Transportation Planning at Norfolk Southern

advertisement

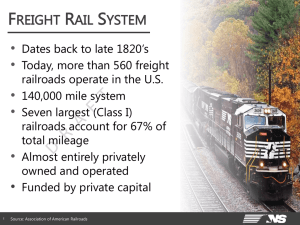

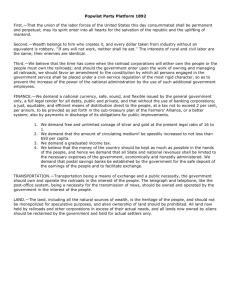

Transportation Planning at Norfolk Southern Darrell Wilson AVP Government Relations Railroads are a function of three essential things • • • • Where do you go “market access”? How do you go-”geography-efficiency”? Why do you go “customers-revenues”? These three functions drive decision making on invested capital. Important Factors when considering investment options • Railroads classify rail lines • Strategic feeder, Core, Super core etc • Investment strategies are organized around increasing density to lower costs • Having more can be less efficient • Operational efficiency before capacity Important Factors when considering investment options MARKETS REVENUES --DEMAND FOR TRANSPORTATION SERVICES --VOLUMES --OPPORTUNITIES FOR GROWTH --RESPONSE TO MARKET NEEDS --COMPETITION --PRICING Economics of Capital Investments on Class I RR COSTS PROFITS --ASSET AND EMPLOYEE PRODUCTIVITY --OPERATING EFFICIENCY --REVENUES > LONG-TERM COSTS --SUFFICIENT RETURN TO ATTRACT INVESTMENT Important Factors when considering investment options • Customers dictate conveyance in many markets • Geography can be a limiting factor for rail access • Infrastructure/Capacity is usually approached incrementally • Operations, Routing, Power-Locomotives, O/D analysis, crews, market demand forecasts drive investments decisions. Freight Transportation Service Spectrum The “Hierarchy” of Investment Risk Infrastructure People Rolling Stock Locomotives Managing Complex External Variables • Numerous forces must be considered and balanced for the implementation of successful freight corridors Customer Needs Domestic Political Dynamics Environmental Awareness Understanding Market Demand Competition from Other Modes Cost of Service Operational/Infrastructural Capabilities Maximization of Public Assets Economic Forces/Trends Domestic/Global Trade Demands Speed, Safety, Security Population Growth and Migration NS Engaged in Over $1.8 Billion in Network improvements Targeting Intermodal • Meridian Speedway: $300mm – Complete 2010 • Heartland Corridor: $282mm – Complete 2010* • Patriot Corridor: $140mm – Complete 2010 • Crescent Corridor Ph 1: $1.1b – Completion 2012 * Ex WV, VA terminals and CFE The Heartland Corridor the nation’s first multi-state intermodal rail public-private partnership • Three year engineering effort • Raise vertical clearances in 28 tunnels • Removed 24 overhead obstructions Inaugural double-stack train exiting Cowan Tunnel near Radford, Virginia September 9, 2010 • The nation’s first multi-state intermodal rail corridor public-private partnership between the FHWA’s Eastern Federal Lands Highway Division, USDOT, Virginia, West Virginia, Ohio, and Norfolk Southern • Tunnel work began Oct 2007; Sept 2010 • New double-stack route eliminates over 200 miles of travel and approximately 24 hours of travel time between the East Coast and Chicago Tonnage on Highways, RRs, and Inland Waterways: 2007 ASSOCIATION OF AMERICAN RAILROADS SLIDE 11 Avg. Daily Long-Haul Truck Traffic on Nat’l Highway System: 2007 ASSOCIATION OF AMERICAN RAILROADS SLIDE 12 Avg. Daily Long-Haul Truck Traffic on Nat’l Highway System: 2040 ASSOCIATION OF AMERICAN RAILROADS SLIDE 13 Peak Period Congestion on the National Highway System: 2040 ASSOCIATION OF AMERICAN RAILROADS SLIDE 14 It’s Not Realistic to Think Highway Construction Will Keep Up 220 Index 1980 = 100 200 Highway vehicle-miles traveled (VMT) 180 160 140 120 Highway lane-miles 100 80 '80 '82 '84 '86 '88 '90 '92 '94 '96 '98 '00 '02 '04 '06 '08 '10 Source: FHWA ASSOCIATION OF AMERICAN RAILROADS SLIDE 15 Annual Highway Capital Investments Needs In billions of 2006 dollars Rural Arterials & Collectors Urban Arterials & Collectors Total All Functional Systems $7.8 $18.3 $4.5 $5.8 $48.0 $19.1 $55.9 System Rehabilitation $71.1 System Expansion Source: U.S DOT Status of the Nation’s Highways, Bridges and Transit Conditions and Performance Report, 2008 $85.2 System Enhancement National Highway Funding Source: FDOT U.S. Freight Railroad Capital Spending $ in Billions Despite the Recession, Capital Spending Staying High $14.0 $13.0 $12.0 $12.0 $10.0 $8.5 $8.0 $6.0 $5.4 $5.7 $5.9 $6.2 $9.2 $10.2 $9.9 $10.7 $6.4 $4.0 $2.0 $2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011e 2012e Source: AAR data, (Class I Railroads). Spending estimated for 2011 & 2012. Rail Ton-Miles v. GDP for the United States 1980-2011 2,000 1,800 Rail Ton-Miles (Billions) 1,600 1,400 1,200 1,000 800 600 400 $5,000 $7,500 $10,000 GDP (Billions, 2005$) $12,500 $15,000 Population Growth Alone Will Mean Much Higher Rail Traffic U.S. Population vs. Class I RR Revenue Ton-Miles (population = millions; ton-miles = billions) 400 2,800 375 2,500 Correlation from 1980-2010: 97% 350 Actual Projection 2,200 325 1,900 300 1,600 Population (left axis) 275 1,300 Ton-miles (right axis) 250 1,000 225 700 200 400 1980 1985 1990 1995 2000 2005 2010 2015 2020 2025 2030 Population projections are from the U.S. Census Bureau. Ton-mile projections are straight-line extrapolations of actual 1980-2011 data. Source: AAR, Census Bureau ASSOCIATION OF AMERICAN RAILROADS SLIDE 20 $1.6 18.0% $1.4 16.0% $1.2 $1.0 $0.8 16.1% 11.4% 14.0% 12.0% 10.1% 9.4% 9.9% 10.1% 9.3% 7.8% 10.0% 8.3% 8.5% $0.6 8.0% 6.0% $0.4 4.0% $0.2 2.0% $0.0 0.0% 1980 1990 2000 2005 2006 2007 2008 2009 2010 2011 Year Percent of GDP GDP in Trillion Dollars Logistics as a Percentage of U.S. GDP Long-Term Demand for Freight Transportation Will Surge Billions of Tons of Freight Transported in the U.S. 2010 Estimated: 18.3 bil 2040 U.S. DOT projection: 27.5 bil 0 10 Up 50% 20 30 Source: FHWA - Freight Analysis Framework, version 3.2 ASSOCIATION OF AMERICAN RAILROADS SLIDE 22 The U.S. DOT expects total U.S. freight movements to rise from around 18.3 billion tons in 2010 to 27.1 billion tons in 2040 – a 50% increase. Sharp Increase in Rail Traffic Density Thousands of Car-Miles Per Mile of Road Owned 450 400 350 300 250 200 150 100 50 0 '80 '83 '85 '87 '89 '91 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11 Data are for Class I railroads. Source: AAR ASSOCIATION OF AMERICAN RAILROADS SLIDE 23 Network of Key Corridors and Port Access RIVER PORT (8) SEA PORT (16) LAKE PORT (7) DETROIT ERIE CHICAGO ASHTABULA CLEVELAND BURNS HARBOR TOLEDO PITTSBURGH NAPLES CINCINNATI GRANITE CITY PORTSMOUTH JEFFERSONVILLE NY/NJ PHILADELPHIA CAMDEN WILMINGTON BALTIMORE LOUISVILLE MEMPHIS NORFOLK PORTSMOUTH MOREHEAD CITY CHARLESTON ST. BERNARD NEW ORLEANS MOBILE BRAITHWAITE SAVANNAH BRUNSWICK JACKSONVILLE NS’ Intermodal Network Norfolk Southern System Intermodal Terminal(s) Market Expansions thru 2010 Market Expansions thru 2012 IM Port Terminal TCS Terminals Port of NY/NJ, Nfk/NN, Charleston, Savannah average container LOH NY/NJ, Nfk/NN, Charleston, Savannah Less than 200 miles 200 to 400 miles 400 to 600 miles 600 to 800 miles Over 800 miles Unknown NY/NJ, Nfk/NN, Charleston, Savannah - Average Container LOH Percent of Total 27% 20% 4% 7% 5% 37% Less than 200 miles 400 to 600 miles Over 800 miles 200 to 400 miles 600 to 800 miles 26 Unknown Record Reinvestments in Recent Years Despite the Economy Class I RR Spending on Infrastructure and Equipment Per Mile of Railroad* $260,000 $240,000 $220,000 $200,000 $180,000 $160,000 $140,000 $120,000 $100,000 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 *Capital spending plus maintenance expenses minus depreciation. Source: AAR ASSOCIATION OF AMERICAN RAILROADS SLIDE 27 Sharp Increase in Rail Traffic Density Thousands of Car-Miles Per Mile of Road Owned 450 400 350 300 250 200 150 100 50 0 '80 '83 '85 '87 '89 '91 '93 '95 '97 '99 '01 '03 '05 '07 '09 '11 Data are for Class I railroads. Source: AAR ASSOCIATION OF AMERICAN RAILROADS SLIDE 28 Working Together: Public-Private Partnerships Combine resources to meet public needs. Railroads pay for their benefits, public pays for public benefits. Examples: Alameda Corridor, CREATE, Heartland Corridor, National Gateway ASSOCIATION OF AMERICAN RAILROADS SLIDE 29 Expansion Capital and Public Partnerships: • • • • • • • Most often at the top of the hierarchy of investment Most likely not feasible if privately funded Long lead time Higher Risk/Moderate Private Return Lower Public Risk/Moderate Public Return Stranded Societal benefits at their core Often involves cross-jurisdictional boundaries—very complex Economic Forces to Consider: Freight Flows Transit time (in days) of ship traveling from Shanghai shown in BLUE circle, with land transit times between major cities appearing in BROWN Market Analysis: Population Migration Population shift from 2000 to 2010, shown as percentage *Green indicates growth, Pink indicates loss Market Analysis: Surface Freight Volumes • • • • • Dry vanloads of domestic freight only Filtered by zip code of origin or destination of shipment in NS footprint Single driver transports only Domestic freight Average trip approximately 1,100 miles Top Intermodal Freight Rail Corridors Corridor Trailers/ (State to Containers State) Avg Length of Haul (miles) CA /IL 2,485,880 2,220 CA/TX 1,383,520 1,550 WA/IL 797,480 2,230 NJ/IL 544,840 950 PA/IL 498,920 750 OH/IL 457,240 360 TX/IL 448,000 1,170 CA/TN 382,000 2,100 CA/KS 312,320 1,775 CA/AR 297,080 2,025 Crescent Corridor at Full Build? in 2020? 350,000 Units Annually ; 1.3 Million Units Annually Crescent Corridor Warehouse Square Footage Density by Zip Code-Memphis SF Density 37501: 885,000 38017: 674,800 38053: 873,289 38103: 240,400 38106: 1,405,154 38107: 289,243 38108: 709,973 38109: 825,693 38111: 550,499 38114: 2,071,316 38115: 4,368,110 38116: 2,183,409 38117: 400,000 38118: 43,729,895 38122: 202,940 38125: 812,697 38126: 120,000 38127: 300,378 38131: 147,695 38133: 1,604,793 38134: 1,848,049 38141: 15,526,560 38654: 8,745,464 38671: 11,486,286 38672: 2,108,499 72301: 1,052,075 72303: 0 72303 38103 36 36 Warehouse Square Footage Constructed Since 2002 by Zip Code SF Since 2002 37501: 38017: 38053: 38103: 38106: 38107: 38108: 38109: 38111: 38114: 38115: 38116: 38117: 38118: 38122: 38125: 38126: 38127: 38131: 38133: 38134: 38141: 38654: 38671: 38672: 72301: 72303: 885,000 0 0 0 0 0 0 0 0 0 0 0 0 3,679,111 0 0 0 0 0 0 0 1,041,622 1,900,464 8,382,110 2,108,499 800,000 0 72303 38103 37 37 External Variable: Market Analysis and Potential Public Benefit Current Lengths of Haul on Long-Distance Trucks 4% of all hauls are over 500 miles in length Hauls over 500 miles represent 20% of total vehicle miles traveled External Variable – Market Analysis Key Origin/Destination Pairs in the Freight Transportation Market 100% 90% Intermodal Market Share Truck Market Share 80% 70% 60% 50% 40% 30% Meridian Speedway Corridor 20% 10% 0% Crescent Corridor Heartland Corridor CRESCENT CORRIDOR INTERMODAL FACILITIES 2012 AND BEYOND – INVESTMENT SUBSETS MOVING FORWARD Open 2012 • Birmingham, AL; Memphis, TN; Greencastle, PA; and Harrisburg, PA Open 2013 • Charlotte, NC Open 2014 and Beyond • Atlanta, Knoxville, E-Rail, Roanoke, Philadelphia, and Bethlehem Open 2012 Open 2013 Open 2014 and Beyond Transit Times Must be Truck Competitive Targeted Schedules Memphis Memphis E. Tennessee Harrisburg – 30 hours Philadelphia – 43.3 hours New Jersey – 30 hours Speed Improvement Study Status Study & O-of-M Estimates Completed Review Complete - Estimates Being Finalized Under Review To Be Evaluated Lines Not Under Study Riverton Norfolk Southern Crescent Corridor and Parallel Interstate Highways Capacity Improvement Status Completed – OofM Costs Determined Hi-Rail/Site Inspection Completed Estimate Being Progressed To Be Evaluated No Improvements Planned Riverton Norfolk Southern Crescent Corridor and Parallel Interstate Highways Intermodal Terminal Expansion Update Facility Location Groundbreaking Date Completion Date Annual Volume Capacity (Lifts) Mechanicville, NY July 2010 Spring 2012 70,000 Greencastle, PA October 2010 Fall 2012 85,000 Memphis, TN April 2011 Fall 2012 200,000 Birmingham, AL June 2011 Fall 2012 100,000 Harrisburg, PA Fall 2011 Spring 2012 65,000 Charlotte, NC Fall 2011 Summer 2013 200,000 Crescent Corridor Financial Investment Hierarchy INTERMODAL TERMINALS SPEED ENHANCEMENTS ADDED CAPACITY ROLLING STOCK Today’s Profits Pay For Tomorrow’s Railroads Today’s earnings pay for tomorrow’s railroads. Take away earnings and you take away investments. Net Income $ billions $14 RR Spending Per Mile $260,000 $12 $240,000 $10 $220,000 $8 $200,000 $6 $180,000 $4 $160,000 $2 $140,000 $0 $120,000 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 Source: AAR SLIDE 46 ASSOCIATION OF AMERICAN RAILROADS Return on Investment is Crucial If ROI > cost of capital: If ROI < cost of capital: • Capital spending expands • Stronger physical plant; more and better equipment. R O I • Lower capital spending • Weaker physical plant, equipment • Slower, less reliable service • Faster, more reliable service • Disinvestment • Sustainability ASSOCIATION OF AMERICAN RAILROADS SLIDE 47 Thank You