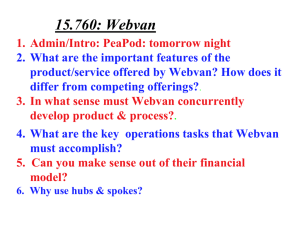

Webvan Case Study: Online Grocery Failure Analysis

advertisement

Webvan: The new and improved milkman By Gediminas Sumyla Mission and vision • No supermarket company succeeded in building truly nationwide grocery operation… • Webvan’s vision was to build a nationwide infrastructure to solve the logistics problem of this business and succeed in this complicated market. Company sought to capitalize on the potential that online grocery shopping had and use this opportunity to become the milkman of the twentyfirst century. • “Our mission is to be the last-mile leader of Internet commerce, and we own the whole process from order to delivery," - Amy Nobile, manager of public affairs Mission (cont’d) • Webvan’s mission was also to create and automated process that was designed to manage all aspects of online grocery business, from order taking to delivery. • Their goal was to take the west coast’s online grocery market and expand to part of midwest and part of east coast. They were hoping to expand to 26 cities in United States. History • Webvan was founded in the heyday of the dot-com boom in the late 1990’s by Louis Borders, who also co-founded Borders Bookstore in 1971. • It launched its San Francisco Bay Area service in June 1999. • Webvan went public on November 5, 1999 at an offering price of $15 a share. • In May 2000, company launched its Atlanta operations and it expanded to Chicago in August 2000. • In June 2000, a major competitor, HomeGrocer.com, agreed to merge with Webvan. • By the end of 2000, Webvan served 10 markets. History (cont’d) • Webvan expected each distribution center to bring in $300 million in revenue by 2003. • In the fourth quarter of 2000, company was operating at a run rate of 2250 orders per day in Los Angeles and 2160 in San Francisco. • 34% of Webvan customers in the San Francisco Bay Area added general merchandise products to their grocery orders. • As of June 2000, Webvan purchased through 50 distributors and directly from 300 vendors, it also sold about 35000 SKU’s up from 15000 when it began its operations. • In the fourth quarter of 2000, Webvan@work program accounted for 15% of company’s San Francisco Bay Area sales, with an average order size of $130. • In January 2001, company opened on its Web site a cobranded pet store with Petsmart.com. • Webvan went bankrupt in 2001. Management team • Louis Borders – founder of Webvan. His name is known nationally for the successful chain of bookstores he founded with his brother. • George T. Shaheen – CEO of the company. He was also a CEO of Siebel Systems. Huge figure and key player in company’s development. Goals and strategies • Company’s goal was to put together a sophisticated distribution and iformation system, optimized from the ground up for e-commerce. • After it first launched Webvan expected to construct up to 26 fulfillment centers around the country within the following 2 years at a cost of about a billion dollars. • Company designed state-of-the-art automated warehouses that could serve an entire metropolitan market area within a radius of 50 miles. Goals and strategies (cont’d) • Webvan created an automated process that was designed to manage all aspects of the online grocery business, from order taking to delivery. • Company implemented an integrated information technology infrastructure, with different areas of operation sharing data through a central database. • Many tasks such as delivery scheduling, route planning, purchasing, and billing were automated and integrated. Goals and strategies (cont’d) • Their goal was also to make online shopping quality equivalent to traditional shopping experience. They wanted their products to be always fresh and on time. • Webvan invested more than 50 person-years in developing proprietary inventory management, warehouse management, route management, and materials handling systems. • Company also used EDI (electronic data interchange) network to connect to its vendors. • Webvan invested 1 billion dollars to build its warehouses, bought a fleet of delivery trucks, bought 30 Sun Microsystems Enterprise 4500 servers, dozens of Compaq ProLiant computers and Cisco Systems 7513 and 7507 routers, and other expensive equipment like huge monitors and luxury desk chairs. Industry and Market • U.S. market for food retailing was $484 billion in 2000. • On average, U.S. households visited supermarkets 2.3 times per week and spent about $87. • In 1999, supermarkets accounted for 77% of grocery sales and numbered about a quarter of all grocery stores. The industry was highly concentrated. • Resulting economies of scale and scope enabled supermarkets to charge lower prices, and competition drove net profit margins to about 1%. Industry and Market (cont’d) • Andersen study found that every group of shoppers was willing to buy groceries online, and most of the groups showed strong interest. • It predicted that 15-20 million U.S. households would buy groceries online by 2007. E-Commerce opportunities • Technological advances have given life to online grocers. • Previous online grocery distributors failed. • Webvan started late comparing to other competitors and can learn from their mistakes. • Good investors such as Goldman Sachs and Yahoo. • Huge market, big opportunities and potential to grab the market share. • Online grocery companies can charge cheaper prices because of saving money on labor. • Opportunity was driven by desire of consumers, particularly dual-income families, to save time. • 60% of consumers disliked grocery shopping cause it was time consuming and many were open to online grocery shopping and home delivery. E-Commerce initiative • A lot of companies failed because of poor business model. • Webvan invested huge money in automating processes and expected to become a “winner takes all” company. • Online grocery market was still very complicated and problematic. • Constant logistics problems. • Grocery margins were as thin as 2%. • Packaging and delivery were still very expensive. • After all that investment Webvan still struggled to make money and ended up with net losses that kept increasing from 1999 to 2000. • Huge investment wasn’t buying off. • Company was still lacking of costumers. Perspective analysis • Technological Drivers of Change Technological advances have given life to online grocers. Webvan saw the opportunity to take part of food retailing market which consisted of $484 billion and used technology to make all the processes automated and all transactions online. Technology development and support were central to Webvan’s operation. Company implemented a centralized IT architecture, with the same platform serving the different markets, while allowing for market-specific features. Webvan outsourced most of its network operation functions. Company also hosted its Web and database servers at AboveNet Communications. DSIR • Webvan had the potential in DSIR and hoped to become “winner takes all” company but it didn’t happen. • The problem was that people weren’t switching from traditional to online grocery shopping at fast enough speed. • There weren’t enough demand for online grocery shopping. • There weren’t any competitors that can actually compete with Webvan. • People didn’t care if others purchased goods the same way as they did. Competitive risks • • • • • Main competitors: Peapod, Streamline, HomeGrocer.com, NetGrocer.com, WebHouse Club. None of the competitors had such investements and automated systems as Webvan. Webvan had huge advantage over all the competitors. All the competitors used different business models and served different areas which made competition way easier for Webvan. None of those companies could actually compete with Webvan. Missed opportunities • Webvan wanted to invest huge money, to take market and become big. Wished to make huge money, but it didn’t work. • They rushed to much into it and burned. • They should have rapidly grow with slower speed and observe the market and consumers. • This would have helped Webvan’s management team to make decisions. • Instead of sticking to the idea of “go big, and do it quick”, they should have thought of “go, think, react” strategy. Why they failed • Rapidly disappearing cash reserves. • Continuous NET losses. • Company was too aggressive about expansion into multiple cities, combined with an overly complex website. • Webvan was also too optimistic about people's willingness to ditch traditional grocery stores in favor of something new and different. • Lack of customers. • It tried to get too big, too fast. • A recent Jupiter survey found that only 2% of Web users had bought groceries online in the last year. • Webvan suddenly found itself with an extraordinary amount of infrastructure and without the ability to get to profitability. Conclusion • Technology wise Webvan was ahead of the competitors, market and time, but it didn’t have and couldn’t get enough customers to use profitable all of that automated infrastructure.