SIF3pres25Nov05 - PC

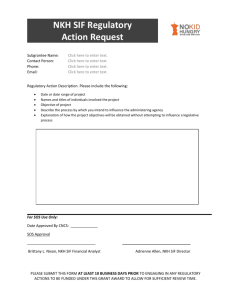

advertisement

Fund raising proposal: SIAM INVESTMENT FUND III L.P. September 2005 Table of Contents A. Summary Terms and Overview B. Track Records of SIF II and SIF C. Fund Concept D. Fund Strategy, Investment Examples & Deal Flow E. Siam Investment Fund III L.P. F. The Advisors and Sponsors G. Biographies H. Contact Information 2 Summary Terms Name of Fund Siam Investment Fund III L.P., a Cayman Islands exempted limited partnership Investment Manager Finansa Capital Ltd., a Cayman Islands exempted company with limited liability Fund Sponsors Finansa Fund Management Ltd. (FFM) and Capital Z Investments L.P. or a successor fund (CZI) General Partner: Siam Investment Partners III L.P. a Cayman Islands exempted limited partnership Target Total Commitments US$100m CZI’s Anticipated Commitment US$10m FFM’s Commitment US$10m Commitment Period Five years from the final closing Term Ten years, subject to two one year extensions Expected Investment Size c. US$10m per investment Management Fee 2% Threshold Return 8% per annum Carried Interest 20% of any net capital appreciation above the threshold return Offering Expenses Limited Partners to reimburse the Investment Manager on a pro-rata basis, the aggregate reimbursement not to exceed US$500,000 This profile is for information purposes only and does not constitute an offer to subscribe to partnership interests in Siam Investment Fund III. An offer to subscribe will be made solely by means of a confidential memorandum. 3 SIF III: Management Structure 4 Overview Background Siam Investment Fund III L.P. (SIF III) is a successor fund to Siam Investment Fund II L.P. (SIF II) which is approaching full investment. SIF II was launched in 2000, raising US$57m . Objective To provide investors with access to the exceptional returns available through timely, opportunistic investment in selective private equity transactions in Thailand. Investment Economy in Transition: Past - Coping with crisis. Present – Cyclical recovery. Future – Structural growth. Thesis Resurgent Business Confidence: A revival in business optimism is spurring a revival in corporate transaction activity and expansion. Restructuring/Rehabilitation to Continue: An improving economy facilitates the resolution of residual business problems. Improving “Exit” Environment: Better capital markets, both for listing and refinancing, and growing demand from local investors for rehabilitated assets. Why SIF III? Successful Track Record: SIF II and its predecessor, SIF, have exceptional records of both making and exiting private equity investments in Thailand over the past seven years. Sponsors are Investors: The Sponsors intend to be material investors in the Fund. Finansa Fund Management will commit US$10m and CZI anticipates US$10m. Value Addition: The Finansa Group has the critical mass of resources locally to support deal flow, monitoring and exits. Single Country Approach: The success of the Funds launched to date is due to the depth of the incountry resources. Comparable resources are not available on a regional basis. 5 Section B Track Record of SIF II Siam Investment Fund II L.P. (SIF II) Established in December 2000 with total commitments of US$57m, SIF II’s objective was to capitalise on investment opportunities in Thailand through privately negotiated equity investments. Managed by Finansa Capital Ltd., the core sponsors of the Fund were CZI and ABN AMRO Asia Capital Investment Ltd. Other investors in SIF II included Norfund, Finnfund, the FMO and Mitsui & Co. To date, c. US$50m has been drawn down: Pranda Jewelry : A 25% stake Evason Phuket Resort and Spa : A 20% stake Leading food service company, targeting the Thai catering industry. Unlisted Siam Paper: A 13% stake One of the leading, listed property developers. Listed. Exited F&B Foodservice (Thailand): A 100% stake Market leader in the manufacture and sale of pickled vegetables. Unlisted. Sansiri : A 5% stake A leading IT services company. Currently exiting. Peace Canning : 80% stake A 260 room resort hotel on the southern tip of Phuket. Unlisted. Loxley Business Information Technology : A 15% stake Thailand’s largest jewelry manufacturer and exporter. Listed on SET. Exited Long established paper producer. A major expansion was disrupted by the 1997 crisis. Expansion will now complete in 2005, following debt restructuring. Planning to list in 2005. INN Connect: A 29% stake INN operates three radio stations in Bangkok and provides content for mobile phoned, Connect One provides ring tones. The aim is to merge the two companies ahead of a listing. 7 Siam Investment Fund II L.P. (SIF II) The investment returns to 30 September 2005 for SIF II are shown in the table below. Initial Date of Inves tment Name Pranda Ev as on L o x b it P e a c e C a n n in g S a n s ir i F & B F o o d S e r v ic e ( T h a ila n d ) S ia m P a p e r SIF II Net IRR 6 /6 /0 1 8 /1 5 /0 1 1 1 /2 /0 1 5 /2 9 /0 2 8 /1 4 /0 2 1 0 /1 5 /0 3 1 0 /2 1 /0 4 Total Inves ted Amount US$ Realized Proceeds US$ Unrealized Value US$ 3 ,3 9 9 ,9 4 9 4 ,5 1 4 ,1 0 8 3 ,9 7 9 ,5 9 8 6 ,8 3 8 ,1 4 5 5 ,2 8 3 ,5 1 4 6 ,6 1 4 ,2 3 4 9 ,4 8 1 ,8 1 8 1 2 ,3 1 7 ,1 5 4 5 3 8 ,5 6 3 7 ,3 9 8 ,9 6 7 9 ,9 5 0 ,7 5 3 - 2 ,9 3 0 ,5 1 0 4 ,3 2 3 ,7 5 2 2 ,5 4 7 ,4 8 0 5 ,5 5 0 ,7 1 2 9 ,5 6 6 ,6 0 3 40,111,365 30,205,437 24,919,056 (i) Peace Canning valued at Book Value: 2004 P/E < 2.0x, but comparables trade at c. 8.0x forward P/E (ii) Net of fees, expenses and carry Inves tor IRR 1 3 5 .7 7 % - 8 .7 4 % 2 .1 4 % 2 4 .7 4 % 1 0 8 .3 7 % - 1 1 .0 1 % 0 .9 5 % 7.18% 8 Section C Fund Concept Fund Concept Thailand is enjoying a structural and cyclical economic recovery which will underpin overall investment returns. The Thai economy has staged a strong recovery since the Asia crisis and is currently one of the fastest growing economies in Asia. Growth has been spurred by government policies to stimulate domestic demand and by buoyancy in exports. The election of Prime Minister Thaksin Shinawatra and a majority Thai Rak Thai Party Government in 2001 was a seminal event. The Thai Rak Thai Party was re-elected in February 2005 with an increased majority. Thailand currently enjoys significant surpluses on its current account and a strong fiscal position. Interest rates are expected to remain subdued in the absence of inflationary pressure. There has been a material improvement in the financial health of the banking system. Banks are shifting management focus from “old” to “new” loans. Improvements in (overall) corporate profitability have been driven by cost cutting, improved productivity and (more recently) volume growth. In the area of Private Investment, few sectors (notably construction) have rebounded. The investment recovery now looks set to broaden. 10 Fund Concept (cont.) An economy in transition 1998-2004 was a period of post-crisis adjustment and recovery. Business confidence was fragile, the banking system weak and reforms were necessary to spur restructuring and rehabilitation. Business owners/managers focused on survival. Today, business confidence is strong, the banking system is functioning to the extent that new loan activity is picking up, capital markets are strong and businesses are looking to expand. Longer term growth will be sustained by structural reforms and a substantial commitment from government to invest in Thailand’s infrastructure. Investment opportunities in the next phase of Thailand’s growth Thailand “today” offers investment opportunities both in the final “clean up” and in the next stage of the country’s growth. Business restructuring will continue to be a feature of the Thai investment environment. A stronger economy and higher asset valuations facilitate the resolution of “old” problems. Many early restructurings were temporary remedies. A period of sustained economic growth will underpin equity returns and valuations. The exit environment has improved. Better capital markets enhance prospects both for listing and refinancing, while there is growing demand from local investors for rehabilitated assets. 11 Section D Fund Strategy Investment Examples Deal Flow 12 Fund Strategy Siam Investment Fund III L.P. will seek to provide investors with high returns through leveraging the expertise, experience and business relationships of the advisors to source and effect investments in assets perceived as offering significant upside potential. These assets will likely include: Negotiated placements of new shares as part of the financial restructuring of businesses Negotiated placements of new shares or equity related instruments to fund business expansion Management Buyouts Strategic disinvestments Minority interests Partnership capital Assets offering scope for rehabilitation and transfer to a Property Fund 13 Example 1: Pranda Jewelry Plc. Pranda Jewelry is Thailand’s leading integrated jewelry manufacturer and exporter. The Company was founded in 1972 and listed on the SET in 1990 The Company encountered severe financial difficulties in the wake of the Baht devaluation in 1997, hit by a combination of exposure to foreign currency loans, a drop in demand and excessive inventory levels. Subsequently, the Company entered a lengthy restructuring process with debt rescheduling and debt write-offs. As part of this, creditors pressed for an increase in share capital. In June 2001, SIF II bought 5 million shares of Pranda through a private placement at Bt28 per share. This represented a 25% interest. The total investment was Bt140m (US$3m). The Company has meanwhile pursued an internal reorganisation and renewed focus on its core strengths. Earnings have staged a strong recovery, reflected in a significant recovery in the share price. The Fund began liquidating its investment in February 2003. Investor IRR 135.8%, Gain US$8.9m, 3.6x Invested Capital. 14 Example 2: The Peace Canning (1958) Co., Ltd. Peace Canning, the country’s leading manufacturer of canned pickled vegetables, filed for bankruptcy in 2001. In 2002, SIF II acquired Peace Canning’s combined debts of Bt3,000m (US$72m) from creditors for a cash consideration of Bt520m (US$12m). SIF II became the sole creditor and took control of the bankruptcy process. In the end, SIF II received a) cash of Bt520m (US$12m) through debt refinancing, corresponding to its original investment and b) retained an 80% stake in the Company. SIF II, jointly with Peace Canning, submitted a debt composition request to the Bankruptcy Court and this was approved. Peace Canning has projected sales of Bt1,000mn (US$25m) in 2006 and projected net earnings of Bt60m (US$3m). The Company is planning to list on the SET in late 2006, early 2007. SIF II reduced the debt outstanding to Bt520m (US$12m) and swapped the balance into an 80% equity stake in the company. On a preliminary P/E valuation of 8.0x, the SIF II’s stake will be worth Bt360mn (US$9mn). Unrealized IRR 25.5%, Value: US$6.8m, 1.5x Invested Capital. In 2003, the Fund Advisor negotiated a 7–year term loan (MLR 2%) with a financial institution for Bt520m (US$12m) to refinance the outstanding debts. 15 Example 3: Sansiri Plc. Sansiri, a listed real estate development company, was one of the first companies to complete a restructuring. In 1999, Starwood Capital joined as a strategic partner. Holding 7% of the equity initially, Starwood had an option to increase its stake to 51% through a warrant exercisable at Bt5. In August 02, SIF II subscribed to Sansiri’s Bt2,520m (US$60m) capital raising at Bt4.41 per share. This capital represented 67.7% of the new equity base. At the same time, the warrant option arrangement with Starwood was terminated. The subscription price implied a P/BV of 1.2x. During 2002, Sansiri shares traded as low as Bt3. With little prospect of Starwood exercising its warrant, the Company was unable to operate satisfactorily. Management identified both the need for new capital and the need to cancel the warrant. Canceling the warrant was critical to the proposed recapitalization. The fundraising transformed the Company’s prospects, allowing it to proceed with a series of new housing projects at a time when housing demand was increasing rapidly. Sansiri is now recognised as a leading housing developer. Following the private placement, there was a substantial rerating of Sansiri shares. Currently, the share price is Bt16.3. Investor IRR 108.4%, Gain US$4.7m, 1.9x Invested Capital. 16 Example 4: F&B Food Service (Thailand) Ltd. F&B Food Service is a full-line food distribution company targeting the hotels and restaurants segment. Established in 1999 by the Booker Group, the business was acquired by Royal Ahold in 2002. In 2003, Royal Ahold took a strategic decision in 2003 to withdraw from the Thai market. In October 2003, SIF II acquired a 76% stake in the Company and an existing shareholder loan for a combined Bt90m (US$2.3m) and committed to management to invest a further Bt160m (US$4.0m) on expanding the business into a national franchise. Management was gifted a 24% stake. In June 2006, management control was transferred to the management of Peace Canning and a plan devised to sell the F&B business to Peace Canning. At this point in time, the Fund’s stake in F&B is 100%. At the date of acquisition, F&B operated three warehouses (Bangkok, Laem Chabang and Had Yai). Three new warehouses will be added in 2004 (Koh Samui, Chiang Mai and Bangkok II). The expansion will establish F&B as the leading company in this rapidly expanding business segment. The intention is to exit the investment through refinancing the shareholder loan and swapping shares with Peace Canning, which aims to list in late 2006, early 2007. SIF II has board representation. 17 Example 5: Siam Paper Public Company Limited Siam Paper was incorporated in 1967 to manufacture printing and writing paper. IN 1995, the Company initiated a major expansion project (PM#A-One), designed to extend the product range to include coated papers and non-carbon required papers. At the time of the 1997 financial crisis, the PM#A-One project was 85% complete, however the project was halted due to a lack a curtailment in financing. The ongoing operations were unable to sustain the Company and Siam Paper entered debt restructuring. At the time, total debts were c.Bt9bn Under the rehabilitation plan, debts were reduced to c.Bt3.5bn and refinanced by Krungthai Bank. In October, 2004, SIF II invested Bt350m through a private placement of 52m shares, to hold a 13.1% stake in the Company. An IPO is planned as and when the PMA#-One project begins operations (raising capacity from 22,000 tpa. to c.120,000 tpa.) The test run of PMA#-One took place in September 2005. As part of the investment agreement, the family shareholders of Siam paper have agreed to a minimum return guarantee whereby shares from the family are transferred to the Fund in the event that the return is below 50% p.a.. SIF II has board representation. As part of the rehabilitation plan, the Company was obliged to raise Bt1bn in new equity through a private placement and/or public offering.. 18 Example 6: TISCO Finance Plc. TISCO Finance is a leading, listed Thai consumer finance company, with a strong position in auto finance. The economic collapse in 1997 resulted in a surge in the company’s non-performing loans and the need for a balance sheet restructuring. In May 1999, under a government sponsored recapitalisation scheme, TISCO issued 600m new convertible preference shares at Bt10, raising Bt6,000m (US$150m). Half of the new shares were acquired by the Ministry of Finance and half acquired by private sector investors. This increased the total number of shares in issue to 700m. The private investors also received a covered warrant (on the MoF’s holding). A consortium led by Finansa and including SIF and China Development and Industrial Bank acquired the private sector allocation. A representative of Finansa was appointed to the TISCO board. The case for reviving TISCO was strong and the successful recapitalisation allowed the company to participate in the subsequent industry revival (with fewer competitors). TISCO’s earnings have enjoyed a sustained increase since the refinancing. The market was quick to recognise the transformation in TISCO’s position and prospects and the shares enjoyed a dramatic rerating. 19 Example 7: Other Investments In April 1998, SIF acquired a 18% equity interest in SEEducation (SE-ED), a listed book wholesaler and retailer with a total investment of US$2.1m SE-ED had been damaged in the economic crisis, as had many of its competitors. The capital injection by SIF enabled the Company to quickly establish itself as the market leader and management embarked on an aggressive expansion plan which resulted in SE-ED opening retail outlets in all of Thailand’s 72 provinces. A strategic tie-up with the rapidly expanding hypermarket industry further strengthened SE-ED’s market position. SE-ED’s revenues and earnings grew strongly after the recapitalisation, contributing to a significant appreciation in the Company’s shareprice. The investment was liquidated through sales on the stockmarket. Between 1997 and 1999, SIF invested US$5.3m in a 14% stake in Nation Mulltimedia (NMG), the listed publishing and media group. The investment was made through private placements of new equity and rights issues. NMG encountered sever financial difficulties in the wake of the 1997 economic crisis, compounded by an ill-judged investment in a real estate project. While provisioning against losses, the Company expanded its media reach (into television) and exploited a strong recovery in advertising spending. For a brief period in late 1999, following the merger of AOL and Time Warner, the shares enjoyed a dramatic “.com” rerating and while the shareprice bubble eventually burst, SIF’s overall investment return, based on a gradual unwinding of the position from 2000 onwards remained strong. 20 Section E Siam Investment Fund III L.P. Why this Fund? The Siam Investment Fund III L.P. can be distinguished from other Thai Funds through: Strong sourcing capability of Thai assets means the Fund is not dependent on external brokers for deal flow Direct experience of restructuring listed and unlisted companies A track record of value creation in restructuring-related investments A track record of high returns to investors Direct ties with companies involved in rehabilitating dormant/distressed assets Direct experience in transferring assets to Property Funds Strong domestic Corporate Finance relationships in Thailand Advisors that can demonstrate a disciplined investment process adopting best international practices of due diligence and risk management Sponsors who intend to be significant investors in the Fund 22 Investment Process Investment Committee Source Investment Meets Initial Criteria? No Yes Investment Proposal for Internal Review Yes Laurence Cheng – CZI Vincent Fan – CZI Eugene Davis – FFM Vorasit Pokachaiyapat –FFM Bordin Thavik – Excelsior Laurent Demey - Proparcoo Other Representatives No Info Memo Yes No Preliminary Term Sheet Negotiation Final Due Diligence Final IC Approval Key: Invest Investment Criteria: Identifiable Exit, Attractive Returns Due Diligence: Financial and Management analysis Exit Investment at Target IRR 23 Section F The Advisors and Sponsors Finansa Overview Finansa Plc. 100% Finansa Vietnam 100% Finansa Securities 100% Finansa Credit 100% Finansa Fund Management 100% Finansa Asset Management Finansa Singapore 50% 67% Finansa Capital ADF Management 50% 33% CZI JAIC Finansa was founded in 1991 and is now the group holding company The principal activities of the group are institutional fund management and investment banking, undertaken by four wholly owned subsidiaries, Finansa Fund Management, Finansa Securities, Finansa Credit and Finansa Asset Management Finansa Plc was listed on the Stock Exchange of Thailand in September 2002 The Finansa Group maintains offices in Singapore and Vietnam to support the fund management and investment banking activities in the region 25 Finansa Overview (cont.) Finansa Fund Management: Manages three offshore equity funds and one debt fund. Two of the equity funds are closedend funds and focused on Thailand and Vietnam, respectively. The third equity fund is a private equity fund for Thailand. The debt fund covers Asia (ex-Japan) A total of c.US$200m was sourced from major offshore institutions. Key strengths in this business are a successful track record in private equity investment in Thailand, experience in investment in Vietnam and experience in trading Asian distressed debt. Finansa Asset Management manages onshore funds, primarily provident funds Its assets under management are c.US$300m. Finansa Securities: An SEC licensed brokerage company and one of the strongest and most active investment banking firms in Thailand. The company offers an extensive range of advisory services for both equity and debt transactions. The qualities of the team are increasingly recognised in the number, size and variety of mandates being won. Finansa Credit: In October 2002, Finansa acquired Primus Finance, a local finance company owned by Ford Credit International; it has since been renamed Finansa Credit. This was an important step for the group, both complementing and strengthening the existing activities. The acquisition provided a foothold in the debt markets in Thailand. The company operates in the wholesale markets and focuses on debt trading opportunities. Finansa Asset Management: Established in 1969, as Bangkok First Investment & Trust Co., Ltd. (BFIT), it was one of the very first companies to be granted a fund management license. It quickly became a market leader in provident fund management and currently manages c. Baht 14 billion (US$350m). The company offers three main types of asset management services: mutual funds, provident funds and private funds. In 2002 all the asset management businesses were combined into a new subsidiary, Krungthep Thanaton Asset Management Co. (BFITAM). BFITAM was acquired by the Finansa Group in January 2005 and renamed Finansa Asset Management Ltd (FAM). 26 Finansa Fund Management : Profile Finansa Fund Management Siam Investment Fund US$25 million Closed End Direct Investment Fund for Thailand London Listed Launched in 1996 Major Investments SE-Education Nation Multimedia TISCO Finance 12 Professional Staff plus 8 Support Staff Headquartered in Bangkok with offices in Hanoi, Ho Chi Minh City and Singapore Siam Investment Fund II, L.P. US$57 million Private Equity Limited Partnership for Thailand Sponsored by CZI and ABN AMRO Asia Capital Investment Launched in 2000 Major Investments Pranda Jewelry Evason Phuket Resort and Spa LOXBIT Sansiri Santiphab F&B Food Service Siam Paper Vietnam Equity Fund Euros15 million Closed-End Fund investing in equitised state owned enterprises in Vietnam Successor to the Vietnam Frontier Fund (1994-2004) Closied in 3Q 2005 The Asian Debt Fund US$185 million Open Ended Fund buying distressed debt in non-Japan Asia Initial closing on 31 December 2003 27 CZI: Overview A Private Equity Firm that Manages over US$2.25 billion Capital Z Investment Partners (CZI) is a sponsor of private equity and hedge fund managers CZI’s total assets under management exceed US$2.25 billion. Offices in New York, London and Hong Kong Managed by four founding partners Capital Z Financial Services, an affiliate of CZI , undertakes direct private equity investment in the financial and healthcare service sectors. Its assets under management exceed US$1.8 billion. 28 CZI: Overview (cont.) The largest and most experienced sponsor of private equity fund managers Committed approximately US$836 million to sponsor 13 private equity fund managers that manage over US$2.4 billion The largest and most experienced sponsor of hedge fund managers Invested approximately US$463 million to sponsor 10 hedge fund managers that manage over US$3.3 billion Significant owner of Lyra Capital, manager of the Dow Jones Hedge Fund Indices, and Starview Capital, a hedge fund of funds. Lyra Capital and Starview Capital collectively have c.US$1.6 billion in assets under management Majority owner of HedgeFund.net and PrivateEquityCentral.net, the leading Internet sites for hedge fund and private equity investors The leading private equity investor focused on financial services Manages a US$1.8 billion private equity fund raised in 1999 29 CZI: Overview (cont.) Sponsor Outstanding Private Equity Managers Sponsorship Approach CZI provides large cornerstone capital commitments and value added support to obtain minority ownership in private equity funds Outstanding Managers CZI looks to sponsor firms that have the potential to emerge as the industry leaders in their respective markets Focused Investment Strategies Unique Market Access Thorough Due Diligence and Structuring Capabilities Ability to Add Value to Their Investments 30 Section G Biographies Biographies Mr. Eugene Davis Chairman, Finansa Group Mr. Davis, age 49, is a co-founder of the Finansa Group and is Chairman of Finansa Plc. He was previously Managing Director of Chase Manhattan (Thailand). Earlier positions include being Director of Fixed Income Trading with The First Boston Corporation in Tokyo. Mr. Davis is a United States Citizen and resides in Bangkok. Mr. Vorasit Pokachaiyapat Managing Director, Finansa Group Mr. Pokachiyapat, age 42, is a co-founder of the Finansa Group and is Managing Director of Finansa Plc. He was previously responsible for IPOs, M&A and privatisation advisory work with Chase Manhattan (Thailand). Earlier positions include Head of Research as TISCO. Mr. Pokachaiyapat is a Thai Citizen and resides in Bangkok. Mr. James Marshall Chief Investment Officer, Finansa Group Mr. Marshall, age 50, is the Research Director for the Finansa Group. He was previously Research Head of a tie-up between Nomura International and Unit Trust of India in Mumbai. Earlier positions include Head of Research of Capital Nomura Securities in Bangkok. Mr. Marshall is a United Kingdom Citizen and resides in Bangkok. Mr. Craig Wilson General Counsel, Finansa Group Mr. Wilson, age 47, is the General Counsel of Finansa Plc. He was previously with the international law firm White and Case and before that, the Asian Development Bank. He received his J.D. from Harvard Law School and his A.B from Yale College. Mr. Wilson is a United States citizen and resides in Bangkok. 32 Biographies (cont.) Ms. Rachanee Mahatdetkul Vice President, Finansa Group Ms. Mahatdetkul, age 38, has been a member of the Finansa Private Equity team since 1994 and worked previously as a financial analyst with American Appraisal (Thailand) She graduated form Assumption University with a degree in Business Administration and completed an MBA at Santa Clara University in the US. Ms. Mahadetkul is a Thai citizen. Mr. Teerath Pratumsuwan Vice President, Finansa Group Mr. Pratumsuwan, age 36, has been a member of the Finansa Private Equity team since 1995 and worked previously Assistant Treasurer at Siam Cement. He graduated from Chulalongkorn University with a Degree in Accounting and completed an MBA at the City University of New York. Mr. Pratumsuwan is a Thai citizen. Ms. Aliya Chupinijsak Vice President, Finansa Group Ms. Chupinijsak, age 33, has been a member of the Finansa Private Equity team since 2000 and worked previously as an Investment Banking Associate with Bankers Trust in Hong Kong. She graduated form Brown University, Rhode Island with a degree in Economics and completed an MBA at University of Michigan in the US. Ms. Chupinijsak is a Thai citizen. Ms. Keiko Sebata Vice President, Finansa Group Ms. Sebata, age 42, has been a member of the Finansa Private Equity team since 1993 and worked previously as a securities analyst win with James Capel in Tokyo. She graduated form Sophia University in Japan with a degree in Business 33 Administration. Ms. Sebata is a Japanese citizen and resides in Bangkok. Biographies (cont.) Mr. Kenneth L. White Executive Director, Finansa Group Mr. White, age 57, is Managing Director of Finansa Credit Ltd. and a Director of Finansa Plc. He was previously Managing Director of Pacific Siam Strategic Consulting. Earlier positions include General Manager of Chase Manhattan in Thailand. Mr. White is a U.S. citizen. Mr. Laurence Cheng Chairman of the Board, Chief Executive Officer & Founding Partner, CZI Mr. Cheng, age 54, is the Chairman of the Board, CEO and Founding Partner of Capital Z Investment Partners. Earlier positions include 23 years at Zurich Financial Services as CIO, member of Zurich’s Corporate Executive Board, and President and CEO of Zurich Investment Management Ltd. Mr. Cheng resides in New York and is a citizen of Canada. Mr. Vincent Fan Partner, CZI Mr. Fan is a Partner at Capital Z Investment Partners. Earlier positions include Chairman of the Advisory Board of CVC Capital Partners Asia Pacific, CEO of CVC Asia Pacific, Chief Executive of Citicorp Capital Asia, and Executive Chairman of Citicorp China Investment Management. Mr. Fan resides in Hong Kong and is a citizen of Canada and Hong Kong. 34 Biographies (cont.) Mr. Bordin Thavik Partner, Excelsior Capital Mr. Thavik, age 42, is a Partner of Excelsior Capital, based in Hong Kong. He was previously Vice President in the Asia Private Equity Group of Bankers Trust Company in Hong Kong where he led the bank’s direct investment efforts in SE Asia.. Mr. Thavik will be a member of the Fund’s Investment Committee. He is a Thai and a U.S. citizen. Mr. Laurent Demey Regional Head, South East Asia and China, Proparco Mr. Demey, age 36, is Regional Head, South East Asia and China, for Proparco, the French Development Finance Institution, one of the core investors in the Fund. Mr. Demey joined Proparco in 2000 and until 2004 headed the Financial Institutions group, which includes private equity activities covering around 30 emerging markets. On assuming his current position he relocated from Paris to Bangkok. Mr. Demey will be a member of the Fund’s Investment Committee. He is a French citizen. 35 Section H Contact Information Contact Information Finansa Plc Capital Z Mr. James Marshall TISCO Tower 16/F 48 North Sathorn Road Bangkok 10500 Thailand Mr. Vincent Fan 38th Floor, Tower 1 Lippo Centre 89 Queensway Hong Kong Tel +662 697 3700 Fax +662 266 6688 jmarshall@finansa.com http://www.finansa.com Tel +852 2230 9800 Fax +852 2230 9898 Vincent.Fan@CapitalZAsia.com http://www.capitalz.com 37