renewables portfolio standard - Pacific Gas and Electric Company

advertisement

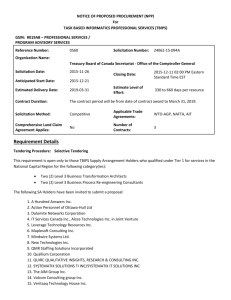

RENEWABLES PORTFOLIO STANDARD 2009 SOLICITATION BIDDERS CONFERENCE July 21, 2009 Agenda Introduction Commercial Overview Shortlisting Evaluation Methodology Transmission Ranking Costs Interconnection Process Solicitation Documents Q&A 1 Document Conflicts This presentation is intended to be a summary level discussion of the information and requirements established in the RFO materials (it does not include all of the detailed information in the RFO Materials) To the extent that there are any inconsistencies between the information provided in this presentation and the requirements in the RFO Materials, the RFO Materials shall govern 2 Commercial Overview 3 RFO Schedule DATE EVENT July 21, 2009 Bidders Conference 1st week of August Bidder workshop via Web – forms, Q&A August 24, 2009 10 a.m. Deadline to submit and receive Offer(s) October 28, 2009 Shortlist notification November 6, 2009 Offer deposits due from shortlisted bidders November 23, 2009 PG&E submits Shortlist to PRG and CPUC TBD CPUC issues Market Price Referent (“MPR”) By June 30, 2009 Negotiate and execute Agreements; PG&E submits Agreements for Regulatory Approval See Section II of the Solicitation Protocol 4 Independent Evaluator Primary role of the IE is to: Monitor RFO processes to ensure fair and equal treatment of all potential counterparties Monitor evaluation processes to ensure PG&E has implemented methodology as described and that bids are treated consistently Ensure utility ownership and PPA offers are treated consistently Report on proposed transactions to CPUC when filed for CPUC approval The IE performs an independent review of all proposals The IE may review all proposal data and monitor all negotiations 2009 IE is Arroyo Seco Consulting (Lewis Hashimoto) 5 New for 2009 Sellers may offer joint development/ownership project PG&E as Scheduling Coordinator for projects in CAISO control area Substantially modified PPA to streamline negotiations Expedited approval process for PPAs up to 4 years in length that meet certain criteria Changes to credit and collateral Increased project development security and “capped” damages Reduced delivery term security Use of Project Viability Calculator to score offers 6 Eligible RPS offers Eligible resources All eligible renewable resources as determined by CEC Target volumes---1-2% of bundled sales (800-1600 GWh) Products As-Available Baseload Dispatchable Delivery term Seller may bid delivery term of one month up to 20 years or more Project location & delivery point Delivery points in CAISO control area Delivery points outside CAISO control area; Seller to provide price for delivery to CAISO 7 Eligible Offer Structures Power Purchase Agreement (PPA) PPA with Buyout Option Turnkey Ownership - Participants may propose to develop, permit, and construct a facility for purchase by PG&E upon commercial operation Joint Development/Ownership Site Offers For development or expansion by PG&E See Section III and Attachments I and J of the Solicitation Protocol 8 Power Purchase Agreement (PPA) Offer Variations Up to six discrete Offers for a PPA for each Project. Offers may vary by: Size Commercial Operation Date Delivery Term Generation Profile Credit Terms Pricing variations With and without PTC/ITC/other financing If not already in price, premium for delivery to CAISO See Section VIII of the Solicitation Protocol 9 PPA Contracts One form (Attachment H) for most PPAs (asavailable, baseload, dispatchable) Confirm to EEI Master Agreement for short-term contracts up to 4 years (Attachment N) 10 PPA Key Commercial Terms Contract Price is $/MWh (all-in) for all products except: Dispatchable - $/kW-year for capacity, $/MWh for energy Seller receives Contract Price as adjusted by TOD Factors Delivery Point is PNode for those projects delivering energy onto the CAISO system Minimum performance criteria apply to all products Certain non-modifiable terms (highlighted in form PPA) PG&E is Scheduling Coordinator for projects in CAISO control area Seller commitment to construction start date and commercial operation date; Provisions for excused delay for force majeure, transmission and permitting See Attachments H and N of the Solicitation Protocol 11 Time of Delivery (TOD) Factors Monthly Period Jun – Sep Oct.- Dec., Jan. & Feb. Mar. – May Night 0.69 0.76 0.64 Payment = Contract Price * TOD Factor * MWh Baseload, Peaking Shoulder 1.12 0.93 0.85 As-Available Super-Peak 2.20 1.06 1.15 Payment = Contract Price * TOD Factor * MWh Reductions for not meeting minimum performance Short-term ERRs may price without TOD See Section IX of the Solicitation Protocol 12 Key Changes to 2009 Form PPA PPA designed to require minimal negotiation Excused delays in construction start and commercial operation for force majeure, permitting and transmission Force majeure no longer an event of default Guaranteed Energy Production (GEP): PPA specifies minimum delivery amount 360 days for force majeure and permitting 540 days for transmission Cumulative delays not to exceed 540 days 80% of contract quantity for solar 90% of contract quantity for baseload P-95 for wind Shortfalls in GEP can be “cured” with higher generation the following year or payment to PG&E 13 Key Changes to 2009 PPA (cont’d) PG&E as Scheduling Coordinator (SC) for projects in CAISO control area Seller responsible for providing meteorological and project availability data PG&E needs to act as SC PG&E to use data to forecast for intermittent resources and to schedule generation for all resources As-available projects eligible for CAISO’s Eligible Intermittent Resource (EIRP) program must become EIRP certified and remain eligible for duration of the Delivery Term. PG&E will use EIRP as needed PG&E bears imbalance risk as long as Seller provides data Seller subject to forecasting penalty if data not provided 14 Short-Term PPA Key Commercial Terms Contract Price is $/MWh (all-in) Price may be fixed $/MWh or Index price (e.g. NP15, COB) + $/MWh adjustment Seller may propose price with or without TOD factors No bid deposit or exclusive negotiations required Relaxed performance requirements Sellers in CAISO control area to use Attachment H; See Attachment N for alternate provisions for Sellers outside CAISO control area See Attachment H and N of the Solicitation Protocol 15 Expedited Approval Process (CPUC D.09-06-050) Establishes price benchmarks and expedited contract review and approval process CPUC approval process for PPAs up to 4 years Tier 2 Advice Letter Process CPUC approval effective in 30 days from advice letter filing unless suspended by CPUC staff Facility must be in commerical operation or in commercial operation within 6 months of PPA execution PPA price(including firming and shaping) does not exceed: – 150% of forward price for a same term, non-renewable energy contract and – 90% of the MPR for a contract of 10 years PPA must be based on approved pro-forma contracts with only “minor modifications” 16 Credit Offer Deposit of $3/kW upon Shortlisting Initial Project Development Security of $15/kW upon contract execution Following CPUC Approval, Project Development Security of $100/kW * capacity factor (minimum of $50/kW) Upon commercial operation, Delivery Term Security: Term Months Revenue at Minimum Expected Revenue (GEP) 10 15 years years 6 9 20 years 12 Offer Deposit and Project Development Security – cash or Letter of Credit Delivery Term Security – cash, Letter of Credit, or acceptable guaranty See Sections V and VII of the Solicitation Protocol 17 Delivery Term Security Example Contract Price = $90/MWh Post-TOD average price = $95/MWh Contract Quantity = 100 GWh/year GEP = 80% of Contract Quantity = 80 GWh year Result Minimum expected annual revenue: $95/MWh * 80 GWh = $7.6 million DTS: 20 year contract = $7.6 million DTS: 10 year contract = $3.8 million 18 Credit—Short Term Offers Term New ERRs Existing ERRs Less than 1 year Project Development Security: None Delivery Term Security: None Pre-Delivery Term Security: None Delivery Term Security: None One year or greater, but less than 5 years Project Development Security: $25/kW Delivery Term Security: 2 months minimum expected revenue Pre-Delivery Term Security: $3/kW Delivery Term Security: 2 months minimum expected revenue 5 years Project Development Security: $50/kW Delivery Term Security: 3 months minimum expected revenue Pre-Delivery Term Security: $5/kW Delivery Term Security: 3 months minimum expected revenue Greater than 5 years, but less than 8 years Project Development Security: $50/kW Delivery Term Security: 4 months minimum expected revenue Pre-Delivery Term Security: $5/kW Delivery Term Security: 4 months minimum expected revenue 8 years or greater, but less than 10 years Project Development Security: $50/kW Delivery Term Security: 5 months minimum expected revenue Pre-Delivery Term Security: $5/kW Delivery Term Security: 5 months minimum expected revenue See Sections XX of the Solicitation Protocol 19 CEC Requirements RPS Eligible Renewable Energy Resources (ERR) must be CEC Certified CEC Pre-Certification should be obtained prior to construction start ERRs must participate in CEC Generation Tracking System (WREGIS) See updated guidebooks at: http://www.energy.ca.gov/renewables/documents/ See Section IV of the Solicitation Protocol 20 Not Part of RPS Solicitation Resources less than 1.5 MW Standard tariff available to all eligible renewable resources Term up to 20 years Price set at Market Price Referent http://www.pge.com/b2b/energysupply/wholesaleelectricsuppliersolicitation/sta ndardcontractsforpurchase Based on combined cycle cost Determined by CPUC on an annual basis Levelized price depends on contract term and online date PG&E’s Proposed 500 MW PV Program Application included proposed PV PPA at $246/MWh and associated RFO Currently under review by CPUC Link to the Application https://www.pge.com/regulation/PV-Program-PGE/Pleadings/PGE/2009/PVProgram-PGE_Plea_PGE_20090224-01.pdf 21 Shortlisting Evaluation Methodology 22 Three Steps to a Shortlist Evaluate all valid offers Determine transmission cost Provides a first ranking No transmission cost included Added to offer’s cost Second ranking using new cost values Shortlist chosen from second ranking 23 Evaluation Criteria Ranking based on combination of Quantitative and Qualitative factors Quantitative Evaluation Market Valuation Transmission Adders Qualitative Evaluation Project Viability Portfolio Fit Credit Consistency with RPS Goals Modifications to Form Agreements See Section XI and Attachment K of the Solicitation Protocol 24 Market Valuation Market-Based Valuation Value of contract is capacity plus the net of the energy benefit and cost. The energy benefit is computed using market prices, volatilities, and correlations. Locational Marginal Pricing (LMP) multipliers applied Capacity value is based on: The net economic carrying cost of a gas-fired power plant Contribution to PG&E’s Resource Adequacy requirements. 25 Market Valuation (continued) Valuation of Contract Types As-Available Contracts Baseload, Peaking Contracts Contract benefit is evaluated based on (deterministic) market forward prices, but with variable quantity, and the value of capacity. Cost is calculated as energy generation times offer price times TOD factors for each period. Contract benefit is evaluated based on (deterministic) market forward prices and the value of capacity. Cost is calculated as energy generation times offer price times TOD factors for each period. Dispatchable Contracts Contract is evaluated as call option on energy. Benefit is the value of capacity and the expected value of energy. Cost is the energy generation times the expected offer price, plus a capacity charge distributed monthly by a Time of Availability factor. (Details for the TOA factor specified in the Protocol.) 26 Project Viability All offers will be evaluated and scored using modified version of CPUC Project Viability Calculator (PVC) Company/Development Team (25%) Technology (25%) Project development experience EPC experience Ownership and O&M experience Technical feasibility Resource quality Manufacturing supply chain Development Milestones (50%) Site control Permitting status Project financing status Interconnection progress Transmission requirements Reasonableness of COD (Commercial Operation Date) 27 Portfolio Fit Differentiates offers by the firmness of their energy delivery and by their energy delivery patterns Firmness (predictability) is preferred Delivery when PG&E is short is preferred Earlier delivery is preferred over later delivery Dispatchability is preferred 28 Credit Performance Assurance Project Development Security Delivery Term Security 29 Consistency with RPS Goals CPUC-stated Goals Legislative Findings Governor’s Order on biomass Impact on Water Quality PG&E’s Supplier Diversity (WMDVBe) WMDVBe: Women-, Minority-, Disabled Veteran-owned Business enterprises 30 First Ranking Shortlist rankings are relative No fixed cut-off price No fixed procurement limit Based on quantitative and qualitative factors First ranking done on the basis of market value with adjustments for qualitative criteria Then, introduce transmission adders 31 Transmission Adder - “the lower of” Use “the lower of” the result of the Transmission Ranking Cost Report or Alternative Commercial Arrangements (remarketing, swaps, or as-available transmission) When no Alternative Commercial Arrangement is feasible, and no transmission study results are available, use the TRCR 32 Second Ranking Market Valuation is adjusted for Transmission Adders, resulting in a Net Value Offers are re-ranked, just like first ranking, but using the new Net Value instead of Market Value Ranking is a relative one Strong offers relative to others will be near the top Weak offers relative to others will be closer to the bottom Shortlist chosen from second ranking Shortlist will err on side of greater inclusion 33 Consultation with PRG and IE Discuss proposed shortlist and evaluation methodology Solicit feedback on whether certain offers should be included and whether certain offers should be excluded Incorporate feedback and finalize shortlist 34 Transmission Ranking Costs 35 Consideration of Transmission Cost in Bid Ranking Pursuant to D.04-06-013 and D. 05-07-040 Generator Cost responsibility - Include in bid price Direct Assignment Facilities (Gen-tie) Identify if desire PG&E to evaluate potential for sharing Wheeling Charges to Delivery Point Customer Cost Responsibility – Considered in bid evaluation Network Upgrades Costs estimates from CAISO Interconnection Process (ISIS/IFAS) Transmission Ranking Cost Report See Section X of the Solicitation Protocol 36 Transmission Ranking Cost For Projects that have not completed the ISIS/IFAS Solely for bid ranking in this solicitation Based on proxy transmission facilities or conceptual transmission plan (PG&E, SCE, or SDG&E Successful bidders must complete the ISO Interconnection Process 37 PG&E Substations Associated with Renewable Resource Clusters Captain Jack Pacific Gas and Electric Co. (PG&E) Malin Oregon California Pit 1 Humboldt Clusters for Bid Evaluation Purposes only Clusters do not have to be Points of Interconnection Out of area resources: North:Round Mountain South:Midway East: Summit Olinda Delta Metering Station Round Mt. Caribou Table Mt. Summit Cottonwood Bellota Fulton Rio Oso Vaca-Dixon Wilson Tracy Stagg Tesla Newark Gregg Metcalf Helm Los Banos Gates Panoche Midway Morro Bay Carrizo Plains Renewable resource Cluster Southern California Edison (SCE) Sylmar Vincent 38 Table X.1 Transmission Ranking Cost Where PG&E is the Purchaser Substation Associated with Cluster of Potential Renewable Generation Bellota 230 kV Peak and Shoulder Night Base Load and As Available Year Round Year Round Year Round Cost of Proxy Network Upgrades to accommodate MW Level of Potential Generation ($ millions in 2008 dollars) Level Maximum MW of Potential Generation In each Level Proxy Voltage Support Devices* Other Proxy Transmission upgrades Maximum MW of Potential Generation In each Level 1 1000 70 0 Cost of Proxy Network Upgrades to accommodate MW Level of Potential Generation ($ millions in 2008 dollars) Cost of Proxy Network Upgrades to accommodate MW Level of Potential Generation ($ millions in 2008 dollars) Proxy Voltage Support Devices* Other Proxy Transmission upgrades Maximum MW of Potential Generation In each Level 400 28 0 400 28 0 2 500 35 28 500 35 28 3 100 7 15 100 7 15 Proxy Voltage Support Devices* Other Proxy Transmission upgrades * Cost of Proxy Voltage Support Devices are to be prorated in proportion to the size of the project. 39 Example Two Offers received: A: 300 MW (base load) B: 300 MW (base load) Offer A ranks higher than Offer B Transmission Ranking Cost to be used in Evaluation Offer Level Gen Capacity (MW) Proxy VAR Support ($Million/MW) Other Proxy Network Upgrades ($Million) A 1 300 0.07 0 B 1 100 0.07 0 B 2 200 0.07 28 “In ranking RPS bids, PG&E, SCE, and SDG&E shall each allocate costs of transmission upgrades that would be used by more than one RPS project on a pro rata basis, based on the percentage of transfer capacity added by the proposed upgrade that would be used by the RPS project: This pro rata allocation of upgrade costs shall be applied only if sufficient renewables potential exists, as identified by the California Energy Commission, to fully utilize the transmission facility sometime in the future." 40 Ways to avoid triggering Next Level of Transmission Ranking Cost Attachment D to the Protocol Energy Pricing Sheet Optional “Dispatch Down” or “Curtailment” Provision Specify the MW of curtailable capacity Gen Profile Sheet Generation profile that does not trigger transmission upgrades Forecast of average-day net output energy production, in MW by hour, by month and by year * This provision is optional and is supplemental to the standard Curtailment or Dispatch Down provision. 41 Interconnection Process 42 Generation Interconnection Study Process Interconnection process must be complete in order for generator to deliver power to the grid and meet obligations of RPS contract Generator responsible for all generation interconnection costs Generator responsible for timely applications with CAISO and timely completion of the process Not part of RPS Solicitation Process should be started early 43 Generation Interconnection Study Process Transmission Interconnections All applications must be submitted with the CAISO Generators less than or equal to 20 MW, Small Generator Interconnection Procedures (SGIP) Generators greater than 20 MW, follow Large Generator Interconnection Procedures (LGIP) Information on the SGIP and LGIP found on CAISO Website, http://www.caiso.com/docs/2002/06/11/2002061110300427214.html Distribution Interconnections Follow Attachment E of WDT http://www.pge.com/includes/docs/pdfs/b2b/newgenerator/wholesal egenerators/wdt.pdf 44 Small Generator Interconnection Procedures (SGIP) Interconnection Agreement (SGIA) Interconnection Facilities Study (IFAS) Interconnection System Impact Study (ISIS) Interconnection Feasibility Study (IFS) Interconnection Request (IR) Study Process (30 BD) Negotiation (30 BD) Study Process (45 BD) Study Process (45 BD) Cumulative time >= 6 months 45 Large Generator Interconnection Procedures (LGIP per GIPR) Interconnection Agreement (LGIA) Phase II Negotiation (60 CD) Cluster Study Phase I Cluster Study Study Process (1 Year) Interconnection Request (IR) Study Process Cumulative time >= 2 Years (1 Year) 46 Solicitation Documents 47 Offer Submittal Offers must be received by PG&E by Monday, August 24, 2009 at 10 a.m. (PDT) Both Electronic and Hard Copies Electronic copies - two (2) flash drives Hard copies (3 Bound & 1 Unbound) delivered to: RPS Solicitation Electric Supply Department Pacific Gas & Electric Company 245 Market Street, 13th floor San Francisco, CA 94105 48 Information due August 24 Signed RPS Solicitation Protocol Agreement (Attachment A) Fully Completed Offer Form (Attachment D) FERC Order 717 Waiver (Attachment F) Applicable Form of PPA (Attachment H or Attachment N), including proposed modifications Buyout Offers must also include a fully completed term sheet (Attachment I) in addition to PPA Ownership Offers must include a fully completed term sheet (Attachment J) instead of a PPA See Section VIII.C. of the Solicitation Protocol 49 Information due August 24 Project Description (includes, but is not limited to): Technology and equipment type Environmental issues and permit status Community Development Plans Contribution to RPS Goals Site Control Milestone Schedule Transmission/Interconnection Experience and Qualifications Supplemental CEC Funding See Section VIII.C. of the Solicitation Protocol 50 Additional forms if Shortlisted By November 6th Offer Deposit Confidentiality Agreement (Attachment G) Participant Credit-Related Information Form (Attachment E) See Section XIV of the Solicitation Protocol 51 Communications and Website All RFO documents are available on PG&E’s website at: www.pge.com/rfo and click on 2009 Renewable RFO, or paste and bookmark the following in your browser: http://www.pge.com/b2b/energysupply/wholesaleelectricsuppliersolicitat ion/renewables2009/index.shtml All announcements, updates and Q&As will also be posted on the website Communications should be directed to: RenewableRFO@pge.com See Section I of the Solicitation Protocol 52 Q&A 53