The National Empowerment Fund

advertisement

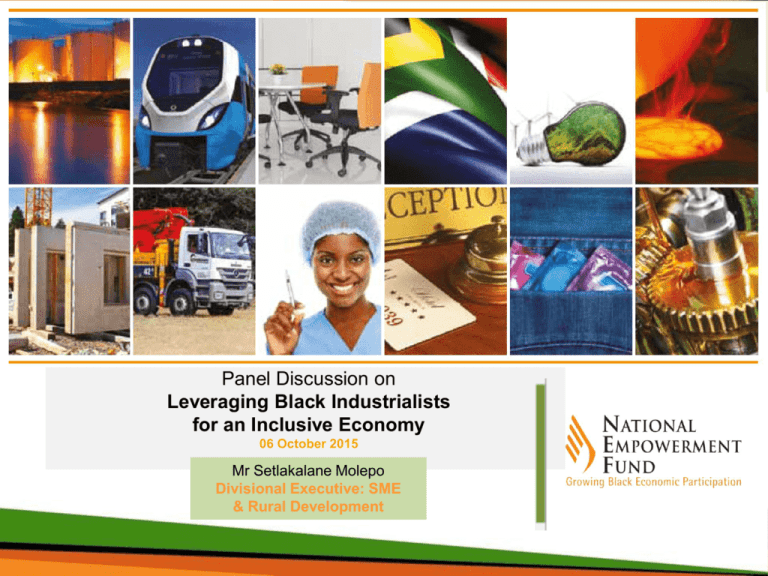

Panel Discussion on Leveraging Black Industrialists for an Inclusive Economy 06 October 2015 Mr Setlakalane Molepo Divisional Executive: SME & Rural Development NEF Mandate… Established by the National Empowerment Fund Act No. 105 of 1998, the NEF is a driver and a thought-leader in promoting and facilitating black economic participation through the provision of financial and non-financial support to black empowered businesses, as well as by promoting a culture of savings and investment among black people. The NEF is an agency of the dti and is the only DFI exclusively mandated to grow B-BBEE 2 JSE BEE Ownership The direct black equity control over the JSE’s average market capitalisation of R11.6 trillion as at 19 Sept 2015 (for Listed Companies), stands at 3% (R349 billion) for shares directly held by black South Africans. To reach 25% of black control it requires an additional 22% worth R2.9 trillion at current estimated market capitalisation of the JSE. This is a gap that still needs to be addressed and funded in order to achieve transformation of up to 25% of JSE market capitalisation. Source: Who Owns Whom & JSE market data, September 2015 3 NEF Funds Across the Economic Spectrum Fund Focus Threshold R250 000 – R10 million 1 iMbewu Fund SME Fund providing Entrepreneurship, Procurement & Franchise Finance 2 Women Empowerment Fund (WEF) Achieve minimum 40% of enterprises owned and managed by black women R250 000 – R75 million 3 Rural & Community Development Fund Supporting rural economic development through New Ventures, Acquisition, Expansion & Greenfields Finance R1 million – R50 million 4 uMnotho Fund 5 Strategic Projects Fund Funding of New Ventures, Acquisition, Project Finance, Expansion, Capital Markets, Liquidity & Warehousing R2 million – R75 million Early-stage investment in industrial / manufacturing transactions Up to R75 million 4 The Industry needs to set aside more funds for early stage investing Shortage of players in SA High NEF funding space. Increase of early-stage players needed. Personal & Family Angels Risk Appetite Venture Capitalists Private Equity Equity Markets Commercial Banks Low Seed Start-up Early growth Investor Stage of Development Established The challenges we are trying to help address Few Angel Investors, Venture Capitalist and/or Private Equity in SA; High risk aversion regarding investment in early stage and high risk projects e.g. mining exploration; Expectation gap of returns (IRR) between providers of capital and borrowers; Investors and funders have difficulty in valuing projects and/or agreeing on project valuations; “First-mover dilemma” of entering novel markets to pioneer new project developments or business ideas in a market lacking investment appetite; Project promoters unable to raise own equity i.e. lack of required equity and/or collateral; Projects normally have a long-term investment horizon (typically 10 to 30 years); Projects face high financial risks due to implementation delays and cost overruns; Low risk appetite of third party investors and/or funders restricted by prudential limits and investment mandates. 6 Funding Black Industrialists - Objectives • Creation of new manufacturing and industrial capacity • Creation of new jobs as opposed replacement capital finance • Investment of new fixed capital into economically depressed areas or poverty nodes • Creation of an inclusive economy by increasing South African participation • Increase RSA export-earning potential and reduce import dependency • Increase co-investment and linkages with foreign direct investors 7 How we are doing it Strategic Projects Fund (SPF) A unit of the NEF established with a mandate to increase the participation of black people in early-stage projects Aligned to national Government policy. Seeks competitive opportunity for the South African economy and the inclusion of black participation in opportunities at the outset of projects, as opposed to doing so during equity closure 8 SPF Project Development Stages 9 Creating Black Industrialists Together with local & international partners the NEF has developed 20 strategic and industrial projects worth R25bn, with the potential to support over 80 000 jobs. The NEF’s future equity rights will total R4.2bn at financial close. Strategic Industrial Sectors RENEWABLE ENERGY Biofuels Biomass Biogas Solar Wind Hydro MINERAL BENEFICIATION Mining & Mineral Beneficiation AGROPROCESSING INFORMATION & COMMUNICATIONS TECHNOLOGY INFRASTRUCTURE Telecoms Broadcasting Roads Dams and Bridges Sewer and Bulk Services Chemicals Agriculture 10 TOURISM B&Bs Hotels Guest Houses (Womenowned) Real Estate A new opportunity to create industrialists 11 SPF Portfolio – NEF Equity Rights Project Sector Current NEF Equity Total Invested NEF Future Equity Rights Total Project Size RMI Mineral Beneficiation 30% 13 500 000 15 000 000 000 2 250 000 000 SA Metals Mineral Beneficiation 29% 40 000 000 1 950 000 000 282 750 000 Coking Coal Mineral Beneficiation 85% 6 000 000 500 000 000 212 500 000 African Silica Mineral Beneficiation 50% 9 100 000 1 500 000 000 375 000 000 Coconut Water Agro-processing 49% 5 000 000 50 000 000 12 250 000 Busamed Hospitals Healthcare 49% 260 000 000 1 600 000 000 392 000 000 Milk for Life Agro-processing 49% 2 000 000 50 000 000 12 250 000 Link Africa Infrastructure 30% 100 000 000 1 000 000 000 150 000 000 Inkomati Mineral Beneficiation 31% 40 481 000 40 481 000 6 250 000 Biomass to Bioethanol Renewable Energy 49% 10 000 000 800 000 000 196 000 000 Tyre Energy Extraction Renewable Energy 68% 57 000 000 50 000 000 17 000 000 KC Energy Renewable Energy 40% 65 600 000 150 000 000 30 000 000 Tyre Manufacturing Research Manufacturing 100% 1 590 000 335 000 000 167 500 000 MIBT Manufacturing 49% 18 600 000 30 000 000 7 350 000 Paediatric Dental Facility Infrastructure 49% - - - Auto Disable Syringes Manufacturing 85% 7 156 600 200 000 000 85 000 000 Mabele Fuels Renewable Energy 22% 61 750 000 2 155 000 000 697 777 600 25 370 000 000 Totals 12 237 050 000 4 426 650 000 Case Studies 13 Infrastructure - Hospitals Busamed’s vision is to be a consolidator of the fragmented health care market. This will be kick-started with the commercialisation of 4 hospital licenses for 630 hospital beds, spread over three provinces, namely Western Cape, Gauteng and the Free State. The aim is to develop centres of excellence, which will provide world-class services. The first hospital (a cardiologic centre) commenced operations & admitted its first patient on 4 May 2015. The second hospital is under construction. Financial close for the third and fourth hospitals is targeted to be June and September 2015 / 16 respectively. investor@nefcorp.co.za Project Development Stage Financial Close - Busamed NEF Investment to Date R260 million Investment Requirement R100 million [$8.1 m or €7.4 m] Project Promoter Profile • Specialist surgeon, retired into business development and entrepreneurship. • Founder of Hillcrest Private Hospital and Ethekwini Hospital & Heart Centre. • Holds directorships and shares in both listed and unlisted companies. • Former president of National Medical and Dental Associate (South Africa) (NAMDA). 14 Infrastructure - Hospitals Investment required for 4th and last hospital R100 million [$8.1 m or €7.4 m] Renewable Energy – Co-generation The cogeneration project aims to develop a Combined Heat and Power (CHP) plant producing steam (60 tph) and power (6MWp) for process plant usage and is based in the Kwa-Zulu Natal province. The plant is currently under construction and is expected to come online later this year. investor@nefcorp.co.za Project Development Stage Construction – KC Energy NEF Investment to Date R65.6 million Investment Requirement R380m [$30 m or €28.3 m] Project Promoters Profile • Comprises three entities with complementary experience and skills in the delivery of energy and co-generation projects, including but not limited to: - Registering, constructing and commissioning two energy projects, - Pioneering the first greenfield Independent Power Producer (IPP) operation in South Africa, - Establishing and managing an Operations and Management (O&M) for its IPP, - Successful installation of specified boilers across Africa, and - Environmental impact studies for various industrial projects. 16 Manufacturing – Medical Devices The project aims to establish a hypodermic disposable syringe and needles manufacturing plant. There is currently no manufacture of all types of syringes in South Africa and the SADC region. Detailed engineering designs are complete and offtake agreements with two international players are at an advanced stage of negotiations. investor@nefcorp.co.za Project Development Stage Financial Close – Kenako Medical NEF Investment to Date R75 million Investment Requirement R110 million [$8.9 m or €8.2 m] Project Promoter Profile • Extensive experience in pharmaceutical & medical device manufacturing & process improvement projects with international companies. • An engineer by profession with an MBA. • American Society for Quality (ASQ) Certified Quality Engineer. • Certified Six Sigma Black Belt & Certified. Manager of Quality and Organisational Excellence. • Certified Project Management Professional with Project Management International, • Currently supplies a number of Hospitals with range of imported medical devices. 17 Renewable Energy – Bioethanol The project aims to develop a 90 million litre per annum cellulosic ethanol biorefinery facility and produce 10MW of power. The project is to be developed as a holistic green solution to address environmental issues related to waste disposal as outlined in the National Waste Management Strategy compiled by the Department of Environmental Affairs and Tourism (DEAT) while meeting clean and renewable energy objectives of the Department of Energy (DoE). A manufacturing license has been issued by the DoE and letters of intent from potential feedstock suppliers received. investor@nefcorp.co.za Project Development Stage Bankable Feasibility – Mkhondo Biorefineries NEF Investment to Date R10 million Investment Requirement R900 million [$73 m or €67 m] Project Promoters Profile • Operations management, commercial evaluation, business plan development, process engineering, project management, capital and cost management, global refinery economics, linear programming and strategy development in the coal to liquids, gas to liquids and crude refining industries. • Sales, marketing, logistics, strategy and mergers and acquisitions expertise. 18 Mineral Beneficiation – Pig Iron The project aims to establish a $200 million pig iron production plant in the Mpumalanga province. The company has been investigating the possible opportunity of beneficiating Pig Iron from abundant iron rich Calcine dump material in South Africa. The project has assessed various sites in the country and the preferred location has been identified. The plant will be designed to use the waste heat from the furnace to generate more than 80MW of electricity that can either be supplied to the existing industrial complex or exported to the national grid. investor@nefcorp.co.za Project Development Stage Bankable Feasibility – SA Metals NEF Investment to Date R40 million Investment Requirement R1.95 billion [$158.5 m or €145.5 m] Project Promoters Profile • The combined expertise of the project promoters include the following: - Iron ore mining, furnace and smelting technology, - Engineering and of large infrastructure and power plants projects, - Mining waste management and environmental waste management services, - International metals trading, logistical and trade finance expertise. 19 Mineral Beneficiation – Rare Metals The project aims to establish a chemical refinery plant in South Africa, which will be able to extract pure metals and add substantial value to the minerals South Africa exports. The promoter has partnered with two established magnesium trading companies. The companies have expressed interest to participate in the various project phases and purchase the bulk of the product once the project is operational. The project requires R300 million for a bankable feasibility study. investor@nefcorp.co.za Project Development Stage Bankable Feasibility – Rare Metals Industries NEF Investment to Date R13.5 million Investment Requirement R15 billion [$1.2 bn or €1.1 bn] Project Promoters Profile • The combined expertise of the project promoters include the following: - Modern processing technologies for magnesium and aluminium-lithium alloys, - Renowned suppliers of titanium sponge production technology & titanium plants globally, - Developers of a number of titanium-magnesium and zirconium projects across the world, - Suppliers of organic, synthetic and polycrystalline silicon technology, - Mining, electrical & smelter infrastructure, and - Power system modelling, project management and energy management. 20 Thank you Contact Details WHERE TELEPHONE 1 Head Office, Johannesburg 011 305 8000 or 0861843 633 / 0861 THE NEF 2 Eastern Cape 0861 633 327 / 0861 NEF ECP 3 Free State 0861 633 377 / 0861 NEF FSP 4 KwaZulu Natal 0861 633 596 / 0861 NEF KZN 5 Limpopo 0861 633 546 / 0861 NEF LIM 6 Mpumalanga 0861 633 678 / 0861 NEF MPU 7 Western Cape 0861 633 927 / 0861 NEF WCP 8 North West 0861 633 697 / 0861 NEF NWP 9 Northern Cape 0861 633 627 / 0861 NEF NCP www.nefcorp.co.za 21