TAX - psych.fullerton.edu.

advertisement

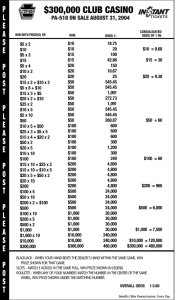

Testing Critical Properties of Models of Risky Decision Making Michael H. Birnbaum Fullerton, California, USA Sept. 13, 2007 Luxembourg Outline • I will discuss critical properties that test between nonnested theories such as CPT and TAX. • I will also discuss properties that distinguish Lexicographic Semiorders and family of transitive integrative models (including CPT and TAX). Cumulative Prospect Theory/ Rank-Dependent Utility (RDU) n i i 1 i 1 j 1 j 1 CPU(G ) [W ( pj ) W ( pj )]u(xi ) 1 140 Probability Weighting Function, W(P) 120 Subjective Value Decumulative Weight 0.8 CPT Value (Utility) Function 0.6 0.4 100 80 60 40 0.2 20 0 0 0 0.2 0.4 0.6 0.8 Decumulative Probability 1 0 20 40 60 80 100 120 Objective Cash Value 140 “Prior” TAX Model Assumptions: G (x, p;y,q;z,1 p q) Au(x) Bu(y) Cu(z) U(G) A BC A t( p) t( p) /4 t( p) /4 B t(q) t(q) /4 t( p) /4 C t(1 p q) t( p) /4 t(q) /4 TAX Parameters 1 For 0 < x < $150 u(x) = x Gives a decent approximation. Risk aversion produced by . Transformed Probability Probability transformation, t(p) 0.8 0.6 0.4 0.2 0 0 0.2 0.4 0.6 Probability 0.8 1 1. TAX Model TAX and CPT nearly identical for binary (two-branch) gambles • CE (x, p; y) is an inverse-S function of p according to both TAX and CPT, given their typical parameters. • Therefore, there is no point trying to distinguish these models with binary gambles. Non-nested Models CPT and TAX nearly identical inside the prob. simplex Testing CPT TAX:Violations of: • Coalescing • Stochastic Dominance • Lower Cum. Independence • Upper Cumulative Independence • Upper Tail Independence • Gain-Loss Separability Testing TAX Model CPT: Violations of: • 4-Distribution Independence (RS’) • 3-Lower Distribution Independence • 3-2 Lower Distribution Independence • 3-Upper Distribution Independence (RS’) • Res. Branch Indep (RS’) Stochastic Dominance • A test between CPT and TAX: G = (x, p; y, q; z) vs. F = (x, p – s; y’, s; z) Note that this recipe uses 4 distinct consequences: x > y’ > y > z > 0; outside the probability simplex defined on three consequences. CPT choose G, TAX choose F Test if violations due to “error.” Violations of Stochastic Dominance : 05 tickets to win $12 B: 10 tickets to win $12 05 tickets to win $14 05 tickets to win $90 90 tickets to win $96 85 tickets to win $96 122 Undergrads: 59% two violations (BB) 28% Pref Reversals (AB or BA) Estimates: e = 0.19; p = 0.85 170 Experts: 35% repeat violations 31% Reversals Estimates: e = 0.20; p = 0.50 Chi-Squared test reject H0: p violations < 0.4 Pie Charts Aligned Table: Coalesced Summary: 23 Studies of SD, 8653 participants • Large effects of splitting vs. coalescing of branches • Small effects of education, gender, study of decision science • Very small effects of probability format, request to justify choice. • Miniscule effects of event framing (framed vs unframed) Lower Cumulative Independence R S R S R: 39% .90 to win $3 .05 to win $12 .05 to win $96 S: 61% .90 to win $3 .05 to win $48 .05 to win $52 R'': 69% .95 to win $12 .05 to win $96 S'': 31% .90 to win $12 .10 to win $52 Upper Cumulative Independence R S R S R': 72% .10 to win $10 .10 to win $98 .80 to win $110 S': 28% .10 to win $40 .10 to win $44 .80 to win $110 R''': 34% .10 to win $10 .90 to win $98 S''': 66% .20 to win $40 .80 to win $98 Summary: UCI & LCI 22 studies with 33 Variations of the Choices, 6543 Participants, & a variety of display formats and procedures. Significant Violations found in all studies. Restricted Branch Indep. S’: .1 to win $40 R’: .1 to win $10 .1 to win $44 .8 to win $100 S: .8 to win $2 .1 to win $40 .1 to win $44 .1 to win $98 .8 to win $100 R: .8 to win $2 .1 to win $10 .1 to win $98 3-Upper Distribution Ind. S’: .10 to win $40 .10 to win $44 .80 to win $100 S2’: .45 to win $40 .45 to win $44 .10 to win $100 R’: .10 to win $4 .10 to win $96 .80 to win $100 R2’: .45 to win $4 .45 to win $96 .10 to win $100 3-Lower Distribution Ind. S’: .80 to win $2 .10 to win $40 .10 to win $44 R’: .80 to win $2 .10 to win $4 .10 to win $96 S2’: .10 to win $2 .45 to win $40 .45 to win $44 R2’: .10 to win $2 .45 to win $4 .45 to win $96 Gain-Loss Separability G G F F G F Notation x1 x 2 xn 0 ym y 2 y1 G (x1 ,p1;x2 ,p2; ;xn ,pn;ym ,qm ; ;y2 ,q2;y1 ,q1) G (0, pi ;ym ,pm ; ;y2 ,q2;y1 ,q1 ) n i 1 G (x1 ,p1;x2 ,p2; ;xn ,pn ;0, q ) m i 1 i G + G : - G : G: Wu and Markle Result .25 chance at $1600 F + F : .25 chance at $2000 .25 chance at $1200 .25 chance at $800 .50 chance at $0 .50 chance at $0 .50 chance at $0 F : .50 chance at $0 - .25 chance at $-200 .25 chance at $-800 .25 chance at $-1600 .25 chance at $-1000 .25 chance at $1600 F: .25 chance at $2000 .25 chance at $1200 .25 chance at $800 .25 chance at $-200 .25 chance at $-800 .25 chance at $-1600 .25 chance at $-1000 %G TAX CPT 72 551.8 > 551.3 < 496.6 601.4 -275.9> -437 < -358.7 -378.6 -300 < -178.6 < -280 -107.2 60 38 Birnbaum & Bahra--% F Cho ice G %G F 25 black to win $100 25 blue to win $50 25 white to win $0 25 blue to win $50 50 white to win $0 50 white to win $0 50 white to lose $0 50 white to lose $0 25 pink to lose $50 25 white to lose $0 25 pink to lose $50 25 red to lose $100 25 black to win $100 25 blue to win $50 25 white to win $0 25 blue to win $50 25 pink to lose $50 25 white to lose $0 25 pink to lose $50 25 red to lose $100 25 black to win $100 50 blue to win $50 25 white to win $0 25 white to lose $0 50 pink to lose $50 25 red to lose $100 Prior TAX Prior CPT G G F F 0. 7 1 14 21 25 19 0. 6 5 -2 1 -1 4 -2 0 -2 5 0. 5 2 -2 5 -2 5 -9 -1 5 0. 2 4 -1 5 -3 4 -9 -1 5 Allais Paradox Dissection Restricted Branch Independence Coalescing Satisfied Violated Satisfied EU, PT*,CPT* CPT Violated PT TAX Summary: Prospect Theories not Descriptive • • • • Violations of Coalescing Violations of Stochastic Dominance Violations of Gain-Loss Separability Dissection of Allais Paradoxes: viols of coalescing and restricted branch independence; RBI violations opposite of Allais paradox. Summary-2 Property CPT RAM TAX LCI No Viols Viols Viols UCI No Viols Viols Viols UTI No Viols R’S1Viols R’S1Viols LDI RS2 Viols No Viols No Viols 3-2 LDI RS2 Viols No Viols No Viols Summary-3 Property CPT RAM TAX 4-DI RS’Viols No Viols SR’ Viols UDI S’R2’ Viols No Viols R’S2’ Viols RBI RS’ Viols SR’ Viols SR’ Viols Results: CPT makes wrong predictions for all 12 tests • Can CPT be saved by using different formats for presentation? More than a dozen formats have been tested. • Violations of coalescing, stochastic dominance, lower and upper cumulative independence replicated with 14 different formats and thousands of participants. Lexicographic Semiorders • Renewed interest in issue of transitivity. • Priority heuristic of Brandstaetter, Gigerenzer & Hertwig is a variant of LS, plus some additional features. • In this class of models, people do not integrate information or have interactions such as the probability x prize interaction in family of integrative, transitive models (EU, CPT, TAX, and others) LPH LS: G = (x, p; y) F = (x’, q; y’) • • • • • • • If (y –y’ > D) choose G Else if (y ’- y > D) choose F Else if (p – q > ) choose G Else if (q – p > ) choose F Else if (x – x’ > 0) choose G Else if (x’ – x > 0) choose F Else choose randomly Family of LS • In two-branch gambles, G = (x, p; y), there are three dimensions: L = lowest outcome (y), P = probability (p), and H = highest outcome (x). • There are 6 orders in which one might consider the dimensions: LPH, LHP, PLH, PHL, HPL, HLP. • In addition, there are two threshold parameters (for the first two dimensions). Non-Nested Models TAX, CPT Integration Allais Paradoxes Lexicographic Semiorders Intransitivity Interaction Transitive Priority Dominance New Tests of Independence • Dimension Interaction: Decision should be independent of any dimension that has the same value in both alternatives. • Dimension Integration: indecisive differences cannot add up to be decisive. • Priority Dominance: if a difference is decisive, no effect of other dimensions. Taxonomy of choice models Transitive Intransitive Interactive & EU, CPT, TAX Integrative Non-interactive & Additive, Integrative CWA Not interactive or 1-dim. integrative Regret, Majority Rule Additive Diffs, SD LS, PH* Testing Algebraic Models with Error-Filled Data • Models assume or imply formal properties such as interactive independence. • But these properties may not hold if data contain “error.” • Different people might have different “true” preference orders, and different items might produce different amounts of error. Error Model Assumptions • Each choice pattern in an experiment has a true probability, p, and each choice has an error rate, e. • The error rate is estimated from inconsistency of response to the same choice by same person over repetitions. Priority Heuristic Implies • Violations of Transitivity • Satisfies Interactive Independence: Decision cannot be altered by any dimension that is the same in both gambles. • No Dimension Integration: 4-choice property. • Priority Dominance. Decision based on dimension with priority cannot be overruled by changes on other dimensions. 6-choice. Dimension Interaction Risky Safe TAX LPH HPL ($95,.1;$5) ($55,.1;$20) S S R R S R ($95,.99;$5) ($55,.99;$20) Family of LS • 6 Orders: LPH, LHP, PLH, PHL, HPL, HLP. • There are 3 ranges for each of two parameters, making 9 combinations of parameter ranges. • There are 6 X 9 = 54 LS models. • But all models predict SS, RR, or ??. Results: Interaction n = 153 Risky Safe % Safe Est. p ($95,.1;$5) ($55,.1;$20) 71% .76 ($95,.99;$5) ($55,.99;$20) 17% .04 Analysis of Interaction • • • • • • Estimated probabilities: P(SS) = 0 (prior PH) P(SR) = 0.75 (prior TAX) P(RS) = 0 P(RR) = 0.25 Priority Heuristic: Predicts SS Probability Mixture Model • Suppose each person uses a LS on any trial, but randomly switches from one order to another and one set of parameters to another. • But any mixture of LS is a mix of SS, RR, and ??. So no LS mixture model explains SR or RS. Dimension Integration Study with Adam LaCroix • Difference produced by one dimension cannot be overcome by integrating nondecisive differences on 2 dimensions. • We can examine all six LS Rules for each experiment X 9 parameter combinations. • Each experiment manipulates 2 factors. • A 2 x 2 test yields a 4-choice property. Integration Resp. Patterns Choice Risky= 0 Safe = 1 ($51,.5;$0) ($50,.5;$50) L P H 1 L P H 1 L P H 0 H P L 1 H P L 1 H P L 0 T A X 1 ($51,.5;$40) ($50,.5;$50) 1 0 0 1 1 0 1 ($80,.5;$0) ($50,.5;$50) 1 1 0 0 1 0 1 ($80,.5;$40) ($50,.5;$50) 1 0 0 0 1 0 0 54 LS Models • Predict SSSS, SRSR, SSRR, or RRRR. • TAX predicts SSSR—two improvements to R can combine to shift preference. • Mixture model of LS does not predict SSSR pattern. Choice Percentages Risky Safe ($51,.5;$0) ($50,.5;$50) 93 ($51,.5;$40) ($50,.5;$50) 82 ($80,.5;$0) ($50,.5;$50) 79 ($80,.5;$40) ($50,.5;$50) 19 % safe Test of Dim. Integration • Data form a 16 X 16 array of response patterns to four choice problems with 2 replicates. • Data are partitioned into 16 patterns that are repeated in both replicates and frequency of each pattern in one or the other replicate but not both. Data Patterns (n = 260) Pattern Frequency Both Rep 1 Rep 2 Est. Prob 0000 1 1 6 0.03 0001 1 1 6 0.01 0010 0 6 3 0.02 0011 0 0 0 0 0100 0 3 4 0.01 0101 0 1 1 0 0110 * 0 2 0 0 0111 0 1 0 0 1000 0 13 4 0 1001 0 0 1 0 1010 * 4 26 14 0.02 1011 0 7 6 0 1100 PHL, HLP,HPL * 6 20 36 0.04 1101 0 6 4 0 98 149 132 0.80 9 24 43 0.06 1110 TAX 1111 LPH, LHP, PLH * Results: Dimension Integration • Data strongly violate independence property of LS family • Data are consistent instead with dimension integration. Two small, indecisive effects can combine to reverse preferences. • Replicated with all pairs of 2 dims. New Studies of Transitivity • LS models violate transitivity: A > B and B > C implies A > C. • Birnbaum & Gutierrez (2007) tested transitivity using Tversky’s gambles, but using typical methods for display of choices. • Also used pie displays with and without numerical information about probability. Similar results with both procedures. Replication of Tversky (‘69) with Roman Gutierrez • Two studies used Tversky’s 5 gambles, formatted with tickets instead of pie charts. Two conditions used pies. • Exp 1, n = 251. • No pre-selection of participants. • Participants served in other studies, prior to testing (~1 hr). Three of Tversky’s (1969) Gambles • A = ($5.00, 0.29; $0, 0.79) • C = ($4.50, 0.38; $0, 0.62) • E = ($4.00, 0.46; $0, 0.54) Priority Heurisitc Predicts: A preferred to C; C preferred to E, But E preferred to A. Intransitive. TAX (prior): E > C > A Tests of WST (Exp 1) A A B C D E 0.712 0.762 0.771 0.852 0.696 0.798 0.786 0.696 0.770 B 0.339 C 0.174 0.287 D 0.101 0.194 0.244 E 0.148 0.182 0.171 0.593 0.349 Response Combinations Notation 000 001 010 011 100 101 110 111 (A, C) A A A A C C C C (C, E) C C E E C C E E (E, A) E A E A E A E A * PH TAX * WST Can be Violated even when Everyone is Perfectly Transitive P(001) P(010) P(100) P(A B) P(B C) P(C 1 3 A) 2 3 Results-ACE pattern 000 (PH) 001 010 011 100 101 110 (TAX) 111 sum Rep 1 10 11 14 7 16 4 176 13 251 Rep 2 21 13 23 1 19 3 154 17 251 Both 5 9 1 0 4 1 133 3 156 Comments • Results were surprisingly transitive, unlike Tversky’s data. • Differences: no pre-test, selection; • Probability represented by # of tickets (100 per urn); similar results with pies. • Participants have practice with variety of gambles, & choices; • Tested via Computer. Summary • Priority Heuristic model’s predicted violations of transitivity are rare. • Dimension Interaction violates any member of LS models including PH. • Dimension Integration violates any LS model including PH. • Data violate mixture model of LS. • Evidence of Interaction and Integration compatible with models like EU, CPT, TAX.