ppt

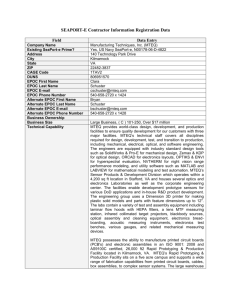

advertisement

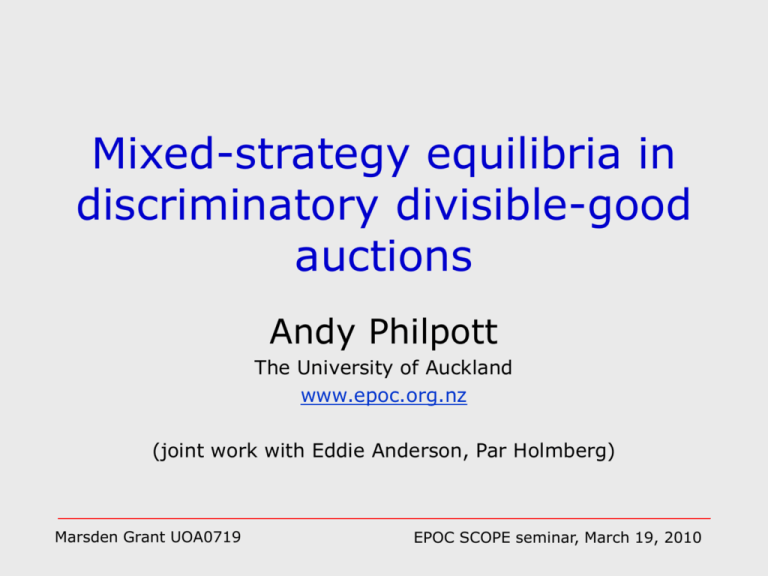

Mixed-strategy equilibria in discriminatory divisible-good auctions Andy Philpott The University of Auckland www.epoc.org.nz (joint work with Eddie Anderson, Par Holmberg) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Uniform price auction price T1(q) price T2(q) p quantity quantity price combined offer stack p demand Marsden Grant UOA0719 quantity EPOC SCOPE seminar, March 19, 2010 Discriminatory price (pay-as-bid) auction price T1(q) price T2(q) p quantity quantity price combined offer stack p demand Marsden Grant UOA0719 quantity EPOC SCOPE seminar, March 19, 2010 Motivation: which is better? Source: Regulatory Impact Statement, Cabinet Paper on Ministerial Review of Electricity Market (2010) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 How to model this? • Construct a model of the auction where generators offer non-decreasing supply functions. • Find a Nash equilibrium in supply functions (SFE) under the uniform pricing rule (theory developed by Klemperer and Meyer, 1989). • Find a Nash equilibrium in supply functions under the pay-as-bid rule (but difficult to find, see Holmberg, 2006, Genc, 2008). • Compare the prices in each setting. Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Recent previous work • Crampton and Ausubel (1996) show results are ambiguous in certain demand case. • Wolfram, Kahn, Rassenti, Smith & Reynolds claim pay-as-bid is no better in terms of prices • Wang & Zender, Holmberg claim lower prices in pay-as-bid. • Our contribution: – Describe a methodology for constructing Nash equilibrium for pay-as-bid case. – Pure strategies generally don’t exist. – Characterize equilibria with mixed strategies Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Antoine Augustin Cournot (1838) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Joseph Louis François Bertrand (1883) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Francis Edgeworth (1897) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Symmetric duopoly setting • • • • • • Two identical players each with capacity qm Marginal costs are increasing (C’(q) ≥ 0) Demand D(p) + e e with distribution F(e) support [e, e]. Each player offers a supply curve S(p) Essential mathematical tools – residual demand curve – market distribution function – offer distribution function Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Residual demand curve with shock D(p) + e - S(p) e price S(p) p q Marsden Grant UOA0719 q q quantity EPOC SCOPE seminar, March 19, 2010 The market distribution function [Anderson & P, 2002] Define: y(q,p) = Pr [ D(p)+e – S(p) < q] = F(q + S(p)-D(p)) = Pr [an offer of (q,p) is not fully dispatched] = Pr [residual demand curve passes below (q,p)] price p ( q, p ) q Marsden Grant UOA0719 S(p) = supply curve from other generators D(p) = demand curve e = random demand F = cdf of demand f = density of demand quantity EPOC SCOPE seminar, March 19, 2010 The offer distribution function [Anderson, Holmberg & P, 2010] Other player mixing over offer curves S(p) results in a random residual demand. G(q,p) = Pr [an offer of at least q is made at price below p] = Pr [offer curve in competitor’s mixture passes below (q,p)] = Pr [S(p) > q] price Note: G(q,p)=1 p ( q, p ) G(q,p) = 1 for q<0 G(q,p)=0 q Marsden Grant UOA0719 quantity EPOC SCOPE seminar, March 19, 2010 F * G equals y Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 1: no mixing, D(p)=0, demand=e (= probability that demand < q+q(p) ) price G(q,p)=1 q(p) p G(q,p)=0 q Marsden Grant UOA0719 q(p) quantity EPOC SCOPE seminar, March 19, 2010 Evaluating a pay-as-bid offer price Offer curve p(q) (q, p(q )) qm Marsden Grant UOA0719 quantity EPOC SCOPE seminar, March 19, 2010 A calculus of variations lesson Euler-Lagrange equation Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Replace x by q, y by p Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Summary so far Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 1: Optimal response to competitor Decreasing function!! Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Nash equilibrium is hard to find Linear cost equilibrium needs Rapidly decreasing density !! Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Mixed strategies of two types A mixture G(q,p) so that Z(q,p)≡0 over some region (“slope unconstrained”) or A mixture G(q,p) over curves all of which have Z(q,p)=0 on sloping sections and Z(q,p) with the right sign on horizontal sections (‘slope constrained”). Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 1: Competitor offers a mixture Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 1: What is Z for this mixture? Note that if Z(q,p)≡0 over some region then every offer curve in this region has the same expected profit. Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 1: Check the profit of any curve p(q) Every offer curve p(q) has the same expected profit. Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 1: Mixed strategy equilibrium Each generator offers a horizontal curve at a random price P sampled according to Any curve offered in the region p>2 has the same profit (1/2), and so all horizontal curves have this profit. G=0.8 G=0.6 G=0.0 Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 2: Mixed strategy equilibrium Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 2: Mixed strategy equilibrium G=0.6 G=0.4 G=0.2 G=0.0 Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 When do these mixtures exist? These only exist when demand is inelastic (D(p)=0) and each player’s capacity is more than the maximum demand (neither is a pivotal producer). (The cost C(q) and distribution F of e must also satisfy some technical conditions to preclude pure strategy equilibria.) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Mixed strategies of two types A “slope unconstrained” mixture G(q,p) so that Z(q,p)≡0 over some region: for non-pivotal players. or A “slope constrained” mixture G(q,p) over curves all of which have Z(q,p)=0 on sloping sections and Z(q,p) with the correct sign on horizontal sections: for pivotal players. Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Slope-constrained optimality conditions p Z(q,p)<0 ( the derivative of profit with respect to offer price p of segment (qA,qB) = 0 ) Z(q,p)>0 qA x Marsden Grant UOA0719 x qB q EPOC SCOPE seminar, March 19, 2010 Examples 3 and 4: D(p)=0 Two identical players each with capacity qm < maximum demand. (each player is pivotal). Suppose C(q)=(1/2)q2. Let strategy be to offer qm at price p with distribution G(p). G(q,p)= Pr [offer curve in competitor’s mixture passes below (q,p)] Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Examples 3 and 4 Suppose e is uniformly distributed on [0,1]. The expected payoff K is the same for every offer to the mixture. Choosing K determines G(p). In this example Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 3: K = 0.719, qm=0.5778 p1=8.205 G(p1)=1 8 Equilibrium requires a price cap p1 6 4 p0=2 0 Marsden Grant UOA0719 G(p0)=0 2 0.1 0.2 0.3 q 0.4 0.5 0.6 EPOC SCOPE seminar, March 19, 2010 Recall optimality conditions p Z(q,p)<0 ( the derivative of profit with respect to offer price p of segment (qA,qB) = 0 ) Z(q,p)>0 qA x Marsden Grant UOA0719 qB q EPOC SCOPE seminar, March 19, 2010 Example 3: K = 0.719, qm=0.5778 Plot of Z(q,p) for K = 0.719, qm=0.5778 3.5 p=3 p=2.5 p=2 3 2.5 2 1.5 p=2 p=2.5 p=3 1 0.5 0 0.1 0.2 0.3 q 0.4 0.5 0.6 Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 Example 4: K = 0.349, qm=0.5778 5 p1=4.06 4 3 2 p0=1.1 1 0 Marsden Grant UOA0719 0.1 0.2 0.3 q 0.4 0.5 0.6 EPOC SCOPE seminar, March 19, 2010 Example 4: K = 0.349, qm=0.5778 Plot of Z(q,p) for K = 0.34933, qm=0.5778 1.6 1.4 p=1.1 p=1.2 p=1.3 1.2 1 0.8 0.6 p=1.5 0.4 0.2 0 0.1 0.2 0.3 q 0.4 0.5 Marsden Grant UOA0719 0.6 EPOC SCOPE seminar, March 19, 2010 Example 4: “Hockey-stick” 4.06 1.5 1.1 0.5156 Marsden Grant UOA0719 0.5778 EPOC SCOPE seminar, March 19, 2010 When do we get hockey-stick mixtures? Assume C is convex, D(p)=0, and generators are pivotal. • There exists U such that for all price caps p1 greater than or equal to U there is a unique mixed strategy equilibrium. • There exists V>U such that for all price caps p1 greater than or equal to V there is a unique mixed strategy equilibrium consisting entirely of horizontal offers. • For price caps p1 greater than or equal to U and less than V there is a unique mixture of hockey stick bids and horizontal offers. Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 What we know for increasing marginal costs Pivotal suppliers Non pivotal suppliers Marsden Grant UOA0719 Inelastic Demand Elastic demand Equilibrium with horizontal mixtures and price cap. Equilibrium with hockey-stick mixtures and price cap. Equilibrium with horizontal mixtures and price cap. Equilibrium with sloping mixtures. No known mixed equilibrium In special cases, equilibrium with horizontal mixtures and no price cap. EPOC SCOPE seminar, March 19, 2010 Listener, July 4-10, 2009 Professor Andy Philpott’s letter (June 20) supporting marginal-cost electricity pricing contains statements that are worse than wrong, to use Wolfgang Pauli’s words. He would be well advised to visit any local fish, fruit or vegetable market where every morning bids are made for what are commodity products, then the winning bidder selects the quantity he or she wishes to take at that price, and the process is repeated at a lower price until all the products have been sold. The market is cleared at a range of prices – the direct opposite of the electricity market where all bidders receive the same clearing price, irrespective of the bids they made. Therefore, there is no competition for generators to come up with a price – just bid zero and get the clearing price. John Blundell (St Heliers Bay, Auckland) Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010 The End Marsden Grant UOA0719 EPOC SCOPE seminar, March 19, 2010