PPT file

advertisement

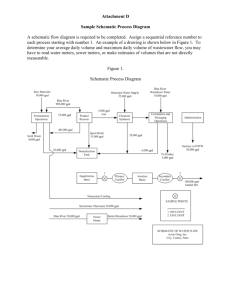

Figure 7.4 The Six Forces Model for the NE Era 1 Unsustainable Competitive Advantage through NE Systems • NE technologies, such as Enterprise Resource Planning (ERP) systems per se may not confer competitive advantage, as commercially available systems are available to anyone. • Furthermore, even ‘homegrown’ software systems are often easily imitated. • Nevertheless, some firms are better at exploiting these systems than others. 2 Sustainable Competitive Advantage through NE Systems • According to Ross, Beath and Goodhue (1996) sustainable competitive advantage comes from the following three areas: Figure 7.10 Resources Leading to Sustainable Competitive Advantages 3 Alpha, Beta, and Omega Effects in Measuring NE Strategic Success • The GSU NE study depicts 3 anticipated levels of benefits [Straub and Klein (2001)]: – – – • Alpha – 1st order changes that fairly immediately lower costs and improve productivity. Beta – 2nd order changes occur when the full effect of intermediation comes into play. Omega – 3rd order changes occur when the firm views NE strategy as a learning process to exploit information advantages over competitors. Firms that create a profile of a customer that indicates the type of products they prefer (e.g., Amazon), can profit from such information advantages. 4 Proprietary Data as a Resource that Captures a Relationship • Resources that are publicly available or readily copied may not be able to provide a sustainable advantage. • But those (such as a customer database) over which a firm has proprietary control may provide competitive advantage since these often create large barriers to potential new entrants. • Creating and sustaining competitive advantage over time can thus be possible for firms that gather and creatively use their proprietary customer data. 5 Figure 7.13 Proprietary Data as Resources that Capture Relationships 6 3 Steps Needed to Dominate the Relationship with Customers • • • First, there must be a commitment to collecting data about customers despite the costs. Second, the firm’s NE systems must be able to be personalized to be able to respond to this customer information. Third, customers must be able to be “pushed” information that successfully targets their personal needs. 7 Model Type Description 1 Content Provider Provides content (e.g., information, digital products & services via intermediaries) 2 Direct-toConsumer Provides goods or services directly to customer often surpassing traditional channel players 3 Full Service Provider Offers a full range of services in one domain (e.g., financial, health care) directly or via complementors who are attempting to own the primary customer relationship 4 Intermediary Brings together buyers and sellers by concentrating information (e.g., search engines, auctions) 8 Table 8.2a Types of NE Business Models (cf. Weill & Vitale 2001) Model Type Description 5 Shared Infrastructure Brings together multiple competitors to cooperate by sharing common IT infrastructure 6 Value Net Integrator Coordinates value net activities by gathering, synthesizing and distributing information 7 Virtual Community Facilitates and creates loyalty of an online community of people with a common interest of enabling interaction and service provision 8 Single Point of Contact Offers a firm-wide single point of contact consolidating all services provided by a large, multi-business organization 9 Table 8.2b Types of NE Business Models (cf. Weill & Vitale 2001) Three Key NE Resources 1. The relationship with the customer. This is usually the most important long-term resource, as it converts to loyalty and sustained revenues. Alternatively, this might be a revenue-producing relationship with a complementor. 2. Proprietary data is one of the most valuable resources a firm can own as it can lead to a sustainable competitive advantage. 3. The transaction may be the least important of the three. Another way to see this is as a customer perception of your company as the point of contact. NE also allows firms to establish links directly with their customers base and by-pass intermediaries. 10 Relationship Data Transaction X X X X X X X X 1. Content Provider 2. Direct-toConsumer 3. Full Service Provider 4. Intermediary 5. Shared Infrastructure 6. Value Net Integrator 7. Virtual Community 8. Single Point of Contact X X X X X X X X Table 8.3 Ownership of Resources by NE Business Models (cf. Weill and Vitale 2001) 11 Figure 8.2 Graphical Symbols for Interpreting Business Model Schematics Schematics allow managers to configure their business models in ways that maximize their effectiveness, as well as helping others understand a model and, in so doing, helping to convince others of its investment potential. 12 Figure 8.3 Type I: Content Provider Schematic 13 Figure 8.4 Type 2: Direct-to-Customer Schematic 14 Figure 8.5 Type 3: Full Service Provider Schematic 15 Figure 8.6 Type 4: Intermediary Schematic 16 Figure 8.7 Type 5: Shared Infrastructure Schematic for Suppliers-Members 17 Figure 8.8 Type 5: Shared Infrastructure Schematic for Customers-Members 18 Figure 8.9 Type 6: Value Net Integrator Schematic 19 Figure 8.10 Type 7: Virtual Community Schematic 20 Figure 8.12 Type 8: Single Point of Contact Schematic 21 Figure 8.13 Lonely Planet as a Hybrid (Molecular) Business Model Composed of Many Atomic Models 22 Chapter 9. Intermediation and Cybermediation Foundations of Net-Enhanced Organizations Detmar Straub, 1st Edition Copyright © 2003 John Wiley & Sons, Inc. 23 9.2 What is Intermediation? • Intermediation: a business process that lies between and facilitates (adds value to) the points in a value chain (see Figure 9.1) Intermediaries often provide an informationbased service rather than a product. • – • Their typical role is to bring multiple buyers and sellers together. Common examples are: stock brokers and travel agents. Figure 9.1 Intermediaries 24 in the Value Chain Intermediaries in a Value Chain • The role of an intermediary is to: 1. Use information to match buyers and sellers, 2. Facilitate the rapid transfer goods and services through their operation. • Two major categories of intermediaries are: 1. Virtuals: who do not take ownership of products and services. 2. Aggregators: who may own, but do not produce or even assemble the goods and services themselves. • When an intermediary offers its services over the Web, it is called a cybermediary. 25 9.4 Dis-intermediation, Re-intermediation and Cyber-mediation (Figures 9.2 and 9.3) • Disintermediation: adding a parallel link going around intermediators [Delta Airlines, encouraged customers to call direct to the airline, saving a 5-15% commission and disintermediating its travel agents]. • Re-intermediation: electronic re-insertion into the role of intermediator in a firm’s value chain [Delta.com allowed customers to go directly to its Web site to buy electronic tickets, taking over the job of brokers via a direct connection. – This is a direct-to-consumer business model, or possibly a shared infrastructure model, as in the case of Orbitz • A firm that offers intermediary services over the Web, is a cybermediary. This can disintermediate agents. 26 Figure 9.2 Disintermediation via Traditional Channels Figure 9.3 Reintermediation of Delta into the Value Chain 27 9.5 Theory of Intermediation • Since purchases and transactions that are least costly are preferable to customers, especially for commodity goods and services, • All other things being equal, the value chain with the fewest intermediaries will have the lowest price. • However, there are additional costs: – Intermediaries have their own cost structure. – Consumers incur costs when searching for goods/services to purchase. • Thus a consumers must weigh a cost tradeoff between searching for the cheapest commodity price and paying extra to use an intermediary. 28 Figure 9.5 Intermediation Pre- and Post- Internet 29 Intermediation Pre- and Post-Internet • A decade ago, for example, intermediation in air travel, involved both airlines and consumers paying commissions to travel agents. • When the issue of disintermediation was first discussed, many predicted the complete demise of intermediators. • Sarker, Butler & Steinfield (1995) argued instead that cyberspace would change intermediation, but never make it irrelevant. • They differentiated between categories of threatened intermediaries, like travel agents, who could lose their business, with cybermediaries, (e.g., Travelocity), who had very low marginal costs and would thrive. • Supplemented intermediaries, firms that decide to reintermediate into the value chain, were also predicted to succeed. 30 Search efficiencies and information management Use knowledge of how to procure items & services; create trading floor for buyers and sellers Expedia.com eBay.com Routinizing and guaranteeing transactions Handle complex transactions; insure payments and shipments Ibm.com Amex.com Logistics Delivery of goods, locally or globally Ups.com Aggregating demand/ negotiating prices Gather orders & negotiate prices with client(s) Priceline.com ETNs like Covisint Creating packages Break bulk through largevolume purchases, and reassemble into packages Dell.com Table 9.2 Value-Added Roles of Intermediaries and Cybermediaries (based on Westland and Clark, 2000) 31 9.7.1 Portals and Content Aggregators • Companies like Yahoo and Amazon are described as cyberspace “portals” and “content aggregators” – Their true business models are complex hybrids and include being intermediaries and making direct-toconsumer sales. • Again the main idea is replacing physical processes with information processes. • If Yahoo was a retailer like Wal-Mart, its distribution system, etc., would have to be huge. – Instead it handles these processes through its Web-based and information-based systems. Its market niche in the economy is based on this. 32