Co-movement of Stock Prices in the CARICOM Region

advertisement

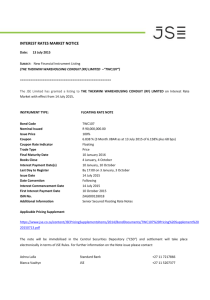

CO-MOVEMENT OF STOCK PRICES IN THE CARICOM REGION JOHN COZIER AND PAT R I C K WAT S O N BBF5 CONFERENCE M AY 2 - 3 , 2 013 OUTLINE OF PRESENTATION Introduction Methodology and Data Empirical Analysis Preliminary Estimation of GARCH Estimation of Copula Conclusions INTRODUCTION Financial integration in the CARICOM Region Importance of stock price comovement Baur (2003) Stock price comovement in the literature Developed markets Kim and Langrin (CARICOM markets) METHODOLOGY AND DATA Preliminary Analysis Correlation coefficients oJanuary 1, 1998 – December 31, 2011 oJanuary 1, 1998 – March 31, 2008 oApril 1, 2008 – December 31, 2011 Sharpe Ratio GARCH-Copula oBollerslev (2008) METHODOLOGY AND DATA Data End of day values of the Composite Indices from January 1, 1998 – December 31, 2011 BSE JSE TTSE NYSE GARCH Copula: End of day values from April 1, 2008 – December 31, 2011 TTSE JSE Ju l NYSE BSE ua ry Ja n 01 2 8, 2 6 09 20 00 ,2 18 l1 3, y 3 1 00 20 0 2, 2 25 , 99 8 1, 1 ob er 2 ry A pr i O ct Ja nu a M ay 20 40 60 80 100 120 FIGURE 1 – EVOLUTION OF COMPOSITE INDICES (1998-2011) 120 40 60 80 100 FIGURE 2 - EVOLUTION OF COMPOSITE INDICES (APRIL 1, 2008-DECEMBER 31, 2011) (APRIL 1, 2008-DECEMBER 31, 2011) November 30, 2007 April 13, 2009 TTSE JSE August 26, 2010 NYSE BSE January 8, 2012 TABLE 1 - CORRELATION COEFFICIENTS FOR THE COMPOSITE INDICES BSE JSE TTSE BSE 1.0000 JSE 0.6275 1.0000 TTSE 0.6292 0.9211 1.0000 NYSE 0.2749 0.4528 0.38268 NYSE 1.0000 January 1998 – March 2008 BSE 1.0000 JSE 0.5267 1.0000 TTSE 0.6215 0.8196 1.0000 NYSE -0.5432 -0.3648 -0.7255 1.0000 April 2008 – December 2011 BSE 1.0000 JSE 0.5849 1.0000 TTSE 0.5584 0.9501 1.0000 NYSE -0.0212 0.5951 0.5464 1.0000 110,000 1,200 90,000 1,000 Index (JSE) 100,000 1,100 Figure 3 – BSE / TTSE 80,000 70,000 Figure 3 - TTSE/BSE 700 800 900 1,000 1,100 JSE/BSEIndex (BSE) 800 900 Index (TTSE) 1,000 900 800 Index (TTSE) 1,100 1,200 FIGURES 3 – 5: SCATTERPLOTS FOR THE RELATIONSHIPS BETWEEN THE CARICOM COMPOSITE INDICES Figure 4 - TTSE/JSE Figure 5 – 700 800 900 1,000 1,100 Index (BSE) Figure 4 – JSE / TTSE 700 800 900 1,000 Index (BSE) Figure 5 – BSE / JSE 1,100 1,200 1,000 70,000 400 80,000 600 800 Index (TTSE) 100,000 90,000 Index (JSE) 900 800 700 Index (BSE) 1,000 110,000 1,100 FIGURES 6 – 8: SCATTERPLOTS FOR THE RELATIONSHIPS BETWEEN THE CARICOM AND NYSE INDICES 4,000 6,000 8,000 Index (NYSE) 10,000 4,000 6,000 8,000 Index (NYSE) Figure 6 - BSE/NYSE Figure 7 - JSE/NYSE 10,000 4,000 6,000 8,000 Index (NYSE) Figure 8 - TTSE/NYSE 10,000 -2 0 -2 -6 -4 Daily Return (JSE) 0 2 2 4 4 FIGURES 9 – 12: DAILY RETURNS (JANUARY 1998 – DECEMBER 2011) FIGURE 9 – BSE FIGURE 10 - JSE May 1, 1998 Jan. 25, 2001 Oct. 22, 2003 July 18, 2006 April 13, 2009 January 8, 2012 Date May 1, 1998 Jan. 25, 2001 Oct. 22, 2003 July 18, 2006 April 13, 2009 Jan. 8, 2012 Date FIGURE 12 - NYSE 0 Daily Return (NYSE) -5 -2 -1 0 1 5 2 FIGURE 11 - TTSE May 1, 1998 Jan. 25, 2001 Oct. 22, 2003 July 18, 2006 April 13, 2009 Jan, 8, 2012 Date May 1, 1998 Jan. 25, 2001 Oct. 22, 2003 July 18, 2006 April 13, 2009 Jan. 8, 2012 Date TABLE 2 - CORRELATION COEFFICIENTS OF THE RETURNS ON BSE, JSE, TTSE AND NYSE 1998 – 2011 BSE JSE TTSE BSE 1.0000 JSE 0.0460 1.0000 TTSE 0.0512 0.1248 1.0000 NYSE 0.0170 0.0226 -0.0032 NYSE 1.0000 January 1998 - March 2008 BSE 1.0000 JSE 0.1208 1.0000 TTSE 0.1153 0.3724 1.0000 NYSE -0.0216 0.0119 -0.0271 1.0000 April 2008 – December 2011 BSE 1.0000 JSE 0.0406 1.0000 TTSE 0.0483 0.0711 1.0000 NYSE 0.0173 0.0253 0.0003 1.0000 TABLE 3 - SUMMARY STATISTICS OF DAILY RETURNS (APRIL 2008 – DECEMBER 2011) Mean Minimum Maximum Standard Deviation Skewness Kurtosis Sharpe Ratio BSE -0.01600 -1.74348 3.63590 0.19121 4.37807 167.153 -232.39 JSE -0.0055 -2.74428 3.45594 0.09350 0.35179 32.18026 -81.17 TTSE 0.000927 -1.507199 0.66052 0.14517 -1.40828 20.20038 -225.01 NYSE -0.00745 0.84153 -0.29779 8.367126 -46.46 -4.44373 5.00557 EMPIRICAL ANALYSIS Estimation of the GARCH The intercepts (𝑐0 ) and mean coefficients (𝑐1 ) for the markets are all relatively close to zero. Two out of the four had negative intercepts (the BSE and the NYSE). Only the NYSE possessed a negative mean coefficient over the sample period. The GARCH coefficient (ω) for the BSE was the largest by a fairly substantial margin. The remainder of the markets had relatively small GARCH coefficients. The coefficient for α of the BSE is further evidence that there is very little volatility within this market. EMPIRICAL ANALYSIS The β coefficient in the AR (1) – GJR (1, 1) model for the BSE (0.4852) was much lower in value less than its three counterparts (0.9347, 0.9285 and 0.9264) and it should be noted that the β for these remaining three was relatively similar to each other. The degrees of freedom parameter υ was equal to two for all the markets except the NYSE, where it was close to eight (7.9466). The parameter for asymmetry or skewness (λ) for the BSE and the NYSE showed negative skewness in the returns over the time period while the asymmetry parameter for the TTSE (0.1071) was much larger than for the JSE (0.0043). EMPIRICAL ANALYSIS Estimation of the Copula Firstly, no results are available from the Symmetrized Joe Copula vine. The estimated parameters for the remaining two Copula vines suggest very little dependence among the four markets (Table 5). There also seems to be little difference in the estimated parameters for the Clayton and the t methods under the Canonical and the d-vines. The only glaring differences can be seen in the parameters for 𝒂𝒕𝒕𝒔𝒆/𝒏𝒚𝒔𝒆 , 𝒂𝒃𝒔𝒆/𝒕𝒕𝒔𝒆|𝒋𝒔𝒆 and 𝒂𝒃𝒔𝒆/𝒏𝒚𝒔𝒆|𝒋𝒔𝒆/𝒕𝒕𝒔𝒆 . EMPIRICAL ANALYSIS The lack of a dependence structure is especially evident upon closer examination of the structures involving the NYSE. This could provide some understanding as to why there seems to be relatively minimal fallout for the CARICOM stock markets resulting from the sub-prime mortgage crisis, which precipitated the global recession. CARICOM stock markets are sufficiently underdeveloped that they represent unattractive investment vehicles due to rigid market illiquidity. Log Likelihood value suggests that the t-distribution d-vine method most effectively explains the relationships existing between the CARICOM stock markets and the NYSE. However, the Clayton d-vine appears to best explain these relationships based on Akaike’s Information Criterion as well as the Bayesian Information Criterion. EMPIRICAL ANALYSIS The bivariate copulas, especially the tDCC method, seem to display a substantial degree of dependence among the respective market pairs. The CARICOM stock markets exhibit substantial dependence structures with each other. The BSE-NYSE dependence structure is considerably lower than the other two CARICOM markets (as evidenced by the β indicator in the tDCC and the GDCC methods). The TTSE-NYSE relationship is the most significant among the three bivariate copulas involving the NYSE. β indicator for the JSE/TTSE (approximately 0.98 under both the tDCC and the GDCC methods) suggests a significant dependence between the JSE and the TTSE. The JSE and the TTSE are highly integrated with each other (with both markets possibly close to being fully integrated with each other), which has resulted in significant co-movement of prices for their listed securities. EMPIRICAL ANALYSIS The BSE and the JSE (0.85 under the tDCC and 0.84 under the GDCC). There is some amount of integration between the BSE and the JSE. Based on the Log Likelihood criterion, the Gaussian Dynamic Conditional Correlation model appears to be the best fit for all except the TTSE/NYSE relationship, which appears to be best explained by the Student’s t copula (tDCC model). The tDCC model seems to be the best fit under the Akaike’s and the Bayesian Criteria. EMPIRICAL ANALYSIS Time varying Clayton (tvC) Copulas show relatively similar β parameters for the three corresponding pairs for the CARICOM stock markets (all within the 4.62 – 4.63 range) which could mean dependence among the markets. The result for the static SJC (SJC) copula show little difference between the upper and lower tails as evidenced by its 𝑇 𝑈 − 𝑇 𝐿 parameter. The time varying SJC (tvSJC) copula shows a significant difference in the β parameters for the lower and upper tails for the BSE/JSE relationship (0.3831 and 9.8648). The BSE/TTSE show little disparity in this parameter. EMPIRICAL ANALYSIS There are some disparities in determining which of the three models has the best goodness of fit indicator. If the Log Likelihood criterion is used for this purpose, the tvSJC copula is most appropriate for explaining the dependence structures for the BSE/TTSE and the JSE/TTSE. The SJC copula is appropriate for the BSE/JSE. The tvSJC copula is best for the BSE/JSE and the JSE/TTSE structures under the Akaike’s Information Criterion (the tvC copula for BSE/TTSE). The tvSJC copula is arguably best fit for all three under the Bayesian Information Criterion. EMPIRICAL ANALYSIS The copulas involving the NYSE (as seen in Table 8) yielded some interesting results. JSE/NYSE: Negative in all of its parameters for the time varying Clayton copula (-7.4874, -1.7807 and -0.8482). The estimations for the SJC copula show little to no difference between the tails and little variance occurring. BSE/NYSE: The only one out of the three possible relationships which shows relative closeness between the β parameters for the lower and upper tails (2.2552 and 3.7025) when one analyses the tvSJC copula. JSE/NYSE and the TTSE/NYSE: Significant differences between these parameters (0.3859, 8.6022 for the former and 0.7031, 4.0764 for the latter). CONCLUSIONS It can be argued that there appears to be comovement in stock prices within the CARICOM stock markets. This is evidenced by the derived bivariate copula estimations. The tDCC copula estimations suggest significant dependence structures between the three CARICOM stock markets, with the most significant being the one between the JSE and the TTSE. CONCLUSIONS However, this does not seem to be fully the case for the structures between each of the CARICOM markets and the NYSE. The TTSE is argued to possess the most developed dependence structure with the NYSE among the three CARICOM stock markets studied. It can be argued that the level of dependence among the CARICOM markets, both as a group and individually, with the NYSE is underdeveloped and not as pronounced. This could be an explanation why the regional markets were not as affected in the fallout from the U.S. originated financial crisis. CONCLUSIONS Further research may be needed to ascertain the factors which affect the dependence among the regional markets as well as whether it is important for the regional markets to strengthen the dependence structure with the NYSE. THE END THANK YOU FOR YOUR ATTENTION.