BACTNG2 Syllabus

advertisement

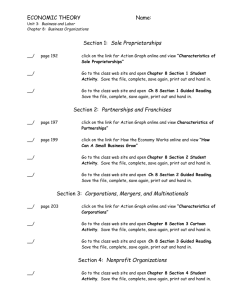

University of Baguio School of Business Administration and Accountancy University of Baguio Vision: In pursuit of perfection, the University of Baguio is committed to provide balanced quality education by nurturing academic excellence, relevant social skills and ethical values in a fun-learning environment. University of Baguio Mission: The University of Baguio educates individuals to be empowered professionals in a global community. School of Business Administration and Accountancy Mission: The School of Business Administration and Accountancy edifies competitive and morally upright individuals. School of Business Administration and Accountancy Objectives: The School of Business Administration and Accountancy, in an exuberant learning climate, aims to nurture a business graduate who: 1. cultivates the knowledge, skills and entrepreneurial spirit that are imperative for career success in a globalized setting; 2. utilizes macro-environmental acumen for economic growth and development; 3. typifies professional integrity with humility; and 4. undertakes researches to promote systematic bases for business decisions. BACTNG2 (6 units) Fundamentals of Accounting Part 2 (Partnership and Corporation Accounting) Course Description This is a continuation of the first course in accounting. It deals with transactions, financial statements, and problems peculiar to the operations of partnerships and corporations as distinguished from sole proprietorships. Topics include: basic concepts of partnership; partnership formation and operations including accounting for the admission of partners, changes in capital, and profit/loss sharing ratios; partnership dissolution and liquidation; the conversion of an unincorporated enterprise into a corporation; accounting for incorporated enterprises, including corporate organizations, paid-in capital, accumulated earnings/loss, dividends and treasury shares. It will also cover the preparation of financial statements for internal and external purposes, accounting information systems manual and computerized special journals; understanding the different financial statements; and analysis of accounting information and decision making. Prerequisites For Accountancy students: BACTNG1, ENGLIS1, PHILOS1, MATHEM1. The grade requirement for BACTNG1 is 85 and 80 for the other prerequisites. For BSBA students: ENGLIS2, MATHEM1, and PHILOS1. Course Coverage Learning Contents/ Topics Course Syllabus VMO Seat Plan Leveling of Expectations 1. Partnership- Basic Concepts and Considerations a. Overview b. Definition c. Characteristics Page 1 of 4 d. e. f. g. h. i. Partnerships distinguished from corporations Advantages and disadvantages from sole proprietorships and corporations Kinds of Partnerships Kinds of Partners Articles of Partnership Other legal concerns in partnership 2. Accounting for Partnership Formation a. Capital and Drawing accounts of partners b. Partnership Formation Scenarios and their Accounting Treatment i. Individuals with no existing business form a partnership ii. A sole proprietor and an individual form a partnership iii. Two or more sole proprietors form a partnership iv. Partnership formation using bonus method 3. Partnership Operations a. Profit and loss ratio b. Divisions of profits and losses i. Equally ii. Based on contributions iii. By allowing salaries, interest on capital, and bonus to partners c. Special profit allocations methods d. Preparation of the Statement of Changes in Equity 4. Partnership Dissolution a. Definition b. Causes c. Accounting for the admission of new partner in an existing partnership i. Through purchase ii. Through investment d. Withdrawal or retirement of a partner e. Death or incapacity of a partner 5. Partnership Liquidation a. Definition b. Causes c. Rules and accounting for the settling of accounts after dissolution i. Under lump sum liquidation ii. Under installment liquidation 6. Corporation- Basic Concepts and Consideration a. Overview b. Definition c. Characteristics d. Advantages and disadvantages from sole proprietorships and partnerships e. Classes or classifications f. Organizing a corporation i. Articles of incorporation ii. By-laws iii. Rights of shareholders g. Components of a corporation h. Minimum subscription and paid-in capital i. Corporate organizational structure j. Corporate books and records 7. Share Capital a. Legal capital b. Share premium c. Types of shares i. Ordinary ii. Preference d. Accounting for issuance of share capital Page 2 of 4 i. Under memorandum entry method ii. Under journal entry method e. Share subscription f. Subscription results g. Accounting for treasury shares h. Incorporation of sole proprietorships and/or partnerships i. Donated capital 8. Retained Earnings a. Introduction b. Definition of dividends c. Important dates in dividend transactions d. Kinds of dividends e. Accounting for dividends i. With only one type of shares ii. With two or more types of shares f. Book value per share g. Share splits i. Share split ii. Reverse share split h. Retained earnings appropriations i. Prior period errors j. Statement of Retained Earnings k. Statement of Changes in Shareholders’ Equity l. Earnings per share 9. Share Capital Transactions Subsequent to Original Issuance a. Retirement b. Conversion of preference shares to ordinary shares c. Recapitalization Grading System Cut-off grade is 70%. The highest possible grade is ninety nine (99); the lowest passing grade is seventy five (75); and the lowest failing grade is 65. However, a grade of 70 will be reflected in the final grade for all failing grades. For Accountancy students, the cut-off grade is 85. Minimum raw score is four hundred (400) points for very grading period. The distribution of total raw score will be as follows: First Grading Class Standing= 70%; Exam= 30% Midterms Class Standing= 60%; Exam= 40% o [(Tentative Midterm Grade x 2) + First Grading Grade]/3 = Midterm Grade Finals Class Standing= 50%; Exam= 50% o [(Tentative Final Grade x 2) + Midterm Grade]/3 = Final Grade Textbook Valencia, Edwin; Roxas, Gregorio; and Asuncion, Darrell Joe (2010). Partnership and Corporation Accounting. Baguio City: Valencia Educational Supply. References Ballada, Win Lu and Ballada, Susan (2010). Partnership and Corporation Accounting. Manila: Dome Dane Publishers and Made Easy Bookstore. Robles, Nenita and Empleo, Patricia (2010). Intermediate Accounting Part 3. Mutual Books Inc. Baysa, Gloria and Lupisan, Ma. Concepcion (2008). Advanced Accounting Part 1. Mandaluyong City: Millenium Books, Inc. Page 3 of 4 www.sec.gov.ph Page 4 of 4