On Line Programs

advertisement

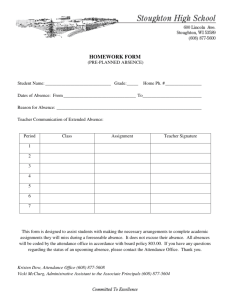

On Line Programs Carla Boren Culver-Stockton College Establish eligibility A school’s eligibility does not necessarily extend to all its programs, so the school is responsible for ensuring that a program is eligible before awarding FSA funds to students in that program. In addition to determining that the program meets the eligible program criteria given in this chapter, the school should make certain that the program is included under the notice of accreditation from a nationally recognized accrediting agency (unless the agency does not require that particular programs be accredited). The school should also make certain that it is authorized by the appropriate state to offer the program (if the state licenses individual programs at postsecondary institutions). In some instances a school or program may need a general authorization as well as licensure for a specific program approval. (See the chart on eligible institutions and the discussion under Legal Authorization By a State in the FSA Handbook. Distance Education A distance education program at a domestic school is considered an eligible FSA program if it has been accredited by an accrediting agency recognized by the Department for accreditation of distance education. It is not subject to the rules that apply to correspondence coursework. Distance education means education that uses certain technologies to deliver instruction to students who are separated from the instructor and to support regular and substantive interaction between the students and the instructor. The interaction may be synchronous (student and instructor are in communication at the same time) or asynchronous. The technologies may include the Internet, audio conferencing, or one-way and two-way transmissions Through open broadcast, closed circuit, cable, microwave, broadband lines, fiber optics, satellite, or wireless communications devices. Cost of attendance - FSA Handbook Chapter 2 The cost of attendance for a student is an estimate of that student’s educational expenses for the period of enrollment. Averages may be used rather than actual expenses for like categories of students. You can have different standard costs for different categories of students, such as a cost of attendance for out-of-state students (who have higher tuition) and a lower cost of attendance for in-state students. However, you cannot combine the COA figures for each separate enrollment status and award aid to a student on the basis of the average COA. There are different ways to arrive at average costs for your students, such as periodic surveys of your student population and local housing costs. Tuition and fees - The tuition and fees normally assessed for a student carrying the same academic workload. This includes costs of rental or purchase of equipment (including equipment for instruction by telecommunications), materials, or supplies required of all students in the same course of study. Books, Supplies, Transportation, Personal expenses – unless you are an online only program, all schools are required to include transportation Room and Board - For students without dependents living at home with their parents, this will be an allowance that you determine. For students living on campus, the allowance is the standard amount normally assessed most residents. For those living off-campus but not with their parents, the allowance must be based on reasonable expenses for the student’s room and board. For students living in housing located on a military base or housing for which they receive a military housing allowance (Basic Allowance for Housing, or “BAH”), the room and board COA component shall include an allowance for board only. This applies to: • independent students who receive, or whose spouses receive, a military housing allowance (BAH) or who live on a military base; and • dependent students who are living with parents who are receiving a military housing allowance (BAH) or who live on a military base Dependent daycare costs For a student with dependents, an allowance for costs expected to be incurred for dependent care. This covers care during periods that include but are not limited to class time, study time, field work, internships, and commuting time for the student. The amount of the allowance should be based on the number and age of such dependents and should not exceed reasonable cost in the community for the type of care provided. Determine reasonable cost - MDHE standard Decide how to collect the data, form, interview, etc. Other allowable expenses… One time direct costs - fees in programs that require licensure or certification; one time per student per program Study abroad programs – reasonable costs associated with the program (get the budget, add to student file for purposes of documentation Allowances for disability - expenses include special services, personal assistance, transportation, equipment, and supplies that are reasonably incurred and not provided by other agencies Allowance for expenses associated with cooperative education program associated with employment Loan origination fees - In all cases, you can either use the exact loan fees charged to the student or an average of fees charged to borrowers of the same type of loan at your school. Exceptions to cost of attendance • For students who are enrolled less than half-time, only the costs for tuition and fees and allowances for books and supplies, transportation, room and board for a limited duration, and dependent care expenses may be included as part of the cost of attendance (miscellaneous expenses and personal expenses may not be included) Consortium agreements - A consortium agreement can apply to all FSA programs. Under a consortium agreement, students may take courses at a school other than the home school and have those courses count toward the degree or certificate at the home school. A student can only receive FSA assistance for courses that are applicable to the student’s certificate or degree program A student receiving a Pell Grant for attendance at two schools through a consortium agreement may have costs from both schools at the same time. The student’s cost of attendance is calculated in the same way as for a student taking classes at only one school. The student’s charges for tuition and fees and books an supplies at the consortium schools have to be combined into a single charge for a full academic year for purposes of the Pell calculation. The school paying the student may choose to use actual charges for the student, which would simply be the sum of the actual charges at both schools. Of course, if the student isn’t attending full-time, your school will have to prorate these tuition and fees and books and supplies charges so that they are the correct amounts for a full-time, fullyear student. If the disbursing school uses average charges, then the average full-time charges at each of the schools must be prorated and combined. If the student is taking a full-time load at each school, the full-time tuition and fees charges for an academic year at each school can be averaged to determine the tuition and fee cost. However, if the student is taking an unequal course load, the disbursing school must prorate the charges based on the number of hours the student is taking at each school. Attendance in On line programs – New standards for the measurement for participation were put in place within the last few years. No longer is a student signing in online proof of participation. The institution is charged with being able to show proof of participation. The standard for participation is determined by the institution. An example might be a submission to an online thread, submission of homework. Login times are not sufficient. Tracking attendance is key for purposes of Return of Title IV; a school must be able to document the last date of attendance. A school must have a policy in place to show management of nonparticipants. 3rd party agencies have been developed to satisfy the need for this administrative responsibility. Authenticating the online student’s identity – regulation requires institutions to have a process in place to authenticate student identity Examples… • Increased emphasis on student portfolios, papers, projects, and quizzes in exchange for high “point weighted” midterm and final tests • Utilization of proctored assessments administered at sanctioned testing centers • Use of advanced technology intended to validate an individual’s biometrics, including fingerprint readers, retinal scanners, and facial or voice recognition programs • Synchronous monitoring, including video surveillance, telephone callback, IP or cookie authentication, and software that detects discrepancies in response patterns such as typing speed • Complete avoidance of secure testing Disbursement of funds… Is the student eligible to receive the funds? Institutions will need to have something in p to measure if the student is still eligible. If there was a change of enrollment, you must recalculate the budget and aid to discern if the student is still eligible… This can be very challenging. Fraud Online programs have become the target for people posing as students in order to receive financial assistance. These are referred to as straw students or formerly Pell runners. Generally low-cost, open admission institutions are targeted as the refunds tend to be larger, and the interaction between student and institution is done virtually. Fraud tends to be found most often by the staff managing the back office duties; verification, release of credit balances, etc. Look for demographic information that shows up multiple times in admissions applications, FAFSA’s, the same bank routing numbers used by multiple recipients, etc. Fraud is required to be reported to the Office of Inspector General’s Fraud Hotline Schools can modify disbursement rules for students participating exclusively in distance learning programs, which would immediately reduce the amount that fraud ring participants can receive. Schools have the authority to: Delay disbursement of Title IV funds until the student has participated in the distance education program for a longer and more substantiated period of time. Make more frequent disbursements of Title IV funds so that not all of the payment period's award is disbursed at the beginning of the period. *information taken from USDOE OIG slide presentation Fundamentals of Title IV Administration Office of Inspector General Investigation Services Overview 1-800-MIS-USED