Del Monte Pacific pr.. - Del Monte Pacific Ltd

advertisement

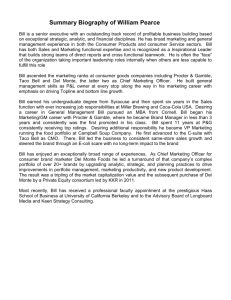

Del Monte Pacific Ltd Corporate Presentation A Global Heritage Brands Company 16 Dec 2015 Disclaimer This presentation may contain statements regarding the business of Del Monte Pacific Limited and its subsidiaries (the “Group”) that are of a forward looking nature and are therefore based on management’s assumptions about future developments. Such forward looking statements are typically identified by words such as ‘believe’, ‘estimate’, ‘intend’, ‘may’, ‘expect’, and ‘project’ and similar expressions as they relate to the Group. Forward looking statements involve certain risks and uncertainties as they relate to future events. Actual results may vary materially from those targeted, expected or projected due to various factors. Representative examples of these factors include (without limitation) general economic and business conditions, change in business strategy or development plans, weather conditions, crop yields, service providers’ performance, production efficiencies, input costs and availability, competition, shifts in customer demands and preferences, market acceptance of new products, industry trends, and changes in government and environmental regulations. Such factors that may affect the Group’s future financial results are detailed in the Annual Report. The reader is cautioned to not unduly rely on these forward-looking statements. Neither the Group nor its advisers and representatives shall have any liability whatsoever for any loss arising, whether directly or indirectly, from any use or distribution of this presentation or its contents. This presentation is for information only and does not constitute an invitation or offer to acquire, purchase or subscribe for shares in Del Monte Pacific. 2 Agenda I. Overview, Brands, History II. Del Monte Foods Acquisition III. Strategies IV. Our Markets V. Financials, Outlook VII. Corporate Governance VIII. Investment Merits IX. Appendix – Competitive Strengths X. Appendix - Products 3 Company Overview • Del Monte Pacific Ltd (“DMPL”) is one of the largest and most well-known marketers of premium quality food products globally • Integrated business model encompassing plantation, processing facilities and sales and distribution networks • Exclusive rights to premium heritage brands Del Monte and S&W in certain geographies and product categories • Dual-listed in Singapore (since August 1999) and the Philippines (since June 2013) • 67% owned by NutriAsia Pacific Ltd (“NutriAsia”) of the Campos family; 5.5% owned by the Lee Pineapple Group • Singapore Corporate Awards (mid-cap category) Best Managed Board, Best CFO, Best IR, Best Annual Report Top 5 ASEAN F&B Co. by Sales (CY 2014 USD bn) DMPL FY2015 Sales (by geography) DMPL FY2015 Sales (by product) 5%2% 14% 8% 6% 19% US$2.2bn US$2.2bn 5.4 5.0 3.7 2.3 2.2 0. 5 Thai Union Frozen Note: Del Monte Pacific is based on FY2015 67% 79% North America Philippines Asia ex-Phils Europe Packaged Fruit and Veg Culinary Beverage Fresh Fruit and Others 4 4 Our Key Brands and Brand Ownership • Del Monte (packaged products): USA, South America, Philippines, Indian subcontinent and Myanmar • S&W (for both packaged and fresh products): Globally except Australia and New Zealand • Contadina and College Inn: Global Canada Europe USA Middle East Mexico & Central America Africa Rest of Asia Indian subcontinent & Myanmar Philippines South America DMPL’s Del Monte brand ownership DMPL’s S&W, Contadina and College Inn brand ownership 5 Our Brand Ownership Heritage Brands : 1896 1892 Asia EMEA North and South America Nutritious as fresh All natural Finest quality Healthy 1914 Italian heritage Premium quality 1923 Premium ingredients Taste of home United States South America Central America & Caribbean Del Monte Panamerican Mexico & Canada ConAgra Europe, Middle East & Africa Asia (ex Philippines, Indian subcontinent & Myanmar) Fresh Del Monte Kikkoman Philippines, Indian subcontinent & Myanmar *DMPL’s Del Monte brand ownership is for packaged products 6 Our History More than 120 years of brand and market leadership 1999 • Del Monte Pacific Limited (DMPL) incorporated as parent of Philippine company • Listed on Singapore Exchange 1980 1892 RJR acquired Del Del Monte was Monte USA born in California 1991 KKR sold Del Monte USA and broke up the Del Monte brand 2007 DMPL bought the S&W brand from Del Monte USA for Asia and EMEA 2013 • DMPL dual-listed on the Philippine Stock Exchange • NPL down to 67% stake 2006 NutriAsia Pacific Limited (NPL) acquired 85% of DMPL 1997 TPG acquired Del Monte USA 1926 Del Monte USA set-up operations in the Philippines 1990 KKR bought RJR-Nabisco 1996 Del Monte USA fully divested from its Philippine operations 2014 DMPL acquired Del Monte USA for US$1.675 bn; Re-united with US company 2011 KKR reacquired Del Monte USA 7 Acquisition of Del Monte Foods 8 DMFI Acquisition • Acquisition of Del Monte Foods, Inc (“DMFI”) completed on 18 February 2014 • Purchase price of US$1.675b or 9x EBITDA (subject to working capital adjustments) • Financed by: o Debt: US$970m LBO loans (in the US at DMFI level) and US$480m loans (in Philippines at DMPL level) o Equity: US$150m Rights and US$75m equity • Current gearing will drop with the proposed preference share offering in CY2016 • DMPL aligned its financial year with that of DMFI to end in April • Recently released 2Q FY2016 (August-October 2015) turnaround results 9 DMPL - DMFI Opportunities Opportunities in new products, channels, markets and cost savings Near-term • • • • Product/Market: Cross selling (USA to Asia and vice versa) and develop Mexico Channel: US Ethnic business (Filipino/Asian American) Cost: Raw material synergy (Pineapple, Tomato) Cost: Outsourcing of US back office functions to the Philippines Mid-term • New Products in USA and Asia • Channel: US Hispanic business Long-term • New products in USA and Asia • Market: South American Markets 10 10 Strategies 11 Business Strategies Leverage the integrated platform with the combined portfolio of brands to generate incremental synergies Continue to invest in the portfolio of well recognised and market leading brands • Focus on integrating the businesses of DMPL and DMFI and leveraging off this integrated platform, broad geographic spread and singular focus on the food and beverage sector • Synergies include the vertical integration of its supply and distribution capabilities for the packaged pineapple business in the US • Maintain market leading positions in the major packaged fruit and vegetable categories and packaged tomato and broth categories • Leverage strong brand recognition in the USA to grow its core markets • Spend approximately 2% of revenue on marketing efforts Invest in R&D to focus on product innovation and marketing Continue to efficiently manage capital structure and exercise prudent financial management • Continued efforts in research and development to develop and introduce new product lines and packaging opportunistically • Efficient financial and cash management policy • Lower gearing ratio by managing equity and debt levels and undertaking de-levering exercises as and when necessary (i.e. rights issue completed in March 2015) 12 12 Bringing the Family Back Together Unites ownership of the iconic Del Monte brand across the US, South America, Philippines, Indian subcontinent and Myanmar Del Monte Pacific Provides DMPL access to world’s leading packaged food market and broad US distribution platform Significant value creation opportunities in the US market especially in the packaged pineapple segment Builds upon existing partnership; DMPL has been the sole supplier of canned pineapple to DMFI for more than 20 years Del Monte Foods Potential realisation of cost synergies for both DMPL and DMFI Extends brand knowledge and best practices between DMPL and DMFI Opportunity to expand to Mexico and South America 13 13 Continue to Leverage on its Strong Brand Equity… Del Monte is the third largest center-of-the-store brand in the United States... ...but it has not begun to reach its potential due to historic lack of support Source: Company, Euromonitor Notes: 1. Reflects top brands by retail sales generated in the Canned/Preserved Food, Dinner Mixes, Dried Processed Food, Oils and Fats, Sauces, Dressings & Condiments and Spreads categories; excludes bakery, refrigerated and frozen sales 2. Excludes revenue related to cheese sales which was >US$3bn in 2012 14 14 …and Market Leading Brands USA Market Share 15 15 …and Market Leading Brands Philippines Market Share 16 16 Invest in Research & Development Product Innovation Philippines India Marketing Campaigns and Packaging Philippines USA 17 Our Markets 18 U.S. Market FY2015 Net Sales by Brand Private 19% Label/Others* FY2015 Net Sales by Product Pineapple Juice/ Concentrate 1% 4% 5% Other 19% Packaged Vegetable 38% Packaged Fruit 42% 2% 71% *Private label sales contributed mainly by Walmart/Sam’s Club; Others include Sager Creek 19 19 Philippines Market FY2015 Sales Split (Total Sales US$303m) Culinary (Sauces, Ketchup, Pasta) 37% Packaged Fruit 23% Beverage 40% 20 20 Other Markets Asia and Middle East Market S&W Asia and Middle East FY 2015 Sales Split Acquired S&W International in November 2007 S&W entered the fresh pineapple business and is now ranked Top 3 in China, South Korea, Japan and Singapore Offer exceptional quality premium canned fruit and vegetable products Brand is extendable to other packaging formats, and to fresh produce Adopt asset light strategy: all products outsourced except packaged pineapple products For Asia and Middle East, S&W sales of US$50m in FY2015 For India, acquired 40% of FieldFresh in September 2007, with stake subsequently increased to 47% via capital call and voting control equally split between DMPL and Bharti Enterprises (the controlling shareholder of Airtel India) In Dec 2010, the Indian operations opened a new facility near Bangalore to produce culinary products and fruit drinks In FY2015, sales amounted to US$61m with US$49m from Del Monte sales in India Others (corn, beans, etc.) 16% Fresh Fruit 52% Packaged Fruit 32% India FY 2015 Sales Split Packaged Fruits 18% Beverage 9% Culinary (Ketchup, Sauces, Mayo) 51% Italian Range (Olive Oil, Olives, Pasta) 22% 21 21 Global – Private Labels/OEM Private Labels/OEM DMPL’s branded business is more than 80% of sales. The following are the segments of the non-branded business: Export Markets Customers Products USA Private labels Packaged vegetable, fruit and tomato Canada Del Monte brand owners Packaged fruit and pineapple juice concentrate (PJC) Europe Private labels Packaged fruit and PJC Asia Pacific Del Monte Asia/ Kikkoman Packaged fruit and PJC Private labels Packaged fruit, PJC and fresh pineapple Fresh Del Monte* Fresh pineapple *DMPL’s Supply Contract with Fresh Del Monte shifted to market prices starting 1 January 2015 22 22 Financials, Outlook, Investment Merits 23 Financial Overview • DMPL aligned its fiscal year with DMFI, ending April instead of December • FY2015 (May 2014 - April 2015) results were impacted by acquisition related expenses hence the net loss of US$38m • Without the one-off items, net income would have been US$25m • FY2015 was a transition period, including reverting to proven strategy for DMFI, growing market share, strengthening partnership with key retailers and exiting from the Transition Service Agreement Reverting to competitive pricing levels Reintroducing the well-recognised classic Del Monte label Reinstating trade support levels • FY2016 is a return to profitability Please refer to the 4QFY15 for more details and to the 2QFY16 results presentation for the latest results 24 Historical Financials REVENUES and GROSS PROFIT In US$m except as stated 27.0% 27.9% 27.3% 2,159.4 CY2011 CY2012 Revenues CY2013 Gross Profit EBITDA 15.0% NET INCOME 434.2*** 134.4 128.4 115.0 20.1% 492.2 459.7 425.2 1H FY2015* Gross Profit Margin 14.0% 11.2% 7.2% 6.5% 6.9% 7.0% 1.1% ** *DMPL changed its financial-year end to 30 April from 31 December to align with that of its US subsidiary, Del Monte Foods, Inc (DMFI). FY2015 refers to May 2014 to April 2015. **EBITDA and Net income in CY2013-FY2015 were impacted by one-off fees relating to the acquisition of DMFI. The figures in the charts are net of one-off items. If inclusive of one-offs, EBITDA were US$42m and US$96m, and net income was US$16m and net loss of US$38m for CY2013 and FY2015, respectively ***Adjusted Gross Profit 25 Historical Dividend Payout 2.5 5.60% 5.10% 2 3.60% US$/share 1.5 1 2.30% 1.00% 0.5 0 2009 2010 2011 12-mo Dividend 2012 2013 Yield Source: Bloomberg, DMPL Annual Reports *Net profit in 2013 was impacted by one-off fees primarily relating to the acquisition of the consumer food business of Del Monte Corporation in the US. Net profit would have been US$33.9 million on a recurring basis instead of US$16.1 million without the one-off fees. 26 26 Profit Outlook for FY2016 Barring unforeseen circumstances, the Group expects to sustain profits in the remainder of the year and return to profitability in FY2016 USA : • Sustain base business growth • Accelerate foodservice growth and enter new vegetable segments through Sager Creek Asia : • Continue to expand Del Monte brand in the Philippines • S&W to gain more traction as it leverages its distribution expansion in Asia and the Middle East • JV in India to continue generating higher sales and maintain its positive EBITDA • El Niño mitigating measures in the field such as continuous enforcement of land preparation activities and reinforcing root health 27 Cash Flow and Debt Outlook 1. Stronger cash flow expected in 2H FY2016 • 1H has seasonally lower sales but high working capital needs due to production season peaking in October • The opposite happens in 2H with seasonally stronger sales due to Thanksgiving, Christmas and Easter, with lower working capital needs • Expect stronger cash flow and deleveraging in 2H 2. Conversion of a substantial amount of loans from short- to medium-term has significantly improved the Group’s current ratio and liquidity 3. Planned issuance of perpetual preference shares • Intends to issue US$ perpetual preference shares • In the Philippines to be listed on the Philippine Stock Exchange • Launch in CY2016 subject to all regulatory approvals and market conditions • Amounting to US$360m • Will result in a further improvement of leverage ratios 28 Corporate Governance • Received a total of 9 awards between 2010-2015 from the Singapore Corporate Awards: Best Managed Board Best Chief Financial Officer Best Investor Relations Best Annual Report • Received the Corporate Governance Award (Runner-Up) from SIAS in October 2014 • Ranked 41st or Top 6% among 639 Singapore-listed companies in the Governance and Transparency Index in August 2015 29 Investment Merits Solid Fundamentals • Global brand footprint with well-known premium Del Monte and S&W brands • Long brand heritage of more than 120 years • Strong local franchise with leading market shares in anchor markets of USA and the Philippines • Globally competitive integrated pineapple producer Growth Drivers • DMPL-DMFI opportunities (slide 10) • Strong legs in USA and Philippines with highly cash generative businesses to: • fund emerging markets growth (eg rest of Asia, Mexico and South America) and • pockets of growth in USA and the Philippines for new product categories, channels and geography • Experienced, dynamic management Valuations • DMFI returns to profit in FY2016, and serves as a platform for future growth of DMPL Corporate Governance • Highly ranked (slide 29) 30 Appendix : Competitive Strengths 1 Established consumer brands with market leading positions worldwide 2 Large global business and vertically integrated operations with economies of scale 3 Strong supply chain management 4 Diversified portfolio of blue-chip customers 5 Strong shareholder support and experienced management team with proven track record 31 31 1 Established Consumer Brands with Market Leading Positions in the US and Globally United States Brands Product Market Share Market Position #1 fruit, #1 vegetable, #2 tomato* Packaged Core Fruit 30.6% #1 #2 tomato* Packaged Core Vegetable 19.6% #1 Packaged Cut Tomato 12.0% #2 Market Position (Canned Food) #2 tomato*, #3 vegetable, #4 fruit #2 broth, Leader in US Northeast •Combined Del Monte, Contadina and S&W Source: Euromonitor and Nielsen for FY2013 ending April Source: Nielsen Scantrack, Total US Grocery+WalMart, 12M ending 2May 2015 Philippines Products Others Market Share Region Canned pineapple 85% (#1) Canned mixed fruit 75% (#1) Japan Canned RTD juices 92% (#1) South Korea Tomato sauce 81% (#1) Spaghetti sauce 55% (#1) Source: Nielsen Retail Index, Apr 2015 Products Market Share Within Top 3 Singapore China Source: Management Estimates 32 32 2 Large Global Business and Vertically Integrated Operations with Economies of Scale Production Facilities USA Mexico Venezuela India Philippines Distribution Reach 13 2 1 1 1 USA Mexico Central America Venezuela S. Korea Japan Hong Kong China Taiwan Mongolia Singapore Indonesia Production facilities 3rd Party Distribution Thailand Philippines Malaysia Pacific Island Israel UAE Iraq Kuwait Saudi Arabia Nepal India Pakistan One of the largest integrated pineapple processors in the world with an 89-year history in the Philippines Plantation Cannery ~23,000 ha. of plantation in the Philippines; planting & harvesting 24 hour operation year round Cannery capacity of 700,000 tons is ½ hr from plantation; processes fruit within 24 hours of harvest assuring freshness Fresh Packhouse State-of-the-art fresh cold storage and packing house facility Ocean Port Ocean port integrated into cannery allows shipping directly to world markets 33 3 Strong Supply Chain Management Efficient and integrated supply chain and distribution logistics system allows it to focus on the most attractive markets and gives it the flexibility to take advantage of changes in product supply and demand Maintains long-term relationships with its growers to help ensure a consistent supply of raw fruits and vegetables Conducts ongoing reviews of system and sets annual goals in conjunction with its six-sigma techniques and its productivity to cost efficiency program Strong US supply chain management provides opportunities for expansion in other of the Group’s products within the US United States Philippines • DMFI sources vegetables and fruits from growers, farmers and cooperatives that operate mainly in the US • DMFI processes its products in 16 facilities: 13 across the US, 2 in Mexico and 1 in Venezuela Vegetables Fruit/Tomato • Close proximity to growers • Off-season production opportunity Yakima • Production capability to expand into new tomato-based products • Close proximity to growers • Off-season production opportunity • Production capability to expand into new products (e.g. frozen vegetables) • In Philippines, pineapples are sourced from its plantation of ~23,000 ha (approximately one-third the size of Singapore). Toppenish Plover Sleepy Eye Rochelle Lathrop Modesto Arkansas Fontana Fruit Production Vegetable Production Distribution Centre – DMFI operated Plymout h Mendota York North Carolina Hanford Tomato Production Markesan Cambria Atlanta Ft. Worth Crystal City McAllen Distribution Centre – 3rd party operated 34 4 Diversified Portfolio of Blue Chip Customers Strong long-term relationships with major retailers across the US US – FY2015 Net Sales Breakdown by Customers 28% Others* 48% 9% 7% 8% (Walmart subsidiary) *Others include Supervalu, Ahold, Publix, Target and Safeway which have 2-4% share each Others Philippines (E-Mart Co Ltd) (Li & Fung Ltd) 35 35 5 Strong Shareholder Support & Experienced Management Team with Proven Track Record Strong Shareholder Support NutriAsia Pacific Limited (“NutriAsia”), owned by the Campos family, has been the majority shareholder of the Company since 2006 and as of 7 July 2015 maintains 67% ownership. Lee Group owns 5.5% and has been a shareholder since 2003. Experienced Management Team Strong core management team across the entities with wide-ranging experience in the international markets DMPL Group CEO DMPL Group COO DMPL Group CCO Luis Alejandro 35 Years Industry Experience Joselito Campos, Jr. 35 Years Industry Experience DMFI CEO Nils Lommerin 25 Years Industry Experience DMPL Group CFO Parag Sachdeva 20 Years Industry Experience Ignacio Sison 25 Years Industry Experience DMFI CFO Dave Meyers 35 Years Industry Experience DMFI Operations Dave Withycombe 40 Years Industry Experience 36 Appendix : Products 37 USA Sales Split FY2015: 42% Packaged Fruit 38% Packaged Veg 1% PJC/Juice 19% Others 38 Philippines Sales Split FY2015: 40% Beverage 37% Culinary (Sauces, Ketchup, Pasta) 23% Packaged Fruit 39 India Sales Split FY2015: 51% Culinary (Ketchups, Sauces, Mayo) 22% Italian Range (Olive Oil, Olives, Pasta) 18% Packaged Fruit and Vegetable 9% Beverage 40 Asia and Middle East – S&W Products Sales Split FY2015: 52% Fresh Pineapple 32% Packaged Fruit 16% Others 41