May 2013 - RI Adviser Services

advertisement

RI Advice – FOFA Training May 2013 Agenda • Introduction: RI FOFA Readiness & Advice Value Chain • Annual Fee Disclosure & Opt-in – 1.5 hrs • Recap of obligations and requirements • Generating an FDS • Client engagement re FDS • Preparation before 1 July & key timing • Activities x 5 • Questions • Morning Tea – 15 mins • Best Interests duties – 40 mins • Recap of obligations • Changes to advice documents • Case Studies x 4 • Conflicted Remuneration – 20 mins • Recap obligations • Activities x 3 • Question & group discussion time – 15 mins 1 RI FOFA Readiness • RI is well placed to meet FOFA obligations for: – Annual Disclosure – Best Interests – Conflicted Remuneration • Strong existing advice process focussed on quality advice • Supported by: – Templated advice tools – Customised technology eg Xplan wizards etc • FOFA will, however, have an impact on your business, especially in regards to additional effort required to meet Annual Fee Disclosure obligations 2 Advice Value Chain Disclosure Best Interests Duty Ban on Conflicted Remuneration 3 Annual Fee Disclosure & Opt-in May 2013 Recap of obligations • Recap of obligations to confirm: – Requirements – Definition of Ongoing Fees – Who should get an FDS (and who doesn’t need to) – Methods for providing an FDS and timing – Confirmation of disclosure/anniversary date options – Process for re-setting disclosure date for new & existing clients – Buying a book / change in servicing adviser – points to be aware of 5 Fee Disclosure Statement (FDS) From 1 July 2013, all retail clients with an ongoing fee arrangement for more than 12 months must be provided with an annual Fee Disclosure Statement Includes both existing clients and new clients from 1 July 2013 Must include the following information for the previous 12 month period Outline all services the client was entitled to under their ongoing service agreement or package Outline the services the client actually received All Ongoing Service Fees the client actually paid whether paid via the platform product or directly invoiced 6 Defining Ongoing Fees Any fee paid by or at the consent of the client for the provision of services under a written or implied ongoing service arrangement. Adviser service fees (ASF) paid via platform or directly by client are ongoing service fees. Generally trail commissions are not required to be disclosed as ongoing fees, however, ASIC’s regulatory guide on FDSs says fee recipients should be careful to ensure that wording on the FDS does not mislead clients. In situations where commissions have been represented as payment for an ongoing service arrangement and done so with the clear consent or at the direction of the client, RI recommends that these payments be disclosed. Legal source Commission disclosure required Ongoing fee definition under FOFA No Misleading Representation Regime Possibly if represented as part of ongoing service arrangement ASIC regulatory guide Disclose if entered into with clear consent of or at direction of client 7 Who does not need to get an FDS? Corporate super members who are not personally advised clients, i.e. the member has never specifically been engaged by the adviser to deliver personal advice for a fee; Clients only paying insurance premiums; Clients only paying trail commissions and no agreement was ever in place indicating ongoing services were being provided in return for the trail. 8 Providing the FDS • How long do you have to provide the FDS to the client? • • Must be provided no later than the end of a 30 day period beginning on the client’s anniversary date, and • EG: if arrangement was entered into on 1/5/2013, FDS is due no later than 30/5/2014 Must relate to a period of 12 months that ends no more than 30 days before the statement is given to the client. • EG: in example above the FDS should include fee data from 1/5/2013 to 30/4/2014 • It may be provided at the time of the client’s annual review or separately. • Can be provided face-to-face, via post or email − A paper or electronic copy of the FDS must be retained on the client file. − If emailed directly to the client’s email address it can be sent without encryption. −Note - the client must have previously SPECIFICALLY authorised the receipt of documents by email - holding the client's email address on file or from a fact find is NOT sufficient. − If being sent to a non-client such as the Accountant, you will need to encrypt the FDS and in the subject line you must include the word "Confidential". 9 Disclosure Date The Disclosure date for the FDS is the anniversary of the date that the ongoing fee arrangement was entered into. RI has determined that the disclosure date will be: the date of the last review between 1 July 2012 and 30 June 2013; or The date the ongoing service agreement was entered into; or the date an authority to proceed was signed; or Where you have taken all efforts to confirm the date, and this can not be determined, you can re-set the date (conditions apply). 10 Disclosure Date – Example A client has an ongoing service arrangement that commences on 1 August 2013 The next disclosure date will be 1 August 2014. The Adviser has up until 30 August 2014 to issue the FDS. The subsequent disclosure date is 01 August 2015. 30 August 2014 Event Date First disclosure day 1 August 2014 First FDS to be given on or before 30 August 2014 Date first FDS is actually given 15 August 2014 Period covered by first FDS 1 August 2013 – 31 July 2014 Second disclosure day 1 August 2015 11 Resetting the Disclosure Date If it is impossible or unreasonably onerous to determine the day an ongoing fee arrangement was entered into with the client, ASIC has allowed a “no action” clause where for existing clients an Adviser can: nominate a date between 1 July 2013 and 31 January 2014 as the disclosure day provide written notification to the client of the date you have nominated, explaining the significance of the disclosure day for the purposes of producing an FDS provide an FDS to the client within 30 days of this chosen day The notification and the FDS can be sent at the same time 12 Resetting the Disclosure Date You may also reset the disclosure date (bring it forward) if: The current disclosure date is not convenient for the client and they have requested a change; You wish to spread the volume of FDS production across a number of months, (remember you can always bring the date forward, however you cannot push it back.) It is more operationally efficient for your practice to disconnect the FDS dates from your client annual review dates and issue them in a bulk run once or twice per year. Resetting a disclosure date effectively brings forward the disclosure day to a period earlier than the client’s original disclosure date. When resetting, please note the following: You must still issue an FDS for the period of the 12 months up to the new disclosure date. Resetting FDS must also include disclaimers to clarify to the client that you are resetting the date. This can be done by selecting one of the appropriate paragraphs in the FDS template. The reset must be appropriately documented. .Where resetting the FDS, remember to amend this date in your client management system (Xplan). 13 Resetting the disclosure date for a group of clients - Exercise In the simplistic example above, you have 5 clients due for review in the month of July 2013. The identified client anniversary dates are the 8th, 14th, 23RD and 27th July. Whilst we recommend fee discussion are carried out in a review meeting, the practice has made a Bus. Decision to send out the FDS and would like to streamline this process for the back-office. Questions: 1) Looking at your clients in July, can you reset the 4 clients to September 2013? No, you can only push these clients forward, not back. 2) If you were looking at creating the simplest process for your practice, what date would you re-set the FDS anniversary date of these four clients? To maximise process and provide a single FDS date in July, bring it forward to 1 July. This gives you to 30 July to disclose the FDS 3) What would be the reporting period that this FDS would cover? 1 July 2012 – 30 June 2013 14 Buying Client Books • Servicing Adviser obliged to produce an FDS as at the disclosure date • FDS must cover the 12 months until disclosure day. This must include ongoing fees paid by the client to the previous adviser or licensee (where this situation arises). Enhanced due diligence – Before you buy When purchasing a book of clients your due diligence processes must consider: • if the old ongoing service arrangements under the previous adviser are continuing?; or • are you going to establish a new service arrangement; and • are you able to determine the client’s disclosure dates, services entitled to, services received and ongoing fees over the 12 months up to their disclosure date? • You should ensure the previous adviser can supply you with the information you need. If you are unable to receive this information you may be forced to establish new arrangements or terminate ongoing fees. • You may also be buying “additional workload for your resources” if disclosure dates for a large number of clients are close together. 15 Buying Client Books For pre - 1 July 2013 Clients • If you are missing the information you need to send your client an FDS, you must have made a reasonable effort to obtain the information from the previous adviser and /or their licensee. You must keep evidence of having made reasonable efforts including keeping file notes and emails of your attempts on the client file. • If after having made reasonable efforts, you are unable to obtain the information for the full 12 months to the disclosure date, you can issue an FDS with the partial information you were able to obtain. • For existing clients as at 1 July 2013, ASIC will not take action against you if the FDS has incomplete information from the previous adviser / licensee. For post - 1 July 2013 Clients • For new clients from 1 July 2013, if you are unable to obtain the information you need after the reasonable attempts, you must establish immediately a new ongoing fee arrangement with your client. 16 Generating an FDS May 2013 Fee Disclosure Statement (FDS) generation • RI solution links in to existing systems and processes ie: – DMS Online – Xplan – RI best practice review process and ongoing service model • Disclosing amount paid to the adviser – may vary from amount client paid due to product rebates (RITC, ETR etc) so caveats/disclosure required to make clear for clients • Solution enables you will meet minimum requirements 18 FDS Generation – overview of automated solution 1 FDS Generation – overview of process Ensure all client details are in Xplan Review records in DMS Online Enter client details into Xplan: •Anniversary date •Service category / segment Consider doing a trial run FDS to determine what data gaps there are Xplan DMS Online Xplan / CommPay Xplan 20 FDS Generation – Automated Solution: Overview of process Xplan Enter new client details into Xplan Picks up groupings from DMS & matches to Xplan. Creates an exception report if can’t match New New New New 21 FDS Generation: Automated Solution – changes to existing process • Continue with existing process ie DMS Online groupings, Manage Review & Client Segmentation processes in Xplan • New processes: – Client matching (of exceptions) in CommPay to ensure correct fee data flows through to Xplan – New disclosure-related fields in Xplan: – “Disclosure Statement Required” – start using this field to identify clients in Xplan who need an FDS – “Next Disclosure Statement Date” field – start using that for all new clients with ongoing service arrangement (in addition to “Review date” field) – Note: RI is working to provide bulk upload of Review Dates into this field for existing clients – Reconciliation of services received by client with services entitled to in Xplan – FDS generation in XPlan 22 FDS Generation – Automated solution – client matching FDS Generation – Automated solution – client matching FDS Generation – Automated solution – client matching FDS Generation – Automated solution – client matching in CommPay Go to the CommPay via the Xplan Dashboard Click on Administration Functions > CommPay 26 FDS Generation – Automated solution – client matching in CommPay Mapping a CommPay client to an Xplan client using their name search • Note: mapping can also be done using the Xplan client entity number View CommPay client name & Xplan Clients Tick clients you want to link and select “Match” 27 FDS Generation: Setting up Services & Fees for Ongoing Arrangements Go to: Xplan > Client Service to enter “Services Entitled To” & Fees in relation to Ongoing Service Agreements 28 FDS Generation: Automated Solution – important Xplan fields Go to: Service – Reviews Identify who needs an FDS in DMS Online and record this in Xplan here Use this field for your Annual Disclosure Date for all clients. Note: For existing clients we will retrofit this field for you from Review Date field Opt-in date: enter date of agreement into this field for new clients post 1 July 2013 29 FDS Generation: Automated Solution – Search criteria Go to: Xplan > Search Use this to find all clients with Annual Disclosure date in certain month For example: search for all clients with “Next Disclosure date” in month of Oct Results: Shows all clients with FDS due in Oct 30 FDS Generation: Automated Solution – FDS Management Report Use this to see a summary report on clients requiring an FDS You can run an FDS Management Report Results: Shows summary of status re Services for FDS clients 31 FDS Generation: FDS Wizard – Disclosing Services Go to: Client Menu / Service / FDS Wizard Select letter options Confirm if resetting disclosure date Tool tips provided to explain steps Services Entitled to: Automatically ticked in line with ongoing service arrangements Services Provided: Tick to confirm what was provided to client Free-text field if you need to explain / clarity anything re services & what was provided 32 FDS Generation: FDS Wizard – Disclosing Fees Go to: Client Menu / Service / FDS Wizard Select CommPay as source of fee data* This screen also shows Fees as per Ongoing Service Agreement so you can quickly reconcile Choose what fees you are disclosing here ie: •ASF only •ASF & Commissions separately •Total fees (only use if not able to unbundle from product manufacturer Breakdown of fee data provided here * Note: option available to input fee data manually if required 33 FDS Generation: FDS Wizard – Generate FDS Click generate FDS Download FDS 34 What does the FDS look like? Cover letter Statement (linked to OGS agreement wording) Services “entitled to” Services “provided” Fees charged Important disclaimer info: • “Services provided” may include services that were made available to you or you had access to, which you did not utilise – allows you to tick where access was given but client didn’t take up service eg didn’t attend seminar • In addition to fees disclosed other ongoing remuneration such as commissions may also be received – important sentence to cover off any perception of misleading & deceptive conduct when only disclosing ASFs 35 FDS Generation – Manual solution In certain situations you may choose to generate an FDS manually ie not using CommPay fee data, eg if: • Unable to complete client matching of exceptions prior to disclosure date, which means fee data via CommPay may not be correct • Unable to reconcile fee data from CommPay with amount you believe client should have paid and you prefer to enter the amount in manually • You have a fixed dollar-based ASF you charge your clients, which means you know easily how much they have paid (eg $100 per month for 12 months) X Run DMS Reports and collate total fees for client relating to ongoing service arrangements Xplan Manually enter fee amount into Xplan 36 FDS Generation – Manual solution Go to: Client Menu / Service / FDS Wizard Select Manual as source of fee data* Manually enter fee 37 Client engagement re FDS Ultimately your clients are paying you because they trust you U.S Based consultant, Charles Green* defines trust as: Credibility + Reliability + Intimacy Self-Orientation How do you rate yourself on the trust scale? • • • • Credibility (i.e. competence, track record & ability to instil confidence) Reliability (i.e. do you deliver on what you say you will deliver – service and advice outcomes) Intimacy (i.e. how well do you engage with your clients on a personal level?) Self-Orientation (i.e. to what extent are you putting their interests before your?) *Article: Trust in Business: The Core Concepts April 29 2007 38 Client engagement re FDS • In order to ensure the FDS does not potentially create issues with your clients, you need to understand the difference between your value and service proposition. • CVP – This really needs to focus on the outcomes – The benefits to the client in having a relationship with you. • CSP - This is the mechanism which provides structure to help you deliver on your value proposition. • When discussing your FDS, focus on value, not on the individual service widgets which you may or may not have delivered.... how much value does a newsletter really provide? • RI have developed a Sales Script and re-worded a new master service agreement to help. • Speak to your RPM if you would like to revisit your value or service proposition 39 Annual disclosure – best practice timeframes New client signs up for ongoing service program Anniversary date (date ongoing agreement commenced i.e. review or ATP signed) e.g. 1 July 2013 Send out review offer letter/email/ phone-call 4 weeks prior however may vary dependant on your review process When looking & value vs. fees, we recommend you make the process part of your review process (i.e. face to face) Conduct Annual Review meeting & provide client with Annual statement of services & fees for 12 mth period ending 30 June 2014 First FD day – eg.1 July 2014 If face-to-face meeting not possible, send out Annual statement (by post/email) Annual disclosure deadline expires – penalties apply past this date 12 months + 30 days eg 30 July 2014 Obligation met 40 Preparation for 1 July Commence client matching (of exceptions) in CommPay – access scheduled for late May FDS template will be available from mid June 2013 Training material and online tutorials in May and June. Refer to RI Report for FOFA updates Contact your RPM or practice Development Coach to assist you through the process. 41 Annual Disclosure – New support tools • New letter templates are being developed: – Cessation of client relationship – Confirmation of services – Re-engagement to confirm changes to service offer and/or price – Letter to request data from adviser or licensee of a practice being purchased – Update to FDS statement for partial disclosure • To be released via RI Report in June 42 Key milestones and timeframes CommPay* access enabled. Start client matching FDS wizard released in Xplan* National Conference 1 Mar 3-5 April FOFA starts 1 May Late May1 June 17 June PD Days Reinforce solutions & processes 1 July 2013 July FDS Testing Identify who needs FDS Group clients in DMS Clear segmentation & service offers in Xplan Anniversary date identified for all OGS clients FOFA Training via RBTs Start booking reviews & preparing for July clients Monitoring & supervision starts C&D client review & clean up * Release schedule TBC as dependant on Technology suppliers. 6 Activities & Question Time May 2013 Activity 1 – FDS The Adviser has inherited a client that has an ongoing service arrangement that commenced in 2010. The Adviser Service Fee (ASF) is $2,200 per year and is deducted monthly from an Investment Account. What would be an the most relevant disclosure date? The date of the new ongoing fee arrangement I have implemented Answer: As a “new” ongoing fee arrangement has been structured, the second option would be the most relevant disclosure date. 45 Activity 2 – FDS An Adviser has purchased a new book of clients from another adviser and has had the servicing rights to their Macquarie Wrap super account changed to you. On the disclosure date your records show the client paid you an Adviser Service Fee of $2,000 for the past 5 months but the previous adviser and their licensee says they are unable to release data for the prior 7 months to you. What should you do? Answer: Issue the FDS with fees paid for the 5 month period with clear disclosures indicating this. All future FDS’s will need to cover the 12 month period. 46 Activity 3 – FDS The client agreed to a “Platinum” Service package in 2010. As part of this, they are entitled to two reviews annually, newsletters, invitations to seminars and any phone queries they initiate. They attended one review but declined the second as they didn’t feel the need to review or make any changes. What must be included in the FDS? Answer: Outline the services entitled to receive, the services they actually did receive and the ongoing fees paid. In this example, if the service agreement is for the adviser to “offer” a review, and the client doesn’t take this up, the adviser has still met its obligation. The FDS wizard/template does allow you to articulate this. Note – the wording of your ongoing service agreement is important. 47 Activity 4 – FDS An Adviser is planning the schedule of FDS due dates for the year ahead. The Adviser identifies that 30 of the clients are due for an FDS by 31 July 2013. 22 of these clients pay less than $100 in ongoing fees to the business 5 clients generate $2000 in revenue per annum 3 clients are top tier clients The Adviser will not have the resources or time to complete all 30 statements by the due date. What could be a solution? Answer: Turn off the fees for the 22 clients and ensure you deliver on your top tier clients. Look to re-engage with the 22 clients to engage into a profitable new service arrangement. 48 Activity 5 - FDS • You have 10 clients who have been on an ongoing service package for the past 6 years. • The ongoing service entitles them to 1 annual review per annum. You agreed with one of the clients that the cost of the ongoing service package is $1,000 per year and you arrange with the client to pay $400 via an Adviser Service Fee with the remaining $600 being paid via trail commission from the product. • At disclosure date, what should be included in the FDS? Answer: As you have made representations and agreed with the client that the ongoing service fee is to be paid from the ASF and commission, both the trail and commission should be included. 49 Best Interests Duty May 2013 What’s changed From 1 July 2013 – reasonable basis – replaced by Best Interests Duty The Law: places the liability on you personally as the advice giver (previously on the Licensee) details specific steps (Safe Harbour) that must be undertaken throughout the advice process states - The client’s needs and interests must be placed ahead of your own or RI’s or associated entities (there was no statutory duty in the past) Penalties for breaching obligations are civil (previously criminal) (Note: ASIC has other powers that it may apply resulting in criminal action being taken) Penalties $200,000 adviser $1 million for licensee (potential for criminal action under other ASIC powers) Best Interests Duty – considerations Any advice given to a client must recommend a strategy that is appropriate for the client and satisfy the best interests duty and related obligations. Is the client in a better position than they were before they sought it? Being better off is tested at the time the advice was given Evaluation will be assessed on whether a reasonable adviser presented with the information that you had at the time of the advice, would consider that the client would be better off if they followed your advice 52 Safe Harbour Step 1 Step 2 Step 3 • Identify your client’s objectives • Identify the scope with your client • Make reasonable efforts to obtain complete and accurate information • Assess whether you have the expertise required to provide the advice. If you don’t, Step 4 refer or decline to provide the advice • Where you make a financial product recommendation you must demonstrate that you have completed a reasonable investigation to ensure that the recommended product Step 5 meets your client’s financial goals & objectives Step 6 Step 7 • Base all judgement on the client’s relevant circumstances • Take any other reasonable necessary steps to ensure your advice and product recommendations are in the ‘best interests’ of your client Most RI Advisers are already doing this and generally will have little change to make. The focus should be on ensuring you have a robust, defendable and well documented advice process. 53 Scoping your advice Assess if you have the expertise to provide advice given the agreed scope and complexity of the needs and circumstances of the client. Establish the scope of advice most appropriate to the client’s needs, objectives and circumstances; Consider your authorisation and experience including your strengths / development areas in advice; With the client’s best interests at heart, determine if you can proceed to provide advice on the agreed scope or have to decline to provide advice or refer the client You must not limit the scope of advice inappropriately to your areas of qualification or experience Referring to another adviser You must decline to provide advice if you do not have the expertise to give advice in the areas the client requires advice. Best practice would be to source a qualified adviser from within the RI network or refer the client to a referral partner Identify potential gaps in your advice offerings where you may need to establish a referral arrangement with another professional (lawyers, accountants, other advisers); 55 Advice records Under the Best Interests Duty, having documentation to prove a defendable and a robust advice process was used becomes as critical as ever. Keeping comprehensive records on client files including research and documenting why the advice was appropriate for your client, remains a critical compliance requirement. Some examples of appropriate documentation to support your advice process are: Detailed file notes Any correspondence between you and your client or between you and the product providers when conducting your research or reasonable investigation Working papers Fact finds Advice documents Recordings Any other supporting documentation that you feel is relevant. 56 Changes to Advice Documents FSG & Adviser Profile • Incorporates the Best interests obligations and the process to refer clients where an Adviser may have limitations in the advice they provide. • Includes updated info in regards to conflicted remuneration Fact Find - Key changes: • Purpose for seeking advice section – new free text section for capturing why client seeking advice • Wording in needs & objectives table has been changed to better reflect client needs • Goals, needs & objectives section – now includes free text section to capture client’s actual words • Goals, needs & objectives section - Advice limitations – new section for recording any limitations • LOE – no longer includes scope of advice as it’s not a requirement to include in the LOE • Authority to provide information – new page added to enable collection of client authority Letter of Engagement • Standalone version of LOE with exactly same wording as current LOE. • Provided as standalone version via Xplan merge report as scope of advice has been removed from version of LOE contained in Fact Find. 57 Changes to Advice Documents Quick Plans - Key changes: • Scope of advice section – updated wording to describe what’s in scope • Inaccurate / incomplete information warning added • ‘What you want to achieve’ section – text updated to create better linkage between strategy & objectives sections RoA & RoA File Note • Intro letter updated with better wording re scope of advice & incomplete / inaccurate info SoA & Strategic Review SOA – Key changes: • Scope of this advice section – text updated to match new scope items in Fact Find (which better reflect client needs & issues) • Limitations text – added for when client hasn’t provided required info • Objectives text amended to match new scope items and priority column added • Overall text updated to ensure linkage between why strategy is right for client and meets their objectives • New sentences added linking product to strategy • Objectives text amended to match new scope items Ongoing Service Agreement • Wording improved to provide greater clarity around services (for future use in FDS) and to ensure focus is on Core Services provided by Adviser, rather than ancillary services 58 Best Interests Checklist – new tool Complete this checklist to help you meet your best interests duty and related obligations. Tick the applicable boxes and retain all applicable supporting information in the client file to show how you have met your obligations. Client name(s): ……………………………… 1.Goals and objectives * I identified and recorded the client’s objectives, financial situation and needs stated by the client 2.Advice area (the subject matter of the advice) and the scope of advice* I identified and recorded the advice area sought by the client, either stated or implied * If the advice area has been limited by the client or by me, I recorded by whom and why # I identified and recorded the scope of advice that is consistent with the advice area sought by the client and the client’s circumstances * 3.Client information * I made reasonable inquiries to obtain complete and accurate information about the client’s circumstances and recorded the information * 4.Expertise and referral * I have the expertise and accreditation to advise the client on the advice area and products, and I am authorised by my licensee to do so # I referred the client to another adviser who had the expertise to provide the advice # I declined to provide advice as I did not have the expertise to provide it # 59 Best Interests Checklist – cont... 5.Investigating and recommending a financial product # * This step is mandatory when recommending acquiring a new financial product, or disposing of, increasing or switching a holding in an existing financial product. Tick the relevant boxes only I formulated and recorded the strategy on which the advice was based before I investigated financial products # I investigated approved financial products that might meet the client’s needs and achieve their objectives, and recorded the findings # Where approved financial products did not meet the client’s needs, I investigated non-approved financial products that might meet the client’s needs and achieve their objectives, and recorded the findings # I investigated a financial product that the client requested that I consider and recorded the findings # I assessed the product information gathered and recorded the details # I provided the client with general or strategic advice that was not product specific # I obtained a waiver/approval to use a non-approved product and/or platform # 6.Judgements * All judgements I made were based on the client’s relevant circumstances. I considered them when scoping the advice, determining the extent of my inquiries into the client’s circumstances, formulating the strategy and recommending the type of and the specific financial product * I believe the client is likely to be in a better position if the client follows the advice * 7.Other reasonable steps * I took other reasonable steps that, at the time, I regarded as being in the best interests of the client and recorded the details * 8.Appropriate advice * The advice is appropriate to the client * 9.Prioritising the client’s interests ahead of my own * I prioritised the client’s interests ahead of my own interests, my related parties and those of my licensee * 60 Best Interests Duty 1 July 2013 Destroy all old stock Fact Find FSG & Adviser Profile Use all new advice documents (in Xplan and on Adviser Services) Fact Finds Letter of Engagement Quick Plans Record of Advice templates Statement of Advice templates Strategic Review SOA Best Interests file checklist – new tool 61 Key milestones and timeframes CommPay* access enabled.FDS wizard Start client released in Xplan* mapping New Advice docs released National Conference 1 Mar 3-5 April FOFA starts 1 May Late May Mid June PD Days Reinforce solutions & processes 30 1 July June July FDS Testing Identify who needs FDS Group clients in DMS Clear segmentation & service offers in Xplan Anniversary date identified for all OGS clients FOFA Training via RBTs Start booking reviews & preparing for July clients Monitoring & supervision starts C&D client review & clean up * Release schedule TBC as dependant on Technology suppliers. 6 Case Study 1 – Replacing a Product Situation: A client has requested an increase of $100,000 to their current AMP life cover and TPD sums insured of $300,000 as their mortgage has increased by this amount. Recommendation: You recommend the client obtain a new policy for $400,000 and cancel their existing policy, rather than apply for additional cover within the existing policy. The terms of the insurance policies and the annual premiums are the same. Result for you: This entitles you to receive a commission of 120% of the annual premium of the entire $400,000 rather than just the increased amount of $100,000. The client accepts the advice and now requires medical checks which would not have been required if the cover had been increased on the existing policy under AMP . No loadings are applied to the client. If the client had held the existing policy, and with the increase they would have been entitled to a 5% increase in the level of cover at no extra cost due to them reaching the four year anniversary on the policy. Has the client been placed in a better position? Who has benefited from this advice? The client is in a better position in the sense that they now have more appropriate levels of cover, however assuming that the policy definitions & terms are the same, they could be worst off compared to increasing cover under existing policy. The adviser has put their interest first. 63 Case Study 2 – Qualifications & Advice Situation - You are a new Adviser that has a life risk only authority. You recently saw a new client who is a self-employed tradesman who requires income protection cover before he’ll be allowed on a building site. Discovery - You conduct reasonable enquiries in relation to the agreed scope of advice and during the Fact Find process discover the client is in partnership operating a hugely successful plumbing business with 20 employees. The client spends his time quoting jobs while his partner runs the logistics and admin. The client also tells you that he does not have any succession plans in place. Recommendation - You consider the clients may have a need for a Buy/Sell Agreement and Business Insurance however as a newly qualified adviser, you don’t feel you have enough experience to provide advice in the additional areas identified. What are your obligations under Best Interests? As the client has highlighted areas outside the area of competency, you must either decline to provide the advice or refer the client to an appropriately qualified specialist (e.g. another RI adviser). You can not ignore the clients need or mutually agree to scope it out. 64 Case Study 3 – Scope of Advice Situation - A couple engages your services to provide them with advice to address three objectives: to pay off their home loan; to obtain education funding strategies for the expected educational expenses of two children; and to increase their superannuation balance. Discovery - In the Fact Finding process you discover that they have a third child who has a disability and will require ongoing care for their entire life. You expand your questions to discover what plans have been made to care for the child in the short and long term. Recommendation - The couple provides further information of the investment and insurances that have already been instigated to care for their third child. The client states that this investment does not need to be reviewed. However you discuss the need to review the insurances. The client agrees with this review. How should you address the additional investments and insurances under Best Interests? The adviser has considered that the information provided was not sufficient to identify the clients relevant circumstances. The adviser uses a series of questions to determine if the client has made provisions for the child & to determine if the needs & objectives as well as the scope of advice should be amended. This demonstrates that the adviser is considering the scope of advice in relation to the clients best interests. Also it is considered that advisers who implement these types of processes are more likely to be able to demonstrate that they have met the BI duty & related obligations when they provide advice. 65 Case Study 4 – Scaled Advice Situation - A 45 year old client has approached you wanting to consolidate super and review their risk position. It appears that this will be a simple scaled advice situation on the surface and you agree and begin the fact find process. Discovery - During the fact find process, you find out the client is divorced from a partner who cannot work and supports a disabled child. It is now clear to you this is not as simple as it first seemed. You are now aware that the client is the sole breadwinner and that you must ask more questions about what extra financial support the disabled child needs as a result of their medical condition. This includes such things as medical fees, adjustments to home or car and extra tools to assist the child through life at school or special education etc. How should you address the additional investments and insurances under Best Interests? The scenario requires you to make further enquiries because under the safe harbour requirements you must: - Identify the needs of the client that would be considered as relevant to the advice sought; and - Where it is reasonably apparent that information in relation to the client is incomplete, you must make reasonable enquiries to obtain all the information. As the provider of the advice with the expertise, it is your responsibility to know how far your enquiries should go, thereby setting the scale of the advice. You can adjust the level of your inquiries about the clients relevant circumstances to reflect the nature of the advice being provided as demonstrated in the example above. 66 Conflicted Remuneration May 2013 Conflicted remuneration – recap of obligations The ban on conflicted remuneration is comprehensive and affects the following types of payments: Fund manager to Platform payments (shelf space) Product manufacturer to licensee payments What advisers can accept from their licensee and from product manufacturers Monetary Soft-dollar benefits Payments from employers to advice giving employees Charging clients asset based fees on borrowed amounts 68 What is conflicted remuneration? • Conflicted remunerations means any benefit, whether monetary or non-monetary, given to financial services licensee, or a representative of a financial services licensee, who provides financial product advice to persons as retail clients that, because of the nature of the benefit or the circumstances in which it is given could reasonably be expected to influence the financial product advice recommended by the licensee or representative to retail clients 69 Ban on conflicted remuneration structures – Superannuation, investments and platforms • A prospective ban, from 1 July 2013, on: – All benefits from any financial services business, relating to the distribution and provision of advice for retail financial products – Includes a ban on initial and ongoing commission – Benefits include monetary and non monetary benefits – Grandfathering provisions for existing clients – Existing clients in existing products are generally grandfathered • Ban applies to all financial products (including managed investments, superannuation and margin loans) but excludes certain risk insurance products Conflicted remuneration Note: Monetary benefits from Life companies are exempt 71 Ban on conflicted remuneration • Excludes: – ASFs directed by a client – Payments in relation to general insurance – Payments in relation to life insurance, other than: – Group life insurance within superannuation – Any life insurance for a member of a default super fund – Payments where no advice is provided – Payments in respect of wholesale clients – Payments in respect of certain stockbroking activities – Prescribed benefits or given in prescribed circumstances Is the benefit conflicted? In order to assess whether a benefit is conflicted you need to answer the following questions: • • • • Is the benefit designed / intended / reasonably capable of influencing the advice given? Is the benefit specifically exempt from the definition of conflicted? If the benefit is conflicted, has the benefit been grandfathered? If the benefit is allowed to be accepted, how do I disclose it? In assessing whether it is conflicted it is important to consider: • What the benefit is in nature (is it monetary or non-monetary? If non-monetary, is it educational, IT or entertainment?). Is it designed to align your interests to your client’s? • What is the benefit designed to reward? (Product recommendations, volume linked sales, activity/sales, non-product linked measures?) • Is it volume based? (linked to volume of product sold? – if so it is presumed conflicted) • Are the benefits passed on to advisers who provide advice to retail clients? 73 Grandfathering of existing arrangements • FOFA grandfathers existing arrangements for existing members in an existing fund or investment (and some new member) – Grandfathering of any arrangement that was entered into before 1 July 2013; and – where a person was a member of the fund, and investor or had given a direction prior to 1 July 2014. Establish new arrangements until 30 June 2013* No new arrangements will be grandfathered Continue to on-board new clients into pre 1 July 2013 arrangements No new clients grandfathered Continue to receive commissions and rebates on grandfathered client balances and additional monies Continue to receive commissions and rebates on switches & top-ups within existing pre 1 July 2013 arrangements An arrangement has potentially broad meaning Applies to platform & non-platform operators 30 June 2013 30 June 2014 * Subject to anti avoidance provisions. 74 Grandfathering of existing arrangements • FoFA grandfathers existing arrangements for existing members in an existing fund or investment (and some new members) – Grandfathering of any arrangement that was entered into before 1 July 2013 – Where a person was a member of the fund, and investor or had given a direction prior to 1 July 2014 – An “arrangement” has a potentially broad meaning – it may encompass contracts, agreements, understandings, schemes or other arrangements – A “benefit” includes: – Commissions – Shelf-space payments – Platform margin – Soft-dollar benefits – These measures now apply in relation to both platform and non-platform operators Grandfathering of existing arrangements • ̵ Existing client in existing fund/investment • Grandfathered ̵ New contributions to existing fund/investment • Grandfathered Switch within existing fund/investment Grandfathering for super, pension and IDPS ̵ “Limited” grandfathering for non-super mastertrusts • ̵ ̵ Transfer to a new fund/investment/platform Not grandfathered Monetary Benefits Benefit From To Conflicted Comments Adviser Service Fees oAsset based fees (other than where investment is sourced from borrowing) oFixed fees oFlat SOA / ROA fees ohourly rates as agreed by you and your client. Adviser Service Fees oAsset based fees (where investment is sourced from borrowing) Ongoing commissions (super and investments) Client Adviser No Fees paid for by client to adviser align the adviser to the client and are not conflicted. You can accept these and disclose them in the SOA / ROA. Client Adviser Yes Specifically banned. You cannot charge a client this after 1 July 2013. Product via Licensee Adviser Yes but Grandfather ed Life insurance commission held both inside & outside of superannuation. Product via Licensee Adviser Exempt Volume rebates Platform via Licensee Adviser Yes You can continue to receive these and disclose them in the SOA / ROA. (Please note however Stronger Super legislation will impact on commissions from default funds) Life insurance commission held both inside & outside of superannuation will continue to be paid (except for group cover inside super or retail in default funds and Mysuper funds) You can continue to receive these and disclose them in the SOA / ROA. (Note Stronger Super legislation will impact commissions from a default fund). Grandfathering may apply to existing pre 1 July 2013 arrangements. Grandfathering does not apply to new arrangements post 1 July 2013. Shelf space fees Fund manager Licensee and / or Adviser Licensee Adviser Purchase of practice Yes Banned (subject to grandfathering of certain arrangements pre 1 July 2013) No Allowed as long as there is no uplift in valuation for specific products / platform 77 Monetary Benefits cont... Benefit From To You recommend OneCare Income Protection to a client after 1 July and receive 115% upfront commission. Product Manufacturer via Licensee Adviser You have a client with an AMP Super Product Account – not in a default investment Manufacturer via choice - that has been active with you Licensee as their Adviser since 2008. You receive a monthly commission payment of 0.6%pa. You purchase a client book with 100 clients who were with an adviser for many years as at 1 July 2013. The book was bought on 10 July 2013. The previous Adviser was receiving ongoing commission of 0.8% on super and investments. You have a large Corporate Super account as a client. You currently receive a trail commission which has been in place for the past 5 years. Conflicted Comments Exempted Life insurance commissions are specifically exempt and you can continue to receive them. Disclose these in the SOA. Adviser Grandfathered Grandfathering may apply to existing pre 1 July 2013 arrangements Product Manufacturer via Licensee Adviser Grandfathered Product Manufacturer via Licensee Adviser Grandfathered The existing client arrangements as at 1 July 2013 can be assigned / transferred to a new adviser subject to same arrangements being in place with both licensees. However you should seek legal advice on how the sale contracts are structured. This is grandfathered however note the impact of Stronger Super legislation on default funds. You agree with a client to charge a one- Client off ASF of $1,100 for the cost of your advice commencing July 2013. Adviser No Client payments to advisers align your interests with the client. This is what the legislation is intended to do. This can be accepted and is disclosed in the SOA / ROA. 78 Non-monetary benefits • Benefits where a payment does not occur between two parties are non-monetary. • Non-monetary benefits are sometimes referred to as soft dollar benefits. • A non-monetary benefit can be allowed if it is not capable or reasonably capable of influencing the advice given to a retail client. • If non-monetary benefits are deemed to be conflicted remuneration, then a ban applies on amounts greater than $300. • This applies to both benefits given from life insurance providers as well as non-life insurance providers. • For soft-dollar benefits <$100 you do not have to record them • For soft-dollar benefits >$100 up to $300 you must record this in your alternative remuneration register. • For benefits >$300 you cannot accept these 79 Non-monetary benefits Frequency of benefits • Note that the benefits above may be regular or frequently given (more than 3 times over a 12 month period). • If benefits are similar in nature (e.g. 4 dinners provided by a product manufacturer to an adviser within 12 months) they may be treated as related and all 4 dinners added as one benefit to see if they exceed the total $300. • If benefits are unrelated / once-off then each individual benefit can be up to $300. Non-monetary exemption • Benefits with an educational or training purpose – not conflicted if it has a genuine educational or training purpose that is relevant to providing financial product advice. The benefit must: – Take up at least the lesser of 6 hours a day or 75% of the time spent on the course; & – The participant or their employer or AFS licensee must pay for travel and accommodation relating to the course, and events and functions held in conjunction with the course. • Benefits for IT & Support – not conflicted if it is for the provision of IT software and support, and the benefit is related to providing financial product advice about the products issued or sold by the benefit provider; and complies with the conditions in the regulations. The benefit must: – be provided by the owner or distributer of the software; – access to an IT “help desk” for problems that an AFS licensee or representative experiences in using admin platform software where the benefit is provided by the software owner or distributer; and – access to a website to place client orders. 80 Non-monetary benefits Benefit – includes following examples (but not limited to) Free or subsidised business equipment (Computers and other hardware, software, IT support (e.g. accounting, anti-virus and software) and stationery) Hospitality (Tickets to sporting events or concerts and subsidised travel) Lunches and dinners provided / entertainment Free use of conference facilities, training rooms for advisers Arranging of loans to other licensees or representatives Attendance at networking events (Conference) domestic and overseas. Provision of marketing services (brochures, newsletters, promotional documents) Promotions or other ways of recognising an employee based on product recommendations / sales 81 Do you employ advisers? Employers have specific obligations to ensure they do not provide conflicted remuneration payments to their employees who give advice to retail clients after 1 July 2013. Employers should consider the following questions. Do you employ advice giving employees? Do you reward employees based on the total amount of $FUA implemented or Specific Product volumes recommended? Do you have long term incentive programs in place where rewards are calculated based on the volume of products implemented? Have you sought HR legal advice on which measures may be conflicted? Have you sought HR legal advice on how to restructure contracts / scorecards before 30 June 2013? 82 Employees – Salary vs Bonuses Fixed Salary Salary payments and SGC are not conflicted remuneration, however, if you attach any conditions to them based on the amount of product sold or volume of funds implemented, they can influence the advice and can be conflicted. Variable benefits (bonuses, rewards and recognition) Bonuses Share of Revenue Criteria for promotion and salary increases attendance at networking and entertainment events reward-focused conferences Long term incentives such as shares or options in the business Care needs to be taken on how these benefits are calculated and how closely they are linked to the volume of product implemented or advice given. Generally an adviser’s contribution to the total revenue or net profit (regardless of product recommended) to your business or division will be less likely to be conflicted than an adviser’s scorecard being linked directly to $FUA implemented. 83 Rewarding Employees When rewarding the Adviser, consider other criteria in addition to revenue generated Meeting employer compliance policies – an “outstanding compliance rating” High levels of client satisfaction Client retention The number of new clients the employee has brought to the business Professional development achievement Team and corporate value 84 Performance Based Bonuses Issues to consider when evaluating performance benefits Purpose of the Performance Benefit Consider the behaviour you are trying to encourage through the benefit. For example is the scorecard criteria designed to encourage best interests advice. Link between the benefit & financial product advice How direct is the link between the benefit and the value/number of financial products recommended to clients? It is likely to be conflicted if based on the volume of product sales compared to one based on the profitability of an employee’s business unit. Involvement of the recipient in the advice giving process How directly involved is the recipient? If the recipient helps prepare the advice but does not provide input into the recommendations made to the client, the performance benefit is less likely to be conflicted. Environment in which the benefit is given Is the benefit given in an environment that encourages good financial advice that is in the client’s best interests? Consider including compliance with internal processes and legal requirements, adviser training undertaken etc. Weighting of the benefit in relation to total remuneration What is the relative proportion of the benefit to the overall remuneration of the employee, which includes the benefit and salary? 85 Rewarding Employees An adviser receives a $5,000 bonus from their employer. The bonus was paid in recognition of client satisfaction an increase in new clients productivity outstanding compliance ratings developing referral networks. This is unlikely to be conflicted remuneration because it would not reasonably be expected to influence the financial product advice given. ASIC are less likely to scrutinise performance benefits that are designed to more closely align the interests of employees who provide advice to retail clients with the interests of their clients. Where the remuneration is based on total employer profitability (e.g. $100,000 fee for service generated), as opposed to employee individual sales ($100,000 commission), would not be considered conflicted remuneration if it could not be reasonably expected to influence the advice give. 86 Activity 1 – Remuneration payments Consider the following remuneration payments that Advisers typically receive. Review the following payments and decide if the payments are permitted from 1 July 2013. Benefit Conflicted Remuneration? You recommend OneCare Income Protection to a client after 1 July and receive 115% upfront commission. No You have a client with an AMP Super Account that has been active with you as their Adviser since 2008. You receive a monthly commission payment of 0.6%pa. Yes You have a client transfer their Super account to you in July 2013. The previous Adviser was receiving ongoing commission of 0.8%. Yes You have a large Corporate Super account as a client. You currently receive a trail commission which has been in place for the past 5 years. No You agree with a client to charge a one-off ASF of $1,100 for the cost of your advice commencing July 2013. No If yes Grandfathered? Yes 87 Activity 2 – Soft Dollar benefits Below are soft dollar benefits that Advisers may have received in the past. Using the decision tree provided, decide if these benefits are permitted to be provided and you are able to receive from 1 July 2013. Conflicted ? Sporting events Bob is invited by OnePath to the State of Origin in Sydney, the cost of the ticket is $100. OnePath also provides dinner and drinks which cost $100. Greg is invited by MLC to four football matches throughout the year. The cost of the ticket each time is $50. Drinks are provided which cost approximately $40 each event. Bob is invited to the Formula 1 racing event in Melbourne by Asteron. The cost of the ticket is $500 for the weekend. Asteron pay for the airline ticket, accommodation and all meals cost being $2,500. Conferences George is invited by Asteron to attend their 3 day international conference in Singapore. Asteron pays for George’s accommodation, other day trips and all meals however George pays for his own flights. The time spent each day on education and training activities is six hours. Andrew is invited to attend the RI conference in the Blue Mountains. It is a three day event with between 6 and 5 hours of educational content each day. The cost of $2,800 for the conference is paid by Andrew and as he lives in Sydney, he drives to the venue. Social events Debbie is invited to a bare foot bowls afternoon by Zurich. The day consists of lunch, drinks and the bowls game. The total cost of the day is $100. Ken is invited to attend a seminar by a motivational speaker by ANZ. The cost of the event is $500. Bob is invited to see Rolling Stones concert with dinner beforehand by Zurich. The total cost of the night is $600 per person. Can you accept it? No Yes Yes No Yes No Yes No No Yes No Yes Yes Yes No No 88 Activity 2 - Soft Dollar benefits Below are soft dollar benefits that Advisers may have received in the past. Using the decision tree provided, decide if these benefits are permitted to be provided and you are able to receive from 1 July 2013. Conflicted ? Software Every month a product issuer offers the financial advisers of a dealer group an incentive of $500 if they sell a certain volume of the issuer’s products. From 1 July 2013, the product issuer no longer makes this offer (the product issuer has not elected to comply with Pt 7.7A before this date). Instead, the product issuer offers to provide the dealer group with access to software that it owns, which allows the performance of a client’s investment in the issuer’s products to be monitored. The software can be accessed by all of the dealer group’s financial advisers. Marketing Allowances Asteron pays for an advertisement sign at the local football field for Joe Brown. This sign provides Joe’s company name, services and his licencee details. The cost of the sign is $500. OnePath pays Bob $2,500 towards Bob’s new corporate brochure which describes his services. Zurich pays $300 towards the client seminar that John is arranging for his A class clients. At this seminar a Zurich representative will provide a presentation on the benefits of Personal Risk insurance. AXA contributions $1,500 towards the printing of client letters for Mary to inform her clients about the upgrade of the AXA Superannuation fund. Educational George is invited by AMP to attend training at their city office which is a four hour session on their new products. Lunch is provided however George pays for his own parking. Andrew is invited by OnePath to attend their Meet the Manager Day in Sydney. The day consists of 3 hours in the morning meeting the OnePath team with information on their services and process requirements. The afternoon 2 hour session is product training. Lunch is provided. OnePath pays for the flight and taxi fares to their office. Can you accept it? No Yes Yes No Yes No No Yes Yes No No Yes Yes No 89 Questions & Group Discussion May 2013 Conclusion Annual Disclosure • From 1 July 2013, all new and existing clients who receive ongoing advice must be provided with a Fee Disclosure Statement (FDS). Best Interests Duty • From 1 July 2013 all Advisers must ensure that they have acted in their client’s best interests, and prioritised the client’s interests above their own or the Licensee. • Advisers must ensure their advice is appropriate as well as meeting the Best Interests Duties by demonstrating and providing evidence that they have followed the ‘safe harbour’ duty and related obligations Conflicted Remuneration • Advisers will no longer be able to receive initial or trail commissions on new investment products from 1 July 2013. Any trail commission paid on Investment Loans, regardless of when the loan was established, are not permitted. • Employers (Proprietors) have specific obligations to ensure they do not provide conflicted remuneration payments to their employees who give advice to retail clients after 1 July 2013. 91 Support Adviser Services New FOFA section – coming soon ASIC website ASIC Regulatory Guides (RG) www.asic.gov.au/rg RG 175 Financial product advisers—Conduct and disclosure RG 245 Fee Disclosure Statements RG 246 Conflicted remuneration Regional Practice Development Manager or Practice Development Coach 92 Appendices May 2013 The impact of Stronger Super and MySuper • General fee rules • Transition to MySuper General fee rules • Apply to ALL super funds (except SMSFs and PSTs) from 1 July 2013 – Entry fees banned – Conflicted remuneration banned – Exit fees, switching fees and buy/sell spreads limited to cost-recovery basis – Rules apply to performance-based fees Transition to MySuper • 1 January 2014 – All default contributions must be paid to a MySuper fund – New contributions for both existing and new members – Existing balance can remain in existing fund – Commission can be paid on FUM and life insurance • 1 January 2014 - 1 July 2017 – Exact date agreed between APRA and Trustee – Existing balance transferred to MySuper fund – Accrued default amounts – All commission ends – FUM and life insurance MySuper and advice • No bundled personal advice (except for intra-fund advice) • MySuper funds can provide intra-fund advice – Cost of intra-fund advice can either be shared across the MySuper membership or charged to those who use the service • Fees for advice (outside intra-fund advice) would be on a fee-for-service basis – Negotiated between member and adviser – Paid from the member’s account – Payments for advice would require express annual renewal – No upfront or trail commission – No shelf-space or volume rebates

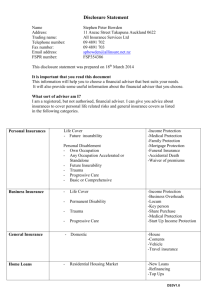

![Literature Option [doc] - Department of French and Italian](http://s3.studylib.net/store/data/006916848_1-f8194c2266edb737cddebfb8fa0250f1-300x300.png)