Revision

advertisement

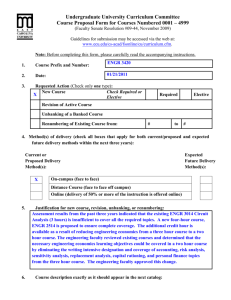

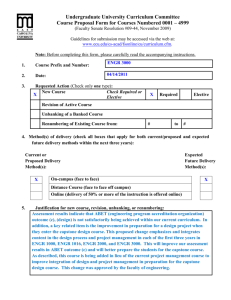

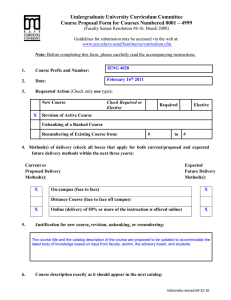

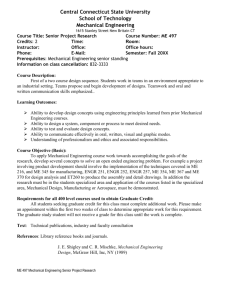

Undergraduate University Curriculum Committee Course Proposal Form for Courses Numbered 0001 – 4999 (Faculty Senate Resolution #09-44, November 2009) Guidelines for submission may be accessed via the web at: www.ecu.edu/cs-acad/fsonline/cu/curriculum.cfm. Note: Before completing this form, please carefully read the accompanying instructions. 1. Course Prefix and Number: ENGR 3420 2. Date: 01/21/2011 3. Requested Action (Check only one type): New Course Check Required or X Elective X Required Elective Revision of Active Course Unbanking of a Banked Course Renumbering of Existing Course from: # to # 4. Method(s) of delivery (check all boxes that apply for both current/proposed and expected future delivery methods within the next three years): Current or Proposed Delivery Method(s): On-campus (face to face) X Expected Future Delivery Method(s): X Distance Course (face to face off campus) Online (delivery of 50% or more of the instruction is offered online) 5. Justification for new course, revision, unbanking, or renumbering: Assessment results from the past three years indicated that the existing ENGR 3014 Circuit Analysis (3 hours) is insufficient to cover all the required circuits topics. A new four-hour course, ENGR 2514 is proposed to ensure complete topical coverage. The additional credit hour is available as a result of reducing engineering economics (currently ENGR 3400) from a three hour course to the proposed two hour course ENGR 3420. The engineering faculty reviewed existing courses and determined that the necessary engineering economics learning objectives could be covered in a two hour course by eliminating the writing intensive designation and coverage of accounting, risk analysis, sensitivity analysis, replacement analysis, capital rationing, and personal finance topics from the three hour course. The engineering faculty approved this change. 6. Course description exactly as it should appear in the next catalog: 3420. Engineering Economics (2) P: MATH 2152. Analysis of cash flows including cost, revenue, and benefits that occur at different times. Evaluation of engineering projects using equivalent worth, benefitcost, and rate of return including impact of depreciation, and taxes. 7. 8. If this is a course revision, briefly describe the requested change: NA If writing intensive (WI) credit is requested, the Writing Across the Curriculum Committee must approve WI credit prior to consideration by the UCC. Has this course been approved for WI credit (yes/no/NA)? No If Yes, will all sections be WI (yes/no/NA)? 9. If service-learning (SL) credit is requested, the Service-Learning Advisory Committee must approve SL credit prior to consideration by the UCC. Has this course been approved for SL credit (yes/no/NA)? No If Yes, will all sections be SL (yes/no/NA)? 10. If foundations curriculum (FC) credit is requested, the Academic Standards Committee (ASC) must approve FC credit prior to consideration by the UCC. If FC credit has been approved by the ASC, then check the appropriate box (check at most one): 11. English (EN) Science (SC) Humanities (HU) Social Science (SO) Fine Arts (FA) Mathematics (MA) Health (HL) Exercise (EX) Course Credit: Weekly or Per Term = Credit Hours Lab Weekly or Per Term = Credit Hours s.h. Studio Weekly or Per Term = Credit Hours s.h. Practicum Weekly or Per Term = Credit Hours s.h. Internship Weekly or Per Term = Credit Hours s.h. Lecture Hours 2 2 s.h. s.h. Other (e.g., independent study): Total Credit Hours 2 s.h. 12. Anticipated yearly student enrollment: 13. Affected Degrees or Academic Programs: Degree(s)/Course(s) BS Engineering 14. 80 PDF Catalog Page 298 Change in Degree Hours None Overlapping or Duplication with Affected Units or Programs: X Not Applicable Applicable (Notification and/or Response from Units Attached) 15. Approval by the Council for Teacher Education (required for courses affecting teacher education programs): X Not Applicable Applicable (CTE has given their approval) 16. Instructional Format: please identify the appropriate instructional format(s): 2 Lecture Technology-mediated Lab Seminar Studio Clinical Practicum Colloquium Internship Other (describe below): Student Teaching 17. Statements of Support: (Please attach a memorandum, signed by the unit administrator, which addresses the budgetary and staff impact of this proposal.) X Current staff is adequate Additional staff is needed (describe needs below): X Current facilities are adequate Additional facilities are needed (describe needs below): X Initial library resources are adequate Initial resources are needed (give a brief explanation and estimate for cost of acquisition of required resources below): X Unit computer resources are adequate Additional unit computer resources are needed (give a brief explanation and an estimate for the cost of acquisition below): X ITCS Resources are not needed Following ITCS resources are needed (put a check beside each need): Mainframe computer system Statistical services Network connections Computer lab for students Describe any computer or networking requirements of this program that are not currently fully supported for existing programs (Includes use of classroom, laboratory, or other facilities that are not currently used in the capacity being requested). Approval from the Director of ITCS attached 18. Syllabus – please insert course syllabus below. Do not submit course syllabus as a separate file. You must include (a) the citation of the textbook chosen for the course, (b) the course objectives, (c) the course content outline, and (d) the course assignments and grading plan. Do not include instructor- or semester-specific information in the syllabus. ENGR 3420 Engineering Economics Textbook: 1. Engineering Economic Analysis, 10th Edition, Newnan, Eschenbach, and Lavelle, Oxford University Press, 2009 (ISBN 0-19-516807-0) 2. Fundamentals of Engineering Supplied-Reference Handbook, 8th edition, National Council of Examiners for Engineering and Surveying, 2008 (ISBN 978-1-932613-30-8. Course Objectives: At the completion of this course, students will be able to: Define fixed and variable cost and apply to solve break even analysis Develop a project cash flow diagram Solve simple and compound interest problems Evaluate cash flows using present worth, future worth, and annual worth methods Compare project alternatives with unequal lives Evaluate the return on a project using internal rate of return (IRR) and compare projects using rate of return methods Evaluate depreciation using straight line, sum of years, and declining balance Compare projects using pre tax and after tax analysis Analyze inflation and cost indices Relate Minimum attractive rate of return (MARR) to sources of capital and risk Course Content Outline 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Topic Introduction, course management; making economic decisions as an engineer, ethics Break even analysis, fixed and variable cost, present / current economy, Interest and cash flow diagrams Time value of money, compound interest, borrowing and lending (saving), Excel basics Equivalence of cash flows, Single payment compound interest formulas Uniform series compound interest, arithmetic gradient Geometric gradient, nominal and effective interest, continuous compounding, compounding other than annually Recitation: Review and spreadsheet Excel functions Test 1 Present worth analysis Application of present worth and spreadsheets, equal and unequal lives Annual cash flows, relation to present value Annual cash flow analysis, alternative lives, continuing requirement, infinite analysis Analysis of loans: principle and interest, bonds Rate of return methods and internal rate of return (IRR) Calculating the rate of return Comparison of projects and incremental analysis, spreadsheet applications Test 2 Other analysis methods: future worth, benefit cost, payback Depreciation: definitions, straight line, sum of years, declining balance Modified accelerated cost recovery system (MACRS) and tax implications Income tax implications- taxable income Income tax rates After tax analysis and cash flows Inflation and constant versus then-current dollars Price indices Sources of capital and Minimum attractive rate of return (MARR) - impact of risk Review for final exam Course Assignments and Grading Plan Assignments Homework: Final Exam: Quizzes: Tests (2) 10% 30% 10% 50% Grading A: 100-90 B: 89-80 C: 79-70 D: 69-60 F: Below 60