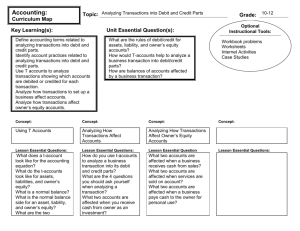

Chapter 2 Unit 3 Balance Sheet Accounts

advertisement

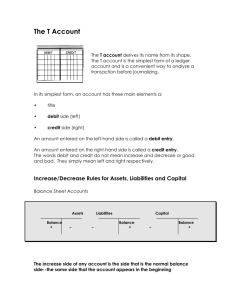

Chapter 2 Unit 3 Balance Sheet Accounts Mrs. Joudrey Recording Transactions in T-Accounts • Transaction analysis sheets (unit2) are impractical in the business world because of the amount of transactions an actual business would have in the run of a day, week, month, or year. Therefore, we are going to break each account out and create T-accounts for them to record what goes on in each account. Recording Transactions in T-Accounts • Every item on the balance sheet will have its own account/ T-account. As transactions occur, the changes as a result of these transactions will be recorded in these T-accounts. Recording Transactions in T-Accounts • T-accounts have two sides. The left hand side of an account is called debit and the right hand side of the account is called credit. _________________ Debit │ Credit Example using the cash account: ______Cash________ Debit │ Credit Left = Debit Right = Credit • The left side will always be a debit and the right side always a credit. One side of the T-account will be for recording increases and the other side decreases – however, it depends on what account you are dealing with (asset, liabilities, owner’s equity) whether the increase will be recorded on the right or left side of the account. Opening Balances • The opening balances for all accounts can come right off of the balance sheet. The side of the balance sheet the items are on will tell you what side the opening balance should be on. Left = Debit Right = Credit • For example assets are listed on the left side of the balance sheet, therefore the opening balances for all of the asset accounts will be on the ____________ side of a T-account. • Liabilities will have opening balances on the ______side of a T-account because they are recorded on the ________ side of a balance sheet. Left = Debit Right = Credit • Owner’s Equity will have opening balances on the ______side of a T-account because they are recorded on the ________ side of a balance sheet. Please record this in your notebooks Dr. _____Assets____Cr. + │ Dr.____Liabilities____Cr. │ + Dr._____OE_____Cr. │ + Introducing Ledgers • A ledger is a group of accounts. • Think about the balance sheet as a large T. This will help you remember where the normal opening balance will go. To Open Accounting in the Ledger • • Place the account name in the middle of each account. Record the date and opening balance from the balance sheet on the correct side. Open the accounts for the following items: Ledgers • Since assets are recorded on the left side of the balance sheet their amounts have been recorded on the left side of the account we have set up. • Liabilities are on the right side of the balance sheet therefore their amounts are recorded on the right side of the accounts. (same for owner’s equity) Please Complete the Following: • Add up all the debit balances (left side of the T-accounts) • Add up all the credit balances (right side of the T-accounts) • What do you notice? Double-Entry Accounting • Double-entry accounting requires a debit amount equal to the credit amount for each transaction. • Therefore if you have a debit amount of $500, you will need to record a credit amount of $500. Recording Transactions in Accounts • Determine which accounts will change (there will always be two or more accounts) • Identify the type of account that has changed. Is the account an A, L, or OE? • Decide whether the change is an increase or decrease in the account. • Decide whether the change is recorded as a debit or credit in the account. REMEMBER THE DEBITS MUST EQUAL THE CREDITS – EVERYTHING MUST STILL BALANCE! Record the Following Transaction Aug. 2 Received $500 cash as payments on membership dues owing. • What accounts will change? • What types of accounts are they (A, L, or OE)? • Is the change an increase or decrease in the account? • Should the change be recorded as a debit or credit in the account? Record the Following Transaction • Aug. 5 Purchased $25 worth of office supplies from Central Supply Co. with 30 days to pay. 1. what accounts are affected? 2. what types of accounts (A, L, OE)? 3. Increase or decrease? 4. Debit or credit? Record the Following Transaction • Aug. 5 Paid $705 now due to Equipment Unlimited for goods previously purchased but not paid for. 1. what accounts are affected? 2. what types of accounts (A, L, OE)? 3. Increase or decrease? 4. Debit or credit? Record the Following Transaction • Aug. 7 Purchased three new tennis trainers for $545 each (total $1635). A cash down payment of $535 was made. The remaining is to be paid at a later date. 1. what accounts are affected? 2. what types of accounts (A, L, OE)? 3. Increase or decrease? 4. Debit or credit? Record the Following Transaction • Aug. 7 Owner invested an additional $5000 in the business. 1. what accounts are affected? 2. what types of accounts (A, L, OE)? 3. Increase or decrease? 4. Debit or credit? Calculating New Balances in the Accounts 1. Add up the debit side of the account (using a single line if there is more than one number). 2. Add up the credit side of the account (using a single line if there is more than one number). 3. Subtract the smaller amount from the larger amount and place the answer on the larger side of the account. This is the new balance for this account. 4. Write the word balance next to the balance. Account Balances • The account balances are always places on the side of the account that has the larger total. For assets, this is usually the debit side and for liabilities and owner’s equity this is usually the credit side. Preparing a Trial Balance • A trail balance is prepared to verify that the total debits are still equal to the total credits in the ledger. • The first column of numbers is used to record the debit balances and the second column is used to record the credit balances. Trail Balance Heading Information • Who? • What? • When? Goldman’s Gym Trial Balance August 7, 2011 Trial Balance Limitations of the Trial Balance • The trail balance only indicates if for each transaction there were debits that equalled the same amount for credits. • It does not tell us if the amounts were recorded in the correct accounts on the correct side (debit or credit). If you record an amount on the wrong side the account will actually be off double that amount. Limitations of the Trial Balance • Ex. If the company paid $500 cash for something. Incorrect ______Cash______ 1500 500_____________ 2000 Correct ______Cash______ 1500 500 1000 How to Check for Errors in Trial Balance • Note that the difference between the one done correctly and the one done incorrectly is twice the amount ($500 x 2 = $1 000) Activity • Prepare a new balance sheet for Goldman’s Gym from the information we have in the accounts (use the new balance amounts)