File - Leaving Certificate Business

advertisement

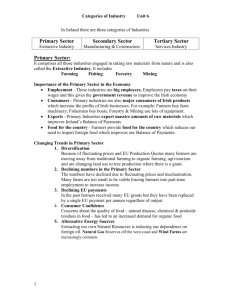

Leaving Cert Business Syllabus Unit 6. DOMESTIC ENVIRONMENT Objective: To enable students to understand the interaction between business firms, the local community, the Government and the economy. 6.1 Categories of industry Agriculture, manufacturing, services and natural resources Changing trends in business Primary Sector; Extractive industries that are based on natural resources both renewable and nonrenewable. 8% of workforce is in the primary sector. Agriculture Very important to Ireland’s economy, we have a good climate and good soil ideal for agriculture. Produce, raw materials for food, milk, beef, lamb, bacon, poultry, grains, roots crops and veg. Low pollution and green image supports our marketing campaign. EU Support, CAP; subsidies, minimum prices and guaranteed markets. Problems CAP supports changing (decoupled payment from production) Irish farms small this creates difficulty in competing with large farms abroad. Vulnerable to weather conditions and disease Consumer concerns about pesticides and growth promoters Trends Fall in employment due to mechanisation and a movement away from land. EU encouraging older farmers to retire an pass farms to younger farmers Many have to have a second job to support their income Farmers diversifying into new enterprises i.e. trees, rape seed organic produce. REPS, Rural Environment Protection Scheme pays grants to preserve the agri environment. Development of non-farming enterprises, tourist accommodation, open farms, horse riding, cheese making etc. Fishing Ireland has fish rich waters but fishing is on a small scale, other EU countries have the right to fish our waters. Produce, sea fish, shellfish and farmed fish such as trout and salmon. EU Irish fishermen have quotas/restrictions on the size of catches. Problems Overfishing has brought some species to a low level. Irish boats are small and find it difficult to compete as they cannot travel long distances for big catches. Consumer fears of pollution, particularly nuclear pollution in the Irish sea. Trends New species that have no quotas are being fished. Secondary sector; Construction and manufacturing industries, which are labour intensive and until recently construction was a huge employer in Ireland. Construction involves building houses, apartments, industrial buildings and infrastructure such as roads bridges tunnels and pipelines. Manufacturing converts raw materials into finished goods i.e. food, drink, pharmaceuticals, chemicals, electronic and computer products. 29% of workforce is in the secondary sector. Manufacturing in Ireland includes Agribusiness, firms involved in supplying products to farmers e.g. fertilisers. Or in manufacturing products based on farm produce e.g. milk, beef or grains. Transnational corporations, head office in one country but operate in lots of different countries, e.g. CHR Cement Roadstone Holding an Irish company that has operations in 75 countries. Know the benefits and problems associated with TNC’s, the factors that attract them to Ireland and the role of the IDA. Indigenous firms, Irish owned and producing goods and services in Ireland. Supported by Enterprise Ireland, most indigenous firms are SME small or medium size enterprises. Know benefits, problems, assistance and agencies that proved it. Problems Construction is subject to fluctuations in activity as the economy slows down. Skilled workers can be difficult to find when the construction industry is in growth. Manufacturing, Agribusiness is small scale and faces competition from larger foreign companies, vulnerable to takeover by larger foreign firms. Spending in R&D has been low, competition from EU’s open market. Power of multiples often forces suppliers to accept low prices. TNC’s less rooted in Ireland, if the close local community can be hugely negative. Repatriation of profits to home country, over dependence on TNC’s. Trends Construction; foreign workers and companies have come to Ireland during the growth period. Manufacturing; World class manufacturing, investment in R&D, high technology sector being developed (computers and communications). Tertiary Sector; Service industries for firms and consumers e.g. banking, travel, tourism, design, advertising, transport, professional services leisure and catering. 64% of workforce is in the tertiary sector. Trends Increase in leisure and entertainment services. Development of ICT, broadband, mobile phones etc. Telecentres/call centres, staff deal by telephone with sales enquires, consumer services. Growth of education design, consultancy and financial services. Childcare services as both parents work outside the home. 6.2 Types of business organisation Choosing between alternatives: Sole trader, partnership, alliances, franchising, private limited companies, transnationals, Public limited companies, co-operatives, state-owned enterprises and indigenous firms Be capable of defining each, formation procedure, features, advantages/benefits and disadvantages/drawbacks Changing trends in ownership and structure Change happens to suit their needs, know the reasons and remember how they usually grow(Capital, expertise & skills risk, workload, limited liability, continuity of existence, reach international markets, economies of scale, privatisation). 6.3 Community development Define, know the aim, and know viable communities. Local community and business How do businesses help? Secure jobs and incomes Boost retail business Local purchasing Creates wealth Encourages infrastructure improvement Rise in standard of living Sponsoring local events and charities Stability for the future Incorporating local community initiatives Steps in community development process, 1. Meeting of interested parties 2. An association is established 3. Research is conducted to identify problems and set goals 4. Resource audit 5. Projects are identified and prioritised 6. Contact state agencies for advice, training and finance (what agencies support, County enterprise boards, Area Partnership companies, Leader plus programme, FÁS, Failte Ireland, business innovation centres) 7. If successful in getting funding Problems/drawbacks/challenges/difficulties’ Lack of expertise, finance, management skills, marketing difficulties, regulations and planning permission, local disagreement. 6.4 Business and the economy Free market economy, problems with free market/government intervenes; Mixed economy (public vs. private sector). Why Governments intervene 1. Regulate nationally (laws under which business and individual conduct themselves) 2. Regulate locally (by-laws for planning/traffic) 3. Enforce existing laws (data protection) 4. Protect individuals and businesses (i.e. sale of goods and supply of services Act 1980, E.P.A. 5. Government departments provide services such as education health 6. Local authorities’, waste management, water supply. 7. Provision of infrastructure 8. A fair distribution of wealth, taxation and spending policy 9. Regional development policy, BMW The impact of the economy on business, taking into account the general state of the economy, inflation, interest rates, tax and grants Economic variables 1. Unemployment – high unemployment = reduced demand = less money = less tax revenue and VAT = increased government spending (S/W) = low standard of living/quality of life = social problems 2. Interest rates – ECB sets rates for euro zone, high interest effects businesses cost of borrowings = negative on cash flow. Reduces demand as households have less income. Restricts expansion 3. Inflation – price of goods rising = high wages (wage price spiral) = exports less competitive in international market. Loss of confidence and unwillingness to invest. 4. Taxation – taxes on employees (PAYE, PRSI, USC) = demand for higher wages for higher take home pay. Prices of goods and services increase b/c of VAT = reduced demand and lower standards of living. Household taxes reduce spending power i.e. income tax, PRSI, VAT, excise duties etc. Company taxes remove incentive to expand or set up in Ireland or to work in Ireland. 5. Exchange rates – outside Eurozone exchange rates can fluctuate constantly making trading unpredictable for gains/losses. When currency falls exports and tourism is cheaper, imports are dearer The impact of business on the economy at local and national level, taking into account employment, tax revenues and environmental issues Local jobs impacts national level, reduces government spending on welfare, increases government revenue, improves infrastructure and environment The interaction between business and the wider economy Covered in community dev and impact of government and economy 6.5 Government and business An introduction to the Government's role in encouraging and regulating business. Government creating a suitable environment for business 1. Low interest rates – reduces borrowing, allows for expansion 2. Low inflation – prices competitive for exports, allows for lower wages 3. Low unemployment – boost spending, reduce social welfare payments 4. Low taxes – on profits = investment, on wages = working, goods = more spending 5. Stable exchange rates – facilitates foreign trade Low corporation tax encourages FDI Government planning creates infrastructure and stability for FDI Partnership programme /national wage agreements, state and semi state bodies support businesses, (why the state set up these bodies, drawbacks of state bodies and privatisation pro’s and con’s) PPP and urban renewal State agencies that support business, IDA, Enterprise Ireland, FAS, LRC and LC Role of the Government as employer Biggest employer approx. 300,000 people employed as teachers, Gardaí etc. They also indirectly employ many in construction of infrastructure Services e.g. and goods such as furniture and stationery 6.6 Social responsibilities of business Ethical business practice Define ethics As well as responsibility to stakeholders business have a responsibility to wider society Employees, H&S, wages, dignity Investors, profit, car for assets, no excessive payment to top people, report honestly on a/c, comply with co. law, work within memo and articles. Customers, safe products, quality, respond to complaints, Suppliers Local community Government Society Socially responsible business at local and national level 6.7 Outcomes On completion, the student should be able to: 6.7.1 recognise and illustrate the categories of industries and their contribution to the domestic economy; 6.7.2 recognise the types of business organisation; 6.7.3 compare and contrast the different types of business organisations; 6.7.4 explain why businesses change their organisational structure over time; 6.7.5 identify the importance of community initiatives in the development of the local economy; 6.7.6 explain the impact of the economy on business; 6.7.7 explain the impact of business in the development of the economy; 6.7.8 identify important environmental issues in business; 6.7.9 list the ways in which the Government creates a suitable climate for business. 6.7.10 explain the ways which the Government affects the labour force; 6.7.11 define ethical business practice; 6.7.12 describe the characteristics of an environmentally conscious company (HL); 6.7.13 analyse the impact of environmental issues on business (HL); 6.7.14 discuss the social responsibilities of business (HL); 6.7.15 evaluate the effects on a firm’s costs of meeting its ethical, social and environmental responsibilities (HL) .