Lecture 8: Debt Markets and Term Structure

Lecture 9: Debt Markets and

Term Structure

Discount Bonds

• No coupon payments, just principal at maturity date (conventionally, $100).

• Initially sold at a discount (less than $100) and price rises through time, creating income.

• Term

T, Yield to Maturity (YTM) r

P t

( 1

1 r )

T

P t

1

( 1

r / 2 )

2 T

Compound Interest

• If annual rate is r, compounding once per year, balance = (1+ r ) t after t years.

• If compounded twice per year, balance is

(1+ r /2) 2 t after t years.

• If compounded n times per year, balance is

(1+ r / n ) nt after t years.

• Continuous compounding, balance is e rt .

Price & Yield on T-Bills

• For buyer, Price = 100-Discount

• Discount = asked*(Days to Maturity/360).

• Yield = (Discount/Price)(365/(Days to

Maturity)). (Unless maturity > 6 months, in which case quadratic formula using semiannual compounding is required.)

Example Dec 18, 2000

• T-Bill maturing March 15, Asked=5.83%,

87 days to maturity.

• Discount = 5.83*87/360=1.40891

• Price=100-1.40891=98.59108

• Yield=(1.40891/98.59108)(365/87)=5.995%

Conventional Bonds Carry

Coupons

• Conventional Bond Issued at par (100), coupons every six months.

P t

c (

1 r

( 1

1 r )

T

1

) r

100

( 1

r )

T

P t

c

2

( r /

1

2

( 1

r

1

2

2 T r /

1

2

)

100

( 1

r 2

2 T

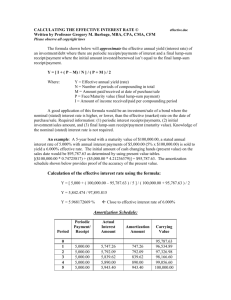

Bond Yield Tables

Term Structure of Interest Rates

• Yield to maturity plotted against term

• Also called “The Yield curve”

• Usually upward sloping

• Inverted yield curve

• Hump shaped yield curve

0.1

Term Structure of Interest Rates, 1999 and 2004

7

Nov-00

6

5

4

3

2

1

0

1

Jan-04

10

Maturity in Years

100

Causes of Interest Rates

• Eugen von Böhm-Bawerk:

Capital and

Interest , 1884: technological progress, time preferences, advantages to roundaboutness

• Irving Fisher 1867-1947, wrote

Theory of

Interest 1930

Irving Fisher Yale ‘88

Irving Fisher Diary at Yale

• July 31, 1885 “it is neither politic nor right to study at the expense of one’s health.” Rowing.

• “When I fall in love she must be a girl of pure morality, broad culture and fine tastes.”

• “I have an earnest desire to be good and useful”

• April 4, 1886, roommate dies of a “cold.”

• May 29, 1887, “I take great satisfaction in my election to Bones for I felt it to be my first little conquest among men. As a freshman I was afraid of my own voice.”

Irving Fisher Diagram Today

Forward Rates

• Forward rates are interest rates that can be taken in advance using term structure

• J. R. Hicks

Value and Capital 1939

( 1

r

2

)

2

( 1

r

1

)( 1

f

2

)

( 1

r k

) k

( 1

r k

1

) k

1

( 1

f k

)

Example of Forward Rates

• Suppose I in 1925 expect to have £100 to invest in

1926, but want the money back by 1927. How can

I guarantee the interest rate on the £100 investment today (1925)?

• Buy in 1925 (1

+r

2

) 2 /( 1 +r

1

) 2-period discount bonds maturing at £100 in 1927. Cost: £1/(1+ r

1

)

• Short in 1925 one 1-period discount bond maturing at £100 in 1926. Receive: £1/(1+ r

1

)

• I have now locked in the interest rate 1+ f =(1 +r

2

)2 /

(1 +r

1

) between 1926 and 1927.

Expectations Theory

• Forward rates equal expected spot rates

• Slope of term structure indicates expected future change in interest rates.

Liquidity Preference Hypothesis

• Forward rates equal expected future spot rates plus a “risk premium.” (J. R. Hicks,

1939)

• Modigliani and Sutch: Risk premium could be either positive or negative. Preferred habitat hypothesis

Inflation and Interest Rates

• Nominal rate quoted in dollars, real rate quoted market baskets

• Nominal rate usually greater than real rate.

( 1

r money

)

( 1

r real

)( 1

i ) r money

r real

i

Indexed Bonds

• Paul Revere, Massachusetts, 1780

• U. S. Treasury, 1997

• TIPS Treasury Inflation Protection

Securities, $115 billion outstanding 2000,

2% of US national debt

• UK Index-Linked Gilts 20% of debt

• France recently issued Euro Index bonds