Unifying our Federal Student Loan Programs - Paul Combe

advertisement

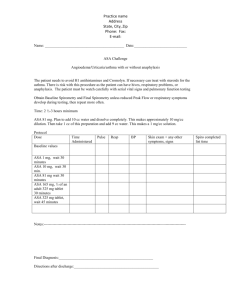

Breaking the Deadlock: Unifying Our Federal Student Loan Programs Paul Combe, President &CEO American Student Assistance PESC 6th Annual Conference on Technology & Standards April 7, 2009 Change is in the Air • New presidential administration and new Congress • Drumbeat within Congress and industry for federal aid simplification • Student debt has become a social issue ASA Confidential and Proprietary Information 2 A Growing Social Issue ASA Confidential and Proprietary Information 3 • Rare opportunity to take advantage of broad consensus for reform • If we could rebuild the federal college loan program, what would it look like? ASA Confidential and Proprietary Information 4 FFELP vs. DL • Debate has missed the bigger issue – Education Debt is now the problem • The major focus of the debate has been about delivery systems and which program costs government less • Loan processing systems have become a market tool that can be used to restrict the range of consumer choice • Competition between FFELP and DL has produced many positives that should not be lost in the future ASA Confidential and Proprietary Information 5 Break the Deadlock • Time to move past FFELP versus DL • Combine the best of both programs to create a single unified program that breaks the gridlock • Create a single loan program with one delivery system that incorporates private and federal funding • Greater focus on education debt management for ALL and a refocused role for GA’s…guaranteeing the borrowers’ success, not the lenders’ ASA Confidential and Proprietary Information 6 Rebuilding with a Consumer Focus • America has chosen debt as the primary method for funding higher education and therefore has a responsibility to help students manage their debt • Federal student loan program should focus on borrower as “consumer” – Consumer rights including: • Real Open Choice • Effective Competition • Debt Management Services • Education Debt Management = Entitlement ASA Confidential and Proprietary Information 7 Building a Market-Based Future • Loan programs should use public and private capital • Federal capital used as benchmark or “ceiling” on loan rate • Benchmark rate set by an analogous market rate…FHA mortgage rates • Federal guarantee only / No SAP • Price / rate competition below benchmark • Post Graduation Borrower Subsidies • New GSC Under-treasury? ASA Confidential and Proprietary Information 8 Single System • Borrower should be able to choose any lender, at any school, with any guarantor, and have it processed just as efficiently • DL mandatory on all schools’ lender list • Low cost of entry … more competitors • Federal System (COD)? ASA Confidential and Proprietary Information 9 What is Education Debt Management? • Effective education debt management is not just due diligence with a prescribed amount of letters and phone calls • It’s about using federal college loans as “teachable moments”: – Use continuum of intervention / education activity (proactive and reactive) to target, engage, and impact the borrower’s financial wellness – It is proactive and focused on getting the right information to the right borrower at the right time – It is individualized and personalized – Uses CRM tools ASA Confidential and Proprietary Information 10 Education Debt Management Services Product Target Channel Print Journeys Student loan grace period Transitions Withdrawn students Consolidation Recently consolidated DAAR Email Program Delinquent borrowers After Cure Accounts current after delinquency Bright Beginnings Defaulted borrowers Post Rehab After complete loan rehab (BB) loan to ACS ASA Confidential and Proprietary Information 11 Email Phone Web ASA Borrower Wellness: Key Success Measures ASA vs. National Cohort Default Rate FFY 97-06 Cohorts (Reported 1999-2008) 10% 8% 6% 4% 2% 0% 1997-1999 1998-2000 1999-2001 2000-2002 2001-2003 2002-2004 2003-2005 2004-2006 2005-2007 2006-2008 National 8.8% 6.9% 5.6% 5.9% 5.4% 5.2% 4.5% 5.1% 4.6% 5.2% ASA 7.7% 5.9% 3.8% 3.9% 3.4% 1.7% 1.3% 1.5% 1.5% 1.4% ASA’s Cohort Default Rate has consistently been among the lowest in the nation; we believe our focus on getting borrowers off to a good start through our Journeys and other communications programs helps drive this success. ASA Confidential and Proprietary Information 12 ASA vs. National Default "Trigger" Rate FFY01 thru FFY07 2.5% 2.0% 1.5% 61.33% 60.84% 54.99% 54.42% 1.0% 56.98% 59.72% 49.81% 0.5% 0.0% FY2001 FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 FY2001 FY2002 FY2003 FY2004 FY2005 FY2006 FY2007 ASA 1.32% 1.24% 0.93% 0.72% 1.00% 0.98% 1.13% Other Guarantors 2.16% 2.04% 1.71% 1.45% 1.76% 1.64% 2.05% ASA Confidential and Proprietary Information 13 To change the Guarantor role, we must change the financing: In Good Standing In Trouble In Default Old Model 1 32.6% 5.6% 61.8% New Model 3 70.36% ASA Confidential and Proprietary Information 0% 14 29.64% Questions? Suggestions? More Information? • We want to hear from you! • Join the discussion on ASA’s Policy Perspectives Blog: http://www.amsa.com/blogs/policyperspectives • Please contact me with questions, suggestions and feedback: combe@amsa.com ASA Confidential and Proprietary Information 15 American Student Assistance® 100 Cambridge Street, Suite 1600 Boston, MA 02114 (800) 999-9080 (617) 728-4670 F A X (800) 999-0923 T D D www.amsa.com