Constructive Trusts

advertisement

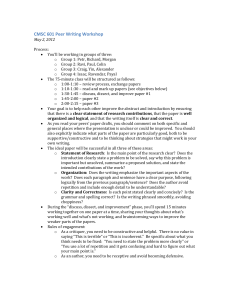

Trust Law Week 8 Constructive trusts arise by the operation of law 1) They are thus imposed by the courts 2) They do not depend upon the intention of the parties Courts appear to be more comfortable giving examples of constructive trusts rather than giving a definition The following the categories, at least, seem to be agreed upon as situations which give rise to constructive trusts: 1) Where advantages have been obtained by fiduciaries who have breached their duty of loyalty 2) Where there has been a disposition of trust property in breach of trust 3) Where advantages have been obtained by fraudulent or unconscionable conduct The following categories are more controversial 1) 2) 3) 4) 5) Secret trusts Mutual Wills Contracts of Sale which are specifically enforceable Exercise by Mortgagees of powers under a mortgage To give effect in equity to transfers of property which are incomplete at law The issue of constructive trust may be controversial because it opens the trustee to 1) proprietary liability and 2) personal liability The constructive trust takes effect from the moment the conduct which gives rise to the trust occurs, unless there is a judicial decision to the contrary in a given case. Normally, the constructive trust arises because of the way the constructive trustee has received the property; in such cases, the trust will arise when the trustee acquires the property When will a constructive trust arise? Trusts of the Family Home (from week 2) Gissing v Gissing 1971 Lloyd’s Bank v Rosset 1991 Stack v Dowden First two treat common intention constructive trusts (CICTs) as institutional constructive trusts and not remedial constructive trusts, although distinction not explicit. In Stack, the majority sent a mixed message, though Baroness Hale (with whom the majority agreed) seemed to be supporting the Institutional model. However, she is still imputing intentions which is potentially dodgy. See printed notes on constructive trusts. In Para 60, she talks about ascertaining the parties intentions, whether actual inferred or imputed. However, In para 61 she seems to reject the remedial constructive trust based on what judges think is fair, stating that the court must search for “the result which reflects what the parties must, in light of their conduct, be taken to have intended” and not “to abandon the search in favor of the result which the court itself considers fair” Contradiction b/w para 60 and 61; caselaw tends to follow 61, as shown: Holman v Howes 2007: CA made reference to para 61 and NOT para 60 Fowler v Barron 2008: CA favored para 61 1. ACQUISITION OF PROPERTY BY FIDUCIARIES Keech v Sandford [1726] EWHC Ch J76 is a foundational case, deriving from English trusts law, on the fiduciary duty of loyalty. It concerns the law of trusts and has affected much of the thinking on directors' duties in company law. It holds that a trustee owes a strict duty of loyalty so that there can never be a possibility of any conflict of interest. The remedy of granting a constructive trust over property, and the strict approach that all possibility of a conflict of interest was to be avoided, derived from the general outrage at the time. Facts: A child had inherited the lease on Romford Market near London. Mr Sandford was entrusted to look after this property until the child matured. But before then, the lease expired. The landlord had told Mr Sandford that he did not want the child to have the renewed lease. There was clear evidence of the refusal to renew for the benefit of the infant. Yet the landlord was happy (apparently) to give Mr Sandford the opportunity of the lease instead. Mr Sandford took it. When the child (now Mr Keech) grew up, he sued Mr Sandford for the profit that he had been making by getting the market's lease. - Persons in a fiduciary position could not use that position to make any unauthorized profit for themselves Stanford held the profits on a constructive trust for Keech (I think) Boardman v Phipps 1967, in which the defendants, a solicitor and a beneficiary of a trust, bought shares in a company in which the trust already held shares after the other two active beneficiaries made it clear that they would not buy any more shares of the company for the trust. When the defendants made a profit on their shares, they were still entitled to pay an account of the profits to the other beneficiaries. In his judgement, Lord Hudson states that any profit obtained by a fiduciary made possible by his fiduciary position was to be accounted for unless consented to by the complaining beneficiary. This makes it clear that even in the absence of any conflict of interest, the fiduciary may not make a profit by using information acquired in the course of his dealings with the trust. -Appellants had used the trust shareholdings to acquire the necessary information about the company, were held to be constructive trustees had acted in good faith and were allowed ‘liberal payments’ for their skill in negotiating that had resulted in the trust acquiring a considerable benefit. Receipt for bribes Attorney‐General for Hong Kong v Reid [1993] UKPC 36 is an English trusts law case, where it was held that bribe money accepted by a person in a position of trust, can be traced into any property bought and is held on constructive trust for the beneficiary. Mr Charles Warwick Reid was the Hong Kong Deputy Crown Prosecutor and then Acting Director of Public Prosecutions, so in a fiduciary relationship with the Hong Kong government. He took bribes to obstruct prosecution of some criminals, and used the money to buy land. Some was kept by Mr Reid and his wife, Mrs Judith Margaret Reid, some conveyed to Reid’s solicitor. The Hong Kong government argued the land was held on trust for them. The Privy Council advised the bribe money received by Reid, and the land acquired after, was held on constructive trust for the Hong Kong government. This meant that the land bought by Reid and his wife was held on trust, and had to be given over to the Hong Kong government. This was held to be necessary to ensure that people in positions of trust could in no way profit from their wrongdoing. If the property was badly invested, the fiduciary in breach would still be under a duty to make good the shortfall. Lord Templeman delivered the advice of the Board. Sinclair Investments v Versailles Trade Finance [2011] Summary: A judge had been right to reject a company's proprietary claim to the proceeds of sale of shares which its director had held in another company; although the proceeds could not have been obtained had the director not enjoyed his fiduciary status, they were not beneficially owned by the claimant. Abstract: The appellant (T) appealed against a decision ([2010] EWHC 1614 (Ch)) that it was not entitled to assert a proprietary interest in the proceeds of sale of some shares. Investors had paid money to T for the purpose of certain trades. However, T's director (C) had permitted those monies to be transferred to another company (V), in which he held shares. V used those monies for fraudulent activities. As a result of those activities, V's share prices rose. C consequently sold his shares in V for £28.69 million. V's activities were later discovered and the receivers were brought in. T had lost money as a result of V's activities and was also wound up. T brought a claim asserting that it was entitled to assert a proprietary interest in the proceeds of the sale of the shares as they had been an unauthorised gain by C in breach of his fiduciary duty and were therefore held on constructive trust by C for T's benefit. T also asserted that its claim was good against the defendant banks (B), who had been reimbursed by the receivers in relation to money they had lent to V. The judge, following the approach of the Court of Appeal in Metropolitan Bank v Heiron (1880) 5 Ex. D. 319 and Lister & Co v Stubbs (1890) 45 Ch. D. 1, held that T had no proprietary interest in the proceeds of sale of the shares, and even if that conclusion were wrong, B were bone fide purchasers for value without notice. However, he found that T did have a proprietary claim in relation to the monies which it had passed to V and which V had mixed with its own monies, and stated that T was entitled to trace those funds into distributions made by the receivers to B from the time that B had notice of T's proprietary interest in the mixed funds. In the instant case the court had to consider whether (i) T had a proprietary interest in the proceeds of sale of the shares; (ii) if so, B were entitled to rely on the defence of bona fide purchaser for value without notice; (iii) the judge had been correct to limit the extent to which T could trace the mixed funds. T submitted that the judge had erred in his approach in relation to the proceeds of sale of the shares claim and that the decision of the Privy Council in Attorney General of Hong Kong v Reid [1994] 1 A.C. 324 should be followed. Appeal dismissed. (1) The Court of Appeal could not follow Reid in preference to its own decisions unless there were domestic authorities showing that those decisions were per incuriam or at least of doubtful reliability (see para.73 of judgment). There was a consistent line of reasoned decisions of the Court of Appeal, spread over 95 years, which appeared to establish that the beneficiary of a fiduciary's duties could not claim a proprietary interest, but was entitled to an equitable account, in respect of any money or asset acquired by the fiduciary in breach of his duties to the beneficiary, unless the asset or money was or had been beneficially the property of the beneficiary or the trustee had acquired the asset or money by taking advantage of an opportunity or right which was properly that of the beneficiary. A claimant could not claim proprietary ownership of an asset purchased by the defaulting fiduciary with funds which, although they could not have been obtained if he had not enjoyed his fiduciary status, were not beneficially owned by the claimant or derived from opportunities beneficially owned by the claimant. In such a case, a claimant had a personal claim in equity to the funds, but there was no case which appeared to support the notion that such a personal claim entitled the claimant to claim the value of the asset, and there were judicial indications which tended to militate against that notion. As C did not owe trustee-like duties in relation to the shares, the judge had been right to reject T's proprietary claim to the proceeds of sale of the shares, North Australian Territory Co, Re [1892] 1 Ch. 322 and Powell v Evan Jones & Co [1905] 1 K.B. 11 considered, Reid not applied, Heiron and Lister applied (paras 88-89, 92). (2) Even if T had a proprietary claim to the proceeds of sale of the shares, on the evidence B had not had notice of the proprietary claim at the time they received the relevant payments. The judge had been at the very least entitled to decide that, even if T had a proprietary claim, B took free of that claim (para.122). (3) The judge had been entitled to conclude that B had not had notice of T's proprietary interest in the mixed fund before the time claimed by T. He had plainly considered that B and the receivers had acted in good faith in not appreciating that they should have sought legal advice as to whether T had, or might have had, a proprietary interest in the mixed fund (para.146). 2. VENDOR-PURCHASER CONTRACTS Lysaght v Edwards 1876 Lord Jessell M.R. (pg. 506): "The moment you have a valid contract for sale, the vendor becomes in equity a trustee for the purchaser of the estate sold, the vendor having a right to purchase money and a right to retain possession of the estate until the purchase money is paid, in the absence of express contract as to the time of delivering possession.” Accordingly the remedy of specific performance was available to enforce the constructive trust which had arisen from a contract of sale. Facts: In 1874 the Plaintiffs entered into a contract for the purchase of real estate. After the title had been accepted, and before completion, the vendor died, having by his will (dated in 1873) given his personal estate to E. , whom he appointed executor, and devised all his real estate to H. and M. upon trust for sale, and having also devised to H. alone all the real estate which at his death might be vested in him as trustee:— Held, that the real estate contracted to be purchased by the Plaintiffs passed to H. under the devise of trust estates. Walsh v Lonsdale 1882 The Defendant on the 29th of May, 1879, agreed to grant and the Plaintiff to accept a lease of a mill for seven years at the rent of 30s. a year for each loom run, the Plaintiff not to run less than 540 looms. The lease to contain such stipulations as were inserted in a certain lease of the 1st of May, which was a lease at a fixed rent made payable in advance, and contained a stipulation that there should at all times be payable in advance on demand one whole year's rent in addition to the proportion, if any, of the yearly rent duo and unpaid for the period previous to such demand. The Plaintiff was let into possession and paid rent quarterly, not in advance, down to the 1st of January, 1882, inclusive, having run in 1881 560 looms. In March, 1882, the Defendant demanded payment of £1005 14& S. (£840 as one whole year's rent for 560 looms at 30& S. , and £165 14& S. as the proportionate part of the rent from the 1st of January last), and put in a distress. The Plaintiff thereupon commenced his action for damages for illegal distress, for an injunction, and for specific performance, and moved for an injunction. Fry, J. , granted the injunction on the terms of the Plaintiff paying the £1005 14s. into Court. The Plaintiff appealed. Held, that since the Judicature Acts the rule no longer holds that a person occupying under an executory agreement for a lease is only made tenant from year to year at law by the payment of rent, but that he is to be treated in every Court as holding on the terms of the agreement: Held, therefore, that the Plaintiff holding under the agreement was subject to the same right of distress as if a lease had been granted, and that if under the terms of the lease a year's rent would have been payable in advance on demand a distress for that was lawful. 3. TRANSFERS ‘SUBJECT TO’ THE RIGHTS OF OTHERS Binions v Evans 1972 A person who acquires land expressly subject to a contractual licence is bound by the licence. L1 granted to T, who was the widow of an employee of L1, the right to reside in a cottage. The document described L1 as "landlord" and T as "tenant," and by it L1, "in order to provide a temporary home," for T "but not otherwise," agreed to permit her "to reside in and occupy" the cottage "as tenant at will of [L1] free of rent for the remainder of her life or until determined . . . by [T] giving . . . not less than four weeks' . . . notice." T undertook to keep the cottage in repair and not to assign or sublet. L1 sold the property to L2 expressly "subject to the tenancy of" T. L2 gave notice to quit to T and sought possession. Held, that the expressions in the agreement as to a tenancy at will and a temporary home were contradictory to others making it clear that the arrangement could only be determined by T on notice or on T's death and not by L1. L2 could be in no better position and held on constructive trust to give effect to the agreement. Lyus v Prowsa Developments Ltd 1982 Where land is sold "subject to and with the benefit of a contract," the purchaser holds the plot upon constructive trust for the beneficiary of the contract, and so does a second purchaser who buys with notice of the contract. By a contract in 1978 P contracted to purchase a plot of registered land, part of an estate being developed by the vendor company. The plot was to be transferred on completion of the house, but the company was wound up before completion. The bank, a prior mortgagee, elected to sell P's land "subject to and with the benefit of the plaintiff's contract." The plot was then sold to D2 subject to the contract in so far as it was enforceable against D1. The transfer itself made no mention of the contract. Held, P's claim for a declaration that the original agreement was binding and for specific performance, that (1) P could not rely on the Law of Property Act 1925s.56; but (2) D were in turn not entitled to rely on the Land Registration Act 1925 s.20 and s.34(4) and P were entitled to an order for specific performance. Ashburn Anstalt v WJ Arnold & Co The reservation of a rent is not necessary for the creation of a tenancy. In 1973 R sold to M a headlease and sublease of premises in Kensington. The sale agreement provided by clause 5 that R could remain in the premises without payment of rent as "Licensees" until M should give one quarter's notice in writing and should certify that it was ready at the expiration of such notice to redevelop the premises; and further provided by clause 6 that upon completion of such redevelopment M should grant to R "a lease of a shop in a prime position at the development with an area available for trading of approximately 1,000 s.m. and with car parking facilities ...". M subsequently sold the headlease and sublease to the freeholder A, who claimed that R were licensees only and sought possession. R claimed that the agreement with M created a tenancy which took effect as an overriding interest under the Land Registration Act 1925 s.70(1)(g) ; alternatively that, if they were licensees only, the licence was binding upon A by reason of the decision in Errington v Errington and Woods [1952] 1 K.B. 290 , or by reason of the doctrine of constructive trust. The judge held that the agreement had created a licence only, but that the licence had been binding upon A; and he refused to order possession. Held, dismissing A's appeal upon other grounds, that (1) the reservation of a rent is not necessary for the creation of a tenancy; (2) the period of the occupation agreement was sufficiently certain in that the agreement could be determined by both parties in circumstances in which there could be no doubt as to whether the determining event had occurred; (3) the agreement had accordingly created a tenancy, which took effect as an overriding interest under s.70(1)(g) of the 1925 Act; (4) clause 6 of the agreement was sufficiently clear to be capable of enforcement as a contract, and likewise took effect as an overriding interest under s. 70(1)(g), notwithstanding that it had not been registered, as an estate contract, since R were in actual occupation of the premises ( Street v Mountford [1985] A.C. 809 applied; Midland Railway Co's Agreement, Re [1971] Ch. 725 considered; Lace v Chandler [1944] K.B. 368 distinguished). Per curiam: (i) In view of the decisions in Thomas v Sorrell 124 E.R. 1098 , Daly v Edwardes (1900) 83 L.T. 548 , Frank Warr & Co v London CC [1904] 1 K.B. 713 , King v David Allen & Sons Billposting Ltd [1916] 2 A.C. 54 , and Clore v Theatrical Properties Ltd [1936] 3 All E.R. 483 , a contractual license does not create an interest in land capable of binding third parties; and the decision in Errington was to this extent only per incuriam (ii) Neither could a mere contractual licence in this case have bound A by way of constructive trust, since the courts will not impose a constructive trust unless it is satisfied that the conscience of the estate owner is affected; and the mere fact that land is expressed to be conveyed "subject to" a contract does not necessarily imply that the grantee is to be under an obligation, not otherwise existing, to give effect to the provisions of that contract. 4. MISTAKEN PAYMENTS The court may conclude that the defendant holds property on constructive trust where he received it from the claimant in circumstances where the defendant can be characterized as acting unconscionably. This was recognized in Westdeutsche Landesbank Girozentrale v Islington London Borough Council [1996] AC 669. In this case the plaintiff bank had paid money to the defendant local authority pursuant to an interest rate swap contract which was null and void. The bank sought restitution of the money. One question which was considered by Lord Browne-Wilkinson was whether the defendant held the money it had received on a constructive trust. His Lordship then considered whether the local authority held the money it received on a resulting trust for the bank. **** I appealed against the Court of Appeal's award of compound interest on repayments which I was obliged to make to W in respect of an invalid swap agreement into which the parties had entered. Swap agreements involving local authorities were declared ultra vires and void in Hazell v Hammersmith and Fulham LBC [1992] 2 A.C. 1 . I contended that simple interest only, not compound interest, was payable on the repayments. Held, allowing the appeal, that the court had jurisdiction to award compound rather than simple interest only if the defendant was a fiduciary, Burdick v Garrick (186970) L.R. 5 Ch. App. 233 , Wallersteiner v Moir (No.2) [1975] Q.B. 373 applied. I did not owe a fiduciary duty to the bank to account for profits from the invalid swap agreement when the authority did not know, at the time when payment was received, that the agreement was ultra vires and void. To find I personally liable as a trustee would necessarily entail creating an equitable proprietary interest in the moneys received, which would have undesirable implications for third party rights in other cases. Commercial transactions would be impeded by uncertainty as to ownership of assets. Claims for moneys had and received were not based on implied contract, Sinclair v Brougham [1914] A.C. 398 overruled. Despite the bank's strong moral claims, the courts should not develop principles that conferred new powers to award compound interest in circumstances where Parliament, having considered the issue, had made clear that there was no jurisdiction to award compound interest. Simple interest only could be awarded on repayment in respect of ultra vires swap agreements. Chase Manhattan Bank v Israel-British Bank 1981 A person who paid another moneys under a mistake of fact is entitled to trace and recover that mistaken payment since he retains an equitable property in it and the payee is under a fiduciary duty to respect that continuing proprietary interest. The plaintiff, a New York bank, was instructed to pay US USD 2m. to another New York bank to the account of the defendants. The sum was paid, but later in the day a second payment was made due to a clerical error. The defendants were wound up and the plaintiffs could not recover the whole sum without claiming a declaration that the defendants received the moneys as trustees for the plaintiffs, thus entitling them to trace the mistaken payment. At trial, it was agreed that the mistaken payment was governed by the law of the State of New York but the procedural rights and remedies had to be ascertained by the laws of England. Held, the plaintiffs were entitled to trace and recover the mistaken payment on the grounds, that (1) under English law the payer of a mistaken payment retained an equitable property in it and the payee was subjected to a fiduciary duty to respect that continuing proprietary interest; (2) on the evidence, a similar equitable interest exists under the laws of New York State; (3) the moneys in the defendant's hands at the commencement of the winding up did not belong to the defendants beneficially and never formed part of its property. REMEDIAL CONSTRUCTIVE TRUSTS Hussey v Palmer 1972 Where under a family arrangement one person spends money on another's land, the land will be held on a constructive trust for the former, proportionate to the payment. P, an elderly widow, was invited to live with her daughter and son- in-law, D, in their house. A bedroom was built on as an extension for her. She paid GBP 607 to the builder for the cost of the extension. Differences arose and, after fifteen months, P left. She claimed in the county court against D, who owned the house, for GBP 607 as money lent. The case was heard by consent by the registrar who intimated that it was not a loan but a family arrangement. P elected to be non-suited and issued a fresh plaint claiming the GBP 607 on a resulting trust. In the second action P gave evidence that she had "lent the money" to D and "they would give me a home for life, if I wanted it." The judge held that there was no case for a resulting trust and gave judgment for D. On P's appeal, held, allowing the appeal (Cairns, L.J. dissenting) that, as the payment by P was not intended as a gift and there were no arrangements for its repayment, it was against conscience for D to retain the benefit of it without repayment and he held the property on a resulting or (per Lord Denning M.R.) constructive trust for P proportionate to her payment. Per Cairns, L.J.: P paid the GBP 607 as a loan and that was inconsistent with a resulting trust. Muschinski v Dodds 1985 An unmarried couple purchased land by a contract under which they were jointly and severally liable. They intended to renovate a cottage on the land which would be used by the woman as an arts and crafts centre and to buy a prefabricated house which was to be erected on the land. The woman paid the price of the land from her own funds and agreed to include the man's name on the title if he undertook to renovate the cottage and pay for the prefabricated house. The land was transferred to them as tenants in common in equal shares. The parties separated without the cottage having been renovated or the house acquired. The woman claimed sole beneficial ownership of the land. Held, (1) that the presumption of resulting trust arising out of the provision by the woman of the whole of the price was rebutted. Calverley v. Green (1984), 155 C.L.R. 242, applied. (2) By Gibbs C.J., Mason and Deane JJ., Brennan and Dawson JJ. dissenting, that the parties held their respective legal interests as tenants in common upon trust, after payment of any joint debts incurred in improvement of the property, to repay to each her or his contribution and as to the residue for them both in equal shares; by Gibbs C.J. because the parties were jointly and severally liable to pay the price, and the woman having paid the whole of it was entitled to contribution for one half from the man; and by Mason and Deane JJ. because it was unconscionable after the failure of the joint venture between the parties for the man to assert his legal entitlement without recognizing the woman's payment. Per Brennan and Dawson JJ. (dissenting) (1) The woman's claim to be entitled to the full beneficial interest was necessarily based on the hypothesis that she paid the price as sole purchaser. Hence there was no room for a finding that she paid it to discharge a joint and several debt so as to entitle her to contribution as a co-debtor. (2) The woman had given the man his beneficial interest in return for his assurance, and on condition, that he would assist her to set up a craft business and pay for the erection of a house. The assurance created a personal obligation to fulfil the condition. Failure to fulfil it did not involve forfeiture of the beneficial interest, though the woman may have been entitled to compensation for non-fulfilment if she had made such a claim. Per curiam. There is no place in Australian law for the notion of a constructive trust which is imposed by law whenever justice and good conscience require it. Proprietary rights fall to be determined by principles of law and not by some mixture of judicial discretion, subjective views about which party ought to win, or the formless void of individual moral opinion. An example is the Australian case Muschinski v Dodds.[8] A de facto couple lived in a house owned by the man. They agreed to make improvements to the property by building a pottery shed for the woman to do arts and crafts work in. The woman paid for part of this. They then broke up. The High Court held that the man held the property on constructive trust for himself and the woman in the proportions in which they had contributed to the improvements to the land. This trust did not arise the moment the woman commenced improvements - that conduct did not involve a breach of duty or an unjust enrichment etc. The trust arose at the date of judgment, to do justice in the case. Peter v Beblow 1993 Appellant lived in a common law relationship with respondent for 12 years, doing the domestic work of the household and raising the children of their blended family without compensation. Respondent had purchased the house occupied by the couple and appellant had undertaken a number of projects -- gardening, planting a hedge, painting -- to maintain or better it during the relationship. During the course of the relationship respondent was able to pay off the mortgage on the house and to buy a houseboat and a van; appellant bought a lot with money earned outside the family unit. The house lay vacant after the parties separated. The trial judge found that the respondent had been enriched, that appellant had not been compensated, and that there was no juristic reason for the enrichment. He awarded appellant the property. The Court of Appeal allowed an appeal from this judgment. At issue here was whether the provision of domestic services during 12 years of cohabitation in a common law relationship is sufficient to establish the proprietary link which is required before the remedy of constructive trust can be applied to redress the unjust enrichment of one of the partners in the relationship. Further, consideration must be given to the extent to which the remedy of constructive trust should be applied in terms of amount or proportion. Held: The appeal should be allowed. Per La Forest, Sopinka, McLachlin and Iacobucci JJ.: The appropriate remedy--a monetary award or the imposition of a constructive trust--must only be decided once an unjust enrichment giving rise to restitution is established. The constructive trust is available where monetary damages are inadequate and where there is a link between the contribution that founds the action and the property in which the constructive trust is claimed. Soulos v Korkontzilas, [1997] 2 SCR 217 Facts: Offer for property was made to Soulos through Korkontzilas, the real estate agent. Soulos makes counter-offer, but counter offer was not communicated to the other party. Korkontzilas gets his wife to buy the property. Property value then goes down, so Soulos can’t show loss. All he can say is that the agent didn’t have the right to take the benefit for himself. There was a fiduciary relationship (agent/principal), and Korkontzilas breached his duty of loyalty in taking the opportunity for himself. Issue(s): Can a constructive trust (CT) be imposed in the absence of enrichment of the defendant and a corresponding deprivation of the plaintiff? Ratio: Breach of fiduciary duty of loyalty may lead to the imposition of a constructive trust; based on the following factors: → 1. Defendant must have been under equitable obligations regarding activities connected to acquiring property in question → 2. Assets acquired through breach of obligations → 3. Plaintiff has legitimate reason for seeking proprietary remedy (personal and/or societal) → 4. No factors rendering imposition of CT unjust Analysis: → Unjust enrichment isn’t complete here (property value went down) → Good conscience ⇒ Need to do justice between parties ⇒ Need to protect the integrity of important relationships (for society as a whole, to hold people to standards) Discretionary decision -- Factors to be considered: → 1. Defendant must have been under equitable obligations regarding activities connected to acquiring property in question → 2. Assets acquired through breach of obligations → 3. Plaintiff has legitimate reason for seeking proprietary remedy (personal and/or societal) → 4. No factors rendering imposition of CT unjust → Also (not in case) 5. Must be property to apply CT to Holding: Yes, a constructive trust should be imposed. Goldcorp Exchange Ltd 1995 K, receiver of gold dealer Goldcorp Exchange (G), appealed from a decision of the New Zealand Court of Appeal ([1993] 1 N.Z.L.R. 257) that certain unrepresented non-allocated claimants (UNC) were entitled to gold bullion stored by G as against the chargee, the Bank of New Zealand. UNC had purchased gold "for future delivery" from G, whose brochures promised that purchasers' non-allocated located gold would be stored free and could be claimed on notice. Held: Appeal allowed. The purchase contract itself did not transfer title to purchasers because the goods were unascertained. Although G's brochures promised that purchasers would have title to gold held in storage, a trust did not arise either when the purchase contract was signed or subsequently when G bought the gold. It was contrary to policy and logic to imply a fiduciary duty where all that existed was breach of contract. Knights v Wiffen (1869-70) L.R. 5 Q.B. 660 , Simm v AngloAmerican Telegraph Co (1879-80) L.R. 5 Q.B.D. 188 , Re London Wine Co (Shippers) Ltd [1986] P.C.C. 121 and MacJordan Construction Ltd v Brookmount Erostin Ltd (1992) B.C.L.C. 350 considered. The argument that equity required the court to grant restitution of the purchase moneys was rejected. Re Polly Peck International plc (in administration) (No 2) PPI's Insolvency In my judgment, the intervening insolvency of PPI means that under English law there is no seriously arguable case for granting the applicants a remedial constructive trust on the basis of the allegations in the draft statement of claim. PPI is a massively insolvent company subject to an administration order. The administrators are bound to distribute the assets of PPI among the creditors on the basis of insolvency. Parliament has,in such an eventuality, sanctioned a scheme for pari passu distribution of assets designed to achieve a fair distribution of the insolvent company's property among the unsecured creditors. This scheme, now contained in the Insolvency Act of 1986, was described by Sir Donald Nicholls Vice-Chancellor in Re: Paramount Airways Ltd [1993] Ch 223 at 230 E, as "a coherent, modernised and expanded code." The provisions of that code apply both to the case of an insolvent company which has gone into formal liquidation and to one in respect of which an administration order has been made. The essential characteristic of the statutory scheme is that the liquidator or administrator is bound to deal with the assets of the company as directed by statute for the benefit of all creditors who come in to prove a valid claim. There is a statutory obligation on the administrators of PPI to treat the general creditors in a particular way. A question may arise as to whether a particular asset was or was not the beneficial property of the company at the date of the commencement of the winding up (or administration). If it is established in a dispute that it is not an asset of the company then it never becomes subject of the statutory insolvency scheme: See Chase Manhattan (Supra). If, on the other hand, the asset is the absolute beneficial property of the company there is no general power in the liquidator, the administrators or the court to amend or modify the statutory scheme so as to transfer that asset or to declare it to be held for the benefit of another person. To do that would be to give a preference to another person who enjoys no preference under the statutory scheme. In brief, the position is that there is no prospect of the court in this case granting a remedial constructive trust to the applicants in respect of the proceeds of sale of the shares held by PPI in its subsidiaries, since the effect of the statutory scheme applicable on an insolvency is to shut out a remedy which would,if available, have the effect of conferring a priority not accorded by the provisions of the statutory insolvency scheme. In her eloquent address Miss Dohmann submitted that "the law moves." That is true. But it cannot be legitimately moved by judicial decision down a road signed "No Entry" by Parliament. The insolvency road is blocked off to remedial constructive trusts,at least when judge-driven in a vehicle of discretion. For those reasons alone I would refuse leave to the applicants to commence these proceedings. To a trust lawyer and, even more so to an insolvency lawyer, the prospect of a court imposing such a trust is inconceivable and, in my judgment, even the most enthusiastic student of the law of restitution would be forced to recognise that the scheme imposed by statute for a fair distribution of the assets of an insolvent company precludes the application of the equitable principles manifested in the remedial constructive trust developed by such courts as the Supreme Court of Canada. Thorner v Major 2009 The Court of Appeal had been wrong to reverse a trial judge's decision that a sufficient assurance had been made by a landowner to his nephew to support the operation of proprietary estoppel so as to enable the nephew to inherit his uncle's land. The judge's findings of fact had not been open to challenge in the Court of Appeal and there had been insufficient reason for that court to reverse them. The court considered the operation of proprietary estoppel generally and the necessary character or qualities that an assurance must have in order to be relied upon as proprietary estoppel. Abstract: The appellant (D) appealed against a decision ([2008] EWCA Civ 732) that proprietary estoppel could not operate in his favour so as to entitle him to inherit the estate of his deceased uncle (P). At the time of his death in 2005, P had owned a farm of substantial value and also had considerable savings. He had made a will in 1997 leaving the residue of his estate, including his farm, to D but had subsequently destroyed the will and died intestate. D had worked at P's farm for no remuneration from 1976 onwards, and by the 1980s, he had come to hope that he might inherit the farm. No express representation had ever been made, but D relied on various hints and remarks made by P over the years, which he claimed had led him to believe that he was to inherit the farm. In 1990, P had handed D a bonus notice relating to two policies on P's life, saying "that's for my death duties". It was D's case that at that point his hope had become an expectation. The judge at first instance had found that D had the benefit of proprietary estoppel because he had reasonably understood P's words and acts as an assurance that he would inherit the farm and that P had intended them to be understood in that way. The Court of Appeal had reversed that decision, finding that there had been no clear and unequivocal intention on the part of P and that there was no basis to construe P's statements as a definite assurance rather than a statement of present intention. The issues for the instant court were (i) the character or quality of the representation or assurance made to D; (ii) whether, if the other elements for proprietary estoppel were established, D must fail if the land to which the assurance related was inadequately identified or had undergone a change during the period between the giving of the assurance and its eventual repudiation. D submitted that the Court of Appeal had been wrong to apply the "clear and unequivocal" test because it was not relevant to proprietary estoppel. Appeal allowed. (1) To establish a proprietary estoppel, the relevant assurance had to be clear enough. What amounted to sufficient clarity depended on context, Walton v Walton (Unreported) April 14, 1994applied. There was some authority for the view that the "clear and unequivocal" test did not apply to proprietary estoppel, especially in Treitel, Law of Contract (12th edn. 2007) and at least the two earlier editions, and in Jones v Watkins (Unreported) November 26, 1987, Jones applied. There was a degree of unreality in making a distinction between the meaning of written words and the meaning of spoken words because in cases of the instant type, a judge's conclusion as to the meaning of spoken words would be inextricably entangled with his factual findings about the surrounding circumstances. In the instant case, the Court of Appeal had concentrated too much on the significance of the 1990 incident regarding the bonus notices and had not given sufficient weight to the advantage that the trial judge had had in seeing and hearing the witnesses. The 1990 incident had marked the transition from hope to expectation, but it had not stood alone, and the evidence had demonstrated a continuing pattern of conduct by P for the remaining 15 years of his life. It was not helpful to try to break that pattern down into discrete elements. There had been insufficient reason for the Court of Appeal to reverse the trial judge's careful findings and conclusion. (2) Proprietary estoppel had to relate to identified property (usually land) owned or about to be owned by the defendant. The trial judge had made a clear finding of an assurance by P that D would become entitled to the farm. Both P and D knew that the extent of the farm was liable to fluctuate as development opportunities arose and tenancies came and went. There was no reason to doubt that their common understanding had been that P's assurance related to whatever the farm consisted of at P's death, Walton applied and Layton v Martin [1986] 2 F.L.R. 227 and Basham (Deceased), Re [1986] 1 W.L.R. 1498 considered. There was no ground on which to challenge the trial judge's discretion in determining the remedy and his order was to be restored/ Westdeutsche Landesbank Girozentrale v Islington LBC " Under an institutional constructive trust the trust arises by operation of law as from the date of the circumstances which give rise to it: the function of the court is merely to declare that such trust has arisen in the past. The consequences that flow from such trust having arisen (including the potentially unfair consequences to third parties who in the interim have received the trust property) are also determined by rules of law, not under a discretion. A remedial constructive trust, as I understand it, is different. It is a judicial remedy giving rise to an enforceable equitable obligation: the extent to which it operates retrospectively to the prejudice of third parties lies in the discretion of the court".