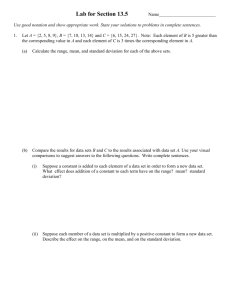

ch12-ClassProblems

advertisement

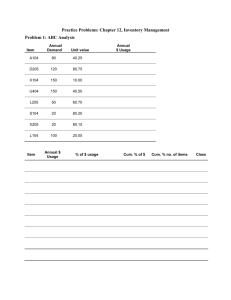

Practice Problems: Chapter 12, Inventory Management Problem 1: ABC Analysis Item Annual Demand Unit value A104 80 40.25 D205 120 80.75 X104 150 10.00 U404 150 40.50 L205 50 60.70 S104 20 80.20 X205 20 80.15 L104 100 20.05 Item Annual $ Usage % of $ usage Annual $ Usage Cum. % of $ Cum. % no. of items Class Problem 2: A firm has 1,000 “A” items (which it counts every week, i.e., 5 days), 4,000 “B” items (counted every 40 days), and 8,000 “C” items (counted every 100 days). How many items should be counted per day? Item Class No. of items Policy A 1000 Every 5 days B 4000 Every 40 days C 8000 Every 100 days Count/day Problem 3: Given, Demand = 360, Holding cost = $0.80/unit/year, Ordering cost = $100 per order. What is the EOQ? Problem 4: Given the data from Problem 3, and assuming a 250-day work year; how many orders should be processed per year? What is the expected time between orders? Problem 5: What is the total cost for the inventory policy used in Problem 3? Problem 6: Assume that the demand was actually higher than estimated (i.e., 500 units instead of 360 units). What will be the actual annual total cost? Problem 7: If demand for an item is 3 units per day, and delivery lead-time is 15 days, what should we use for a re-order point? Problem 8: Assume that our firm produces type C fire extinguishers. We make 30,000 of these fire extinguishers per year. Each extinguisher requires one handle (assume a 300 day work year for daily usage rate purposes). Assume an annual carrying cost of $1.50 per handle; production setup cost of $150, and a daily production rate of 300. a. What is the optimal production order quantity? b. Determine (i) Imax, (ii) average inventory, (iii) annual total cost, (iv) number of batches per year, (v) time between orders and (vi) duration of production run. Problem 9: We need 5,000 special valve units per year. The ordering cost for these is $100 per order and the carrying cost is assumed to be 25% of the cost per unit. Price schedule is as given below. Quantity range 1 - 149 150 - 399 400 and above What should be the order quantity? Price/unit 80.00 70.00 68.00 Problem 10: Litely Corp sells 1,350 of its special decorator light switch per year, and places orders for 300 of these switches at a time. Litely estimates discrete probability distribution for demand during lead time as follows: Demand 60 70 75 80 85 Probability 0.20 0.30 0.20 0.15 0.15 The carrying cost per unit per year is calculated as $5 and the stock-out cost is estimated at $6 ($3 lost profit per switch and another $3 lost in goodwill, or future sales loss). What level of safety stock should Litely use for this product? Assume that the ROP with no safety stock is equal to 75 units. Problem 11: Presume that Litely carries a modern white kitchen ceiling lamp that is quite popular. The anticipated demand during lead time can be approximated by a normal curve having a mean of 180 units and a standard deviation of 40 units. What safety stock should Litely carry to achieve a 95% service level? Problem 12: Grey Wolf lodge is a popular 500-room hotel in the North Woods. Managers need to keep close tabs on all of the room service items, including a special pint-scented bar soap. The daily demand for the soap is 275 bars, with a standard deviation of 30 bars. Ordering cost is $10 and the inventory holding cost is $0.30/bar/year. The lead time from the supplier is 5 days. The lodge is open 365 days a year. The management wants to have a 99 percent cycle-service level. a. What should the reorder point be for the bar of soap? b. If the lead time is also variable with a standard deviation of 1 day, what should be the reorder point? Problem 13: A small town monthly news magazine circulation averages 2000 copies with a standard deviation of 250. The cost per copy is $1.25 and sells for $3.99 per copy. Any unsold copy is recycled, the value of which 0.20 per copy. a. What is the cost of stock out per copy? b. What is the cost of overstocking per copy? c. How many copies of the magazine must be printed? d. What is the stock out risk?