Party for purposes of the arbitration. For purposes of this paragraph, any instance in which two or more Reinsurers have not paid their proportional shares of the same balance claimed due by the Company shall be deemed to involve the “same dispute(s) or difference(s) arising out of this Contract.” Communications shall be made by the Company to each of the Reinsurers constituting one Party. Nothing in this paragraph shall impair the rights of Reinsurers to assert several rather than joint defenses or claims, change their liability under this Contract from several to joint, or impair their rights to retain separate counsel in connection with the arbitration. 35 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Judicial System In Lieu of Arbitration Resolution in Court: Unless mutually agreed otherwise, each party hereby agrees to submit all matters that involve the formation and validity of this Contract or that exceed 125% of the Reinsurer’s proportionate share of total liability as respects the amount in dispute, to a trial before a judge sitting in a court of competent jurisdiction. Unless mutually agreed otherwise, each party hereby waives its right to a jury trial. 36 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Mediation within Arbitration; English Rule Mediation: During the course of an arbitration conducted under Sections A or B of this Article, the parties agree to submit to a mediation session of at least 8 hours, to attempt to resolve certain or all of the disputes at issue in the arbitration. Notwithstanding the foregoing, the Panel has the discretion to order the parties to submit to additional mediation at any time during the course of an arbitration conducted under Sections A or B of this Article. Attorney’s Fees: The prevailing party shall be entitled to recovery of costs and reasonable attorneys fees. 37 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Features 21st Century Arbitration Clauses 38 Composition of Panel -Neutral Panel -Traditional Panel -Single Arbitrator Panel -Use of Court system instead of Panel for larger disputes Rules and Tools -ARIAS-US Regular, Neutral and Streamlined Rules -Procedures for Resolution of US Insurance & Reinsurance Disputes -ARIAS-US Certified Arbitrator, Neutral Arbitrator and Umpire lists -ARIAS-US Umpire Questionnaire -Streamlined proceedings through Consolidation Discovery -By decision of parties or Arbitrator(s) -Limits: time and scope Evidence -Honorable Engagement; may abstain from following strict rules of law -Follow strict rules of law Decision & Awards -Reasoned Awards -Baseball, Hi/Low Arbitration Awards Attorney’s Fees -American Rule -English Rule Mediation -Within Arbitration; used at Panel’s discretion ARIAS•U.S. 2015 Fall Conference / November 12, 2015 OCCURRENCE 39 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Loss Occurrence Older Clause (Property Loss Newer Clauses (Property Loss The term “Loss Occurrence” shall mean the sum of all individual losses directly occasioned by any one disaster, accident or loss or series of disasters, accidents or losses arising out of one event which occurs within the area of one state of the United States or province of Canada and states or provinces contiguous thereto and to one another. However, the duration and extent of any one “Loss Occurrence” shall be limited to all individual losses sustained by the Company occurring during any period of 168 consecutive hours arising out of and directly occasioned by the same event except that the term “Loss Occurrence” shall be further defined as follows: “Loss Occurrence” means the sum of all individual losses directly occasioned by any one disaster, accident or loss or series of disasters, accidents or losses arising out of one event which occurs within the area of one state of the United States or province of Canada and states or provinces contiguous thereto and to one another. However, the duration and extent of any one “Loss Occurrence” shall be limited to all individual losses sustained by the Company occurring during any period of 168 consecutive hours arising out of and directly occasioned by the same event, except that the term “Loss Occurrence” shall be further defined as follows: (i) As regards windstorm, hail, tornado, hurricane, cyclone, including ensuing collapse and water damage, all individual losses sustained by the Company occurring during any period of 72 consecutive hours arising out of and directly occasioned by the same event. However, the event need not be limited to one state or province or states or provinces contiguous thereto. 1. As regards windstorm, hail, tornado, (other than tropical depression, tropical storm, hurricane or typhoon, and all other atmospheric perils arising out of a tropical cyclone), including ensuing collapse and water damage, all individual losses sustained by the Company occurring during any period of 72 consecutive hours arising out of and directly occasioned by the same event. However, the event need not be limited to one state or province or states or provinces contiguous thereto. Occurrence- for Property Catastrophe) (ii) As regards riot, riot attending a strike, civil commotion, vandalism and malicious mischief, all individual losses sustained by the Company occurring during any period of 72 consecutive hours within the area of one municipality or county and the municipalities or counties contiguous thereto arising out of and directly occasioned by the same event. The maximum duration of 72 consecutive hours may be extended in respect of individual losses which occur beyond such 72 consecutive hours during the continued occupation of an Assured’s premises by strikers, provided such occupation commenced during the aforesaid period. 40 Occurrence- for Property Catastrophe) 2. As regards riot, riot attending a strike, civil commotion, vandalism and malicious mischief, all individual losses sustained by the Company occurring during any period of 72 consecutive hours within the area of one municipality or county and the municipalities or counties contiguous thereto arising out of and directly occasioned by the same event. The maximum duration of 72 consecutive hours may be extended in respect of individual losses which occur beyond such 72 consecutive hours during the continued occupation of an insured’s premises by strikers, provided such occupation commenced during the aforementioned period. ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Loss Occurrence cont’d Older Clause (Property Loss Occurrence- for Property Catastrophe) (iii) As regards earthquake (the epicenter of which need not necessarily be within the territorial confines referred to in the opening paragraph of this Article) and fire following directly occasioned by the earthquake, only those individual fire losses which commence during the period of 168 consecutive hours may be included in the Company’s “Loss Occurrence”. (iv) As regards “Freeze”, only individual losses directly occasioned by collapse, breakage of glass and water damage (caused by bursting of frozen pipes and tanks) may be included in the Company's “Loss Occurrence”. For all “Loss Occurrences”, other than (ii) above, the Company may choose the date and time when any such period of consecutive hours commences provided that it is not earlier than the date and time of the occurrence of the first recorded individual loss sustained by the Company arising out of that disaster, accident or loss and provided that only one such period of 168 consecutive hours shall apply with respect to one event, except for any “Loss Occurrence” referred to in sub-paragraph (i) above where only one such period of 72 consecutive hours shall apply with respect to one event, regardless of the duration of the event. As respects those “Loss Occurrences” referred to in (ii) above, if the disaster, accident or loss occasioned by the event is of greater duration than 72 consecutive hours, then the Company may divide that disaster, accident or loss into two or more “Loss Occurrences” provided no two periods overlap and no individual loss is included in more than one such period and provided that no period commences earlier than the date and time of the occurrence of the first recorded individual loss sustained by the Company arising out of that disaster, accident or loss. No individual losses occasioned by an event that would be covered by 72 hours clauses may be included in any “Loss Occurrence” claimed under the 168 hours provision. 41 Newer Clauses (Property Loss Occurrence- for Property Catastrophe) 3. As regards tropical depression, tropical storm, hurricane or typhoon, and all other atmospheric perils arising out of a tropical cyclone, including ensuing collapse and water damage, all individual losses sustained by the Company occurring during any period of 96 consecutive hours arising out of and directly occasioned by the same event. However, the event need not be limited to one state or province or states or provinces contiguous thereto. 4. As regards earthquake (the epicenter of which need not necessarily be within the territorial confines referred to in the opening paragraph of this Article) and fire following directly occasioned by the earthquake, only those individual fire losses which commence during the period of 168 consecutive hours may be included in the Company’s “Loss Occurrence.” 5. As regards “freeze,” only individual losses directly occasioned by collapse, breakage of glass and water damage (caused by bursting of frozen pipes and tanks) may be included in the Company’s “Loss Occurrence.” For all “Loss Occurrences” the Company may choose the date and time when any such period of consecutive hours commences, provided that it is not earlier than the date and time of the occurrence of the first recorded individual loss sustained by the Company arising out of that disaster, accident or loss and provided that only one such period of 168 consecutive hours shall apply with respect to one event, except for those “Loss Occurrences” referred to in subparagraphs (1), (2) and (3) above where the applicable shortened period of consecutive hours shall apply with respect to one event, regardless of the duration of the event. Losses arising from a combination of two or more perils as a result of the same event shall be considered as having arisen from one “Loss Occurrence.” Notwithstanding the foregoing, the hourly limitations as stated in subparagraphs (1), (2), (3) and (4) above, shall not be exceeded as respects the applicable perils, and no single “Loss Occurrence” shall encompass a time period greater than 168 consecutive hours. ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Loss Occurrence cont’d Newer Clause 1. “Loss Occurrence” means the sum of all individual losses directly occasioned by any one disaster, accident or loss or series of disasters, accidents or losses arising out of one event. However, the duration and extent of any one “Loss Occurrence” shall be limited to all individual losses sustained by the Company occurring during any period of 168 consecutive hours arising out of and directly occasioned by the same event except that the term “Loss Occurrence” shall be further defined as follows: Newer Clause Named Event means any active named hurricane/windstorm occurring in the Atlantic Basin during the Period of this Contract that is identified and assigned a name by the National Weather Service/National Hurricane Center or their successors (“NWS”/”NHC”) . For purposes of determining coverage under this Contract, the parties shall use the NWS/NHC determination of the location of each Named Event storm and the time and place the Named Event storm makes landfall. 42 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 Loss Occurrence cont’d Information Technology Clarification (2000) Losses directly or indirectly occasioned by: (i) loss of, alteration of, or damage to or (ii) a reduction in the functionality, availability or operation of a computer system, hardware, programme, software, data, information repository, microchip, integrated circuit or similar device in computer equipment or noncomputer equipment, whether the property of the policyholder of the Company or not, do not in and of themselves constitute an event unless arising out of one or more of the following perils: fire, lightning, explosion, aircraft or vehicle impact, falling objects, windstorm, hail, tornado, cyclone, hurricane, earthquake, volcano, tsunami, flood, freeze or weight of snow. 43 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 CONCLUDING THOUGHTS • Newer Clauses Are More Complex • Many Clauses Are Integrated and Offer Alternative Formulations of Traditional Contract Wording With a Variety of Options • Clauses Attempt to Address Legal Issues Arising From Court Cases Like Occurrences, Privilege and Corporate Activity 44 ARIAS•U.S. 2015 Fall Conference / November 12, 2015 CONTACT INFORMATION Elaine A. Caprio President Caprio Consulting 30 Newbury Street, 3rd Floor Boston, MA 02116 617-833-9576 Elaine@Caprio.Consulting John Phillips Senior Vice President - Contracts Manager Gen Re - A Berkshire Hathaway Company 120 Long Ridge Road, Stamford CT 06902 Tel.203-328-5928 | Cell 203-685-6234 | john.phillips@genre.com Myra E. Lobel, ARe, Esq. Managing Director Guy Carpenter 1166 Avenue of the Americas, New York, N.Y. 10036-2708 Phone 917.937.3157 | Fax 917.937.3657 | myra.e.lobel@guycarp.com www.guycarp.com Joseph L. Pulvirenti Vice President, Senior Counsel and Contract Wording Specialist Partner Reinsurance Company of the US One Greenwich Plaza Greenwich, CT 06830 tel: (203) 485-4530 fax: (203) 485-4531 Larry P. Schiffer Squire Patton Boggs (US) LLP 30 Rockefeller Plaza, 23rd Fl New York, NY 10112 646-557-5194 larry.schiffer@squirepb.com 45 ARIAS•U.S. 2015 Fall Conference / November 12, 2015