Lecture 4

advertisement

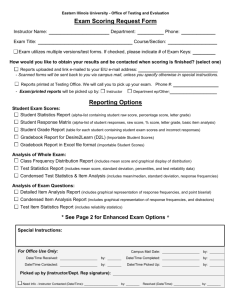

Updated:09/03/2007 Lecture Notes ECON 622: ECONOMIC COST-BENEFIT ANALYSIS Lecture 4 0 ECONOMIC VALUATION OF TRADABLE GOODS & SERVICES 1 Tradable Commodities Classification of a Project’s Inputs and Outputs A good or service is considered tradable when an increase in demand (or supply) by a project does not affect the amount demanded by domestic consumers • An increase in demand for an IMPORTABLE commodity results in an increase in demand for imports • An increase in demand for an EXPORTABLE commodity results in a reduction in exports • An increase in supply of a tradable commodity by a project will cause either a reduction in imports or an increase in exports An Importable commodity includes imported goods and domestically produced goods that are close substitutes for imported goods An Exportable commodity includes exported goods and close substitutes for exported goods 2 Measuring the Economic Values of Tradable Goods: Four Cases 1. Economic value of importable good production 2. Economic cost of importable input 3. Economic cost of exportable input 4. Economic value of export production 3 Importable Good Price S Domestic Supply Distorted World Supply Price Pm Em * PCIF * (1+Tm) + Fm D Domestic Demand Imports = Q d - Q so Q s o Q d o Quantity per year o Em = Market Exchange Rate FM = Domestic Freight to Market Tm = Rate of Import Tariff PCIF = Price of imports at entry point to country, including international freight and insurance charges expressed in units of foreign currency 4 Project Supplies More of an Importable Good Price S domestic S w/ project Em * PCIF* (1+Tm) + Fm S world D domestic Qs0 Qs1 Qd0 Quantity Project reduces quantity imported. No change in domestic consumption. 5 Estimating The Economic Prices of Tradable Goods 1. Adjust for commodity - specific trade distortions • Financial prices for the commodities demanded (or supplied) by a project must be adjusted for commodity-specific distortions and costs that drive a wedge between their international prices and their domestic market prices • Taxes and Subsidies are transfers between consumers, producers, and the government. Therefore, they are not part of the real resources consumed or produced by a project. 2. Value the foreign exchange at the economic (shadow) exchange rate (Ee) • Multiply the CIF and FOB prices at the border by the economic price of foreign exchange (Ee). • Alternatively, add a foreign exchange premium [(Ee/Em) - 1], or [(Ee/OER) - 1], per unit of foreign exchange demanded (or supplied) by a project. 3. Adjust for handling and transportation costs • The economic costs of handling and transportation that are necessary to move commodities to or from the point of entry must be included. • In the case of imported commodities, these costs should be added to the CIF price. • In the case of exported commodities, these costs should be subtracted from the FOB price. 6 Visayas Communal Irrigation Project Basic Facts • The National Irrigation Administration (Philippine National Agency) proposes to rehabilitate 55 damaged communal irrigation systems and to build 25 new systems in Visayas. • The project’s additional components include water protection and erosion control, the strengthening of irrigation association, and the development of agricultural extension services. • The goal of the project is to alleviate poverty, while improving environmental sustainability of the region. The life of project is 20 years. • • The economic benefits arise from the increased production of rice and corn, which must otherwise be imported. • The foreign exchange premium is 24.6%. • The project is expected to cost approximately 480.910 million pesos (US$19.78 million). • The project will be financed with US$15.1 million loan from the International Fund for Agricultural Development, and remaining funding would be provided by the Philippine government. 7 Table 1: Project Supplies an Importable Good (Rice) Value of Economic Financial Adjustment Adjusted Tradable Non-Tradable Value of Forex SPNTO Value Price For Taxes Content Content Value Premium Premium (F=C*D*0.246) (G=C*E*0.01) (H=C+F+G) (A) (B) (C= A*B) (D) (E) 314.8 7659 1 7659 100% 0% 1884 0.00 9543 CIF World (US$) CIF per metric ton of rice PLUS Transportation and Handling Charges Trading Margin Wholesale Price in Manila LESS Transport cost, rice mill to Manila 205 472 8336 1 0.68 205 321 8185 30% 10% 70% 90% 15.13 7.90 1.44 2.89 222 332 10096 515 1 515 30% 70% 38 3.61 557 Ex-mill price of rice 7821 LESS Net milling cost 346 Pre-milled value 7475 Palay equivalent (65%) 4859 LESS Grain dealer margin (4% margin) 194 Transport and handling cost, farm to mill 130 Farmgate price of palay 4534 Conversion Factor 9540 1 346 50% 50% 43 1.73 390 9150 5947 0.68 1 132 130 10% 30% 90% 70% 3 10 1.19 0.91 137 141 5670 1.25 8 Measuring the Economic Values of Tradable Goods: Four Cases 1. Economic value of importable good production 2. Economic cost of importable input 3. Economic cost of exportable input 4. Economic value of export production 9 Project Demands More of an Importable Good Price S domestic Em * PCIF * (1+Tm) + Fm S world D domestic Qs0 Qd0 Qd1 D w/ project Quantity Project requirements will be met by additional imports (world supply). Domestic consumption is not affected. 10 Project Purchases Importable Inputs Input subject to Import Tariff Price D0+P S0 D0 Pd = Em P w(1+t) World Supply After Tariff Em Pw 0 World Supply Qs0 Qd0 Q1d Quantity Financial cost is EmPw (1+t) (Q1d-Q0d) Economic cost is EmPw(Q1d – Q0d) + Foreign exchange premium 11 Economic cost of Importable Goods: With Tariff, Trade Margin and Domestic Freight Price / unit S0 C A E (P3+freight)=P4 (P2+trade margin)=P3 F L J (P1+tariff)=P2 G M K D1 Em (cif)=P1 H B I D0 0 QS0 Q d0 Q1d Quantity of units per year (000’s) 12 Table 2: Project Uses an Importable Good (PESTICIDES). Financial Adjustment Price For Taxes (A) CIF World (US$) CIF per 1000 liters of pesticides PLUS Tariff Port charges, handling and transportation to Manila Importer Price, Manila (B) Value of Economic SPNTO Value Premium (F=C*D*0.246) (G=C*E*0.01) (H=C+F+G) Adjusted Tradable Non-Tradable Content Content Value (C= A*B) (D) (E) Value of Forex Premium 166 4038 1 4038 100% 993.35 5031 201 155 0 1 0 155 0% 30% 0.00 11.44 0 168 70% 1.09 4394 PLUS Transport cost, Manila to local market 515 Dealer's margin 201 Price at local market 5110 PLUS Local transport cost 120 Price at farm gate 5230 Conversion Factor 1.15 5199 1 0.68 515 137 30% 10% 70% 90% 38.01 3.36 3.61 1.23 557 141 5897 1 120 30% 70% 8.86 0.84 130 6026 13 Measuring the Economic Values of Tradable Goods: Four Cases 1. Economic value of importable good production 2. Economic cost of importable input 3. Economic cost of exportable input 4. Economic value of export production 14 Exportable Good Price S Domestic Supply Em * PFOB * (1-tx) - Fx Distorted World Demand Price Pm D Domestic Demand Exports = Q s o- Q d o Q d o Q s o Quantity per year Em = Market Exchange Rate tx = Export Tax Fx = Freight and Trading Costs to Port PFOB= Price of exports at point of export from country in units of foreign currency 15 Project Demands More of an Exportable Good Price S domestic Em * PFOB * (1-tx) - Fx D world D w/ Project D domestic Qd0 Qd1 Qs0 Quantity Project requirements will reduce quantity exported. Consumption of previous consumers remains unchanged. 16 Table 3: Project Uses an Exportable Good (Seeds) Financial Adjustment Adjusted Tradable Non-Tradable Value of Forex Value Price Content Content For Taxes Premium (A) FOB per ton of PADDY SEED (pesos/ton) (B) (C= A*B) (D) (E) Value of Economic SPNTO Premium Value (F=C*D*0.246) (G=C*E*0.01) (H=C+F+G) 6326 1 6326 100.00% 0.00% 1556.20 0.00 7882 Port Handling and Transportation From IRRI to port of Manila 155 1 155 30.00% 70.00% 11.44 1.09 168 IRRI Exporter Price PLUS Transport Cost, IRRI to local market Dealer's margin 6171 Price at Local Market PLUS Local transport cost from Market to farm (Project site) 6921 Price at Farm Gate 7041 Conversion Factor 1.22 LESS 515 235 120 7715 1 0.68 515 160 30.00% 10.00% 70.00% 90.00% 0.00 38.01 3.93 0.00 3.61 1.44 557 165 8436 1 120 30.00% 70.00% 8.86 0.84 130 8566 17 Measuring the Economic Values of Tradable Goods: Four Cases 1. Economic value of importable good production 2. Economic cost of importable input 3. Economic cost of exportable input 4. Economic value of export production 18 Project Supplies More of an Exportable Good Price S domestic S w/ Project D world Em * PFOB * (1-tx) - Fx D domestic Qd0 Qs0 Qs1 Quantity Project increases exports. Domestic consumption remains unchanged. 19 Project Produces Exportable Goods subject to Export Tax (No domestic transportation costs) Price S0 S0+P Em Pw World Demand w Pd=EPmdP=wP(1-t) (1-t) World Demand After Export Tax D0 0 Quantity Q d0 Q s0 Q1s Financial benefit is EmPw (1-t) (Q1s-Q0s) Economic benefit is EmPw(Q1s – Q0s) + Foreign exchange premium Economic values of exportable goods are based on the FOB values of demand for exports 20 Table 4: IRRI Supply an Exportable Good (Seeds) Financial Price (A) FOB Port (US$) 260 FOB Port (Pesos/ton) 6326 LESS Port Charges and transportation 155 from IRRI to Port IRRI Gate Price 6171 Conversion Factor (EV/PV) 1.25 Value of Value of Economic Adjustment Adjusted Tradable Non-Tradable Forex SPNTO Content Content Value Premium Premium Value For Taxes (B) (C= A*B) (D) (E) (F=C*D*0.246) (G=C*E*0.01) (H=C+F+G) 1 1 6326 100.00% 155 30.00% 0.00% 1556.20 0.00 7882 70.00% 11.44 1.09 168 7715 21 SUMMARY Economic Value of Importable Good Production = CIF (adj. For Economic Exchange Rate) + Economic Cost of Local Freight from Port to Market - Economic Cost of Local Freight from Project to Market Economic Cost of Imported Input = CIF (adj. For Economic Exchange Rate) + Economic Cost of Freight from Port to Project Economic Cost of Exportable Input = FOB (adj. For Economic Exchange Rate) + Economic Cost of Local Freight from Export Producer to Project - Economic Cost of Local Freight from Export Producer to Port Economic Value of Exportable Production = FOB (adj. For Economic Exchange Rate) - Economic Cost of Local Freight from Project to Port 22