Project Risks

advertisement

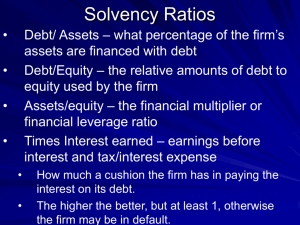

Finance Lecture # 4 Jan H. Jansen E-mail: jan.jansen@han.nl Wind energy Minor Wind Energy Project Management Finance Law Energy Project Supply Chain Management Mechanical Engineering Construction Programme Lecture Topic 1 Overview Energy Market 2 Annual Reports & Management Accounting 3 Management Accounting &Project Financials 4 Project Financials 5 Project risk & DOSIT Methodology 6 Business plan & Case study WEPM 7 Business Model & Case study WEPM 8 Written Exam DSCR • Debt Service Cover Ratio: CFADS / DS • DS (Debt Service) – Interest – Instalment or Repayment of the loan (12 - 15 years) • CFADS – Cash Flows Available for Debt Service – CFADS = Revenues – Costs – Taxes • Costs – O&M costs (Operations & Maintenance) – Insurance costs – Management & Concession Costs Recap lecture # 3 Project Financials (1) • Investment amount (A) – Trade off’s: – Financial structure: – e=E:A – l=L:A • Currency Risks – Transaction Risk – Economic Risk – Translation Risk • Discount factor (d) – d = wacc + π + σ • Cash Out Flows • Cash In Flows Structure Excel model Cash Outflows Data Assumptions Cash Inflows Results How to build an Excel model – Worksheet 1 (Project name) • • • Project name Version & Date Authors – Worksheet 2 (Results) • • • Investment amount Economic life Decision criteria – Worksheet 3 (Data) • • Data Assumptions – Worksheet 4 (COF) • Cash Outflows – Worksheet 5 (CIF) • Cash Inflows – Worksheet 6 (NCF) • Net Cash Flows Decision Criteria Capital Budgeting • • • • • • Pay Back Period (PBP) Return on Investment (ROI) Net Present Value (NPV) NPV Investment Ratio (NPV / INV) Internal Rate of Return (IRR) Break Even Time (BET) Investment case • • • • • • • • • • • Investment € 50,000,000 Expected economic life: 10 years Equity / Asset Ratio: 0,6 Required ROE: 5% Expected Interest rate: 3% Expected Inflation: 2.5% Risk mark up: 2.9% Annual Revenues: € 10,000,000 Increase electricity prices: 6% Annual Maintenance Costs: € 2,000,000 Increase maintenance costs: 4% Results Investment Economic life Pay Back Period (PBP) Return on Investments Net Present Value € 50.000.000,00 10years 6years 23,12%ROI € 14.294.531,75 NPV NPV Investement Ratio 0,29 Internal Rate of Return 15,19%IRR Break Even Time 8BET Literature • • • • • • • • Management Accounting for Decision Makers, Atrill cs Management Accounting, Kaplan cs Advanced Management Accounting, Kaplan cs Cost Accounting, Horngren cs Fundamentals of Corporate Finance, Ross cs Fundamentals of Corporate Finance, Brealy cs Multinational Business Finance, Eitman Wind Energy (Fundamentals, Resource Analysis and Economics), Sathyajith • Wind turbines (Fundamentals, Technologies, Application, Economics), Hau • Principles of Project Finance, Yescombe Project Finance • A method of raising long-term debt financing for major projects through “financial engineering” based on lending against the cash flow generated by the project alone. • It depends on a detailed evaluation of a project’s construction, operating and revenue risk, and their allocation between investors, lenders, and other parties through contractual and other arrangements • Project Finance ≠ Financing Projects Features of Project Finance • • • • Ring-fenced project (Separate Project Company) New project / New Business High Equity Debt Ratio No guarantees form the Project Company (nonrecourse finance) • Lenders rely on future cash flow for debt service payments (interest + repayment) • Main security for lenders: – Contracts – Licenses / ownership natural resources • Project has a finite life Forms of Projects • BOOT – Built-Own-Operate-Transfer • BOT – Built-Operate-Transfer • BTO – Built-Transfer-Operate • BOO • Built-Own-Operate Financial structure (leverage) Low leverage Investment (=A) High leverage $ 1,000 $ 1,000 Debt or Loans (=L) $ 300 $ 800 Equity (=E) $ 700 $ 200 Net Revenues $ 100 $ 100 5% 7% Interest payable $ 15 $ 56 Profit $ 85 $ 44 Return on Equity (ROE) 12% 22% Interest rate Financial leverage effect on costs Low leverage Investment (=A) High leverage $ 1,000 $ 1,000 Debt or Loans (=L) $ 300 $ 800 Equity (=E) $ 700 $ 200 Return on Equity (15%) $ 105 $ 30 5% 7% Interest payable $ 15 $ 56 Profit $ 85 $ 44 $ 120 $ 86 Interest rate Revenues Required Why project finance? • • • • • • • • • High leverage Tax benefits Off-balance sheet financing Borrowing capacity Risk limitation Risk spreading Long-term finance Enhanced credit Unequal partnership Project Structure (1) Finance • Equity Investors • Lenders Contractor (Construction) Operator (O&M) Project Company Government Support Agreement Input Supplier Off taker (Power Distributer) Government Concession / License Source : Project Finance, Yescombe Ring-fenced project Finance • Equity Investors • Lenders Contractor (Construction) Operator (O&M) Project Company Government Support Agreement Input Supplier Off taker (Power Distributer) Government Concession / License Source : Project Finance, Yescombe Project Structure (2) Source: www.vestas.com Project Structure (3) Source: www..worldbank.org Wind Farm Finance Structure http://www.wind-energy-the-facts.org Project Risks Project Risks Commercial Risks Macroeconomic Risks Political Risks Inflation Risk Currency Convertibility Risk Transfer Risk Revenue Risk Interest Rate Risk Expropriation Risk War & Civil Disturbance Risk Input Supply Risk Force majeure risk Exchange Rate Risk Change of Law Risk Quasi-political Risks Contract mismatch risk Sponsor support Risk Completion Risk Environmental risk Operating Risk