Development of capital markets forum

advertisement

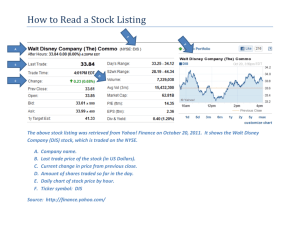

19th ANNUAL RESEARCH WORKSHOP DSE’s EGM AS A VEHICLE FOR CREATING CAPITAL FORMATION AND INCLUSIVE DEVELOPMENT By Marwa Moremi 1 Ledger Plaza Bahari Beach Hotel Dar es Salaam, Tanzania April 09-10, 2014 The Agenda The Dar es Salaam Stock Exchange Role of Stock Exchange to the Economy Overview of EGM & SMEs in Tanzania EGM Experience & Prospects Experience in Other Markets Challenges & Policy Options for a Successful EGM & SMEs Conclusion 2 Role of DSE to the Economy • Raising capital for businesses (also cost efficient & effective future capital raising) • Facilitates privatization of SOE, development of capital markets and economic transformation • Rational allocation of funds, through mobilizing savings for productive investments • Improves corporate governance, transparency, disclosure, management standards & efficiencies • Creating investment opportunities for small investors • Government capital raising for development projects & for monetary policies objectives • Barometer of the economy • All these translates into job creation, more government revenues, better returns to investors & sustainability of businesses & economy. 3 DSE Current Status • DSE started operations in 1998 • 18 listed companies (6 cross listed); 7 through privatization • Domestic market capitalization (TZS 6.2 trillion, total market capitalization TZS17.5 trillion) • Domestic Market cap/GDP (measures depth of the market is ~12%) • All Government bonds are listed: currently worth TZS 3.3 trillion • 4 outstanding corporate bonds worth TZS 47 billion • Investor base ~ 200,000 investors 4 Why & Who should use the DSE? The purpose of listing is very often, but not always to raise capital Management involved in a buy-out of a company Companies that are growing rapidly and feel constrained by inadequate funding can issue shares to provide funds for expansion Companies that wish to provide employees with a stock in ownership Shareholders of companies who wish to realise some of their investments in the company Takeovers and mergers can be facilitated by a listing due to the transparency of a listed company’s accounts as well as the continuous value placed on the shares by the market Parastatals or government controlled corporations may make use of the stock exchange to broaden their shareholder base 5 Basic Listing Requirements (MIM) Share capital amounting to a minimum of Tshs. 500 million A minimum of 1 million shares must be in issue and 25% public shareholding A profitable trading record for two years An acceptable record in its field of business and adequate management to maintain business Other criteria such as the vulnerability of a company to specific factors or events will be taken into consideration The company should have qualified auditor’s report for the preceding 3 years 6 Advantages of Listing into DSE FINANCING to increase the equity base of a company, thus allowing for future expansions and growth without the interest burden associated with borrowed funds A listing creates the possibility of using the company’s shares to finance acquisitions, as sellers are more likely to accept marketable listed shares in exchange for their investments A listing may make it easier to obtain other forms as finance, such as bank loans A listing provides a basis for the valuation of a company’s shares ORIGINAL SHAREHOLDERS All shareholders will benefit from the establishment of a market for their shares, leading to a potentially higher demand and higher prices than would have been the case in a limited market A listing enables original shareholders to realize part or all their holdings. Original shareholders may benefit from the increased liquidity of their investment brought about by a listing 7 Advantages of Listing in DSE EMPLOYEES The implementation of share incentive schemes may result in a significant improvement of the motivation of both staff and management. A listing would make such a scheme more attractive to employees, and facilitate its operation. The public attention focused on the company by the media may boost the morale of employees, as they share in the enhanced status of the company. PUBLIC IMAGE The enhanced status brought about by a listing may favourably affect relations with banks, suppliers, customers and the Government. Stock exchange bulletins and reports in the financial press result in the greater publicity for the company and its product. 8 Methods of Listing Securities on the Exchange An offer for sale of existing or issued securities Initial Public Offering Introduction of Securities already listed in the Exchange outside Tanzania Any other method approved by the Authority Additional new listing of securities: [rights issue, capitalization (or bonus issue), script dividends, or any other method approved by the Authority) 9 Market Segments at DSE Main Investment Market Segment Enterprise Growth Market Segment Fixed Income Securities Market Segment The issuer may seek to transfer from one segment to another upon meeting eligibility criteria and disclosure requirements for the segment to which it wishes to transfer to and shall be subject to the Authority’s approval on the recommendation of the Exchange 10 Enterprise Growth Market FSDT Baseline survey of 2013 indicates that there are more than 3 million SMEs employing more than 5 million people leading sectors are: trade (55%), accommodation & food services (26%), manufacturing (14%) MSMEs contribution to GDP is 27% Key sources of capital for SMEs are: household savings, bank facilities, MFIs loans, and in a relatively small scale PE & VC funds and capital markets (EGM) 11 Enterprise Growth Market-2 Genesis: 2006 Study by CMSA Indicated the existing Listing Rules & Regulation are not inclusive (excludes and not feasible for SMEs) EGM Listing Rules are less stringent Focus on SMEs with: capital base of TZS 200 million; 20% of public float; minimum shareholders of 100; can be a start up (with a feasibility and business plan) i.e. operability and profitability not key; good record keeping & governance structures Inaugurated in November 2013 – has 1 listed and 2 standing applications 12 EGM Experience & Prospects Have one listing – capital raised TZS 4.5 billion 2 applications: for TZS 2.75 billion and TZS 3.2 billion Good source for long term, relatively less costly & sustainable capital Has the potential of financing value chain activities in the commercial agriculture, agro processing light manufacturing industries Have the potential for job and wealth creation in both urban & rural areas Can strategically be used in transforming the social economic dynamics and hence reduce influx of rural to urban migration Will facilitate transforming sources of long term development financing which has traditionally been aid, grant, loans and FDIs 13 EGM Experience, other Countries Alternative, small cap market segments is not unique for Tanzania only Well established capital markets have used this approach to grow their mid-sized companies i.e: London’s AIMs: >3,000 companies, NYSE’s Altenext, Japan’s (Market for Highgrowth & Emerging Stocks – MOTHERS: 192 companies), Malaysia’s ACE Market: 109 companies, Hong Kong GEMs market: 267 companies, Italy’s AIM: 28 companies, Brazil’s Nova Mercado Other African countries with similar model & experience are: South Africa’s Altx: 80 companies, Mauritius’s DEM: 48 companies, Nigeria’s ASeM: 9 companies, Kenya’s GEMs: 1 company, Egypt’s NILEX, Ghana’s GAX 14 EGM Experience, Why established? SMEs’ contribution development in job creation and economic According to research by ACCA (2007-09); SMEs contribution to employment in U.K is 59% (& informal sector contribution to GDP is 11%), in Japan 70% (10%), Malaysia 56% (33%), Hong Kong 48% (19%), Italy 81% (22%), USA 58% (8%) South Africa --%, Mauritius 45% (24%), Nigeria 75% (63%), Kenya 28% (39%), Egypt --%, Ghana 16% (43%) 15 EGM Experience, Tanzania? Lack of sophistication, education and awareness SMEs’ not willing to share ownership, even in exchange for less costly, efficient & better priced capital and also fiscal (tax) incentives SMEs’ not willing for more disclosures, transparency and continuous listing obligations i.e. good governance SMEs’ opts private funding (mostly borrowed funds) to public funding of their businesses Lack of implementation of policies and legislative actions aimed at inclusive economic ownership & development i.e. privatization & EPOC & Mining Acts of 2010 Private sector skeptical due to lack of leadership from the Government 16 Way forward & Conclusion Public education and awareness creation through media, seminars & workshops to focus groups Engage policy makers and the government in efforts to capital market one of the key focus for economic growth i.e. prefer, reward and encourage transparency, encourage privatization through the stock exchange Private sector be encouraged and motivated to transform from small local entities into regional corporate entities through taping sizable and sustainable capital from the public while practicing good corporate governance 17