ch13-ClassProblems

advertisement

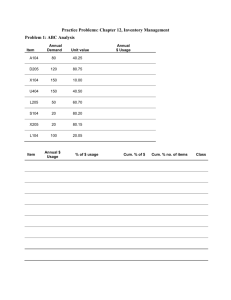

Practice Problems: Chapter 12, Inventory Management Problem 1: ABC Analysis Item Annual Demand Unit value A104 80 40.25 D205 120 80.75 X104 150 10.00 U404 150 40.50 L205 50 60.70 S104 20 80.20 X205 20 80.15 L104 100 20.05 Item Annual $ Usage % of $ usage Annual $ Usage Cum. % of $ Cum. % no. of items Class Problem 2: Given, Demand = 360, Holding cost = $0.80/unit/year, Ordering cost = $100 per order. What is the EOQ? Problem 3: Given the data from Problem 3, and assuming a 250-day work year; how many orders should be processed per year? What is the expected time between orders? Problem 4: What is the total cost for the inventory policy used in Problem 3? Problem 5: Assume that the demand was actually higher than estimated (i.e., 500 units instead of 360 units). What will be the actual annual total cost? Problem 6: Assume that our firm produces type C fire extinguishers. We make 30,000 of these fire extinguishers per year. Each extinguisher requires one handle (assume a 300 day work year for daily usage rate purposes). Assume an annual carrying cost of $1.50 per handle; production setup cost of $150, and a daily production rate of 300. a. What is the optimal production order quantity? b. Determine (i) Imax, (ii) average inventory, (iii) number of batches per year, (iv) cycle time, (v) run time, and (vi) the annual total cost. Problem 7: We need 5,000 special valve units per year. The ordering cost for these is $100 per order and the carrying cost is assumed to be 25% of the cost per unit. Price schedule is as given below. Quantity range 1 – 149 150 – 399 400 and above What should be the order quantity? Price/unit 80.00 70.00 68.00 Problem 8: Litely carries a modern white kitchen ceiling lamp that is quite popular. The anticipated demand during lead time can be approximated by a normal curve having a mean of 180 units and a standard deviation of 40 units. What safety stock should Litely carry to achieve a 95% service level? Problem 9: Grey Wolf lodge is a popular 500-room hotel in the North Woods. Managers need to keep close tabs on all of the room service items, including a special pint-scented bar soap. The daily demand for the soap is 275 bars. The lead time from the supplier is 5 days. The lodge is open 365 days a year. Ordering cost is $10 and the inventory holding cost is $0.30/bar/year. The management wants to have a 99 percent cycle-service level. Determine the reorder point under the following conditions. a. Both the daily demand and lead time are known and constant as stated above. b. The lead time is constant as stated above but the demand is variable with a standard deviation of 30 bars per day. c. The demand is constant as stated above but the lead time is variable with a standard deviation of 0.5 day. d. Both the daily demand and the lead time are variable. Let the standard deviations be as stated in (b) and (c) above. e. Calculate the annual service level. Problem 10: The manager of a store that sells shoes wants the service level for a popular shoe to be 98%. The store sells on the average 600 pairs of the shoe annually. The standard deviation of demand is 1.75 per day. Suppose that there are 300 days the store is open annually. The holding cost for the shoe is $6 per year and the ordering cost is $15 per order. The lead time for reorders is a fixed 3 days. a. What is the average number of units shortage per year the manager can expect for the service level of 98%? b. What is the average number of units shortage per cycle at this service level? c. What is the lead time service level for the desired annual service level? Problem 11: A hardware store uses the periodic inventory system to place restocking orders for all their plumbing fittings with 4 weeks as the order interval. For the ½ inch compression Tcompression fitting, the average demand is 20 per week with a standard deviation of 4 per week. The lead time for the item is 2 days. Vendors supply orders 5 days a week. Given there is 20 units on hand at the reorder time, determine the order quantity. Assume 96% cycle service level. Problem 12: A small town monthly news magazine needs to determine the optimal number of copies to print. The cost per copy is $1.25 and sells for $3.99 per copy. Any unsold copy is recycled, the value of which 0.20 per copy. a. What is the cost of stock out per copy? b. What is the cost of overstocking per copy? c. How many copies of the magazine must be printed if i. demand is uniform between 1500 and 2000? ii. demand is normal with an average demand of 2000 and standard deviation of 250? iii. demand follows a discrete probability distribution given below. Demand 1500 1750 2000 2250 2500 Probability 0.10 0.15 0.20 0.30 0.25