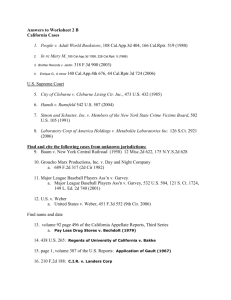

Wells Fargo

advertisement