Concentrated Markets

advertisement

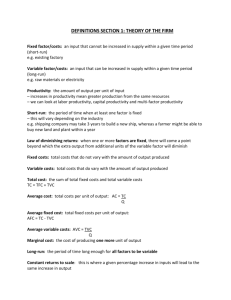

Concentrated Markets Content • • • • • • • • • • • • Monopoly Oligopoly Price makers and price takers Growth of firms Sources of monopoly power Model of the monopoly Collusive and non collusive oligopoly Interdependence in oligopolistic markets Price discrimination Consumer and producer surplus Contestable and non contestable markets Market Structure, Static Efficiency, Dynamic Efficiency and Resource Allocation Monopolies • Monopoly – this is where there is a single producer in the market • Features: – – – – – One producer is able to charge relatively high prices New products are rarely introduced Resources are not used efficiently Monopolies have market power Monopolies are able to set prices – price setters Oligopolies Few firms in the market who are interdependent in their actions – Firms consider competitors reactions when changing prices / introducing new products – There is a high degree of competition – Businesses try and avoid price competition preferring non price competition – Products are branded and differentiated from each other – Can be many take-overs – Collusion may occur leading to cartels being formed Price makers and price takers • In pure monopolies the firm is a price maker as they are able to take the markets demand curve as their own • The monopoly firm is able to set the price anywhere on this demand curve • The ability of the monopoly firm to set price is dependent on price elasticity of the product – if demand is elastic it will limit the firms price setting power Price takers • Firms in perfect competition are price takers • All businesses have to accept the price that is set by the market • Firms are not able to set their own price Factors that influence the ability of a firm to be a price maker • Only firms in pure monopolies can be price makers • This means that there must be: – Barriers to entry and exit – Only one producer / firm in the market – Imperfect knowledge • In reality this is seldom the case and pure monopolies rarely exist Factors that influence the ability of a firm to be a price maker • Very few markets are dominated by just one firm – it is more likely that they are dominated by a few major firms who are able to act as price makers • Barriers to entry do exist in many markets however they may be overcome in a number of ways including: – – – – Takeovers from outside / inside the industry Growing markets Increased overseas competition Transfers of brand names between sectors of the economy in companies that differentiate their product offerings Price Makers • As pure monopolies rarely exist having one firm as a price maker is unlikely • If firms are able to set prices in a market the extent to which they can is influenced by price elasticity for that market, the more inelastic the demand for a product the more a firm can set the price The Growth Of Firms • Growth is often a key objective of firms • Business grow for a number of reasons including: – – – – – To increase profits To decrease costs To dominate the market To reduce risk To fulfil objectives of management Internal and External Growth • Businesses can choose to grow internally by selling more of their products or externally by acquiring / merging with another firm • Internal growth is often referred to as organic growth • Internal growth is slower External growth - Takeovers • Takeovers are where one firm gains control of another firm • The amount a firm pays to takeover another firm is dependent on its perceived value • Attacker firms often pay a premium to shareholders in order to secure their shares • Bids can be hostile or welcome • Hostile bids have a greater degree of risk Mergers • Mergers occur when at least two firms join together to form one organisation • Mergers and takeovers can take the following forms: – Horizontal – firms join together who are at the same stage in the production process – Vertical – firms join together who are at different stages in the production process – Conglomerate – firms in different markets join together Why do firms merge ? • Mergers and takeovers are ways for businesses to grow • Firms decide to merge / take over due to synergy • Synergy is where the performance of the new firm is greater than the performance of the separate firms • Synergy is created by shared resources, ideas and skills Management Buyouts • Where managers in a business take it over by buying a controlling interest in its shares • Managers may do this as they think they can turn the business around, or if shareholders lose interest in a particular part of the business • Manager often need to borrow money to finance MBOs • MBOs are risky however if successful they allow managers to reap plenty of rewards Joint Ventures • Joint ventures occur when two businesses set up a third business together to develop a new product, enter a new market etc • Joint ventures are set up to achieve a specific objective or project for both parties • There are benefits for both parties from these relationships • Sony and Ericsson enjoyed a joint venture where they worked together to develop mobile phones Outsourcing • Outsourcing allows a business to contract out some of their operations to a third party to perform • Outsourcing of production overseas has allowed businesses to reduce their costs e.g. call centres locating overseas in lower wage countries • Outsourcing has been driven by technological change, pressure on profit and costs and an increase in the level of competition Sources of Monopoly Power • Monopoly power is influenced by the following factors: – – – – Barriers to entry Number of competitors Advertising Degree of product differentiation Sources of Monopoly Power • The larger and more expensive the barriers to entry the greater the monopoly power • The smaller the number of competitors in the market the greater the monopoly power • The greater the advertising spend and more recognisable the brand name the greater the monopoly power • The larger the degree of product differentiation the greater the extent of the monopoly power : The Model Of Monopoly Monopoly Model • In the monopoly model the average revenue curve is the same as the demand curve • Where total revenue exceeds total costs the firm is able to make supernormal profits Collusive Oligopoly • Collusion occurs where the firms work together to reduce uncertainty in the market • Firms may become involved in price fixing or cartels to act as though they are the only firm in the market and therefore can set prices • This is illegal in the UK and EU Price fixing and collusion • Price fixing is where all firms in the market try and control supply to achieve a “monopoly” like situation • For this to happen producers need to have an influence over supply • This is most likely when the market is dominated by a few large firms, demand is inelastic, market demand doesn’t fluctuate and you can easily quantify the output of each firm Price leadership and collusion • Where one firm is dominant in the oligopoly they often take the role of price leader setting the price for the market • Tacit collusion – is where companies are engaging in behaviours which minimise the response of competitors • In the UK the supermarket business could be seen as behaving in a way similar to tacit collusion Non Collusive Oligopoly • Oligopolies are markets which have the following features: – – – – – A few large firms Entry barriers Non price competition Product branding and differentiation Interdependence in decision making Oligopolies • Firms operating in oligopolies tend to invest heavily in new machinery and processes to try and reduce their cost structure and make more profits • Research and development expenditure is also high as businesses try and differentiate their products from their competitors • Businesses in oligopolies use advertising and marketing to build strong brand recognition which allows them to compete on factors other than price and acts as a barrier to entry for new firms Non Price competition • In oligopolies the majority of competition is non-price • This aims to influence demand and build brand recognition • Methods include: – – – – – – – – Better customer service Discounts on upgrades Free deliveries and installation Extended warranties Credit facilities Longer opening hours Product branding After sales service Price Wars • Firms tend to compete on non price factors as competing on price can lead to price wars • Price wars occur when one competitor lowers its price, then others will lower their prices to match . If one of the firms reduces their price below the original price cut, then a new round of reductions is begins. Entry Barriers • Oligopolies have a number of barriers to entry – Size of the firms in the market means they can influence output and price – Larger firms can exploit economies of scale – Branding and brand recognition Interdependence in Oligopolies – Kinked Demand Curve • • • Firms in an oligopoly face a kinked demand curve If they raise price above P* the demand curve is relatively elastic as people will switch to buying substitute products from competitors If they drop price below P* they face an inelastic demand curve as other firms will also cut prices so few gains in quantity demanded occur Interdependence in Oligopolies – Game Theory • Game theory looks at the players in a game or firms in a market • In making decisions each player has a number of choices • Each player is influenced by their own actions and the actions of other players • Game theory can be used to illustrate the interdependence of firms in an oligopoly Price Discrimination • Price discrimination is where a firm charges different prices for the same product to different consumers • The most common example is peak and off peak pricing for travel • For price discrimination to work the following conditions are needed: – Differences in price elasticity of demand between markets – Barriers to prevent consumers switching between suppliers Price Discrimination 1. • • Perfect Price Discrimination – this is where the firm charges whatever the market will bear. This means the producer can transfer all of the consumer surplus to producer surplus. This could hypothetically happen if a monopolist was able to segment the market precisely however it is very unlikely to occur in real life Price Discrimination 2. Second degree price discrimination – where packages of products that are surplus to requirements are sold at lower prices • This often happens with last minute holiday deals where businesses are selling off their spare capacity to gain some revenue • In the low cost airline sector firms operate a strategy opposite to this where the cheapest flights are those you book the furthest in advance Price Discrimination 3. Peak and Off Peak pricing – this is where a different price is charged due to the time of day / year • During peak times there is more demand for the product so higher prices can be charged – demand is likely to be more inelastic • Examples of peak / off peak include rail travel, holidays and phone calls Price Discrimination 4. Third degree price discrimination – Charge different prices for different products to different market segments • Markets are usually segmented by time or geographical area • E.g. having one price for the UK and one for the USA Advantages and Disadvantages of Price Discrimination Advantages • Increases profit for the firm • Increase in size of producer surplus • Firms may be able to exploit economies of scale • Can be used to cross subsidise goods with high social benefits Disadvantages • Reduction in size of consumer surplus Consumer and Producer Surplus • Consumer surplus – This is the difference between what a person would be willing to pay and what they actually pay to buy a product. • It is the area below the demand curve and above the price • Producer surplus – This is the difference between the price where a producer would be willing to provide a product and the actual price the product is sold at Consumer Surplus • The consumer surplus is shown by the shaded area on the diagram • At a price P1 all consumers in the shaded area would pay more for the good and therefore they gain extra benefits from the lower price Producer / Consumer Surplus and Efficiency • If the market is perfectly competitive at equilibrium price and quantity consumer and producer surplus will be maximised • This represents the most efficient output level Price Discrimination and Producer / Consumer Surplus • If first degree price discrimination occurs then the consumer surplus is removed and transferred to producer surplus • Other forms of price discrimination also reduce the consumer surplus and increase the producer surplus Consumer Surplus and Monopoly • In Monopolies the consumer surplus is reduced • Some of this reduction is passed to producers in the form of the producer surplus Contestable and Non Contestable Markets • Contestability markets are where there is one firm (or a small number of firms) and due to freedom of entry and exit, the firm (or firms) face competition from potential new entrants and so operates like a perfectly competitive market • In reality there are barriers to contestability to most markets • The majority of markets are contestable to some extent • The degree of contestability is dependent on barriers to entry Conditions for Contestability • The following conditions need to apply for pure market contestability: – Freedom of entry and advertisement – Absence of sunk costs – these are costs that a business has to pay to enter the industry that cant be recovered or recouped – Perfect information • Contestability means that businesses in a market will make pricing and output decisions based on the threat of competition • Markets are become increasingly contestable due to globalisation Efficiency, Dynamic Efficiency and Resource Allocation • Productive efficiency – is the level of production that makes the most cost effective use of the factors of production • Allocative efficiency – is the level of production where no resources are wasted, no one can be better off without anyone else being worse off • Perfectly competitive markets exhibit productive and allocative efficiency • . Market Structure, Static Efficiency, Dynamic Efficiency and Resource Allocation • Efficiency is influenced by a number of factors including: – – – – research and development investment in human and non-human capital Technological change. Candidates should be able to compare and discuss the • The more competitive a market is the greater the allocative efficiency of resources Summary • • • • • • • • • • • • • Monopolies operate where there is one firm in the market, they are able to set prices and have high barriers to entry Oligopolies have a few firms in the market, high brand recognition and heavy competition on non price factors Price makers are able to set the price for the market whereas price takers have to accept the market price Growth of firms – firms grow internally and externally through organic growth or mergers, takeovers, joint ventures and management buyouts Outsourcing is increasingly being used by firms to grow their operations Monopolies have power as they are able to influence the price for the whole market The model of the monopoly shows how the monopolist takes the industry demand curve as their own Collusive and non collusive oligopoly – collusive oligopolies work together to set prices, non collusive oligopolies do not Interdependence in oligopolistic markets – companies take decisions based on the expected decisions of others, all decisions are influenced by those of others and influence them Price discrimination is where you charge a different price for the same product to different consumers Consumer and producer surplus show the extra benefits to producers and consumers of a certain price Contestability looks at the threat of entry of new firms to the market Market Structure influences the allocation of resources within an economy