NEWSFLASH 17th August 2015 British construction output returned

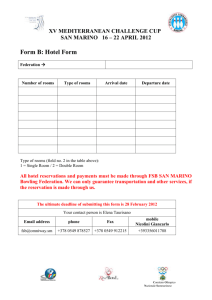

advertisement

NEWSFLASH 17th August 2015 British construction output returned to moderate growth in June, recovering from a slowdown seen in April and May, official data showed on Friday. For the second quarter as a whole, the Office for National Statistics said output was up by 0.2 percent from the first quarter, compared with an estimate of unchanged output which it had used to calculate gross domestic product last month. The ONS said this small upward revision to construction did not point to any material revision to its preliminary estimate of 0.7 percent GDP growth in the second quarter of 2015. In June alone, construction output rose 0.9 percent on the month, below economists' forecasts of a 2.2 percent pick-up. But falls in output in April and May were revised to be smaller than previously stated, with output falling 1.0 percent in May compared with an earlier estimate of a 1.3 percent fall. On the year, output in June was 2.6 percent higher, below economists' forecasts of a 3.3 percent rise but still the fastest growth since March. However, looking at the second quarter as a whole, annual output growth was the slowest in two years and just 2.4 percent higher than in the second quarter of 2014. Construction makes up 6 percent of Britain's economy, but the data is volatile, especially on a monthly basis, and can contribute to significant revisions to overall GDP. Construction fell sharply after the financial crisis and was slow to recover. It gained pace early last year but then weakened towards the end of 2014, as a temporary slowdown in the housing market reduced the construction of new homes. Allied London is to open events hub XYZ Studio, the Cotton Building development, in Spinningfields in Manchester this October. The developer said the studio, which will have its own events team and events programme, will help set the tone for the 160,000 sq ft XYZ building that is due to be completed in 2016. It will boast more than 30,000 sq ft of public amenity space including cafes, restaurants, meeting spaces, a bike park, leisure facilities, indoor gardens and a wellbeing centre. Final plans for a 15 acre mixed development in Manchester which sits on the site of the former home of the ITV studios in the city centre have been submitted by Allied London. If approved the St John’s Place development will be worth £1.35bn. Planning applications have now been submitted for all buildings in the development which includes St john’s Place, The Villages, The Riverside and Manchester’s first vertical village, Trinity Islands. The first to be submitted was the refurbishment of the historic Bonded Warehouse back in June as well as the conversion of the former Old Granda Studios headquarters buildings into an event hotel to be known as Manchester Grande. The first of the new submissions is for St John’s Place, which will be the gateway to the new neighbourhood and is made up of a cluster of four 5 to 50 storeys mixed-use buildings. The largest of these will be a new 50– storey landmark tower consisting of approximately 280 residential apartments and 180 hotel suites set within its own garden. Alongside this tower will be an apartment hotel with approximately 150 bedrooms and two residential buildings that face onto the River Irwell and Quay Street with retail and leisure space at ground level. Altogether the plans include 2,500 apartments, Three hotels comprising 350 to 400 rooms, new riverside space with cycle ways, new green spaces, low rise buildings to be used by independent firms to create 'a village vibe' and a £76m Factory Manchester theatre. Allied London proposes to start construction work on St. John’s in 2016 subject to planning approval. TH Real Estate has been granted planning permission by the City of Edinburgh Council for its £850m mixed-use Edinburgh St James scheme. This pivotal decision marks a major milestone for this transformational development, which is one of the largest regeneration projects currently underway in the UK. The City of Edinburgh Council Planning Committee has approved Primary Reserved Matters, Secondary Reserved Matters and a John Lewis detailed application for the 1.7 million sq ft (157,935 sq m) development project. The approved designs, by Edinburgh-based Allan Murray Architects, will see the 1970s shopping centre currently on site replaced with 750,000 sq ft (69,677 sqm) of retail space, a luxury hotel, up to 250 new homes, 30 restaurants and a multi-screen cinema. It is hoped that planning permission for the scheme’s luxury hotel will be granted when the design goes before the City of Edinburgh Council later this summer. As the centrepiece of Edinburgh St James, this iconic building will affirm Edinburgh’s position as a global destination and is already attracting the attention of major international hotel brands. Overlooking St James Square and creating a new landmark building for the city, the hotel will include up to 210 beds and will feature restaurants, bars and a rooftop terrace at uppermost levels. Looking further ahead, subject to the successful resolution of the Compulsory Purchase Order (CPO) scheduled for September, the project team is working towards a January vacant possession of the St James Centre, to enable demolition works to begin onsite in early 2016. Edinburgh St James is anticipated to complete in 2020. Research has found that growth in revenue per available room among UK hotels was slower in Q2 2015 than in the last eight quarters, while Aberdeen and London experienced a year-on-year decline. The other ten major UK cities featured in the Q2 Hotel Bulletin, which is published by business advisors AlixPartners, hotel data firm AM:PM and hotel consultancy HVS, recorded year-onyear growth in revenue per available room. However, the average growth figure of 4% was the lowest recorded since Q1 2013. Discounting London, average growth in revenue per available room in regional cities has fallen from 21% in Q3 2014 to 5%. BCFA NEWSFLASH Page 1 Glasgow saw the highest percentage change, with revenue per available room increasing by 14% year-on-year. This was followed by Belfast at 12% and Manchester, Cardiff and Birmingham which all saw growth of 9% year-on-year. The average rate for each available room in Glasgow also increased by 12%, while occupancy increased by 2%. In the first half of this year, the city has attracted £75m of new conference business with 229 events booked between now and 2022. However, not all Scottish cities enjoyed the same growth. Aberdeen performed the worst of the twelve cities monitored, experiencing a 27% reduction in revenue per available room along with a 13% decline in occupancy rates and a 16% fall in the average price charged per room. This was coupled with a 7% increase in supply of hotels in the city: also the highest of all cities surveyed. London also saw a reduction in revenue per available room to 3%. Both cities also experienced a negative percentage change in occupancy rates, which fell by 3% in London and 13% in Aberdeen. The figure also dropped by 1% in Bath, Newcastle and Leeds, with marginal increases in all other cities. Belfast saw the highest increase in occupancy at 6%. The report says London’s decline may be due to the increase in supply in the city between 2012 and 2013, since which time occupancy has gradually decreased. It also says the recent weakening of the Euro, which has meant that UK holidays are comparatively more expensive. £0.7bn of investment transactions also completed in Q2 2015, the lowest figure since Q2 2014. Restaurants Busaba Eathai and Drake & Morgan have signed for space at the South St Andrew Square development in Edinburgh – both brands’ first ventures in Scotland. Drake & Morgan, which serves cocktails and seasonal British food, has signed a 20 lease on a 7,050 sq ft unit. Busaba Eathai has taken a 6,820 sq ft unit on a 25 year lease for its Thai dining experience. The new restaurants will front on to St Andrew Square. The Standard Life Investments Pooled Pension Property Fund and Peveril Securities’ St Andrews Square development spans 165,000 sq ft and creates a link between Princes Street/George Street and Multrees Walk/The St James Centre. It is scheduled for completion towards the end of 2016. The development has already signed retailer TK Maxx for a 30,000 sq ft unit on South St David Street for its flagship Edinburgh store, and Standard Life Investments. Pier Point restaurant on Torquay's promenade is planning to expand with a £300k upper deck. The aim is to build some additional restaurant space indoors upstairs and create an outdoor terrace boosting the covers from 200 to 300. Paul Feasey, a partner in the enterprise, said that the restaurant had a record year last year and is doing even better this year. Hotel owner and operator Kew Green Hotels has been sold to HK CTS Metropark Hotels for an estimated £400m, along with its portfolio of 44 UK hotels. A wholly owned subsidiary of the firm acquired the entire issued share capital of Kew Green from previous owners Goldman Sachs and TPG Special Situations Partners, which had owned the business since 2013. It was initially put up for sale in March. The firm operates 54 UK hotels, more than 40 of which are under the Holiday or Holiday Inn Express brands, making it the brand’s largest franchisee in Europe. It also operates hotels under the Crowne Plaza, Ramada and Courtyard by Marriot brands. It owns 44 of its properties and manages 10 UK hotels for other operators, the most famous of which is The Grand on Brighton’s seafront, an independent hotel owned by Wittington Investments. Other notable properties managed by Kew Green include the Crowne Plaza at Liverpool’s John Lennon Airport, the Courtyard by Marriott at Gatwick and the Ramada Encore at Birmingham’s NEC. Senior management has been retained with the intention of continuing to grow the business in the UK and throughout Europe. BLACKPOOL £3M Site Of Former Yates Bros Wine, 2 - 10 Talbot Road Planning authority: Blackpool Job: Detailed Plans Submitted for hotel & restaurant/bar Client: Shlomo Memorial Fund Ltd Agent: Archer Architects, 55 Newton Street, Manchester, M1 1ET Tel: 0161 228 6020 CRIEFF £3M Loch Earn Brewery, The Drummond Hotel, St Fillans A85t Main Road Planning authority: Loch Lomond National Park Job: Detail Plans Granted for micro brewery & visitor centre (new/conversion) Client: Arran Brew Ltd Developer: WD Harley Architects, 2 Cross Street, Callander, Tayside, FK17 8EA Tel: 01877 331708 LONDON £5.4M 100 Whitechapel Road Planning authority: Tower Hamlets Job: Detail Plans Granted for 1 hotel & 4 commercial units (extension/conversion) Client: Alyjiso Ltd Developer: Webb Gray Architects, The Banking Hall, 33 Bennetts Hill, Birmingham, West Midlands, B2 5SN Tel: 0121 616 6030 Concordia Leisure Centre in Cramlington is to receive an extensive modernisation to its fitness facilities as part of a refurbishment due to start in September. Northumberland County Council and operator Active Northumberland are investing £3.5m into the project, which includes a facelift for the gym, the addition of a new Clip ‘n Climb activity, soft play facilities and a tenpin bowling alley. Plans have been submitted for a mobile pub in Manchester which will move around the city’s new NOMA development. Backers of the scheme said The Pilcrow pub “will be built by hand using disappearing construction crafts and contemporary design.”Plans have now been have submitted to Manchester City Council for the scheme which will be driven by professional craftspeople and built largely by local volunteers. The pub will be “a temporary structure, designed to move around the NOMA neighbourhood as it develops.” A series of free-to-attend workshops will see groups of volunteers spend time being taught a new skill and then spend a BCFA NEWSFLASH Page 2 couple of days putting what they have learnt in to action by constructing their part of the pub themselves. Subject to approval, construction is expected to start in January 2016, with the pub itself opening for first orders in the autumn of 2016. Builders, coders, designers and makers will be recruited to lead volunteers through skills workshops covering everything from drystone walling and cabinet making, through to home brewing, bee keeping and robotics. For those interested in finding out more about volunteering, there is a sign-up form on the website. A controversial 12-storey hotel, which it is claimed could “damage” Edinburgh’s skyline, has been given the green light. Dubbed the “ribbon hotel” due to its unusual façade, it is expected to open by 2020, with luxury chains including W and Four Seasons thought to be among those interested in moving in. Doubts have also been raised about the bronze coloured, stainless steel coating, which it is feared could be “too shiny and reflective” It will feature 210 rooms and a rooftop terrace with panoramic views, and will form the centrepiece of the £850m St James redevelopment project, which will also see the construction of luxury apartments, a cinema, new shops and restaurants. Plans for a five-star hotel on the Golden Mile have been submitted to Blackpool Borough Council. The proposed 96-bedroom property would be part of a multi-million pound investment to convert and extend the Sands Entertainment Venue on the promenade near Blackpool Tower. It would also include associated leisure and retail facilities. The report submitted to the council said the new hotel would not only provide accommodation within the resort but would also greatly improve the existing architectural fabric of the site and its surroundings. A hotel known as the Palatine previously occupied the site, prior to the construction of the present day structure in the 1970s. The designs have been created by the architecture and design team at the Frank Whittle Partnership (FWP), which has offices in Preston and Manchester. The hotel would feature luxury penthouse suites providing views over the promenade and the Irish Sea. A decision for the proposals is expected later this year. The Plough in Harborne near Birmingham is set to launch a new £750,000 extension called 'Upstairs at the Plough'. The first floor extension is expected to open in November. It will be home to two new private dining and meeting rooms, while extending its ground floor by 40 covers. The ground floor renovations will see the arrival of a new bar to help showcase The Plough’s global selection of rare, award-winning and artisan whiskies alongside its collection of craft beers. The makeover will also see the arrival of a new pizza kitchen and coffee bar. The refurbishment is being overseen by interior design expert Melony Spencer of Spencer Swinden. Serviced apartments are increasing their foothold in the UK market, according to new research. The Hotel Bulletin: Q2 2015, drawn up by AM:PM, HVS and AlixPartners, states that the segment is on the cusp of maturing from niche to mainstream. The report said the sector has gained significant momentum over the past three years but challenges still remain – including the need for clear and consistent industry definitions as well as better data transparency. London dominates the supply of serviced apartments with more than 55% of the UK total – compared to 23% of the total of UK hotel bedrooms. The report also showed the majority of cities reviewed recorded revpar (revenue per available room) growth, albeit at a slower rate than experienced in the previous eight quarters. Ten of the 12 cities recorded revpar growth; however, the average growth of 4% was the lowest recorded since Q1 2013. London’s revpar decreased by 3% in Q2 2015, but the report said performance trends historically lag 12 to 18 months behind supply trends. The contraction could be partially due to a significant increase in supply from January 2012 to December 2013, according to the report. In Q2 2015, the 11 regional cities showed average revpar growth of 5%, although signs of the market slowing which were identified in the previous quarter continued in Q2 2015. The top performer in this quarter was Glasgow with 14% revpar growth, while the worst performer was Aberdeen – which, for the second consecutive quarter, was the only regional city to record a decline. Other cities considered in the report were Liverpool, Birmingham, Cardiff, Leeds, Manchester, Bath, Newcastle, Edinburgh and Belfast. Hilton London Euston hotel has announced plans to invest over £8m on a major refurbishment project, adding bedrooms to meet increasing demand. The scheme will include a transformation of the existing 150 bedrooms, the development of a brand new fitness centre and the addition of a number of new bedrooms. Situated next to London’s Euston Station, the hotel is made up of two Victorian town houses joined together. The new design of the bedrooms will be inspired by the heritage of the surrounding area, including its culture, literary, artistic and social links. Following a recent £3m refurbishment, Aubrey Park Hotel in St Albans has been granted four-star status by the AA. The Grade IIlisted, independent country hotel is now planning a £2m investment in new conference rooms which are expected to open in spring 2016. The new meeting facilities will enable Aubrey Park Hotel to host meetings for up to 250 delegates in future. The investment will also see a complete refurbishment of the existing meeting facilities including the Garden Room plus the addition of a new gym. The Inn Collection Group (ICG) has been announced as the operator for a multi-million pound 40-bedoom pub with rooms in Blyth. The Commissioners Quay Inn will be built by Arch, The Northumberland Development Company, and will be open for business ahead of the arrival of the Tall Ships in Blyth next year. Located on Quay Road, the four-storey building has been designed with 40 bedrooms across three floors providing stunning sea views, while a ground floor bar and eatery area overlooking the river BCFA NEWSFLASH Page 3 will provide covers for up to 265 diners inside with a further 100 covers outside and offer informal meeting spaces. The Economist Group is to sell its longstanding editorial headquarters in London’s West End and seek new office space in central London. The weekly magazine will sell the three properties at 25 St James’s Street, including the Economist Tower, which has been home to the editorial team since the 1960s, to part-fund the repurchase of share capital from Pearson. Publisher Pearson has announced it had agreed to sell its 50% stake in The Economist Group for £469m. The company will be seeking new office space in central London but is not believed to have yet appointed agents for either the requirement or the sale of the building. Sports media brand MP & Silva has confirmed it is taking 15,000 sq ft of office space at Qatari-owned Park House in London’s West End. The company, which has an annual turnover of $720m, is taking part of the fourth floor at Park House on a 15-year lease at a rent believed to be in the mid £90s/ sq ft. The company is expected to relocate its London headquarters from nearby 30 St George’s Street by the end of the year. Deutsche Asset & Wealth Management has acquired Two St Peter’s Square in Manchester at a price of up to £100m. The 162,000 sq ft prime office development, which is still under construction, was acquired in an off-market transaction from Mosley Street Ventures, the developer of which Betfred boss Fred Done is principal owner. Upon completion in 2017, Two St Peter’s will become home to accountancy firm EY after it signed up to a 15-year lease for 41,628 sq ft of space earlier this year at a headline rent of £31.50/sq ft. The scheme also has 5,100 sq ft of leisure space. Luxury yoga-wear brand Lululemon is taking the upper floors of Royal London Asset Management’s Garden House for its new UK headquarters. The upmarket yoga and running retailer opened its flagship store in the Covent Garden area in March last year. It is now set to move into its new headquarters at 57-59 Long Acre in September having agreed a 10-year lease on 8,885 sq ft at a rent of £600,000 a year. A £17m Balfour Beatty office development in the centre of Cardiff has been stopped after the Welsh Government announced it was looking to sell the land. The Welsh Government announced last month that it was “exploring options for the marketing and disposal” of the Callaghan Square site in central Cardiff despite handing Balfour Beatty the contract to build a 500,000 sq ft office block on the land just over a year ago. A spokeswoman for Balfour Beatty told Construction News that it had completed the design stage of the work but would not proceed with the construction phase due to the impending sale. The Welsh Government bought the land for £7.2m in 2014, with a view to “kick-starting” the development of offices in the city’s Central Cardiff Enterprise Zone. Balfour Beatty was chosen as the project’s main contractor in May 2014, with October 2015 set as a provisional start date for construction work. However, due to a high number of similar office schemes being built in the area, the Welsh Government announced that it was now looking to the private sector for buyers. THURSO £15M Dounreay Planning authority: Highland Job: Detail Plans Granted for archive building Client: Dounreay Site Restoration Ltd Developer: Reiach & Hall Architects, 6 Darnaway Street, Edinburgh, Lothian, EH3 6BG Tel: 0131 225 8444 Willmott Dixon’s interior arm has won the contract to retrofit Network Rail offices in London. Work will involve revamping the office building at One Puddle Dock, near Blackfriars Station, and was secured with a bid of £20.6m. The offices were previously part occupied by Balfour Beatty’ Blackfriars Bridge station project team. Now Willmott Dixon will refurbish the six-storey office block to create a new home for 580 Network Rail staff and new shops on the ground floor. The job involves a complete strip out of M&E services and replacement of existing glazing to achieve a BREEAM Excellent rating. Willmott Dixon will also create a new extra plaza area as part of the 11-month overhaul. Morgan Sindall has been handed a contract to build a new £27.5m building for the University of Huddersfield. The new six-storey building will be developed in Huddersfield’s city campus and provide a home for the university’s School of Music, Humanities and Media. It will cover 7,500 sq m and provide a link to the university’s student central building that was finished in January 2014 by the Leeds-based GB Building Solutions, which went into administration earlier this year. GB Building Solutions had initially been selected for the project in February 2015 but had to be replaced a month later after it went into administration. OXFORD £10M Mansfield College, Love Lane Planning authority: Oxford Job: Detail Plans Granted for student accommodation Client: Mansfield College Agent: Rick Mather Architects, 123 Camden High Street, London, NW1 7JR Tender return date: Tenders invited. Tel: 020 7284 1727 BCFA NEWSFLASH Page 4 Carillion has reached financial close on the Midlands Priority School Building Programme private finance batch. The 25-year private finance concession contract will generate £187m of construction and support services revenue and sees Carillion invest £5.5m of equity, less than the £9m first mooted at preferred bidder stage. Under the deal eight new schools will be constructed over a two-year period at a cost of £138m. Schools in the Midlands Priority Programme Alfreton Grange Arts College, Derbyshire ARK Kings Academy, Birmingham Greenwood Academy, Birmingham Plantsbrook School, Birmingham President Kennedy School, Coventry The Phoenix Collegiate, Sandwell The Queen Elizabeth Academy, Warwickshire Top Valley Academy, Nottingham Planning approval has been given for Kingston University’s new £55m landmark building in Surrey. The scheme has been designed by Grafton Architects and a contractor is due to be confirmed within weeks. Once completed, the proposals will provide three new public landscaped areas as well as 9,027 square metres of learning space including; a modern learning resources centre over several floors, a 300-seat multi-media auditorium, rehearsal and performance space for the University’s popular dance courses and a café and other informal learning spaces. Osborne has won its first contract under the Sussex Cluster Contractor Frameworks to design & build a primary school for Kent County Council. The contract, worth nearly £5m, is for the new Langley Primary School in Maidstone. It will be the first school that Osborne has built in Kent. The two-storey building will have 14 classrooms as well as a hall, office space, a special education needs area and a small nursery and community facility. The new school will open in September 2016 and help meet provision for the 1,000+ houses that are currently being built to the south of Maidstone. Plans for a £20m transformation of the Leeds University students' union have been granted full planning permission with work scheduled to start later this year. The union has a long-term lease of the building from the university and has secured funding to develop key areas to compete with other student facilities throughout the country. A planning application, drawn up by DLA Architecture, seeks permission to refurbish and extend in parts the existing building both internally and externally. The union covers approximately 130,000 sq ft within four interconnected buildings and provides a range of facilities including bars, offices, performance venue theatres and a nightclub. Existing theatre spaces will be refurbished, while a new Arts Quarter will be created internally and a new southern entrance added to the rear of the building. Additionally, a new terrace bar conservatory with a similar aesthetic to the south entrance extension will be developed to provide a covered seating area during the winter and with the flexibility to open up in the summer months to become open to the elements. The permission granted by Leeds City Council must be implemented within three years and samples of materials must be approved prior to work commencing. Due to the continued need for the building to function throughout the year, the refurbishment and extension of the student union will be carried out in three phases. Carillion has been selected as preferred bidder on one of the first hospital projects to be procured under the government’s PF2 project financing model. A Carillion joint venture with Richardsons Capital and Infrastructure UK – known as The Hospital Company – will build and manage the £353m Midland Metropolitan Hospital for the Sandwell and West Birmingham Hospitals NHS Trust as part of a 30-year concession contract. Under the PF2 model, a replacement for the Private Finance Initiative, Carillion will invest £16m in equity into the 670-bed hospital. The capital cost of the project is expected to be £297m, while hard facilities management and life-cycle maintenance services are expected to net the firm £140m in revenue over the course of the contract. The deal is expected to reach financial close at the end of the year, with construction due to get underway in early 2016 and completion scheduled for mid-2018. EDINBURGH £4.1M 99 Inchview Terrace Planning authority: Edinburgh Job: Detail Plans Granted for care home Client: Care UK Developer: Burnett Pollock Associates, 17B Graham Street, Edinburgh, Lothian, EH6 5QN Tel: 0131 555 3338 HORSHAM £1.28M Oaktree Farm Care Limited, Copsale Road Oaktree Farm Maplehurst Planning authority: Horsham Job: Detail Plans Granted for residential care facility Client: Oaktree Farm Care Ltd Developer: Brett Incorporated Limited, 18 Seal Road, Selsey, Chichester, West Sussex, PO20 0HW Tel: 01403258800 Castlemead has won approval to build a 70-bed care home in Kidlington. The Port Haven home will be built at the Gravel Pits site in The Moors next to Briar Close and will provide 70 beds with a focus on elderly people with dementia. BCFA NEWSFLASH Page 5 UKTI Alert Qatar - Architectural finishes for Doha metro Invitation to Prequalify for Architectural finishes subcontracts for Phase 1 of the Doha Metro. This full online edition with links is available at: http://www.businessopportunities.ukti.gov.uk/uktihome/item/922560.html Brookfield Multiplex has been selected as main contractor to deliver the $1bn (£650m) Al Maryah mall in Abu Dhabi. Gulf Related awarded the $425m (£275m) construction contract to Brookfield Multiplex, with main construction work due to get underway later this month. When completed in March 2018, the 2.3m sq ft mall will include 145 restaurants and cafes, a 20-screen cinema, medical centre, crèche, health club, public library, food market and three rooftop car parks. There will also be 400 retail outlets, including the the first branch of Macy’s located anywhere outside of the US. Hilton Worldwide is set to introduce 10 new hotels throughout Germany and Austria following a strategic development agreement with Primestar Hospitality (formerly Interstar Hotel GmbH). The new additions are expected to focus on the rapidly expanding Hampton by Hilton brand, and concentrate on key cities across the Central European region. The hotels will join more than 35 properties trading or in development under Hilton Worldwide brands in Germany and Austria, of which 13 are within its focused service Hampton by Hilton and Hilton Garden Inn brands. Starwood Hotels & Resorts Worldwide, Inc. has announced three more Element hotels set to open in Greater China in the next four years, following the recent opening of the Element brand’s Asia Pacific flagship Element Suzhou Science and Technology Town in Suzhou, China. Element Hotels set to open in Greater China by 2019 include: Element Chongli (2017) — Situated in Zhangjiakou, co-host city of the Beijing 2022 Winter Olympics, in Chongli County, Hebei Province, the hotel has an ideal setting in Sitaizui Village, a vibrant ski area surrounded by mountains. The 150-room hotel is a 30-minute drive from Chongli County Center and just 90 minutes fromZhangjiakou Ningyuan Airport (ZQZ). Element Sanya Haitang Bay (2018) — Surrounded by mountains with breathtaking beach views, Element Sanya Haitang Bay will be located in the Haitang Bay District in the southern part of Hainan Island, known as the Hawaii of the East. The 204-room hotel is a 40-minute drive from Sanya’s city center and just 50 minutes from Sanya Phoenix International Airport (SYX). Element Tianjin Beichen (2019) — The 200 room hotel will overlook the Northern Canal of the Hai River, with sites such as the Tianjin Eye, a 120-meter Ferris wheel, and the 336-meter Tianjin Tower, and a skyscraper with an observation deck. Located just 30 minutes away from Tianjin’s city center, the hotel is less than 45 minutes from Tianjin Binhai International Airport (TSN) and the city’s major train stations. Starwood Hotels & Resorts Worldwide, Inc. and real estate developer Dubai Properties has announced an agreement to open four new hotels in Dubai under Starwood’s Aloft and Element brand flags. This milestone signing strengthens the company’s midrange portfolio with 11 announced deals year to date and more than 50% of Starwood’s Middle East pipeline. Scheduled to open in 2018, the four new Aloft hotels and Element hotel will introduce 816 rooms in Dubai while expand Dubai Properties’ developments within the hospitality sector. The deal is in line with the Dubai Government’s focus on mid-scale hotel development ahead of the Dubai World Expo 2020. Aloft Dubai Dubiotech - Featuring 227 guest rooms the hotel is 20km from the Dubai International Airport and 40 km from the new Dubai World Central International Airport. The hotel will also be equipped with three meeting rooms. Aloft Dubai Studio City - Aloft Dubai Studio City comprises of 200 guests rooms, meeting space of up to 120 sqm and all of Aloft’s signature brand elements. The hotel is located in Dubai Studio City 15 minutes from Dubai International Airport and the city centre. Aloft Dubai IMPZ - Aloft Dubai IMPZ is located in Dubai’s dedicated media production zone, International Media Production Zone (IMPZ). The hotel will offer 221 guest rooms. Element Dubai IMP Z- Element, Starwood’s eco-innovation lab, is designed for today’s healthy, active traveler, with a natureinspired design philosophy that is clean, modern and bright. Element IMPZ will offer guests 168 studio accommodations and double rooms. There are 2,379 hotels totalling 557,133 rooms Under Contract in the Asia Pacific region, according to the July 2015 STR Global Construction Pipeline Report. This represents a 6.3% increase in rooms Under Contract compared with July 2014, and a 0.8% yearover-year decrease in rooms under construction. The Under Contract data includes projects in the In Construction, Final Planning and Planning stages but does not include projects in the Unconfirmed stage. The region reported 257,049 rooms in 1,019 hotels under construction for the month. Among the Chain Scale segments, the Upscale segment accounted for the largest portion of rooms Under Contract at 29.2% (162,938 rooms). Upper Upscale followed in rooms Under Contract at 24.6% (136,918 rooms). The Upscale segment also accounted for the largest portion of rooms In Construction (29.9% with 76,879 rooms), followed by Upper Upscale (25.4% with 65,399 rooms). There are 804 hotels totalling 131,389 rooms Under Contract in Europe, according to the July 2015 STR Global Construction Pipeline Report. This represents a 9.5% decrease in rooms Under Contract compared with July 2014 and a 9.4% year-over-year BCFA NEWSFLASH Page 6 decrease in rooms under construction. The Under Contract data includes projects in the In Construction, Final Planning and Planning stages but does not include projects in the Unconfirmed stage. Among the region’s key markets, Istanbul, Turkey, reported the most rooms under construction with 4,584 rooms in 23 hotels. Three other markets reported more than 2,000 rooms under construction: Greater London, England (3,759 rooms in 22 hotels); Moscow, Russia (3,071 rooms in 13 hotels); and Greater Amsterdam, Netherlands (2,346 rooms in eight hotels). There are 693 hotels totalling 176,612 rooms Under Contract in the Middle East/Africa region, according to the July 2015 STR Global Construction Pipeline Report. This represents a 19.5% increase in rooms Under Contract compared with July 2014 and a 45.4% year-over-year increase in rooms under construction. The Under Contract data includes projects in the In Construction, Final Planning and Planning stages but does not include projects in the Unconfirmed stage. The region reported 98,831 rooms in 381 hotels under construction for the month. Among the Chain Scale segments, the Upper Upscale segment accounted for the largest portion of rooms in the Under Contract stage, 31.6% with 55,789 rooms. Two other segments each accounted for more than 15.0% of rooms Under Contract: Upscale (20.2% with 35,734 rooms) and Luxury (15.5% with 27,325 rooms). The Upper Upscale segment made up the largest portion of rooms under construction, 33.9% with 33,491 rooms. Three other segments each accounted for more than 15.0% of rooms In Construction: Unaffiliated (20.5% with 20,268 rooms); Upscale (17.6% with 17,378 rooms); and Luxury (16.4% with 16,212 rooms). The Economy segment accounted for the smallest portion of rooms Under Contract (0.5% with 839 rooms) and In Construction (0.4% with 401 rooms). BCFA NEWSFLASH Page 7