SEZ - ICAI Visakhapatnam

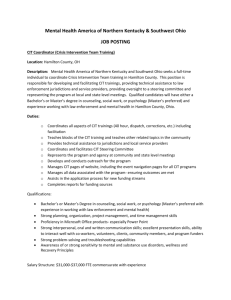

advertisement

Business income computation CHYTHANYA K.K., B.Com, FCA, LLB Raghuraman & Chythanya Advocates #32, 1st Floor, Patalamma Temple Street, Basavanagudi, Bangalore, Karnataka, India. Chythanya K.K., Advocate 1 Critical aspects of business income computation Chythanya K.K., Advocate 2 GENERAL PARAMETERS “Profits” to be understood in its commercial sense –Calcutta Company Ltd. v. CIT [1959] 37 ITR 1 SC; For determining the question of taxability, well settled legal principles as well as principles of accountancy to be taken into account – CIT v. U.P. State Industrial Development Corporation [1997] 225 ITR 703 SC; The term “Profits” in various Sections of Income-Tax Act do not have the same meaning : It could be assessable profits under some context or commercial profits in other contexts – CIT v. Orient Paper Mills [1983] 139 Chythanya ITR 763 SC; K.K., Advocate 3 Deduction under section 28 itself Real Income Theory – Loss due to deduction of damages from current bills against supplies is allowable - CIT v. Carbon Industries Pvt. Ltd. [2004] 134 Taxman 368 [Mad.]; A claim for deduction for which there is no specific provision would be admissible under Section 28 itself – CIT v. Mahsana District Co-Operative Mils Products Union Ltd. [2005] 146 Taxman 355 [Guj.]; Certain business losses which may not come under Section 37 may be allowed on ordinary commercial principle – State Bank of Saurashtra v. DCIT [2005] 93 ITD Chythanya K.K., Advocate 662 [Ahd.] 4 MEANING OF TRADING RECEIPTS Whatever tax collected constitutes trading receipt - Chowringhee Sales Bureau Pvt. Ltd. v. CIT [1973] 87 ITR 542 SC; Payment from Public Fund to assist assessee in carrying his trade, is revenue receipt – Sahaney Steel & Press Works Ltd. v. CIT [1997] 228 ITR 253 SC; The word Income should be the same as that of word occurring in the Legislative list and that it is of widest amplitude and must be given natural Chythanya K.K.,-Advocate and grammatical meaning CIT V 5 ONE OFF TRANSACTION Even a single transaction could be termed as business - CIT v. S.P. Balasubramaniam [2002] 120 Taxman 491 [Mad.]; 250 ITR 127 - CIT v. Sutlej Cotton Mills Supply Agency Ltd. [1975] 100 ITR 706 SC; Contra - Indian Hume Pipe Company Ltd. v. CIT [1992] 195 ITR 386 [Bom.]; CIT v. Sashikumar Aggarwal [1992] 195 ITR 767 (All.) - Chythanya K.K., Advocate 6 INTEREST – BUSINESS OR OTHER SOURCES Short Term Deployment Trade Surplus is Business Income – - A.P.Industrial Infrastructure Corp Ltd. v. CIT [1989]175 ITR 361 [A.P.]; - CIT v. TN Diary Development Corp Ltd. [1995] 216 ITR 535 [Mad]; - CIT v. Choudhury & Sons [1993] 203 ITR 881 [SC]; Contrary – Murali Investment Company v. CIT [1987] 167 ITR 368 [Raj.; Preconstruction period Interest; - - Assessable under other head as per Tuticorn Alkali Chemicals & Fertilisers Ltd. v. CIT [1997] 227 ITR 172 SC; Advocate Not Assessable but Chythanya to beK.K.,reduced from capital cost as7 per RENTAL - BUSINESS OR OTHER SOURCES Rental to be assessed only as house property income - East India Housing and Land Dev Trust Ltd. V. CIT [1961] 42 ITR 49 SC Where assessee gives certain quarters on rent to his employees and charges rent, rental income to be treated as business income - CIT v Delhi Cloth & General Mills Co. Ltd [1966] 59 ITR 152 [Punj.] Where premises are given for locating a branch of bank, police station, excise office, etc., to run business of assessee more efficiently, rentals to be taxable as business income - CIT National Chythanyav K.K., Advocate 8 BROAD PRINCIPLES - East India Housing and Land Dev Trust Ltd. V. CIT [1961] 42 ITR 49 SC Sultan Brothers Pvt. V CIT [1964] 51 ITR 353 (SC) No precise test can be laid down It is a mixed question of law & fact and should be determined from point of view of a businessman in that business on facts & circumstances of each case, including true interpretation of the agreement under which the assets are let out. Where all assets of business are let out, the period for which the assets are let out is a relevant factor If only a few assets are let out temporarily as assessee carries on his other business activities, it is a case of exploiting business assets; But if the business never started or has started but ceased with no intention to be resumed, assets also will cease to be business assets and the transaction Chythanya K.K., Advocate will only be exploitation9 of ONE BUSINESS OR SEVERAL BUSINESSES Several activities constitute one business if there is Unity of Control & Management & Interlacing of Funds – - Jayashri Tea & Industrial Ltd. v. CIT [2005] 272 ITR 193 [Cal.]; - BR Ltd. 113 ITR 647 SC Chythanya K.K., Advocate 10 Computation under other head – business character not lost The breaking up of business income under different heads for computation purpose does not render income to be non-business - CIT v. Chugandas & Co. [1965] 55 ITR 17 SC; CIT v. Cocanada Radha Swamy Bank Ltd. [1965] 57 ITR 306 SC; Brooke Bond & Co. Ltd. v. CIT [1986] 162 ITR 373 SC; DCIT v. Jindal Aluminum [2003] 87 ITD 598 [Bang.]; Apollo Tyres Ltd. v. CIT [2002] 255 ITR Chythanya K.K., Advocate 273 SC - 11 BUSINESS PERQUISITES Car received by a dealer as a gift is a trading receipt –Boeing v. CIT [2002] 122 Taxman 49 [Mad.]; Unexpected benefits received do not come under Section 28 [iv] – Mahindra & Mahindra Ltd. v. CIT [2003] 261 ITR 501 (Bom) Chythanya K.K., Advocate 12 SETTING UP OF BUSINESS Difference between setting up and commencement CIT v. Coromandal Fertilizers Ltd., 2003 261 ITR 408 AP & Hotel Alankar v CIT (1982) 133 ITR 866 (GUJ) - When a business is established and is ready to commence business it can be said of that business that it is set up - The words ‘ready to commence’ would not necessarily mean that all the integrated activities are fully carried out and/or wholly completed so that the business can be commenced Previous year begins when business is set up - Western India Vegetable Products Ltd. V. CIT [1954] 26 ITR 151 Bby Chythanya K.K., Advocate 13 SETTING UP OF BUSINESS Placing P.O.s or receiving P.O.s could mean setting up - CIT v Stones & Minerals Associate Ltd (2002) 257 ITR 479 When trial production takes place, business is set up - CIT v. Kanoria General Dealers P.Ltd [1986] 159 ITR 524 Cal. Negotiation for obtaining and for acquiring a land is a part of business expenses and if advance was made for this purpose, business is set up - CIT V.CHEMCROWN (IND) LTD. (2003)262 ITR 177 (Cal.) Where business consists of different categories, business is set up from the date when one of the categories of the business is started and it is not necessary that all the categories of the business must start either simultaneously or that the last stage must start before it can be said that the business was set up - Prem Conductors [P] Ltd. [108 ITR 654] 14 Chythanya K.K., Advocate Rent, repairs & rates Entire mill to be treated as one single plant and machines only a part of it and no new assets created in process of replacement of worn out machines CIT v. JANAKIRAM MILLS LTD. (2005) 275 ITR 403 (MAD) Municipal tax is a recurring liability whereas building tax under the Kerala Building-tax Act, 1975 is a one time liability, which is entirely different CIT v. HOTEL SHAH & CO [2005] 146 TAXMAN 86 (KER) Chythanya K.K., Advocate 15 Some special cases Expenditure incurred in keeping in existence corporate entity and to comply with statutory obligations under various statutes even while there was no business activity in the relevant year is incidental to business activity as per Gojer Bros (P) Ltd. v. ITO (2005) 142 Taxman 39 (Kol) Contra : INTERNATIONAL MARKETING LTD (IN FAVOUR OF REVENUE) vs. INCOME-TAX OFFICER (2007) 159 TAXMAN 24 (DELHI) Chythanya K.K., Advocate 16 DEPRECIATION Meaning : Mysore Minerals Ltd. V. CIT (1999) 239 ITR 775 SC Depreciation allowance is mandatory Where Sec 144 assessment is made taking Net profit %, the Depreciation should be allowed Circular Dt 31.08.1965 Where income is assessed at 8% Gross profit rate, Depreciation should be allowed - CIT v Sriram & Co (2002) 120 Taxman 238 (Raj) & CIT v Amritlal Khatri (2002) 123 Taxman 457, CIT v. Jain Construction Co. 245 ITR 527 Chythanya K.K., Advocate 17 DEPRECIATION A partner can claim depreciation on his assets used by firm from his share of salary and remuneration (if he has retained ownership over the assets) - CIT v Ramlubhaya R Malhotra (2002) 254 ITR 165 (Guj) In the case of land and building, the splitting has to be made both u\s 32 and u\s 45 as held in the following cases: - CIT v Vimal Chand Golecha (1993) 201 ITR 442 (Rajasthan) - CIT v Dr.D.L.Ramachandra Rao (1999) 236 ITR 87 (Madras) - CIT v T C Itty Xpe (2001) 119 Taxman 137 Chythanya K.K., Advocate (Madras) 18 DEPRECIATION - USE - “Use” means ‘kept ready for use’ and not the actual use - Capital Bus Service (P) Ltd v CIT (1980) 123 ITR 404(Delhi) - The word “used” should be understood in a wide sense, so as to include passive as well as active user - CIT v. Viswanath Bhaskar Sathe (1937) 5 ITR 621 (Bby) - User of machinery in test production was user for the purposes of the assessee’s business - Ramakrishna and Sons Ltd. v. CIT (1984) 149 ITR 554 (Mad.) - ‘Use’ is sufficient not degree or extent of use - CIT v Union Carbide (I) Ltd (2002) 124 Taxman 859 (Cal) - Contra : DCIT v YELLAMMA DASAPPA HOSPITAL,BANGALORE 2007 (62) Chythanya K.K., Advocate KAR.L.J.42 (HC) 19 DEPRECIATION - USE - Where assessee bought cars on last day of accounting year and had not registered same for being brought on roads and there being no evidence of assessee having used said cars before end of accounting year, it was not entitled to depreciation in respect of those vehicles CIT v. MAPS TOURS AND TRAVELS (2004) 141 TAXMAN 38 (Madras) Chythanya K.K., Advocate 20 DEPRECIATION- MOTOR VEHICLE The MV Act does not lay-down that a person cannot be the owner of a motor vehicle unless the motor vehicle is registered in his name K.L. Johar and Co. v. Deputy CTO [1965] 16 STC 213 [SC] Motor vehicle is a movable property, transfer of ownership is governed by the Sale of Goods Act and it takes effect from the date of sale. Registration is not necessary to pass title in motor vehicle, to claim depreciation under the Income-tax Act. - CIT v. Nidish Transport Corporation [1990] 185 ITR 669 [Ker] Vehicle registered in partner’s name, firm is entitled to depreciation if funded by firm and used by firm - CIT v Mohd. Bux Shokat Ali Chythanya K.K., Advocate (2002) 256 ITR 356 (Raj) 21 DEPRECIATION- MOTOR VEHICLE - Motor car registered in the name of a director is entitled to depreciation in the hands of the company Chhabria Textile Mills Pvt Ltd. v. ACIT ITAT Mumbai ‘E’ Bench 2004-05 38 BCAJ 579 Car includes jeeps - Crompton Engg. Co (Madras) Ltd v CIT (1992) 193 ITR 483 (Mad.) & Southern Roadway Ltd v CWT (2002) 122 Taxman 128 (Mad) Depreciation of car – Lease or hire CIT v Madan & Co (2002) 254 ITR 445 (Mad.) CIT v. SOUTH INDIA VISCOSE(2005)272 ITR 115 (MADRAS) CIT v. Kotak Mahindra Finance Ltd (2003) 130 Taxman 130 Bby Circular No.2 of 2001, dated February 9, 2001 ABB Ltd v. Industrial Finance Corpn. of India (2005) 56 SCL 21 [154 Taxman 512] Chythanya K.K., Advocate 22 DEPRECIATION- COMPUTER Colour xerox machine run with help of computer & printer and scanner are integral part of computer system – colour xerox machine to be treated as computer & entitled to higher rate of depreciation - ITO v. SAMIRAN MAJUMDAR [2005] 280 OF ITR [A.T.] 74 [KOLKATA] Chythanya K.K., Advocate 23 UNABSORBED DEPRECIATION Unabsorbed depreciation carried forward from earlier years can be allowed to be set off against income assessed under other heads as held - CIT v Virmani Industries (P) ltd (1995) 216 ITR 607 (SC) & CIT v Jaipuria China Clay Mines (P) Ltd (1996) 59 ITR 555 (SC) Legal fiction envisaged under section 32(2) for deeming the unabsorbed depreciation as a part of the current year’s depreciation is only to achieve the limited purpose of carry forward & adjustment of the same against other heads of income, in the absence of which, the aforesaid set off against other incomes would not have been available - CIT v. Mother India Refrigeration Industries (P) Ltd. [1985] 155 ITR 711 SC Chythanya K.K., Advocate 24 Interest deduction - Capital u/s 36(1)(iii) means “money” and not any other asset as held by the Supreme court in the case of Bombay Steam Navigation Co.(1953) Pvt Ltd (1965) 56 ITR 52. - Unless nexus is proved between loan taken and loan given, interest cannot be disallowed : British Paints (India) Ltd v CIT (1991) 190 ITR 196 (Cal) - The case where loan is advanced to a subsidiary stands on a different footing than advance made to a sister-concern. In the latter situation, interest can be disallowed, but not in the case where advances are made to a subsidiary company for purposes of business : DCIT v. INDIAN HOTELS CO.LTD. (2005) 92 ITD 97 (Mum.) K.K., Advocate - S.A.BUILDERS LTD vs. CITChythanya (APP) (2007) 288 ITR 1 25 Interest on capital borrowed for acquisition of an asset - Proviso to section 36(1)(iii) wef 01.04.2004 inserted by Finance Act 2005 - Explanation 8 to section 43(1) inserted by Finance Act 1986 wef 01.04.1974 and Challapalli Sugar Mills Ltd. V. CIT (1975) 98 ITR 167 SC - JCT LTD v. DEPUTY COMMISSIONER OF INCOME-TAX [2005] 144 TAXMAN – TAX REPORTS 435 [CAL.] Chythanya K.K., Advocate 26 Bad debts Section 36(1) (vii) as amended by the Finance Act, 2001 requires not only debit to Profit and Loss account but also credit to the party’s account as per Jubliant Organosys vs CIT [2004] 265 ITR 421 (All.). SLP dismissed in 266 ITR 108 There is no need to establish that the debt has become bad and it is sufficient if the debt is written off as bad in the books DCIT v. Oman International Bank (2006) 100 ITD 285 (Bby SB) Chythanya K.K., Advocate 27 Section 43B Contribution to PF and ESI Whether section 43B covers both employee contribution and employer contribution - Yes as per Hitech India Pvt. Ltd v. UOI (1997) 227 ITR 446 AP - No as per CIT v. Madras Radiators and Pressings Ltd., 2003, 129 Taxman 709 Mad. Chythanya K.K., Advocate 28 Section 43B Contribution to PF and ESI Whether amendment to (omission of Second retrospective? section 43B Proviso) is - Yes as per - CIT v. GEORGE WILLIAMSON (ASSAM) LTD (2006) 284 ITR 619 (GAUHATI): No as per CIT ITR366 (MAD) vs. SYNERGY FINANCIAL 288 Chythanya K.K., Advocate 29 Section 43B Whether section 43B overrides section 40A(7) PF and ESI - Yes as per Sree Kamakhya Tea Co.(P) Ltd vs CIT Cal., A.T.E. (P) Ltd. v. ACIT (2004) 84 TTJ 186 (ITAT – Mumbai) - No as per George Williamson (Assam) Ltd. v. CIT[1997]228 ITR 343 Gau. & COMMONWEALTH TRUST (I.) LTD. (2004) 269 ITR 291 Chythanya K.K., Advocate 30 Section 40A(3) Constitutional validity upheld in case of Attar Singh Gurumukh Singh (1991) 191 ITR 667 SC Validity upheld even after amendment to Rule 6DD as per Kamath Marbels v ITO and others (2003) 260 ITR 470 (Ker) Whether section 40A(3) applies to split payments - No as per CIT v Aloo Supply Co (1980) 121 ITR 680 (Orissa) & Shree Mahaveer Corporation v ITO (2002) 258 ITR (AT) 55 (ITAT- Bang) - Yes as per Shri Radhika Prakashan v CIT (2002) 123 Taxman 213 (MP) Chythanya K.K., Advocate 31 General deductions Mere non making of entry doesn’t deprive assessee of his right of deduction, so also a mere disputing of his liability - Sutlej Cotton mills Ltd v CIT (1979) 116 ITR 1 SC The expression “wholly and exclusively” used in section 37(1) does not mean “necessarily” Sasson J.David & Co. P.Ltd. v. CIT (1979) 118 ITR 261 SC The expression “for the purpose of business” is wider than the expression “for the purpose of earning profits” - CIT v. Malayalam Plantations Ltd. (1964) 53 ITR 140 (SC) Chythanya K.K., Advocate 32 General deductions “Spending’ in the sense of ‘paying out or away’, of money is the primary meaning of ‘expenditure’. ‘Expenditure’ is what is paid out or away and is something which is gone irretrievably - General Insurance Corpn. of India v. CIT (1999) 240 ITR139 SC Benefit to third party is not a criteria - Eastern Investments Ltd. v. CIT, 20 ITR 1 [SC] A company cannot as such have personal expenditure - Sayaji Iron & Engg co v CIT (2002) 121 Taxman 43 [253 ITR 749] (Guj) Chythanya K.K., Advocate 33 Capital or Revenue Expenditure incurred by the assessee in acquisition of an income earning asset is a capital expenditure and the expenditure incurred in the process of earning of income was a revenue expenditure Assam Bengal Cement Co. Ltd. v. CIT [1955] 27 ITR 34 SC Test of enduring benefit may break down - Empire Jute Co. Ltd., v. CIT [1980] 124 ITR 1 SC Expenditure should result in creation of an asset in favour of the assessee - L.H.Sugar Factory and Oil Mills (P.) ltd v. CIT [1980] 125 ITR 293 SC Chythanya K.K., Advocate 34 Capital or Revenue Payment of technical know-how in this age of fast changing technology is ordinarily understood as constituting revenue expenditure - Alembic Chemical Works Co. Ltd. v. CIT [1989] 177 ITR 377 (SC) Sum paid as royalty may have to be split between capital and revenue - Jonas Woodhead and Sons (India) Ltd. v. CIT [1997] 224 ITR 342 (SC) Incurring a lump sum expenditure in lieu of revenue expenditure over a long period is also in the revenue field as per CIT v MADRAS AUTO SERVICE (P) LTD [1998] 233 ITR 468 (SC) Chythanya K.K., Advocate 35 Deferred Revenue Deferred revenue income - In a Time share scheme only annual income may be recognised in T.K.INTERNATIONAL LTD. v. ASSISTANT COMMISSIONER OF INCOME-TAX (2004) 91 ITD 481 (Cuttack) Deferred revenue expenditure - The discount on issue of debenture may be amortized as per Madras Industrial Development Corpn. V. CIT (1997) 225 ITR 802 SC Chythanya K.K., Advocate 36 Crystalisation of contractual liability This liability may be claimed in the year to which the transaction relates provided it can be fairly ascertained or estimated on agreed and admitted terms of the contract - Calcutta Co. Ltd. v. CIT [1959] 37 ITR 1 SC Metal Box Co. of India Ltd. v. Their Workmen [1969] 73 ITR 53 SC Where, a dispute is raised by the parties, it would be allowable only on its final outcome of the dispute either in the year of amicable settlement by the parties or in the year of final determining of judicial process as per Swadeshi Cotton & Flour Mills [P.] Ltd. [1964] 53 ITR 134 [SC] Chythanya K.K., Advocate 37 Crystalisation of statutory liability Statutory liabilities arise according to the provisions of law and do not depend on the view which the assessee may take of its rights. Therefore, even if, such liabilities are disputed or contested before the Courts, deduction in respect thereof would be allowable as per Kedarnath Jute Mfg. Co. Ltd. V. CIT [1971] 82 ITR 363 (SC) Chythanya K.K., Advocate 38 Infraction of law Irrespective of nomenclature, one has to find out whether it is compensatory or penal in nature in order to allow compensatory part as deduction u/s 37(1) : Swadeshi Cotton Mills Ltd v CIT (1998) 233 ITR 199 SC Infraction of law is not a normal incidence of business : Haji Aziz & Abdul Shakoor Bros. v. CIT [1961] 41 ITR 350 SC The payment will be deductible only if it is compensatory and not punitive : Prakash Cotton Mills P.Ltd v. CIT (1993) 201 ITR 684 (SC) Bribes cannot be allowed as a business expenditure. But “mamools” could be so allowed :CIT v. Coimbatore Salem Transport (P.) Ltd. [1966] 61Chythanya ITRK.K., 480 (Mad). Advocate 39 Infraction of law Compounding fine paid and claimed as business expenditure by builder for violation of building norm is not allowable : C.I.T. Mamta Enterprises [KAR] [2004] 135 Taxman 393 [KAR] Chythanya K.K., Advocate 40 Interest on tax Interest on outstanding sales tax is an allowable expenditure being compensatory in nature : Lachmandas Mathuradas v CIT (2002) 122 Taxman 828 SC Interest on delay in payment of sales tax cannot be disallowed : CIT v. Delhi Automobiles (2005) 272 ITR 381 (Delhi). Interest paid to income tax department cannot be allowed as business expenditure : Bharat Commerce and Industries Ltd. v CIT (1998) 230 ITR 733 SC Chythanya K.K., Advocate 41 WARRANTY COSTS Provision made by assessee for warranty claims on the basis of past experience is not a contingent liability as the liability towards warranty is certain and had accrued on the date of sale, therefore, is allowable as a deduction - Wipro GE Medical Systems Ltd. v. DCIT (2003) 81 TTJ 455 (Bang) CIT v. Beema Mfrs. (P.) Ltd. [2003] 130 Taxman 400 (Mad.) Maruti Udyog Ltd. V. Deputy Commissioner of Income-tax (2005) 142 TAXMAN – TAX REPORTS 57 (Delhi) Chythanya K.K., Advocate 42 SOFTWARE COSTS Revenue - Media Video Ltd v JCIT (2002) 122 Taxman Mag 28 (Delhi) Jt. CIT v. Citicorp Overseas Softwares Ltd. (2004) 85 TTJ (Mum.) 87 JCIT V.CITICROP OVERSEAS SOFTWARES LTD. 85 TTJ 87 (Mum) CIT v. K & Co. (2003) 181 CTR (Delhi) 378 Business Information Processing Services v. Asstt. CIT (2000) 73 ITD 304 (Jp.) - Capital - CIT v Arawali Construction Co. (P) Ltd (2002) 124 Taxman 146 (Raj) Maruti Udyog Ltd. V. DCIT (2005) 142 TAXMAN – TAX REPORTS 57 (Delhi) - Chythanya K.K., Advocate 43 CA fees for IT return Allowable - CIT v Birla Cotton Spinning & Weaving (1971) 82 ITR 166. - H S Shivakantappa v CAIT (1982) 134 ITR 481 Ker Not allowable - Associated stone Ind (Kotah) Ltd v CIT (2002) 123 Taxman 643 (Raj) Chythanya K.K., Advocate 44 Foreign travel – Director’s wife Allowable - CIT v Appollo Tyres Ltd (1999) 237 ITR 706 - D.B.Madan v CIT (2003) 261 ITR 193 (Mad.) Not allowable - Ram Bahadur Thakur Ltd v CIT (2002) 257 ITR 289 Ker Chythanya K.K., Advocate 45 Partners’ life insurance premium Allowable - ITO v. Thakur Vaidyanath Aiyer & Co. (1984) 7 ITD 9 (Bby) - Clarification by the LIC vide its ACTL/1729/4,dated July 24,2000 Not allowable - CIT v. Khodidas Motiram (1986) 161 ITR 99 (Guj) Chythanya K.K., Advocate Panchal 46 CONCLUSION Business income computation is a complex exercise thanks to ambiguities in relevant tax provisions This head of income contributes maximum litigation This paper seeks to bring out some critical aspects which may not be taken as exhaustive Chythanya K.K., Advocate 47 CHYTHANYA K.K, B Com, FCA, LLB Partner , Raghuraman & Chythanya, Advocates. Thank You Email id : Chyti@vsnl.net Chythanya K.K., Advocate 48