Presentation Title Goes Here - Corporate-ir

advertisement

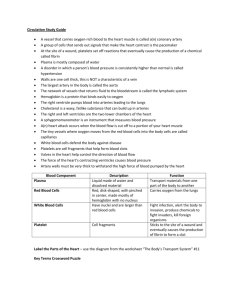

Innovative Solutions for a Healthier World NASDAQ: OMRI Merrill Lynch 2007 Global Pharmaceutical, Biotechnology & Medical Device Conference February 6-8, 2007 Robert Taub, President & Chief Executive Officer SAFE HARBOR STATEMENT This presentation contains forward-looking statements. Forward-looking statements provide the company's current expectations or forecasts of future events. Forward-looking statements include statements about the company's expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as ‘‘anticipate,’’ ‘‘believe,’’ ‘‘continue,’’ ‘‘ongoing,’’ ‘‘estimate,’’ ‘‘expect,’’ ‘‘intend,’’ ‘‘may,’’ ‘‘plan,’’ ‘‘potential,’’ ‘‘predict,’’ ‘‘project’’ or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking. Forward-looking statements are subject to known and unknown risks and uncertainties and are based on potentially inaccurate assumptions that could cause actual results to differ materially from those expected or implied by the forward-looking statements. The company's actual results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors described in the company’s filings with the SEC, including sections entitled ‘‘Risk Factors’’ and "Management’s Discussion and Analysis of Financial Condition and Results of Operations" in the company's prospectus as filed with the Securities and Exchange Commission on December 15, 2006 and the company’s most recent quarterly reports on Form 10-Q and its current reports on Form 8-K. Accordingly, you should not unduly rely on these forward-looking statements, which speak only as of the date of this press release. Unless required by law, the company undertakes no obligation to publicly revise any forwardlooking statement to reflect circumstances or events after the date of this press release or to reflect the occurrence of unanticipated events. You should, however, review the factors and risks we describe in the reports the company will file from time to time with the Securities and Exchange Commission after the date of this presentation. 2 OMRIX Biopharmaceuticals, Inc. Biopharmaceutical player in protein-based biosurgery and passive immunotherapy Diversified and synergistic business platforms Hemostasis in surgery backed by Johnson & Johnson Hyperimmunes provide upside potential BIOSURGERY IMMUNOTHERAPY 3 INVESTMENT HIGHLIGHTS Establishing presence in growing and underpenetrated markets − Expanding market share with commercialized biosurgery product, Evicel; indication expansion expected in 2H07 − 2H07 Thrombin launch is anticipated to capture market share Continued growth and profitability − 157% product sales growth ($41.2M YTD Q306 vs. $16.0M YTD Q305)* − $16.7M net income in Q306 vs. net loss of $27.8M in Q305 Visible pipeline of near-term and medium-term product launches − Breakthrough biosurgery product in development addressing brisk bleeding: The Fibrin Patch − Three immunotherapy product candidates to address emerging viral threats Long-term development, marketing & distribution partnership with Ethicon, a Johnson & Johnson company and dominant player in surgical closure and wound management, including hemostasis Differentiated business model − Manufacturing commonalities and economies of scale between two business lines − Development costs financed by third parties * Total revenues: $45.7M YTD Q306, $19.2M YTD Q305 4 OUR STRATEGY BIOSURGERY Execute and expand Ethicon partnership Develop new products outside of Ethicon relationship Commercialize hemostasis products in new territories IMMUNOTHERAPY Three tiered strategy: − Launch current products in new territories − Commercialize product candidates − Rapidly respond to emerging viral threats Achieve continued growth while maintaining financial discipline 5 Innovative Solutions for a Healthier World NASDAQ: OMRI BIOSURGERY MARKET OPPORTUNITY - HEMOSTASIS Active hemostats is fastest growing segment of surgical sealant market $1,500 (WW) $650 (WW) Fibrin Sealants & Thrombin Products $1,100 Fibrin Sealants & Thrombin Products 2006 Fibrin Patch $400 2015 Note: $ in millions Source: IMS data, Company Reports and OMRIX Estimates 7 MARKET SHIFT: TOWARDS ACTIVE AND ADVANCED HEMOSTATS Passive Hemostats Active Hemostats Advanced Hemostats Action: Mechanical Action: Physiological Action: Combination of mechanical and physiological Fibrin Sealants Gelatin/ Collagen-Based Evicel™ / Quixil™ Cellulose-Based Thrombin Price per procedure ~$50 - $100 Price per procedure ~$200 - $500 Fibrin Patch Price per procedure TBD 8 EVICEL (US) / QUIXIL (EU): LIQUID FIBRIN SEALANTS Competitive Advantages Ease of use − Ready to use in less than one minute (refrigerated) • No mixing or reconstitution required − Sprays or drips with same device tip Safety − Human only, no bovine − Needle-free device Product Overview Used as adjunct to hemostasis in surgery Only commercially available bovine-free fibrin sealant Indicated for liver surgery in US; General hemostasis in EU 2006 US Market: ~$100M, Growing 15% annually Evicel Approval Timeline 1H06 Liver Surgery Indication 1H07 PV Surgery Indication 2H07 Kidney Surgery Indication General Hemostasis Indication 9 THROMBIN STAND-ALONE Product Overview BLA submitted on November 6, 2006 Designed for gradual onset of clotting Component of Evicel registered as stand-alone product 2006 US Thrombin Products Market >300M Competitive Advantages Ease of use − Ready to use in less than one minute (refrigerated) • No mixing or reconstitution required Safety − Human only, no bovine Partnered with Ethicon − Launch, marketing to be powered by Ethicon leadership 10 FIBRIN PATCH: BREAKTHROUGH CONVERGENCE PRODUCT Product Overview Phase 1 clinical trial commenced on December 6, 2006 Addressing unmet medical need – Hemostasis in severe bleeding scenarios Convergence of Johnson & Johnson’s matrix with OMRIX’s biologicals Global Market Opportunity Biodegradable matrix $400M Competitive Advantages Multiple development barriers to entry Lack of comparable product on market or in development “#1 project in Ethicon pipeline” Embedded fibrin sealant biologics Dan Wildman, President Johnson & Johnson Wound Management 11 WET LAB DEMONSTRATION OF FIBRIN PATCH 12 JOHNSON & JOHNSON PARTNERSHIP OVERVIEW Exclusive supply, distribution and development agreement OMRIX receives substantial revenue share Johnson & Johnson expands leadership position in hemostasis market Manufacturing Regulatory submissions Sales & marketing Development costs ONE-STOP-SHOP FOR SURGICAL HEMOSTATS 13 BEYOND HEMOSTASIS: MARKET OPPORTUNITIES OMRIX Biopharmaceuticals, Inc. Ethicon Internal Wound Bleeding Hemostasis Other Partners Fibrin Polymer Healing Tissue Engineering, Repair, Regeneration Adhesion Prevention 14 BIOSURGERY PRODUCT PIPELINE Program Indication Thrombin Stand-Alone* General Hemostasis in surgery EvicelTM** (US) General Hemostasis in surgery Fibrin Patch Management of brisk bleeding; use on active bleeding sites Adhexil Adhesion Prevention Preclinical Phase I Phase II Phase III Spine * Biologics License Application (BLA) submitted on November 6, 2006 ** Currently approved as adjunct to hemostasis in patients undergoing liver surgery 15 Innovative Solutions for a Healthier World NASDAQ: OMRI IMMUNOTHERAPY THREE MARKETED IMMUNOTHERAPY PRODUCTS HYPERIMMUNES: Provide ongoing protection, prevention and treatment against viral threats and infectious diseases Vaccinia Immunoglobulin (VIG) Biodefense stockpile Treatment of smallpox vaccine related complications Hepatitis B Immunoglobulin (HBIG) For the prevention of post liver transplant Hepatitis B re-infection POLYVALENT IMMUNOGLOBULIN: Intravenous Immunoglobulin (IVIG) Currently marketed in Israel Phase 3 study in US by FFF Enterprises 17 IMMUNOTHERAPY PRODUCT PIPELINE Program Indication WNIG * West Nile IG Treatment of West Nile Virus HT-VIG * High Titer IG Treatment of complications related to vaccinia vaccination Influenza IG ** Avian Influenza IVIG (US) Primary Immune Deficiency Preclinical Phase I Phase II Phase III * We have received NIH Grants for the development of these product candidates ** Cooperative Research and Development Agreement (CRADA) with the NIAID 18 UPCOMING MILESTONES PRODUCT 1H07 2H07 Thrombin Adhexil sBLA Filing US Launch Kidney General Hemostasis US IND Filing EU Launch Clinical Development US Launch US Launch Clinical Development WNIG IVIG (US) 2009 US Launch EMEA Filing Fibrin Patch 2008 Phase 3 Phase 3 US Launch sBLA – Supplemental Biologics License Application 19 FINANCIAL OVERVIEW DELIVERING RESULTS $20.0 70.0% $15.0 $10.0 $5.0 $15.0 50.0% 40.0% $10.0 30.0% 20.0% $5.0 Gross Margin 60.0% Product Sales Product Sales $20.0 10.0% $0.0 $0.0 Q305 Q405 Q106 Biosurgery Q206 Q306 Immunotherapy 0.0% Q305 Q405 Q106 Q206 Q306 Product Sales Gross Margin Increased Product Volume Drives Margin Expansion 21 INCOME STATEMENT & BALANCE SHEET ($ IN THOUSANDS, EXCEPT PER SHARE DATA) 9 Months Ended September 30, FY 2005 2005 2006* 2006 Guidance Product Sales $22,478 $16,019 $41,241 $54 - $55M Total Revenue $27,499 $19,171 $45,721 Operating Income (Loss) ($2,190) ($2,823) $15,415 ($27,712) ($27,805) $16,668 ($2.45) ($2.48) Net Income (Loss) Diluted EPS $1.23 $1.40 - $1.45 * Note: Figures include $15.3 million sales under the UK contract for VIG. As of September 30, 2006 Cash and short term investments Total debt Working capital Total assets $40,463* $1,370 $47,511 $76,390 * Note: Figure does not include $51.4 million in net proceeds raised from follow-on offering and exercise of over-allotment completed on December 14, 2006 and January 12, 2007, respectively. 22 MANAGEMENT TEAM Robert Taub, Founder, President and CEO 30+ years pharmaceutical experience; serial entrepreneur Co-Founder of Octapharma AG, a privately-held plasma fractionator Monsanto; Revlon Health Care Group; Baxter International Inc. Michael Burshtine, Executive Vice President, Chief Financial Officer Former PricewaterhouseCoopers partner Joined in 2004, has worked with OMRIX since 1995 Nissim Mashiach, Executive Vice President, Chief Operating Officer 20 years device and biological experience Joined 1998, prior management experience in leading Israeli pharmaceutical and biotech companies Orgad Laub, Ph.D., Vice President, R&D Immunotherapy 25 years of biotechnology experience Chiron, Ares Serono and The Weizmann Institute of Science Israel Nur, Ph.D., Vice President, R&D Biosurgery 15 years of biosurgery experience at Octapharma and OMRIX Hank Safferstein, Ph.D., JD, Vice President, Business Development 15 years biotechnology and pharmaceutical experience Bristol-Myers Squibb; The National Institutes of Health; Acorda Therapeutics 23 INVESTMENT HIGHLIGHTS Establishing presence in growing and underpenetrated markets − Expanding market share with commercialized biosurgery product, Evicel; indication expansion expected in 2H07 − 2H07 Thrombin launch is anticipated to capture market share Continued growth and profitability − 157% product sales growth ($41.2M YTD Q306 vs. $16.0M YTD Q305)* − $16.7M net income in Q306 vs. net loss of $27.8M in Q305 Visible pipeline of near-term and medium-term product launches − Breakthrough biosurgery product in development addressing brisk bleeding: The Fibrin Patch − Three immunotherapy product candidates to address emerging viral threats Long-term development, marketing & distribution partnership with Ethicon, a Johnson & Johnson company and dominant player in surgical closure and wound management, including hemostasis Differentiated business model − Manufacturing commonalities and economies of scale between two business lines − Development costs financed by third parties * Total revenues: $45.7M YTD Q306, $19.2M YTD Q305 24 Innovative Solutions for a Healthier World NASDAQ: OMRI Merrill Lynch 2007 Global Pharmaceutical, Biotechnology & Medical Device Conference February 6-8, 2007 Robert Taub, President & Chief Executive Officer FIBRINOGEN CROSSLINKING FIBRINOGEN D:D D domain E domain Thrombin FPA D: D XIIIa g dimer (XIIIa) Thrombin FPA Crosslinked fibrinogen D:E Crosslinked fibrin FIBRIN 26