Multi-Use slides

advertisement

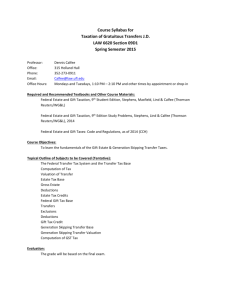

Personal Trust Tax Update 2006 Fran M. DeMaris Executive Vice President Cannon Financial Institute 1 Tax Stats • Members of Congress said recently that federal regulations should be written in a grammatically correct and concise manner. According to the Wall Street Journal, a treasury official responded that the requirement would “make it hard to write tax regulations.” • Since 1950, the tax code has grown from 103 to 1,564 sections • Since 1954, on average, Congress has changed the tax code every 1.3 years 2 More Tax Stats • Between the last major tax overhaul in 1986, and TRA 1997 there were more than 4,000 changes to the tax code • There are over 12,000 pages of IRS tax rules • Each year, U.S. residents spend 5.4 billion hours preparing taxes • Each year, the IRS prints 8 billion pages of forms • The government spends $159 billion a year, or 24% of tax revenue, enforcing the tax code 3 2006 • Annual Exclusion - $12,000 • Annual Exclusion for non-citizen spouse - $120,000 • GSTT Exemption - $2,000,000 4 2006 Changing Figures • Unified Credit Effective Exemption Amount (UCEEA): $2,000,000 (formerly referred to as Unified Credit Equivalent, now Applicable Exclusion Amount ) • Applicable Credit Amount for Gift Tax: $345,800 (formerly known as Unified Credit—no longer fully “unified”) • Applicable Credit Amount for Estate Tax: $780,800 5 Note that on the rate chart… • The maximum estate and gift tax bracket goes down to 46% in 2006 from 47% in 2005 • The lowest rate is effectively 41% 6 Estate Tax Credit, Effective Exemption, and Rates Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 (2011 Credit UCEEA Max. Rate $220,550 $675,000 55% $345,800 $1,000,000 50% $345,800 $1,000,000 49% $555,800 $1,500,000 48% $555,800 $1,500,000 47% $780,800 $2,000,000 46% $780,800 $2,000,000 45% $780,800 $2,000,000 45% $1,455,800 $3,500,000 45% N/A (Estate Tax Repealed) $345,800 $1,000,000 55%) 7 Note that on the credit chart… • The estate tax credit for 2006 is $780,800 • It will continue to increase every couple of years hereafter until repeal • The top tax rates continue to decrease by 1% a year down to 45% • Estate Tax repeal takes place in 2010 • The law, as written, will “sunset” in 2011 8 Gift Tax Credit, Effective Exemption, and Rates Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 (2011 Credit $220,550 $345,800 $345,800 $345,800 $345,800 $345,800 $345,800 $345,800 $345,800 $345,800 $345,800 UCEEA Max. Rate $675,000 55% $1,000,000 50% $1,000,000 49% $1,000,000 48% $1,000,000 47% $1,000,000 46% $1,000,000 45% $1,000,000 45% $1,000,000 45% $1,000,000 35% $1,000,000 55%) 9 Note that on the Gift chart… • The gift tax credit likewise remains at $345,800 for 2006 • It does NOT continue to increase, it fixes at an effective exemption of $1,000,000 • The top rate reduces with estate tax rates • The gift tax is NOT repealed in 2010 and is then applied at the top income tax bracket 10 Generation Skipping Transfer Tax Exemption & Rates under EGTRRA Year 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011+ Exemption GST Tax Rate $1,060,000 55% $1,100,000 50% $1,120,000 49% $1,500,000 48% $1,500,000 47% $2,000,000 46% $2,000,000 45% $2,000,000 45% $3,500,000 45% N/A (Estate & GST Tax Repealed) $1,000,000 [plus indexing] 55% 11 Note that on the GSTT chart… • This year the indexing continues as before • For 2006, the GSTT exemption and Estate tax UCEEA are aligned • The GSTT rate is the maximum estate tax rate and thus reduces each year • GSTT is repealed in 2010 12 State Death Tax Credit Table If the ad ju sted taxable estate (taxable less $60,000) is: The m axim u m tax cred it is: bu t not of am ou nt m ore than m ore than tax p lu s % over 0 90,000 .8% 40,000 90,000 140,000 400 1.6% 90,000 140,000 240,000 1,200 2.4% 140,000 240,000 440,000 3,600 3.2% 240,000 440,000 640,000 10,000 4.0% 440,000 640,000 840,000 18,000 4.8% 640,000 840,000 1,040,000 27,600 5.6% 840,000 1,040,000 1,540,000 38,800 6.4% 1,040,000 1,540,000 2,040,000 70,800 7.2% 1,540,000 2,040,000 2,540,000 106,800 8.0% 2,040,000 2,540,000 3,040,000 146,800 8.8% 2,540,000 3,040,000 3,540,000 190,800 9.6% 3,040,000 3,540,000 4,040,000 238,800 10.4% 3,540,000 4,040,000 5,040,000 290,800 11.2% 4,040,000 5,040,000 6,040,000 402,800 12.0% 5,040,000 6,040,000 7,040,000 522,800 12.8% 6,040,000 7,040,000 8,040,000 650,800 13.6% 7,040,000 8,040,000 9,040,000 786,800 14.4% 8,040,000 9,040,000 10,040,000 930,800 15.2% 9,040,000 10,040,000 1,082,800 16.0% 10,040,000 13 State Death Tax Credit • Under EGTRRA the Maximum Death Tax Credit is quickly reduced, then eliminated as follows: – – – – 2002 2003 2004 2005 75% of the previous credit allowed 50% of the previous credit allowed 25% of the previous credit allowed No credit • Credit is replaced by a deduction for estate taxes actually paid to a state from 2005-2009 • TIP: Watch for more states to impose a state estate tax as a result 14 What Happens If Estate Tax Is Repealed? • Gift Tax Still Exists • Modified Carry-Over Basis Applies at Death • Planning is Still Crucial 15 Gift Tax Continues • Gift Tax is not repealed so consider which strategies still make sense: – Under Annual Exclusion - Yes – Up to Gift Tax Credit Equivalent - Yes – Over the Gift Tax Credit Equivalent? - It depends 16 Modified Carry Over Basis • The Estate tax system is replaced in 2010 by a modified system of “carry over basis” treatment • Basically, no estate tax but assets don’t step up in basis, except: – Up to $1,300,000 can be added to basis in whatever manner determined by the executor – An additional $3,000,000 in basis may be added to assets transferred to a spouse 17 Estate Plan Still Vital Post-2010 • Providing for minors and disabled persons and general spendthrift/creditor protection • Plan for distribution of tangible personal property with emotional attachments • Control for QDRO required payments 18 Estate Plan Still Vital Post-2010 • RLTs for protection of self during incapacity and privacy at death for estate settlement • Family business succession • Charitable foundations • Planning for an anticipated return of the tax 19 Various Other Topical Issues 20 Applicable Federal Rate • For purposes of determining the present value of an annuity, an interest for life or a term of years, or a remainder or a reversionary interest, the federal mid-term rate under Code Section 7520 for December 2005 is 4.53. 120% of the AFR is 5.43%. • Applicable federal rates for various types of transactions differ. 21 Gifts by Check • Delivery of a check to noncharitable donee is complete for transfer tax purposes when the donor has parted with “dominion and control” under local law leaving the donor no power to change the disposition, or • Date on which the donee deposits the check or presents the check for payment 22 Gift Tax Returns Binding • After the statute of limitations has expired (a three year statute) • Gift must be “adequately disclosed” on a gift tax return (Form 709) • If so, then valuation is binding on the IRS for both gift and estate tax purposes 23 Fees Charged to Income • A reduction in value of the marital or charitable share is made for “estate transmission expenses” charged to income • No reduction for “estate management expenses,” because these expenses would have been incurred whether the property were held in trust or not 24 Minority Interest Discount • Lack of Control • Lack of Marketability – – – – Limits on ability to transfer Blockage discount Unusual costs of sale Restricted stock • Key person • Built in gains (gifts only) 25 Family Limited Partnerships • Business purpose requirement • Valuation discount reasoning • Concerns raised on present interest – No immediate use, possession or enjoyment – Couldn’t unilaterally withdraw capital, couldn’t sell without LLC manager’s approval, couldn’t effect a dissolution by themselves • Attacks on last minute, pre-death planning • Strangi has changed the course of IRS attacks on these structures 26 Disclaimer of Joint Interests • Final regulations: disclaimer of jointly held property allowed • Surviving joint tenant may disclaim the one-half survivorship interest in property held in joint tenancy with right of survivorship or tenancy by the entirety, within nine months of the death of the first joint tenant 27 Reference Pages Estate & Gift Tax Charts Years 2006-2009 28 2006 Gift & Estate Tax Rates If the amount is: but not more than more than 0 10,000 10,000 20,000 20,000 40,000 40,000 60,000 60,000 80,000 80,000 100,000 100,000 150,000 150,000 250,000 250,000 500,000 500,000 750,000 750,000 1,000,000 1,000,000 1,250,000 1,250,000 1,500,000 1,500,000 2,000,000 2,000,000 tax 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 448,300 555,800 780,800 plus The tentative tax is: of amount % over 18% 20% 10,000 22% 20,000 24% 40,000 26% 60,000 28% 80,000 30% 100,000 32% 150,000 34% 250,000 37% 500,000 39% 750,000 41% 1,000,000 43% 1,250,000 45% 1,500,000 46% 2,000,000 After calculating the tentative tax, subtract the $345,800 gift tax credit, or $780,800 estate tax credit 29 2007 Gift & Estate Tax Rates If the amount is: but not more than more than 0 10,000 10,000 20,000 20,000 40,000 40,000 60,000 60,000 80,000 80,000 100,000 100,000 150,000 150,000 250,000 250,000 500,000 500,000 750,000 750,000 1,000,000 1,000,000 1,250,000 1,250,000 1,500,000 1,500,000 tax 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 448,300 555,800 plus The tentative tax is: of amount % over 18% 20% 10,000 22% 20,000 24% 40,000 26% 60,000 28% 80,000 30% 100,000 32% 150,000 34% 250,000 37% 500,000 39% 750,000 41% 1,000,000 43% 1,250,000 45% 1,500,000 After calculating the tentative tax, subtract the $345,800 gift tax credit, or $780,800 estate tax credit 30 2008 Gift & Estate Tax Rates If the amount is: but not more than more than 0 10,000 10,000 20,000 20,000 40,000 40,000 60,000 60,000 80,000 80,000 100,000 100,000 150,000 150,000 250,000 250,000 500,000 500,000 750,000 750,000 1,000,000 1,000,000 1,250,000 1,250,000 1,500,000 1,500,000 tax 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 448,300 555,800 plus The tentative tax is: of amount % over 18% 20% 10,000 22% 20,000 24% 40,000 26% 60,000 28% 80,000 30% 100,000 32% 150,000 34% 250,000 37% 500,000 39% 750,000 41% 1,000,000 43% 1,250,000 45% 1,500,000 After calculating the tentative tax, subtract the $345,800 gift tax credit, or $780,800 estate tax credit 31 2009 Gift & Estate Tax Rates If the amount is: but not more than more than 0 10,000 10,000 20,000 20,000 40,000 40,000 60,000 60,000 80,000 80,000 100,000 100,000 150,000 150,000 250,000 250,000 500,000 500,000 750,000 750,000 1,000,000 1,000,000 1,250,000 1,250,000 1,500,000 1,500,000 tax 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 448,300 555,800 plus The tentative tax is: of amount % over 18% 20% 10,000 22% 20,000 24% 40,000 26% 60,000 28% 80,000 30% 100,000 32% 150,000 34% 250,000 37% 500,000 39% 750,000 41% 1,000,000 43% 1,250,000 45% 1,500,000 After calculating the tentative tax, subtract the $345,800 gift tax credit, or $1,455,800 estate tax credit 32