Report - Department of Education and Early Childhood Development

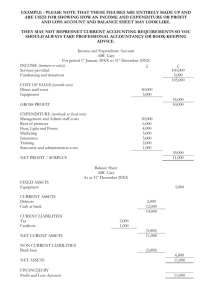

advertisement