Accounts 2010

advertisement

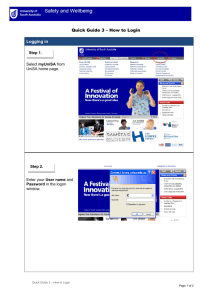

What to do for a Financial year end And When to do it This is a run-through of the stages needed to take you from one financial year to the next It assumes we are preparing Income & Expenditure Accounts It assumes this is the end of your first financial year using Accounts 2010 Let’s call the year ending 31 March Year 1, the Year starting 1 April will be Year 2 (and the year preceding would have been Year 0) Further info and examples of all the stages are included in the Online Help Update the Accounts 2010 application Make sure you have the latest version of the program Download and install if you don’t have it yet (guidance on the website) Make sure that Year 0 end-of-year data has also been entered into the system This is needed to show ‘last year’ columns in the Year 1 accounts, because Year 0 was not done on this system To enter details, go to Setup and select Restate Last Year ◦ The minimum you will need is: Funds, Cash at Bank and VAT. Also enter any Debtors or Creditors at that year end. ◦ For I&E Annual Return purposes you must also enter the total Balance C/Fd ◦ Remember that if a VAT refund was due, the VAT recoverable will be positive here (but negative in the VAT balance c/fd) Create Year 2 Login to Year 1 as normal, go to Setup and select Financial Years Select New and add a description, and start and finish dates Remember that this will in future appear at the top of the list of years at login, so be careful what you log in to in future Copy Login to Year 2 Go to Setup and select Copy from Previous Year Select any or all of the items you wish to continue the same next year (suppliers, codes etc) the basic structure to the next year Amend any of the details to reflect your next year activity If budgets are much the same year on year, it is easiest to copy all codes then amend the ones which have changed. To edit code details including budgets go to Setup and select Cost Codes Definitely copy VAT Rates Carry out a final year-end Bank Reconciliation Obtain if you can a 31 March statement from the bank Login to Year 1 Go to Bank and select Reconcile If everything successfully reconciles, print off the reconciliation report for each bank account If you have successfully reconciled all bank accounts, run Reconcile All Banks* *You must present a 31 March reconciliation. If you check each bank account at the exact end of year you can obtain this consolidated report automatically at a later date. (Less work later!) Start using Year 2 From now on Login to Year 2 for all new transactions You do not have to wait for Year 1 accounts to be completed before starting Year 2 BUT do not enter Year 2 transactions until you have run the Year 1 Reconcile All Banks, if you want a consolidated report which can be presented without alteration Complete your VAT return for the period ending 31 March Login to Year 1 Run the usual VAT reports and confirm the end of year VAT balance Make sure that your balance, your Balance Sheet and your HMRC claim all state the same figure! Bring forward your Bank and VAT Balances Login to Year 2 Go to Setup and select C/fd Bank/VAT Balances Bring forward both (if you later find an error in Year 1 you can repeat this) From now on use Year 2 for bank reconciliation (even for checking off transactions created in Year 1) Produce all your End of Year Accounts Login to Year 1and go to Year End Enter any conversion data needed (Adjustments etc) Select Calculate Run the Year End Reports (I&E Account, Working Document, Balance Sheet) Fix any problem, calculate and run the reports again Produce your Annual Return Login to Year 1and go to Year End If you have successfully completed the Accounts so that everything balances, you can now produce the Annual Return Close the Year 1 Accounts Login to Year 1and go to Year End Select Close accounts Close Accounts locks down Year 1 to prevent further amendment and also posts Year 1 data into Year 2 ready for Balance Sheet calculations at the end of Year 2 Don’t Close the Accounts until any Audit is complete and accounts signed off by External Auditor Check I&E Account and Balance Sheet for the current year whenever you wish Login to Year 2 and go to Year End You can produce trial ‘year-end’ accounts for Year 2 at any time, after the Year 1 accounts have been closed and data transferred Remember in every year you must Close the previous year’s accounts before you can run any current year-end reports Backup your Data Login and go to Utilities:Security and select Backup Backup the database to removable media which you can store safely Check the User Website Look out for News and for Further Program Updates