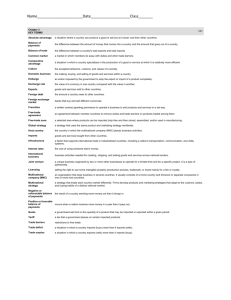

Financing International Trade work sheet

advertisement

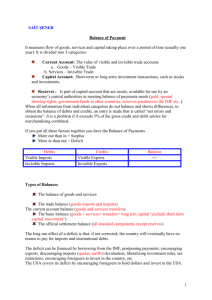

Financing International Trade activity This combines the topics exchange rates and balance of payments. Let us try and make sense of it all. Trade involves imports and __________as well as dealings with the ___________________of the countries involved. Let us start with an IBLAND exporter Muhammad Kara, a lifelong Arsenal supporter who has gotten used to Arsenal’s lack of trophies. When he exports his products to Canada, he wants to be paid in IBLAND currency (Dukesh, ¥), but the Canadian importer; Susie Cui uses ___________________ (CAD$). They must exchange IBLAND dollars for Canadian dollars before the export transaction can occur. This exchange takes place in the foreign exchange market Assumptions in this model IBland exporter (MK) agrees to sell ¥400,000 of oil equipment to Canadian importer (SC). The rate of exchange is ¥2.00 for $1.00. This means that the Canadian importer (SC) must pay the equivalent of $________, to the IBLAND EXPORTER (MK) to obtain the ¥400,000.00 worth of equipment. SC conducts all her financial transaction with Bank of Montreal Transaction costs are zero IBLAND export transaction STEPS 1. SC draws a cheque of $______________________ on its chequing account from BMO and sends it to MK 2. MK must pay for its bills in Dukesh, not dollars, so he has to sell the $200,000.00 to the Zyhlo bank in IBLAND, which is a dealer in foreign exchange. This bank adds ¥400,000.00 in MK account for the $_____________________ cheque 3. The Zyhlo Bank deposits the corresponding $___________________ cheque in a corresponding Canadian Bank for future sale to some IBLAND buyer who needs dollars Note this important point: IBLAND exports create a foreign demand for Dukesh, and the fulfillment of that demand increases the supply of foreign currencies, CAD$ in this case, owned by IBLAND banks and available to IBLAND residents. IBLAND import transaction STEPS 1. An IBLAND importer Austin Le purchases $CAD200, 000.00 by writing a cheque for ¥________________ on its IBLAND Zyhlo Bank. He wants to import Ipods 2. He then sends this cheque of $___________________ to the Canadian Firm which deposits it in a Canadian Bank. Note that the IBLAND import create a domestic ___________________for foreign currencies, CAD$ in this case, and the fulfillment of this demand reduces the supplies of foreign currencies (again CAD$) held by IBLAND banks and available to IBLAND consumers. The combined export and import transactions bring one more point in focus. IBLAND exports (The oil equipment) make available, or earn a supply of foreign currencies for IBLAND banks and IBLAND imports (the IPODS), create a demand for those currencies. In a broad sense, any nations exports finance or pay for its imports. Exports provide the _______________currencies needed to pay for ___________________. Although we have looked at the exporting and importing of goods, demand for and supplies of CAD$ also arise from transactions involving services and the payments of interest and dividends on foreign investments. IBLAND demands dollars to buy insurance and transportation services from Canada, to vacations in Toronto, Vancouver and Alberta. The Balance of payment IBLAND’s Balance of Payment 2010 in Billions Current Account 1. 2. 3. 4. 5. 6. 7. 8. 9. Merchandise exports Merchandise imports Balance of Trade*** Exports of services Imports of services Balance on goods and services*** Net investment income Net transfers Current account balance ______ -386.7 +66.7 +63 ______ +53.3 -22.8 _______ +30.2 Capital and Financial accounts 10. Net change in foreign Investment in IBLAND (capital inflow) 11. Net change in IBLAND Investment abroad (capital outflow) 12. Capital account balance +90.5 ________ -22.2 Official settlement accounts 13. Official international reserves Balance of payments…………………………………………………………………………………………………………………...0 A nations Balance of payment is the sum of all transactions that take place between its residents and the residents of all foreign nations. The table above is a simplified balance of payment statement for IBLAND. What are the numbers above telling us? Current account Exports are treated as a credit (+ sign) because they earn and make available foreign exchange in IBLAND Imports are treated as debit (- sign) because they reduces the stock of foreign currencies in IBLAND Balance on goods is the difference between its exports and imports of goods and services. If exports exceed imports, the result is a trade surplus. If imports exceed exports, the result is a trade deficit…balance on goods and services =balance of trade Balance on current account Item 7, net investment, represents the difference between interest and dividend payments people abroad have paid IBLAND for the services of exported IBLAND capital and what IBlandians paid in interest and dividends for the use of foreign capital invested in IBLAND. The figure demonstrates that IBLAND paid more in interest and dividends to people abroad that what they received. Item 8 shows net transfers both public and private, between IBLAND and the rest of the World. These include foreign aid, pensions paid to citizens living abroad, funds received from home by international students and remittances by immigrants to relatives abroad. Item 9 is an addition of all transaction in the current account = current account balance= surplus of 30.2 Capital and Financial Account This account summarizes the flows of money capital from the purchase or sale of real or financial assets. For example, foreign firm may buy a real asset; say an office tower in IBLAND or a financial asset, for instance an IBLAND government bond. Both kinds of transactions involve the ‘export’ of ownership of IBLAND assets from IBLAND in return for inpayments of foreign currency money. As indicated in line 10, these exports of ownerships of assets are designated net change in foreign investments in IBLAND. Conversely, a IBLAND firm may buy say a ranch in Alberta or common stock of a foreign firm. Both transactions involve imports of the ownership of real or financial assets to IBLAND and are paid for by outpayments of IBLAND currency. These imports are designated (see line 11) Items 10 and 11 combined yield a capital account balance of -22.2 billion (line 12). In 2010 IBLAND exported 90.5 billion of ownership of its real and financial assets and imported 112.7 billion. This capital account deficit depleted 22.2 billion of foreign currencies from IBLAND. Official Settlement Account The Central Banks of nations holds quantities of foreign currencies called official international reserves. These reserves can be drawn on to make up any net deficit in the combined current and capital accounts (much as one would use their savings to pay for a special purchase). In 2010 IBLAND had an 8.0 billion surplus (line 9 plus line 12). Balance in the IBLAND international payments led the IBLAND government to increase its official international reserves by 8 billion (item 13). The negative sign indicates that this is a debit- the inpayment to official international reserves needed to balance the overall balance of payments account. In some years, the sum of the current and capital accounts balances may be negative, meaning that IBLAND earned less foreign currencies than it needed. The deficit would create an outpayment from the stock of international reserves. As such item 13 would have a positive sign since it’s a credit Payments deficits and surpluses Even though the BOP payments must always sum to zero, deficits and surpluses refer to imbalances between the current and capital accounts (line 9 minus line 12) which cause a drawing down or building up of foreign currencies.