Applications: Deadweight Loss

advertisement

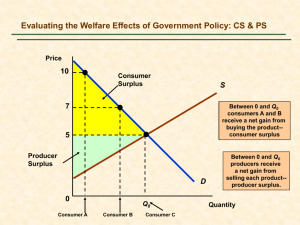

APPLICATIONS: DEADWEIGHT LOSS ETP Economics 101 DEADWEIGHT LOSS Changes in Welfare A deadweight loss is the fall in total surplus that results from a market distortion, such as government regulations on prices and tax. Price ($ per month) RENT CONTROL: EQUILIBRIUM 1100 b 1000 900 0 supply equilibrium excess demand 290 300 demand 310 Quantity (Thousand units a month) Rent Control: Surpluses Price ($ per month) Consumer surplus gain = cfeg Consumer surplus loss = dgb Producer surplus loss = cfeg + geb Deadweight loss=dgb+geb d 1100 1000 c 900 f b g supply e demand 0 290 300 310 Quantity (Thousand units a month) Wage ($ per hour) MINIMUM WAGE: EQUILIBRIUM a excess supply supply 4.20 b 4.00 equilibrium c 0 demand 8 10 11 Quantity (Billion worker-hours a week) Wage ($ per hour) Minimum Wage: Surpluses seller (employee) surplus gain = fdge seller (employee) surplus loss = ghb buyer (employer) surplus loss = fdge + egb Deadweight loss=ghb+egb a 4.20 4.00 f d supply e b g h c 0 demand 8 10 11 Quantity (Billion worker-hours a week) FIGURE 1 THE EFFECTS OF A TAX Price Supply Price buyers pay Size of tax Price without tax Price sellers receive Demand 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western TAX WEDGE A tax places a wedge between the price buyers pay and the price sellers receive. Because of this tax wedge, the quantity sold falls below the level that would be sold without a tax. The size of the market for that good shrinks. FIGURE 2 TAX REVENUE Price Supply Price buyers pay Size of tax (T) Tax revenue (T × Q) Price sellers receive Demand Quantity sold (Q) 0 Quantity with tax Quantity without tax Quantity Copyright © 2004 South-Western FIGURE 3 HOW A TAX EFFECTS WELFARE Price Price buyers = PB pay Supply A B C Price without tax = P1 Price sellers = PS receive E D F Demand 0 Q2 Q1 Quantity Copyright © 2004 South-Western DETERMINANTS OF DEADWEIGHT LOSS What determines whether the deadweight loss from a tax is large or small? The magnitude of the deadweight loss depends on how much the quantity supplied and quantity demanded respond to changes in the price. That, in turn, depends on the price elasticities of supply and demand. DETERMINANTS OF DEADWEIGHT LOSS The greater the elasticities of demand and supply: the larger will be the decline in equilibrium quantity and, the greater the deadweight loss of a tax. FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (a) Inelastic Supply Price Supply When supply is relatively inelastic, the deadweight loss of a tax is small. Size of tax Demand 0 Quantity Copyright © 2004 South-Western FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (b) Elastic Supply Price When supply is relatively elastic, the deadweight loss of a tax is large. Size of tax Supply Demand 0 Quantity Copyright © 2004 South-Western FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (c) Inelastic Demand Price Supply Size of tax When demand is relatively inelastic, the deadweight loss of a tax is small. Demand 0 Quantity Copyright © 2004 South-Western FIGURE 5 TAX DISTORTIONS AND ELASTICITIES (d) Elastic Demand Price Supply Size of tax Demand When demand is relatively elastic, the deadweight loss of a tax is large. 0 Quantity Copyright © 2004 South-Western DEADWEIGHT LOSS AND TAX RATE With each increase in the tax rate, the deadweight loss of the tax rises even more rapidly than the size of the tax. TAX REVENUE AND TAX RATE For the small tax, tax revenue is small. As the size of the tax rises, tax revenue grows. But as the size of the tax continues to rise, tax revenue falls because the higher tax reduces the size of the market. FIGURE 6 DEADWEIGHT LOSS AND TAX REVENUE FROM THREE TAXES OF DIFFERENT SIZES (a) Small Tax Price Deadweight loss Supply PB Tax revenue PS Demand 0 Q2 Q1 Quantity Copyright © 2004 South-Western FIGURE 6 DEADWEIGHT LOSS AND TAX REVENUE FROM THREE TAXES OF DIFFERENT SIZES (b) Medium Tax Price Deadweight loss PB Supply Tax revenue PS 0 Demand Q2 Q1 Quantity Copyright © 2004 South-Western FIGURE 6 DEADWEIGHT LOSS AND TAX REVENUE FROM THREE TAXES OF DIFFERENT SIZES (c) Large Tax Price PB Tax revenue Deadweight loss Supply Demand PS 0 Q2 Q1 Quantity Copyright © 2004 South-Western FIGURE 7 HOW DEADWEIGHT LOSS AND TAX REVENUE VARY WITH THE SIZE OF A TAX Deadweight Loss 0 Tax Size Copyright © 2004 South-Western FIGURE 7 HOW DEADWEIGHT LOSS AND TAX REVENUE VARY WITH THE SIZE OF A TAX Tax Revenue 0 Tax Size Copyright © 2004 South-Western LAFFER CURVE AND SUPPLY-SIDE ECONOMICS The Laffer curve depicts the relationship between tax rates and tax revenue. Supply-side economics refers to the views of Reagan and Laffer who proposed that a tax cut would induce more people to work and thereby have the potential to increase tax revenues.