EIS_-_Innovation_of_the_Chip_Vfinal

advertisement

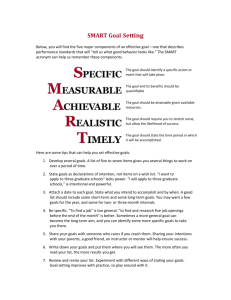

Entrepreneurship & Innovation Strategy Mini-project: Ecosystem Strategy The Innovation of the Smart Card Elizabeth Pomerantz; 33287K Deeksha Mittal; 34047H Melissa Brown; 34436P Professor Adner: Section 1 Value Vision: The value proposition of the chip-enhanced credit card is the provision of enhanced security for transactions. The impetus for this innovation was growing identity theft and fraudulent activity, which jumped to $48 billion in 2008 and affected 9.9 million adults in the United States according to Javelin Strategy & Research. This statistic is even more astounding when compared to its industry value back in 2003 of only $2.3 billion. While lost and stolen wallets, checkbooks, and credit/debit cards make up 43% of all identity theft incidents, the transition to an online retail environment served as a catalyst because it enabled a means to conduct purchasing activity without having to disclose an identity or be in possession of the physical card. Therefore, the world had finally evolved to a point where there existed a demand for the innovation that the chip offered. However, the chip faced several hurdles in its adoption due to the different relative value proposition within its complex ecosystem. Part of this complexity stems from the number and size of some of the players that are not the ultimate end user. This value chain is dominated by the credit card companies, government and financial institutions who have great influence on the world of the fragmented merchants and consumers. The challenges that were faced however were not centered on the degree of execution risk or co-innovation risk since the technology itself was incremental and not radical. The biggest hurdle was actually in the adoption chain risk: these large significant players needed to adopt the innovation before the end consumers were able to adopt it. The Smart Card Ecosystem: Following is a brief description of the major players in the credit card eco-system and the relative benefit (if any) they can derive from Smart Cards. Please refer to Appendix I for an illustration of the ecosystem, Appendix II for a cost vs. benefit analysis as well as Appendix III for an innovation classification breakdown. 2 The End Consumers: (Power to influence adoption in eco-system: Low; Relative Benefit from Smart Cards: Moderate) The change to a Smart Card is relatively painless for a consumer. There is a nominal change in the technological knowledge required since consumers have the same interaction with their credit card at the point of purchase. With no notional cost, there only exists a minor inconvenience to contact and activate the pin number for the new card. Thereafter, the only difference in their merchant interaction remains the shift to a four digit code instead of a written signature. As this process replicates the information required by an ATM, an earlier and widely adopted innovation, the learning curve is also exceptionally fast and seamless. As such, the market knowledge required is also unchanged. Switching costs are also nullified because consumers had full functionality of both the old and new process on the new cards, which contained a magnetic stripe as well as a chip. Through this ‘hybrid’ design, users were caused no disruption to the ability to purchase irrespective of any delay in adoption by some retailers. This low total cost for a consumer is also enhanced by the net benefits the Smart Card provides. The value of the Smart Card relates to the higher degree of security and confidence it provides with purchasing activity. This is highly valuable to a consumer, given the time, anxiety and inconvenience involved with being a victim of fraud. Finally, there is an improvement in the Smart Card’s performance since consumers can easily transact while they travel internationally with the same card. Therefore, the innovation in its entirety provides a moderate net positive surplus. However, the fragmented nature of consumers, they have little bargaining power to demand or speed up the adoption of the Smart Card based on its unique eco system. 3 Merchants: (Power to influence adoption in eco-system: Low; Relative Benefit from Smart Cards: High) Merchants have a powerful reason to accept Smart Cards: they reduce fraud, which they ultimately pay for. Currently, American law allows credit card companies to reverse potentially fraudulent transactions and charge a fee. This means that for each fraudulent transaction, a merchant loses the revenue generated, plus a processing fee charged by the credit card company. Therefore, there exist significant benefits for the merchants through the increased reliability of each transaction. Quicker transactions are also possible, because the merchant’s card reading device does not need to use telecommunications to check the validity of the credit card with the issuer. One downside is that the merchant must invest in new card readers, which is not a small expense for a large company with several checkout counters compared to the average fraudulent transaction size of $484.1 While the process of taking credit card information using a card reader device is the same as before, the merchant may still be required to integrate the new card reader with their old technology systems as well, which could cause disruption. According to the Market Knowledge/Technical Knowledge matrix, the new card reader should be relatively easily accepted by both merchants and consumers. While both parties would need slightly different technological knowledge to operate the device, the method of providing a credit card and punching a pin code into the machine cannot be considered disruptive. Market knowledge is completely conserved. The ultimate value to merchants, however is directly tied to the volume of fraud to make the relative benefits exceed the total costs. In high-fraud environments, Smart Cards provide a large advantage because fewer dollars are lost to reversed transactions and credit card company fees. However, in fairly low-fraud environments, such as the United States, it is only worth investing in the necessary infrastructure when a critical mass of consumers have cards with Smart Cards. As that has yet to appear in the United 1 Calculated using the total fraud amount of $48 billion and number of U.S. fraud victims (9.9 million) in 2008, according to Javelin Strategy & Research, February 2009 4 States, merchants have not upgraded. They have, however, preserved the option to upgrade in the future. Credit Card Companies & Financial Institutions: (Power to influence adoption in eco-system: High; Relative Benefit from Smart Cards: Low) Credit card companies such as Visa and Master Card as well as banks and financial institutions issuing credit cards are the biggest players in the credit card ecosystem and hence have the power to control the adoption of any new technology in the credit cards space. Credit card companies such as Visa and MasterCard not only act as transaction processing agencies for end consumers, merchants and financial institutions but also position themselves as agencies providing secure payments processing, fraud monitoring and fraud prevention services. Moreover, credit card companies make money by charging transaction fees and providing these fraud prevention services. Hence, in the current circumstances a Smart Card that can help prevent frauds does not have any value proposition for the credit card companies. In fact, it poses a threat to the existing fraud prevention services provided by these companies. Also, the financial institutions have little incentive to switch to Smart Cards. According to the US federal reserve regulation Z, federal reserve regulation E and the Electronics fund transfer act, US consumers are protected against fraud by affording them the right to reverse any dubious/ fraudulent transaction on their debit and credit cards. In case of a transaction reversal, the cost of investigating a fraud is usually passed on to the merchants in the form of a heavy penalty called the ‘Chargeback fee’. Thus, financial institutions have little financial liability in the case of a fraudulent transaction and hence little incentive to switch to a Smart Card. Moreover, issuing and supporting Smart Cards also poses significant additional costs for the financial institutions. A fully loaded Smart Card costs about $1.62 whereas a magnetic stripe card costs around 50 cents.2 Thus, a bank wanting to enable millions of card holders will have 2 Source URL: http://www.sans.org/reading_room/whitepapers/authentication/identity-protection-smart-cardadoption-america_1122 5 to pay a significant premium. This cost can be transferred to the consumers only if they see significant value in paying extra for these cards. The cost for banks to convert to Smart Cards in the U.S. would be in the area of $12 billion, according to Frost & Sullivan, the market research firm.2 Also, fraud as a percentage of total Visa card transactions has decreased to 0.06% from to about 0.15% in the early 1990s thereby making the Smart Cards even less attractive for the financial institutions and credit card companies. The US Government: (Power to influence adoption in eco-system: High; Relative Benefit from Smart Cards: N/A) The US government is not a primary party in this ecosystem. While the EU inserted itself into the ecosystem by requiring credit card companies to issue cards with chips, the US government is not making the same decision. While less fraud and more revenues for small businesses would result in higher tax revenue for the government, this benefit is erased by the lobbying campaigns brought by the credit card companies and financial institutions. The American Bankers Association and lobbyists for Visa, MasterCard, and American Express have access to tremendous resources and, before the financial crisis, had successfully killed bills aiming to protect college students, require minimum payment disclosures, reinstate the usury ceiling on credit card interest rates, prevent “baiting and switching,” and several other proposals. While the Dodd-Frank Act successfully passed several of these regulations, the populist tide for financial regulation seems to have turned and is no longer powerful enough to counter the financial resources of the lobbyist groups. Additional regulation requiring chips in credit cards is not likely to pass despite the pleas of foreign countries encouraging the United States to upgrade. As these countries do not have a powerful position in the US credit card ecosystem, their voices have fallen on deaf ears. US credit card eco-system Vs. Europe credit card eco-system Smart Cards have been extremely successful and popular in Europe. So much so that travelers from US often face problems in Europe while trying to use their credit cards to make payments at small shops, public transport and even toll plazas. However, there are several distinctions 6 between the European ecosystem, which has universally adopted chips in credit cards, and the US ecosystem, which has taken initial steps to begin issuing credit cards with chips, but not made use of them. The first difference is that the level of fraud in the United States is considered “manageable” compared to the level of fraud in other countries. Because consumers are not worried when a waiter takes their credit card to put the transaction through at the register, popular support for the changeover is relatively weak. The relative benefit is much smaller in the United States, another hurdle for adoption. The economic split of fraud charges in Europe also differs somewhat from the United States, where the merchant shoulders the entire downside.3 Finally, the push toward deregulation in the United States also slowed the movement, while in contrast, Europe had popular support and pushed the transition through by law. Europe was also more concerned about expensive telephone calls the merchant had to make every time a customer wished to charge an item, and saw the new version of the reader, which was able to read the chip without communicating with its issuing financial institution, as a large cost-saving opportunity. In the United States, airtime is relatively cheap and even more reliable as compared to the cost of issuing cards with chips. The future for Smart Cards in the US: Although the current credit card eco-system in the United States does not seem very attractive, the Smart Card technology itself has a promising future. Smart Cards can find multiple applications such as – Medical cards: Cards that can store all medical history of a patient that can lead to speedy diagnosis and easy accessibility to critical information in case of medical emergencies. National ID cards: Cards that can store biometric identification information, criminal history, driving license and driving history of a person. These cards can act as one source of 3 This split also differs between countries in the EU. For example, under French law, no transaction may be reversed unless the card was lost or stolen. (Source: http://ec.europa.eu/internal_market/finservicesretail/docs/onlineservices/chargeback_en.pdf). Therefore, the merchant is subject to far fewer chargebacks and the economic split is between consumers and merchants, when comparing the European landscape to the American (where consumers may simply reverse a transaction they regret). 7 identification for a country’s citizens and provide security advantages for governments by enabling easier tracking. Integrated payment solution with mobile phones: Smart Cards can be attached with mobile phones and be used to make payments for purchases instead of regular credit cards. This provides even more convenience to the end customers who do not have to carry multiple cards in their wallets. Also, with increasing concerns on identity theft and credit card frauds, a government legislation requiring financial institutions to issues Smart Cards or at least offer it as an option to it consumers can help boost adoption of these Smart Cards in the US. 8 APPENDIX I: The Eco-System Map Government Smart Card Technology Innovator/ Manufacturer Financial Institutions/ Credit card issuers Credit Card Company (VISA, MasterCard etc.) Merchant End Customer 9 Appendix II: Benefit vs. Cost Analysis Value Partner Benefit Consumer Increased Cost Adoption time: Call Surplus Moderate security/fraud toll-free line; Select incentive to prevention PIN and Switch card adopt – less Must remember PIN hassle transition given every time they use involved with dual capability of card fewer frauds Seamless chip card (swipe to report (and and chip hybrid) ease of travel Convenience to Europe) Improved reliability Global use Faster transactions Merchant Improved reliability Faster Adopt technology – get a card reader May need to HUGE surplus benefit Will wait until transactions integrate new reader consumers Reduced with old tech have the fraudulent cards to charges (liability invest in the of proof on card readers merchant, not bank) 10 Credit Card Fraud reduction * Credit card upgrades Company No Reduced demand for telecommunicati fraud prevention ons charges services sold by cc No benefit surplus company Financial Institutions Reduced Lost/stolen cards – transaction costs more expensive to due to replace (if they pay??) automation No Benefit surplus Possibly more security software US Government Less fraud More tax N/A Definitely a revenue from small businesses Smart Card Manufacturer Increased sales surplus Benefit Old Credit Card Technology Possible increase in Cannibalization of existing sales A possible loss in sales if sales if same cannot manufacturin switch. g setup can be Hence, no used to benefit manufacture new technology 11 APPENDIX III: Innovation Classification Technology Knowledge Market Knowledge Conserve Conserve Disrupt *Consumers *Merchants *Government *Credit Card *Financial Institutions Companies Disrupt *Smart Card Technology APPENDIX IV: Power to Influence Vs. Relative Benefit LOW HIGH HIGH *Credit Card Companies *Financial Institutions Power to Influence *Merchants *End Consumers LOW Relative Benefit 12 *New Technology Manufacturers References: http://www.sans.org/reading_room/whitepapers/authentication/identity-protectionsmart-card-adoption-america_1122 http://www.creditcards.com/credit-card-news/outdated-smart-card-chip-pin-1273.php http://www.nytimes.com/2001/08/12/us/credit-card-chips-with-little-todo.html?pagewanted=all&src=pm http://www.pbs.org/wgbh/pages/frontline/shows/credit/interviews/mierzwinski.html http://av.conferencearchives.com/pdfs/080503/17.pdf http://en.wikipedia.org/wiki/Chargeback http://en.wikipedia.org/wiki/Credit_card_fraud#United_Kingdom http://en.wikipedia.org/wiki/Consumer_Credit_Act_1974 http://ec.europa.eu/internal_market/finservices-retail/docs/onlineservices/chargeback_en.pdf 13